Looking for a way to set your teenagers up for financial success down the road? Get them off to a good—and early—start by opening Roth individual retirement accounts (IRAs) for them as soon as they start working. Put the power of time and compounding to work on their behalf. You’ll be surprised at the result.

Mike Gray is a dad who thinks ahead. Far ahead. When his son and daughter were teenagers, he set up wonderful tax-free gifts for them to help secure their financial futures.

When his kids got their first jobs, he opened Roth IRAs for them. Gray, a financial advisor in CAPTRUST’s Raleigh headquarters office, put in an amount matching their modest earnings. He continued contributing to those accounts for years.

Retirement accounts for teens? It may sound premature until you consider that the golden rule of retirement savings is to start early so the savings have more time to grow. Financial advisors often point out that 20-somethings who start saving a little each month gain a big-time advantage over those who wait till their 30s or 40s to get started.

By the same reasoning, why not help your child reap the benefits of an extra-long investment time horizon of 50 years or more? A Roth IRA, funded with after-tax dollars and that grows tax-free, is well-suited to help with this goal.

Eligible with a First Job

Just like adults, kids of any age are permitted to contribute to Roth IRAs as long as they have wages or compensation within Internal Revenue Service limits. In 2022, the maximum contribution is $6,000 or the amount earned, whichever is less.

Minors need a parent, grandparent, or other adult to open custodial Roth IRAs in their names. And it’s fine for an adult to make the contributions on the child’s behalf.

Gray’s daughter got her first real job at a summer camp at about age 14. She earned less than $2,000 that year, he recalls. She was allowed to keep her paychecks and spend the money as she liked. Gray opened the Roth IRA in her name and made a contribution in the amount she earned. Every year she had a job, he matched the amount. “I’ve made contributions for eight or nine years now, in whatever amount her earnings were,” says Gray. “She has a real job now, as a nurse, so I put in the full Roth amount each year.”

When his son turned 15 and got a job as a lifeguard, Gray opened a Roth IRA for him, too.

His kids are in their 20s now, and he hasn’t told them yet.

Lots of Time for Investments to Grow

Here’s why an early start is a gift in itself. Say you gave your 25-year-old child $5,500 to invest. After thirty years, the money would grow to $41,867, assuming 7 percent growth, compounded monthly.

But you could double the impact of your gift by giving it to your child at age 15. After forty years, assuming the same rate of return, the $5,500 would grow to $82,360.

Consider what would happen if your 25-year-old child funded a Roth IRA for 10 years, then stopped making contributions. After 30 years, the account would be worth $314,643 (assuming equal monthly contributions adding up to $5,500 a year and a 7 percent annual return, compounded monthly).

What if you helped your child make the same investment a decade earlier, at age 15? The difference would be huge. After 40 years, at the same rate of return, the sum would grow to $618,951.

“Getting started that early is really powerful as far as the value of compound growth. It’s pretty amazing the effect of another 10 years,” says Gray.

Kid-Friendly Tax Rates

Roth IRA rules are great for young people. Kids generally pay little or no taxes, so it makes sense to use after-tax dollars in a Roth rather than tax-deferred dollars in a traditional IRA. Decades down the line, all withdrawals from the Roth IRA after age 59 1/2 will be completely tax-free, barring a change to Roth IRA tax treatment.

Non-Retirement Uses of Roth IRA Funds

Roth IRAs work best if the money is left to grow undisturbed until retirement. However, the rules are flexible enough to allow funds to be tapped under some circumstances.

Contributions have already been taxed, so they can be withdrawn at any time.

Earnings, or investment returns, are treated differently. Prior to age 59½, early distributions of earnings are generally subject to income tax, a 10 percent penalty, or both—with some important exceptions:

- Funds for a first home—A Roth IRA could help your child buy a first home, a goal that escapes many young adults. Homeownership is near 20-year lows among millennials, according to the Brookings Institute, a nonprofit public policy organization. Your child could use Roth IRA funds, within limits, toward a down payment when it comes time to buy a first home. He or she could withdraw up to $10,000 of the earnings, without tax or penalty, provided the account has been open for at least five years. Before the five-year mark, income tax would apply, but not the penalty.

- Funds for college—Roth IRA contributions can be pulled out for any reason, including college expenses. When your child goes to college, he or she could also withdraw earnings without penalty if they are used toward college tuition, room and board, or other qualified higher education expenses. Earnings would be subject to income tax.

-

Funds for emergencies—In bad times, Roth IRAs can become emergency funds. In addition to contributions being accessible, IRS rules allow earnings to be withdrawn without penalty for specific emergencies. These include becoming disabled, having to pay for health insurance premiums while unemployed, and having high medical expenses.

Gray plans to reveal his children’s Roth IRAs to them one day, though he hasn’t decided when. It might be when the balances reach a nice, round number, like $50,000, or some kind of special occasion. “Marriage might be something that triggers it. It’s a gift, but it comes with caveats,” he says. The big news will come with a serious discussion about using the money wisely.

For now, those gifts that date back to their summer camp and lifeguarding years continue to grow, tax-free.

Even with the obstacles of the past few years, charitable giving is on the rise. In fact, The National Philanthropic Trust says that 86 percent of affluent households maintained or increased their giving in 2020, despite uncertainty about further spread of COVID-19. Charitable donations are up 5.1 percent overall, according to Giving USA. But we’re not just talking about simple cash donations.

When it comes to giving, Eric Bailey, head of endowments and foundations at CAPTRUST, says he sees a focus on tax-efficient methods of giving. There are several ways to support a nonprofit and reap the tax benefits. “We’re initiating creative tactics with our wealth management clients who are thinking about a cash contribution,” Bailey says. “We’ll go through different scenarios to help the donor understand other ways to give, rather than just writing a check.”

Donating Appreciated Securities

Donating appreciated securities—stocks or bonds that have increased in value since purchase—can provide major benefits to both the donor and the nonprofit. “Gifting shares of a stock can be more efficient than writing a check,” Bailey says, “because the donated stock is typically free of capital gains taxes.” This could mean savings of tens of thousands of dollars of capital gains taxes, depending on the stock’s value, and could help maximize the value of your gift.

For example, a stock with a current value of $50,000—originally purchased for $8,000—could result in $12,000 in capital gains taxes when sold (assuming a 28% tax rate), leaving only $38,000 for the nonprofit. But when the stock is donated instead of sold, capital gains tax is avoided on the gift, allowing the full $50,000 to help the nonprofit fulfill its mission.

Donating appreciated securities can result in giving more money to the organizations you care about.

Donor-Advised Funds

When you donate money to a donor-advised fund (DAF), the funds are set aside in a 501(c)(3) account with a third party. The money is then available to distribute at your discretion to your charities of choice. The National Philanthropic Trust’s 2021 Donor-Advised Fund report notes that the number of DAFs has increased 36.4 percent from 2016 to 2020.

“A donor-advised fund is a qualifying charity, so you can immediately take that deduction before it’s distributed,” says Steve Morton, principal and financial advisor at CAPTRUST. Relocating assets like appreciated securities, property, or cash into a donor-advised fund—depending on the amount donated—may allow you to itemize deductions, which may lower your tax bill.

With a DAF you can be more strategic by considering the timing of your donations to maximize your itemized deductions. Bunching charitable donations into a single year could provide an itemized deduction when you need it most. Then, the money is there to distribute on your time and at your discretion. “I find it easier to give from a donor-advised fund, because you don’t think about it as your money anymore,” says Bailey.

Moving money into a DAF lets you take a charitable tax deduction of the donation’s full market value. It’s important to note that the amount of your donation’s deduction is based on your adjusted gross income (AGI), and any unused deduction can be carried up to five additional years.

Donor-advised funds can be especially helpful for clients nearing retirement. “It could be beneficial to put assets into a DAF and take the tax deduction when you are at your highest earning potential,” says Morton, “typically when someone is close to retirement.”

Morton says many of his clients like to make anonymous gifts. “With a donor-advised fund, the gift is acknowledged directly to the third party that holds the account. It’s much easier to make an anonymous gift that way.”

Qualified Charitable Distribution

Over 72 years old? If so, you must make annual withdrawals, known as required minimum distributions (RMDs), from your individual retirement account (IRA). Using your RMDs to fund qualified charitable distributions (QCDs) to your favorite charities is a tax-friendly method of giving, eliminating the income tax while simultaneously satisfying some or all of your yearly RMD.

“Retirees typically don’t have a lot of itemized deductions. The standard deduction is so high that most can’t deduct their charitable donations,” says Morton. Instead of a traditional charitable deduction, you can utilize QCDs in your tax-saving strategy.

“Many clients aren’t ready at 72 to take their required distributions from their IRAs and don’t want to pay taxes on them. QCDs are an easy solution and something to consider.”

Keep in mind that the 2022 maximum donation from your RMD is $100,000 per person, and the gift must come directly from the IRA to the charity.

Charitable Remainder Trust

Funding a charitable remainder trust (CRT) is another option for tax-efficient giving. Assets gifted into a CRT create income for you and your beneficiaries. Plus, the leftover is eventually donated to one or more nonprofits that you support. Income from the CRT and the ultimate gift to the charity can appreciate based on how the assets are invested within the CRT.

“A charitable remainder trust is a great strategy for appreciated assets,” Morton says, because you receive a partial tax deduction based on the assets gifted into the CRT, depending on a number of factors.

The assets remaining in the CRT must go to a qualifying nonprofit after the income distribution term ends. This time period can cover either the lifetime of the beneficiaries or up to 20 years.

“Designating a charity as a beneficiary through a CRT is a perfect way to give back,” says Morton. “There are tax benefits for you now, and down the road a charity gets money as well. It’s a win-win.”

Everyone’s situation is different, so consult your tax and financial advisors for the best option for your charitable giving. Have a nonprofit in mind that you want to support? Talk with their team about their preferred way to receive a donation.

Medicaid Eligibility: State-Specific Asset and Income Requirements

Medicaid is a joint federal- and state-sponsored program designed to provide medical assistance to low-income individuals. Eligibility requirements vary by state, so it is essential to carefully review your state’s requirements. Generally, eligible individuals include those who are over 65 years old, disabled, or blind.

Medicaid is the largest payer of nursing home costs in the United States and often serves as a last resort for people with no other means to finance long-term care.

Although states set their own rules, federal minimum standards and guidelines apply nationwide. Beyond medical and functional criteria, Medicaid eligibility is contingent on financial thresholds for assets and monthly income. This can be complex, because certain assets—such as your primary residency—and a portion of income may be exempt.

Leveraging Medicaid Planning to Meet State Requirements

Your state may only count income or assets legally available to you when determining Medicaid eligibility. This creates an opportunity for strategic Medicaid planning. Certain approaches can accelerate eligibility while preserving resources for your family.

Potential Goals of Medicaid Planning

- Exchange countable assets for exempt assets

- Preserve assets for loved ones

- Provide for a healthy spouse, if married

Goal 1: Exchange Countable Assets for Exempt Assets

Countable assets are accessible to the state for Medicaid purposes. The total value of countable assets, in conjunction with countable income, determines eligibility for Medicaid. Federal guidelines require each state to compile a list of exempt assets. Typically, this includes the family home, prepaid burial plots and contracts, one automobile, and term life insurance.

It may be possible to rearrange your finances to convert countable assets into exempt assets, making them inaccessible to the state. Examples include:

- Paying off the mortgage on your family home

- Making home improvements and repairs

- Paying off your debts

- Purchasing a car for your healthy spouse

- Prepaying burial expenses

Goal 2: Preserving Assets for Loved Ones

One way to preserve assets for your loved ones is to use an irrevocable trust. Key considerations include:

- Permanent transfers. Once assets are placed in an irrevocable trust, you cannot change the terms, beneficiaries, or asset titling.

- Medicaid exclusion. Property placed in an irrevocable trust is excluded for Medicaid purposes.

- Advance planning required. The trust must be established and funded for a specific period before it becomes an effective Medicaid planning tool.

- Fixed rules. The conditions set at the time of creation remain in place permanently.

Goal 3: Providing for Your Healthy Spouse

Medicaid rules for married couples pool assets for eligibility purposes. The healthy spouse is entitled to keep a spousal resource allowance, generally equal to half of the couple’s assets. One option is to use jointly owned, countable assets to purchase a single-premium immediate annuity for the healthy spouse. This converts assets into an income stream, which each spouse may keep individually.

For annuities purchased on or after February 8, 2006, the state must be named as the remainder beneficiary after the spouse or a minor or disabled child.

Beware of Medicaid Planning Risks

Medicaid planning can be valuable, but it is not without risks or some drawbacks. Common concerns include look-back periods, possible disqualification for Medicaid, and estate recovery.

When applying for Medicaid, the state reviews your finances, and those of your spouse, for a period before your application date. This review, known as the look-back period, typically spans 60 months for transfers of countable assets for less than fair market value. Transfers made during this period often result in a waiting period before benefits begin.

For example, giving your home to your children one year before entering a nursing home could make you ineligible for Medicaid for a significant time, as determined by a state formula.

Medicaid planning also varies in effectiveness by state. Federal law encourages states to recover Medicaid payments made on your behalf. This may include placing a lien on your property while you are alive or seeking reimbursement from your estate after you die.

Consult an attorney with Medicaid planning experience and consult the laws in your state before taking action.

Source:

Resource by the CAPTRUST wealth planning team

Important Disclosure

This content is provided for informational purposes only, and does not constitute an offer, solicitation, or recommendation to sell or an offer to buy securities, investment products, or investment advisory services. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness, or reliability cannot be guaranteed. Nothing contained herein constitutes financial, legal, tax, or other advice. Consult your tax and legal professional for details on your situation. Investment advisory services offered by CapFinancial Partners, LLC (“CAPTRUST” or “CAPTRUST Financial Advisors”), an investment advisor registered under The Investment Advisers Act of 1940.

DOL Weighs In on Cryptocurrencies in 401(k) Plans: Be Very Careful … and Audits Are Coming

The U.S. Department of Labor (DOL) issued a Compliance Assistance Release in March cautioning 401(k) plan fiduciaries “to exercise extreme care” before they consider adding a cryptocurrency option to a plan’s investment menu. The release included the DOL’s view that, “When plan fiduciaries, charged with the duties of prudence and loyalty, choose to include a cryptocurrency option on a 401(k) plan’s menu, they effectively tell the plan’s participants that knowledgeable investment experts have approved the cryptocurrency option as a prudent option for plan participants.” Although focused on cryptocurrency, the release also references a wide range of digital assets. Importantly, the release is not a formal regulation with the force of law, but it does make clear the DOL’s negative view of cryptocurrencies and other digital assets.

Although the release was directed primarily to 401(k) plan fiduciaries, it referenced defined contribution plans more broadly and can be anticipated to apply to all plans offering participant-directed investments, including 403(b) plans. The DOL also addressed the possible availability of cryptocurrencies in self-directed brokerage windows, which is addressed below.

Specific issues the DOL called out, which fiduciaries should consider if evaluating cryptocurrencies, include:

- They are “highly speculative” and have been “subject to extreme price volatility.” Extreme volatility can have a “devastating impact” on plan participants.

- It is harder for participants to make informed investment decisions about cryptocurrencies than other investments. It can be “extraordinarily” difficult for even expert investors to separate the facts from the hype about cryptocurrencies.

- Cryptocurrencies are not held in the same way as other investments, presenting a variety of potential issues.

- There is not a commonly accepted approach to how cryptocurrencies are valued. Also, cryptocurrency market intermediaries are not subject to the same reporting and data integrity requirements as more traditional investments.

- The regulatory environment for cryptocurrencies is evolving, and some market participants may be operating outside the regulatory framework. Additionally, cryptocurrencies have reportedly been used in a variety of illegal activities, which could result in limitations on the use of specific offerings.

In an unusual step, following this cautionary list of issues, the DOL also notes that it expects to conduct an investigative program “aimed” at plans that offer participant investments in cryptocurrencies and related products. Any plan fiduciaries considering the addition of cryptocurrencies may want to consider involving legal counsel.

Self-Directed Brokerage Accounts: DOL Cryptocurrency Release Opens Door to Examining What Is Offered Through the Account

At the end of its Compliance Assistance Release on digital currencies, discussed above, the DOL added a further caution to plan fiduciaries whose plans offer self-directed brokerage accounts. A self-directed brokerage account option permits a participant to use a brokerage account as one of their 401(k) plan investment options. Using the brokerage account, they can invest 401(k) plan assets in anything available in the brokerage account.

In the release, the DOL said that fiduciaries whose plans permit self-directed brokerage accounts should expect to be questioned on how they have “squared” their responsibility for plan oversight with the DOL’s serious concerns about cryptocurrency. This seems to open a new area of evaluation by the DOL into what is available through self-directed brokerage accounts.

There is a fiduciary responsibility to select the self-directed brokerage offering and monitor that it is functioning properly and without issues. However, until now it has been generally understood that there is not a fiduciary responsibility to monitor the specific investments offered through the brokerage account. The release seems to lay that responsibility at plan fiduciaries’ feet with respect to cryptocurrencies. It also raises the possibility that other investments available through a self-directed brokerage program may be challenged.

Fiduciaries whose plans offer a self-directed brokerage option should evaluate whether their brokerage account includes cryptocurrencies or other digital assets the DOL is challenging.

Pension Actuarial Equivalence Lawsuits Update

At least 14 lawsuits have been filed alleging that pension plans paid improperly low benefits to some pensioners and their survivors by using incorrect actuarial assumptions. Generally, these cases allege that outdated mortality assumptions or interest rates were used to calculate joint and survivor or early retirement benefits, resulting in understated benefits, violating ERISA’s rules.

It has been reported that half of these cases have been resolved. Only two monetary settlements have been reported: one for approximately $59 million, where the claim was for approximately $150 million, and the other for $2.8 million. Motions to dismiss in two of the remaining cases were recently issued and came to opposite conclusions.

In Belknap v. Partners Healthcare System, Inc. (D. Mass. 2022), an early retirement (age 62) joint and survivor benefit was calculated using a mortality table from 1951 and an interest rate of 7.5 percent—as prescribed by the plan. In the same plan, for standard single life annuities, up-to-date assumptions including the 2000 mortality table and market-based interest rates (likely 3.7 percent) are used. The suit alleges that, if the early retirement was calculated using the current mortality table and an appropriate interest rate, the monthly difference to the participant would be $33.48, with a present value of $5,840. The judge evaluated the law and did not find a requirement that reasonable actuarial assumptions be used. Rather, he found that the plan’s dictated assumptions should be used and dismissed the case. An appeal has been filed.

In Urlab v. CITGO Petroleum Corp. (ND Ill. 2022), an early retirement (age 62) joint and survivor benefit was calculated using 1971 mortality tables and an interest rate of 8 percent. The plan sponsor argued that the applicable law does not require the use of reasonable actuarial assumptions. The judge rejected this argument, saying, “[I]t cannot possibly be the case that ERISA’s actuarial equivalence requirements allow the use of unreasonable mortality assumptions.” For this and other reasons, the motion to dismiss was denied and the case will proceed.

There have been no full trials of these cases, and a pattern of outcomes cannot be discerned from the settlements and motion to dismiss rulings at this time. However, outcome of the appeal in Belknap may be informative.

Fee Litigation Update

The flow continues of new cases, decisions, and settlements alleging fiduciary breaches through the overpayment of fees and the retention of underperforming investments in 401(k) and 403(b) plans. A sound process for periodically assessing the reasonableness of fees and expenses and monitoring documents is essential to the defense of these cases. Following is a sampling of this quarter’s developments, including appellate court reversal of two cases that had been dismissed in favor of plan fiduciaries and a new suit against fiduciaries of a plan with only $70 million in assets. Fiduciaries of smaller plans cannot assume that they will not be targeted.

Following is a summary of recent developments:

- New Case Filed Against Smaller Plan—Most plans that have been sued alleging overpayment of recordkeeping fees and investment expenses have had approximately $1 billion in assets or more. A plan with only $70 million has recently been sued in a case making nearly identical allegations to those in the larger plan cases and requesting class action status. Aquino v. 99 Cents Only Stores, LLC (C.D. Cal. 2022)

- Dismissed Cases Reinstated—We previously reported on Davis v. Salesforce.com, Inc. and Kong v. Trader Joe’s Co., both of which were dismissed because the complaints did not include sufficient allegations. Each dismissal was reversed by a separate panel of the U.S. Court of Appeals for the Ninth Circuit. In both instances, the court of appeals found the allegations in the complaints to be sufficient for the case to proceed. Davis v. Salesforce.com, Inc. (9th Cir. 2022), Kong v. Trader Joe’s Co. (9th Cir. 2022).

New Cases with Mixed Dismissal Results:

- Case was initially dismissed and survives dismissal after an amended complaint was filed. Johnson v. PNC Financial Services Group (D. N.C. 2022).

- After plaintiffs were given the opportunity to file an amended complaint, the new complaint was found to be insufficient and dismissed with prejudice. This means that the case is finished and cannot be refiled. Matney v. Barrick Gold of North America, Inc. (D. Utah 2022)

- New case dismissed with leave to file an amended complaint in 28 days. Perkins v. United Surgical Partners International, Inc. (N.D. Tex. 2022)

- New case survives motion to dismiss. Cunningham v. USI Insurance Services, LLC (S.D. N.Y. 2022)

Fiduciary Breach in Evasive and Incomplete Participant Communications

Sean Smarra was a participant in the Boilermaker-Blacksmith National Pension Trust, the defined benefit pension plan for Boilermakers union members. He worked as a boilermaker until he was permanently disabled at age 42. Under the Boilermakers pension plan, a fully disabled plan participant is eligible to begin receiving lifetime pension benefits. The plan was amended in January 2017 to substantially reduce the amount of disability benefits based on the participant’s age when requesting benefits if they are not yet age 55. To qualify for an unreduced disability pension benefit, plan participants were required to apply for benefits by August 14, 2017.

When he was age 45, in March 2017, Smarra contacted Stacy Higgins at the pension plan’s administration firm to ask about his disability retirement benefit. Although he did not say he wanted to begin receiving retirement benefits immediately, Higgins understood his intention to retire soon. Indeed, she mailed him a pension retirement packet the next day. However, she did not inform Smarra that the plan had been amended and that he would receive a reduced benefit if he did not submit his retirement papers by August 14. Because Smarra was only 45, his benefit reduction would be approximately 60 percent.

Higgins was aware of the plan change and the deadline to receive unreduced benefits. However, she and other employees at the pension administrator were affirmatively instructed to not raise or discuss upcoming changes with participants who contacted them. They were also instructed to not respond to participant questions on the subject.

When Smarra applied for benefits later in 2017, he was informed that his benefit would be $1,393 per month, rather than the $3,804 he was quoted about a year earlier. Disappointed that his lifetime monthly benefit had been reduced by more than 60 percent, he sued.

The judge observed that fiduciary responsibilities under ERISA “encompass not only a negative duty not to misinform, but also an affirmative duty to inform when the [fiduciary] knows that that silence might be harmful.” The Boilermakers argued that Higgins, as a staff person, was not acting in a fiduciary capacity. The judge disagreed, noting that Boilermakers as the plan fiduciary is responsible for Higgins’s failure to provide Smarra the information he needed to protect his benefits.

Finding that a trial would be unnecessary, the judge entered summary judgment in favor of Smarra. Smarra v. Boilermaker-Blacksmith National Pension Trust (W.D. Penn. 2022). The case is now on appeal.

What sits on a company’s balance sheet for a very long time, is highly complex, and costs a bunch to maintain? The answer: a pension plan. In fact, there are currently more than $3 trillion in U.S. plan assets held by private-sector pension plans.

Sound like a heavy responsibility? It is. And it is precisely why sponsors of defined benefit (DB) plans have been reviewing their plans’ statuses and costs with an eye toward managing risk, says Arthur Scalise, New York City-based director of actuarial services at CAPTRUST.

A form of pension risk management known as pension risk transfer (PRT) is the process of transferring a defined benefit plan’s risk away from an employer who sponsors a pension plan. It represents “a shift from an asset-only risk focus to managing pension plan assets and liabilities, while minimizing volatility generated by the plan’s surplus risk,” Scalise says.

Risk transfer or de-risking transactions addressing pension plan risks can include, for example, the purchase of annuities from an insurance company that transfers liabilities for some or all plan participants; the payment of lump sums to pension plan participants that satisfy the liability of the plan for those participants (either through a one-time offer or a permanent plan feature); and the restructuring of plan investments to reduce risk to the plan sponsor.

Moreover, with an estimated total volume between $38 billion and $40 billion in U.S. pension transactions, the 2021 PRT market exceeded 2020’s record of $27 billion and its highest value to date—$36 billion in 2012.

So … Why Are So Many Plan Sponsors Checking Out PRT?

The current interest rate environment is a tailwind for pension risk transfer, says Scalise. “It is at the top of the leader board when it comes to reasons for plan sponsors to initiate a PRT.” Favorable interest rates have helped many pensions get close to full funding. “That is a core gauge of a plan’s health—a measure of plan assets relative to liabilities—and it hasn’t looked this good since before the 2008 financial crisis,” he says.

Another biggie making PRTs more attractive? Pension plan participants living longer. According to a recent analysis by Club Vita, mortality rates have been improving much more quickly for U.S. pension plan participants than for other Americans (around 0.8 percent per year higher among those who are over 65 years old). This increase in longevity, particularly for a very large population of pension plan participants, can increase plan costs. According to Scalise, if this pace documented in this analysis continues, the existing life expectancy gap between pension plan participants and the U.S. population will widen by one year by the late 2020s.

And don’t forget the historically favorable annuity buyout market—another influence nudging plan sponsors to offload retiree liabilities. Data from the Milliman Pension Buyout Index tells us retiree buyout costs dropped to record lows by the end of 2020 (competitive rates dropped from 103.3 percent at the beginning of 2020 to 99.3 percent at the beginning of 2021), and stayed low through all of 2021 (with competitive rates between 99.3 percent and 100.2 percent).

Might we also suggest that smaller plan sponsors are finding validation in the actions of larger corporations? For example, there is no shortage of plan sponsors who say pension risk management transactions completed by major Fortune 500 corporations increase the likelihood that they would consider offloading pensions to insurers themselves, says Scalise. “Large and mid-sized corporations tend to follow in the footsteps of Fortune 500 companies because those are typically the first movers.”

How Should Plan Sponsors Be Thinking About PRT?

”For plan sponsors who are curious, or who feel that PRT may be in the pension plan’s future, taking preparatory steps today can shorten the implementation timeline,” Scalise says.

Most importantly, “the plan sponsor can determine whether PRT fits the organization’s goals,” Scalise says. “However, the fiduciary duty to participants takes precedence over the company’s bottom line.”

The length of time it takes to complete a pension risk transfer will vary by plan; however, the entire process may take 18 to 24 months, Scalise says. However, even if no immediate action is taken to execute a PRT strategy, plan sponsors can still prepare themselves in case they have to revisit the issue down the road. If the plan sponsor does decide to consider a change, Scalise has a handful of questions to think about before making any moves.

- Who will be on the company’s internal team that will manage the process?

- Will the PRT process include specialty consultants such as actuaries, investment bankers, annuity placement providers, or legal counsel?

- Is the company’s valuation data clean and up to date? Can final accrued benefits be validated, and missing participants located?

- Who will evaluate request for proposal (RFP) responses submitted by the insurers, and ultimately select the annuity provider?

- What would the communication strategy be to senior management, plan participants, retirees, etc.? What about externally to the public and other interested parties?

Rising inflation, the specter of higher interest rates, and the outbreak of war made for a challenging backdrop for investors during the first quarter.

The year began with modest declines across major asset classes in a synchronized sell-off as investors processed a range of significant global crosscurrents. Only commodities moved higher during the quarter, accelerated by supply shocks stemming from the Russian invasion of Ukraine. Normally sedate bond markets were rattled by inflation fears and the beginning of a Federal Reserve tightening campaign.

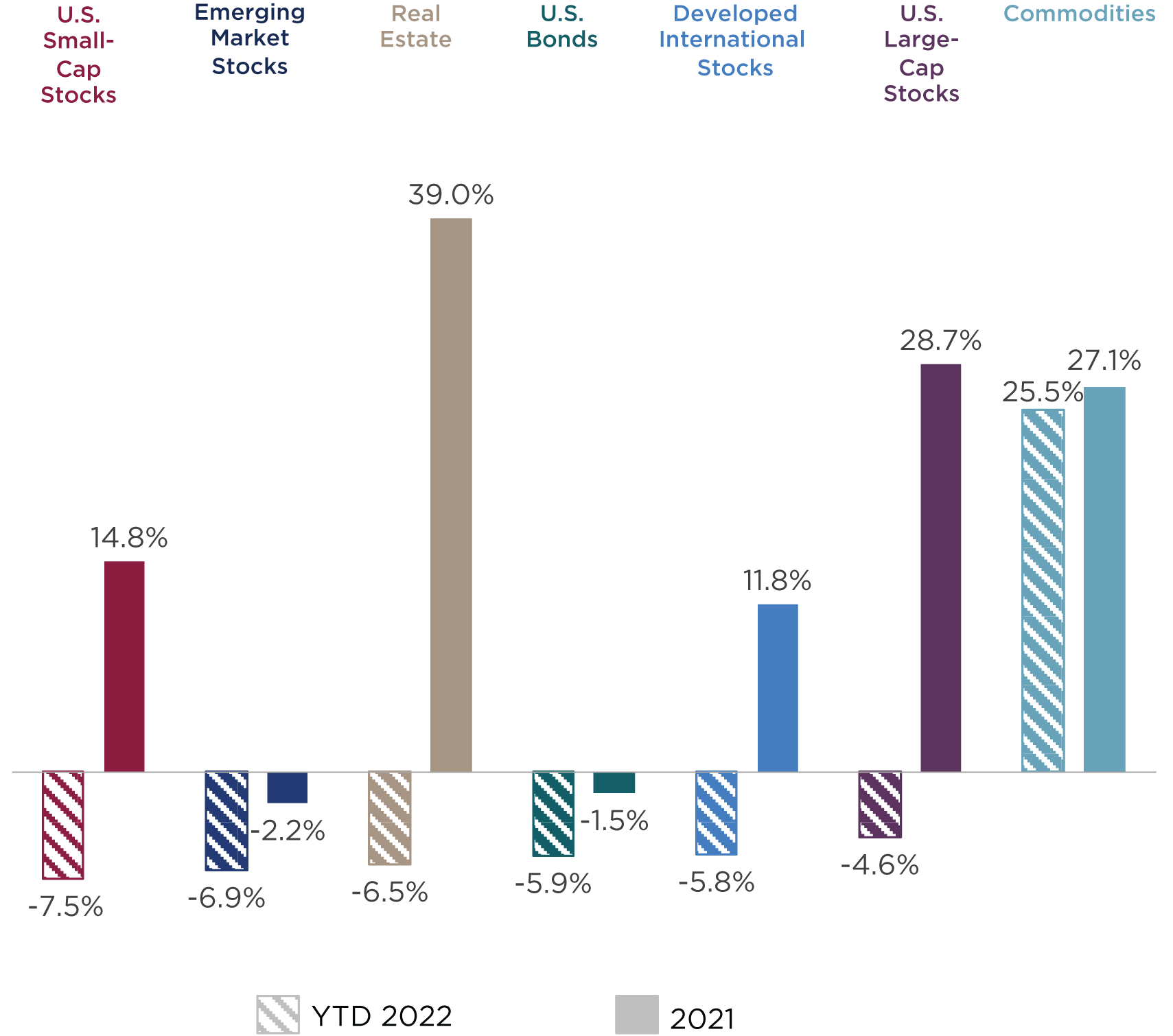

Figure One: Major Asset Class Returns

Source: Bloomberg. Asset class returns are represented by the following indexes: Bloomberg U.S. Aggregate Bond Index (U.S. bonds), S&P 500 Index (U.S. large-cap stocks), Russell 2000® (U.S. small-cap stocks), MSCI EAFE Index (international developed market stocks), MSCI Emerging Market Index (emerging market stocks), Dow Jones U.S. Real Estate Index (real estate), and Bloomberg Commodity Index (commodities).

- U.S. large-cap stocks declined 4.6 percent during the first quarter despite a strong March rally, as the S&P 500 delivered its first quarterly decline since the first quarter of 2020.

- International stocks fared worse amid fears of energy and commodities shortages. Developed market stocks slipped by 5.8 percent, while emerging markets stocks dropped by 6.9 percent.

- Bond prices retreated as interest rates rose, leading to a 5.9 percent decline in the first quarter, the largest quarterly loss for the Bloomberg U.S. Aggregate Bond Index in more than 40 years.

- The only major category to post gains during the quarter was commodities, as prices for a wide range of inputs—from food to energy and basic materials—surged higher amid higher demand, constrained supply, and the shock of the Russian invasion of Ukraine. The result was the best quarter for commodities since 1990.

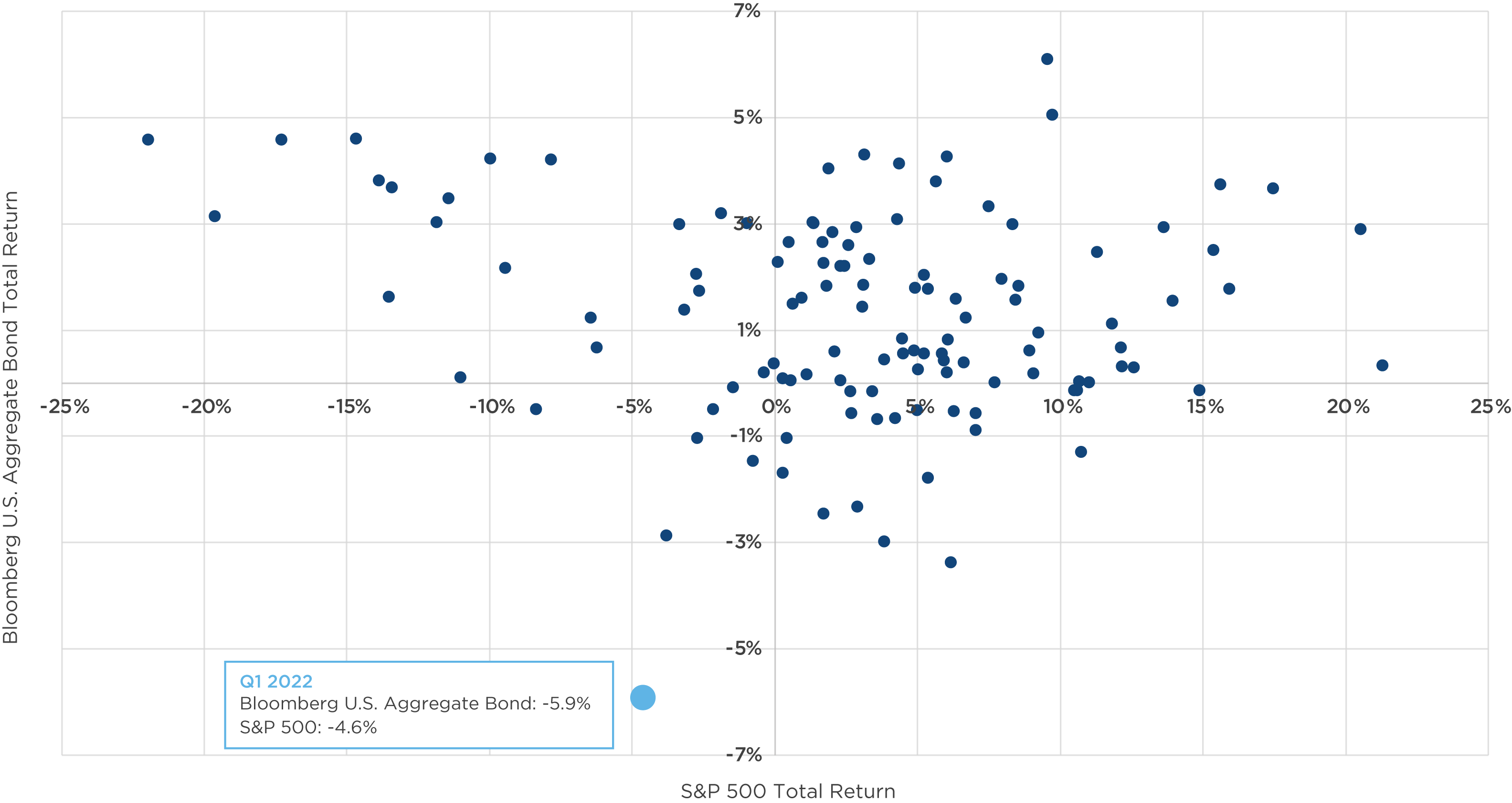

The first quarter was a rare instance when diversification felt more like diversi–frustration, as both the S&P 500 and the Barclays U.S. Aggregate Bond indexes suffered simultaneous declines, something that has occurred in just six other calendar quarters over the past 30 years. As shown in Figure Two, when stock prices fall, bonds typically appreciate, providing a counterweight and diversification benefit (see top left quadrant). But during the first quarter, bonds also fell sharply (lower left), leaving investors with few places to hide.

Figure Two: Quarterly Returns for U.S. Stocks and Core Bonds (since 1992)

Sources: Bloomberg, CAPTRUST Research

A World of Two Wars

We entered 2022 with the belief that, following the abnormal economic, market, and policy conditions arising from the COVID-19 pandemic, investors should brace for a return to more normal market conditions, including the higher levels of volatility and market pullbacks that characterize them. Even so, we were surprised by just how quickly volatility returned, beginning the very first week of the year. Even as businesses and consumers continued to recover from the economic consequences of the pandemic, the outbreak of two simultaneous wars introduced new risks and uncertainties: the Russian invasion of Ukraine and the Federal Reserve’s war on inflation.

Unfortunately, the first of these wars is measured in human lives and destroyed cities. The invasion of Ukraine is both a humanitarian nightmare and a conflict that poses significant economic risks to the global economy. And while the second war pales in comparison on a human scale, the consequences of elevated inflation and the policy actions needed to bring it under control have pushed both interest rates and market volatility sharply higher.

Rising Prices Raise Alarms

Even before Russia invaded Ukraine, the U.S. economy was facing levels of inflation not seen since the 1980s due to pandemic-driven supply and demand imbalances and the extraordinary government stimulus used to blunt the economic damage caused by the COVID-19 pandemic.

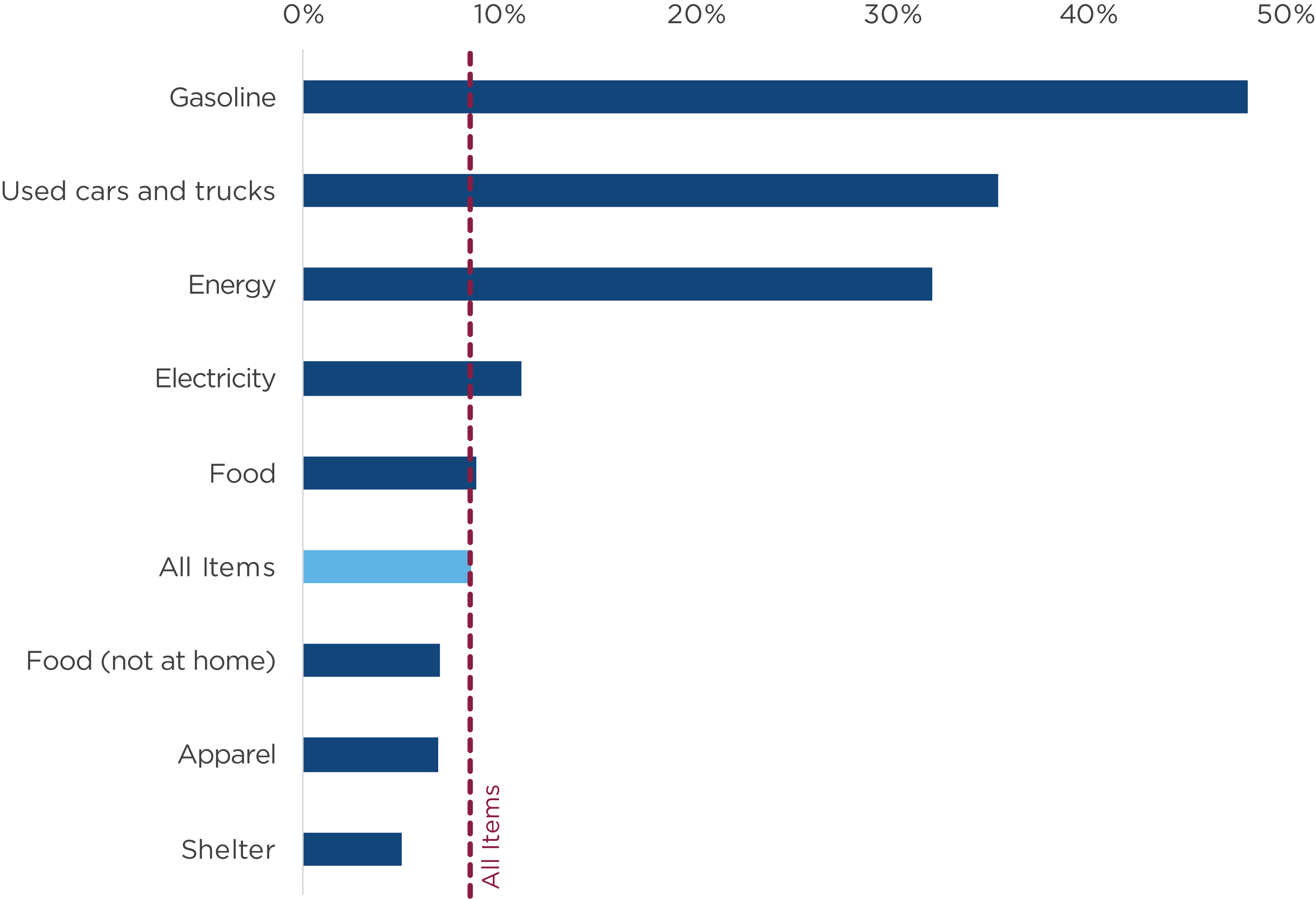

After climbing steadily in 2021, inflation accelerated this year, with the Consumer Price Index (CPI) touching 7.5 percent in January on its way to a whopping 8.5 percent year-over-year increase in March—the highest reading since 1981. With this level of inflation, it’s no surprise that consumer sentiment has fallen to one of its lowest points in the past 70 years, as rising costs have significantly eroded the benefits of wage gains for many workers.

However, hidden within the March inflation data were some glimmers of hope that the trajectory of inflation could flatten or even decline later this year. Over half of the March increase was driven by an 18 percent spike in gasoline prices within a single month due to the Russian invasion. Oil prices have since moderated from weaker demand due to China’s severe COVID-19 lockdowns and the impact of the largest-ever releases of oil from strategic petroleum reserves.

Other bright spots in the March CPI data: Core price inflation, which excludes the volatile categories of food and energy, rose by a smaller amount, and used car prices posted a significant monthly decline. Vehicle prices are still elevated over pre-pandemic levels and could serve as a continuing source of disinflation as the automobile market normalizes.

An Inflation-Fighting Fed

Figure Three: Consumer Price Index Year-over-Year Change (March 2022)

During the pandemic, as factories were shuttered and supply chains were jammed, massive stimulus payments and lower costs gave people money to spend. This is a clear recipe for higher prices, and the hope was that inflation would fade as pandemic disruptions began to resolve. But as we entered the new year with inflation signals flashing red and the strongest labor market in a half century, the Fed was forced to use its words—also known as Fedspeak and closely scrutinized by analysts—and its policy actions to reduce the inflation threat.

The only way to tamp down inflation is to slow the pace of growth within an economy that’s running full tilt, and the Fed has several tools to do so. The first is raising the federal funds rate, the interest rate that is used for short-term loans between banks. The fed funds rate flows through the financial system into all kinds of business and consumer credit. Higher rates increase borrowing costs, reduce consumer demand and business investment, curtail more speculative activity, and cause the economy to cool.

In mid-March, the Federal Reserve hiked the fed funds rate by 0.25 percent. This represents its first uptick since 2018 and the opening salvo of an inflation-fighting campaign expected to deliver seven or more rate hikes this year. But the minutes of the Fed meeting released several weeks later supply even stronger indications that more aggressive 0.50 percent increases are also on the table. Investors have taken these comments to heart, with the futures markets suggesting a nearly 87 percent probability of a 0.50 percent increase during the Fed’s next meeting in May, according to the CME Group’s FedWatch Tool.

The March meeting minutes also yielded clues about another weapon within the Fed’s inflation-fighting arsenal: quantitative tightening—or reducing the size of its enormous balance sheet of securities purchased during the crisis to inject liquidity into the financial system and keep borrowing costs low. The March minutes suggest that the Fed could begin quantitative tightening as early as May at a pace of up to $95 billion per month.

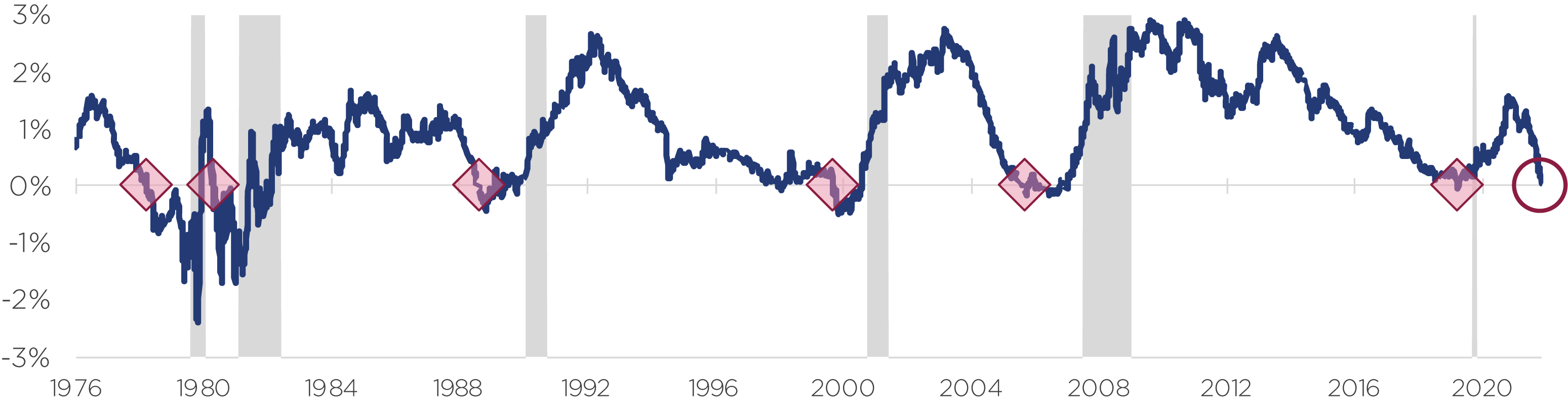

Bond markets have reacted swiftly to the Fed’s hawkish pivot. Two-year Treasury yields, which are more sensitive to the fed funds rate, leapt from 0.7 percent to 2.3 percent over the course of the first quarter. This rapid rise in short-term yields led to the market condition known as an inverted yield curve, where yields for long-term bonds fall below those of shorter-term bonds. Historically, this condition has been a reliable harbinger of recession.

Figure Four: Spread between 10- and 2-Year Treasury Yields

Sources: Federal Reserve Bank of St. Louis, Strategas, CAPTRUST Research

Although the yield curve inversion at quarter-end was brief, it highlights one of the biggest questions facing investors today: Can the Fed can prove the yield curve wrong by employing its policy tools to engineer an economic soft landing that reduces market excesses and inflation without pushing the economy into recession? This is a hard enough task in a normal market cycle but is greatly complicated by the war in Ukraine, the experimental nature of quantitative tightening, and the lingering effects of a global pandemic.

Economic Impact of War in Ukraine

Russia’s invasion of Ukraine represents, first and foremost, a shocking humanitarian crisis and a threat to global peace and stability. It has also introduced an unpredictable factor to global inflation dynamics, as the production and distribution of key commodities have been interrupted by both the conflict and the financial sanctions imposed to punish Russia’s aggression.

Russia is a major exporter of key industrial and food commodities. It is the second-largest net exporter of crude oil, the fourth-largest provider of natural gas to global markets (which supply much of Europe’s electricity), and the top exporter of fertilizers that are critical to global food production. Perhaps most critically, together Russia and Ukraine export almost 30 percent of the global trade in wheat, as well as other important grains and vegetable oils used in food production, according to the Observatory of Economic Complexity.

In the days following the invasion, prices spiked for a range of energy sources, industrial metals, and food staples. This could amplify inflation pressures in the months ahead and create risks of global food shortages that could trigger political or social unrest. In March, a global food price benchmark compiled by the United Nations rose by nearly 13 percent, reaching the highest level since the index was created in 19901.

What Could Go Right?

During a volatile, breaking-news-driven market environment, it is also important to consider what could go right from here. Fundamentals remain in place for investment gains if the trio of macroeconomic risks—inflation, the Fed’s actions to contain it, and the war in Ukraine—can be better understood by investors.

Despite a backdrop of rising uncertainty, U.S. stocks suffered only modest declines during the first quarter, in part because economic and business fundamentals remain strong. Although U.S. companies’ profit growth has slowed due to rising input and labor costs, margins still are well above their long-term averages. Meanwhile, investors have cheered as companies continue to return capital to shareholders.

Companies have two primary ways to return capital to investors: dividends, which are more certain but immediately taxed, and stock buybacks, which can defer taxation but provide a more uncertain future return. Last quarter, buybacks set a record at $270 billion—more than double the pace of the same period in 2020. Companies also set a record for dividends in 2021, returning more than $500 billion to shareholders, according to data service Bloomberg.

And despite rising input and labor costs, high levels of profitability continue to serve as a tailwind for stocks, as strong consumer demand and productivity gains have allowed firms to pass higher input and labor costs along to customers.

More Questions than Answers

Amid this challenging backdrop, investors are hungry for clarity. Based upon our ongoing conversations with clients, asset managers, and other market participants, we believe that some of the most important questions investors face today fall into four categories.

The Russia and Ukraine War

- How extensive will the human, physical, and financial damage from the war in Ukraine be?

- How long will the conflict last, and will it tip Europe into recession?

- How will the conflict impact energy, industrial, and food commodity prices?

Inflation and the Fed

- Are we nearing the point of peak inflation?

- Can an inflation-fighting Fed avoid a policy error and engineer an economic soft landing?

Business Conditions

- Will oil prices rise further and remain higher for longer?

- When will worker shortages resolve?

- Will higher wages and inflation draw workers from the sidelines?

- When will the effects of rising prices offset higher wages and elevated levels of savings, dampen consumer demand, and reduce the ability of companies to maintain profit margins?

The COVID-19 Pandemic

- Will COVID-19 and its economic impacts remain in the background?

- When will global supply chains catch a break?

Given this list of questions, our view remains cautious. However, this doesn’t mean investors should head for the exits to wait for an all-clear. In fact, some of the best days in the markets have historically come during the depths of a crisis, when the all-clear isn’t yet obvious. During volatile markets, investors’ greatest assets are caution and patience, and it is far better to remain invested with a diversified portfolio that is resilient to a wide range of conditions.

1Alistair MacDonald and Patrick Thomas, “Ukraine War Drives Food Prices to Record High,” Wall Street Journal, April 8, 2022

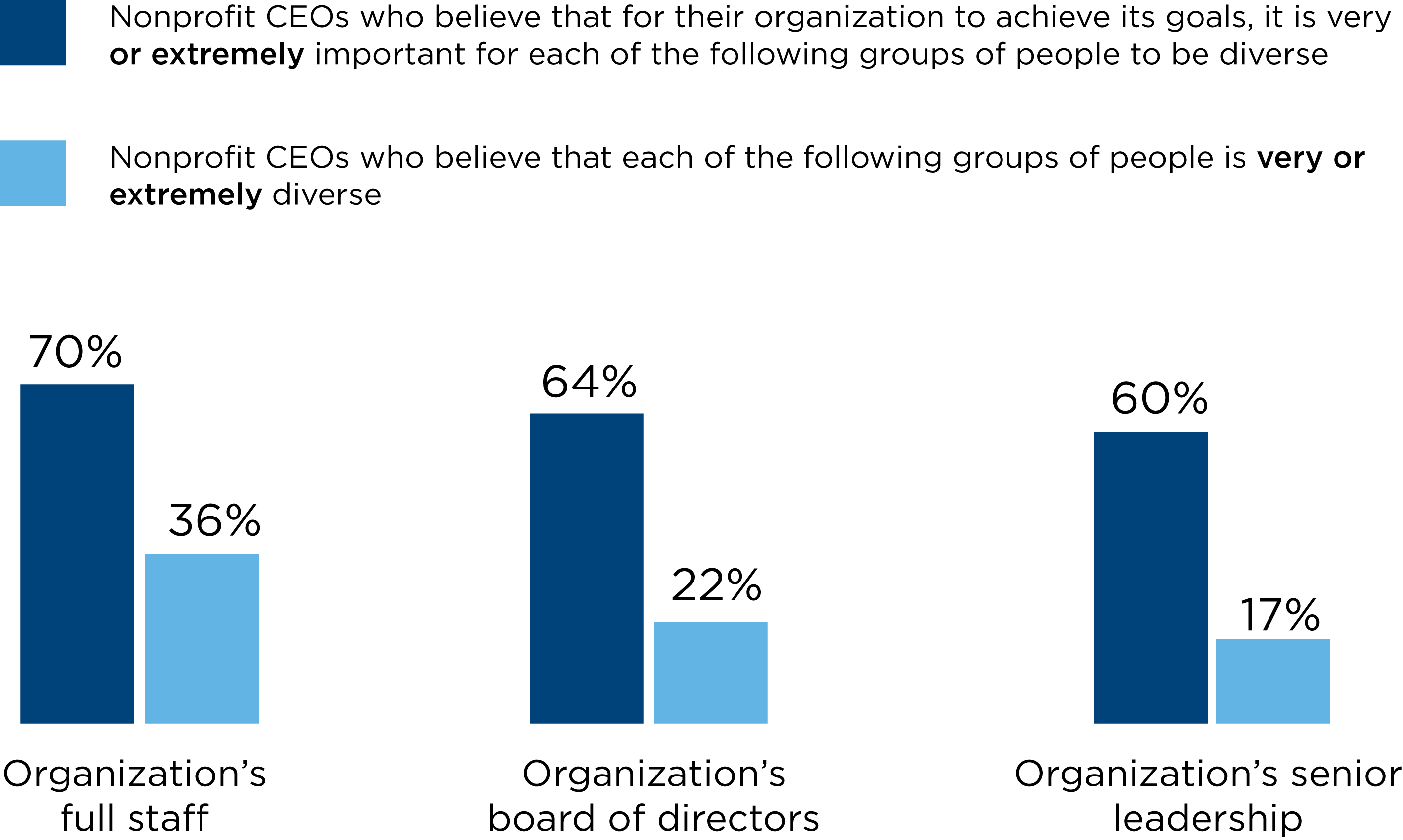

Seventy percent of nonprofit CEOs believe that for their organizations to achieve their goals, it is very or extremely important that the organizations’ full staff are diverse. However, when asked if they believe their staffs, as they exist today, are very or extremely diverse, an average of only 36 percent agreed. When looking at the diversity of organizations’ board of directors and senior leadership, the numbers are even worse, as shown in Figure One.

Figure One: The Disconnect Between the Importance of Diversity and Actual Diversity

Source: The Center for Effective Philanthropy

The good news is that the country’s third-largest employer, the nonprofit sector, is more than ready for change. In fact, 69 percent of public and private foundations focused on religious, educational, and other charitable missions polled in CAPTRUST’s annual Endowment & Foundation Survey consider diversity, equity, and inclusion (DEI) a priority for their organization.

The fourth annual survey, which includes the perspectives of more than 150 organizations, shows us nonprofits can take action and improve satisfaction around DEI. How? Measure it as intently as any other key performance indicator and keep track of it over time, says James Stenstrom, endowment and foundation director at CAPTRUST.

Stenstrom says some organizations already track DEI metrics as “a baseline for assessing achievements on cultural and engagement goals across the various demographic segments within their organization.” For example, he says, 71 percent of nonprofits track diversity metrics on the communities they serve. However, at the same time, nearly half of that group does not track the same for grantees.

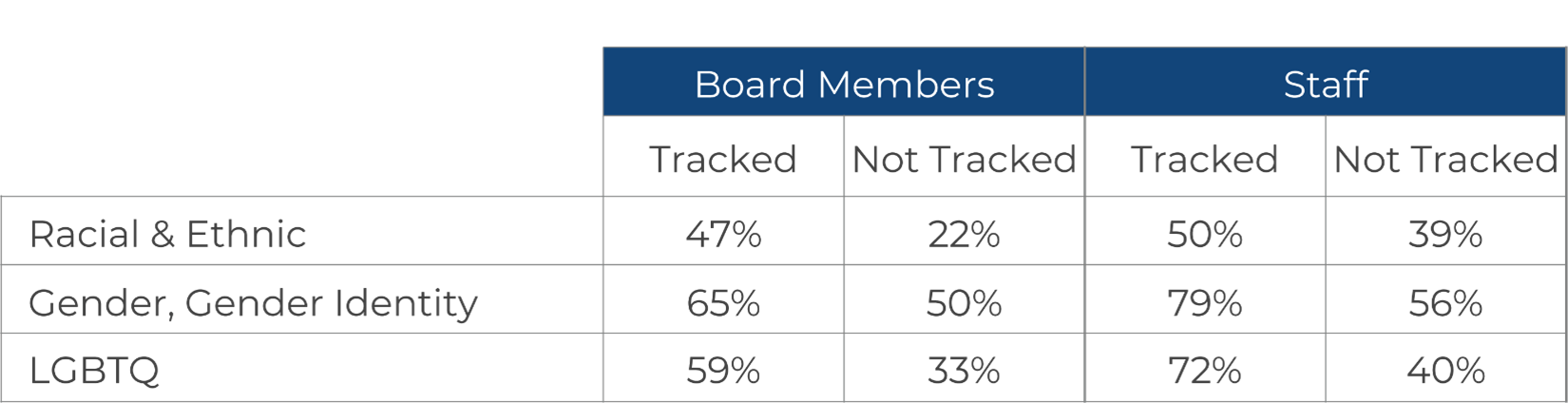

Meanwhile, nonprofits who quantify DEI metrics are universally more satisfied with the diversity of their board members, staff, communities served, and grant recipients than those who don’t, says Stenstrom. For example, as shown in Figure Two, the percentage of respondents satisfied or very satisfied with the ratio of lesbian, gay, bisexual, transgender, and queer (LGBTQ) staff nearly doubles—and satisfaction with racial and ethnic diversity of board members more than doubles—when diversity metrics are tracked.

Figure Two: Of Those Satisfied or Very Satisfied with Diversity, What Percentage Are Tracking It?

Source: CAPTRUST’s 2021 Endowment & Foundation Survey

Where to Begin

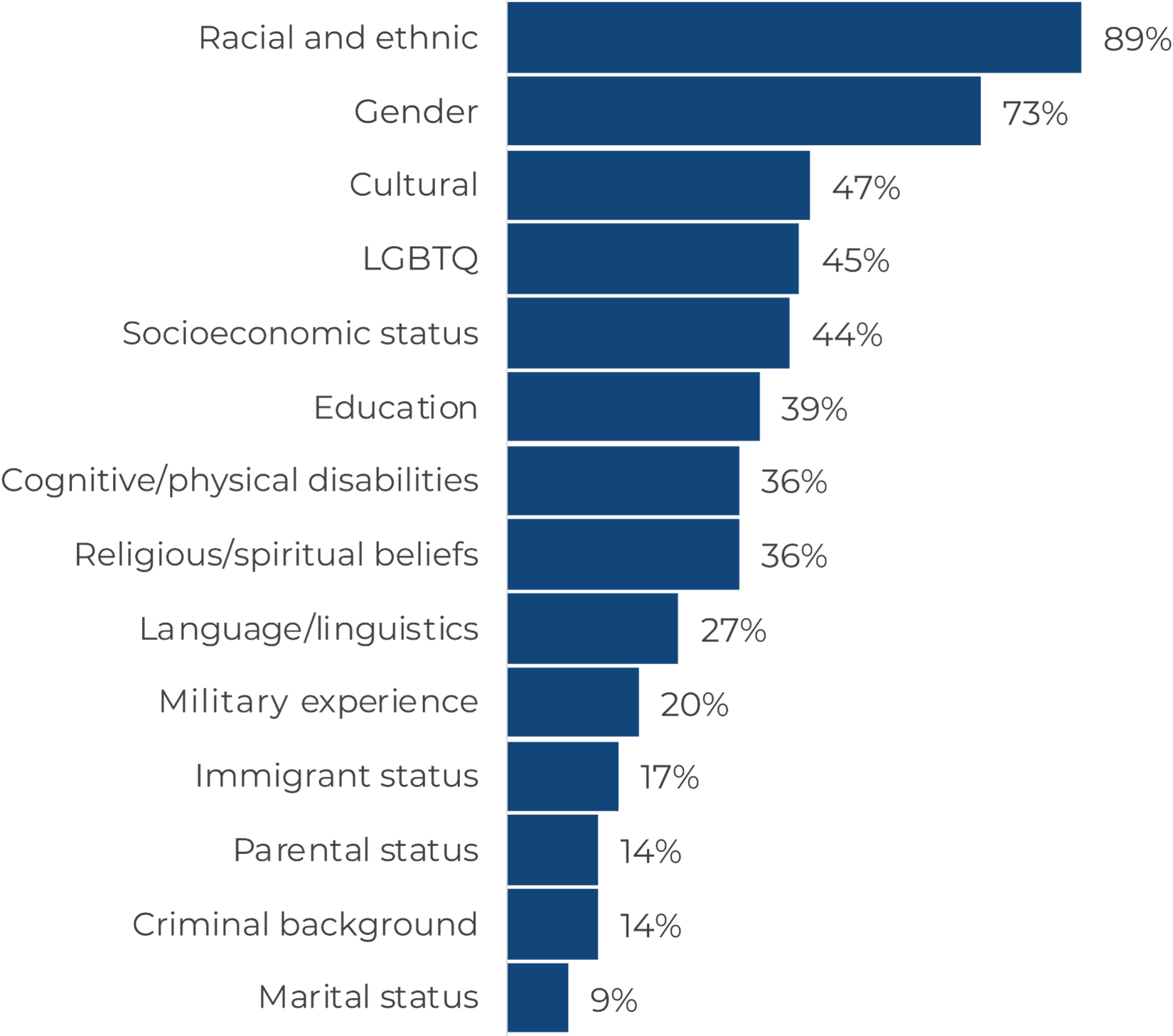

As shown in Figure Three, the DEI issues most important to nonprofits were about race and ethnicity, gender, and culture. Other issues of high importance were related to LGBTQ, socioeconomic status, and education.

Figure Three: What DEI Issues Are Most Important to You?

Source: CAPTRUST’s 2021 Endowment & Foundation Survey

The highest-ranked issues are a good place to start in terms of collecting that data, says Stenstrom, but it is important to make sure that the diversity metrics nonprofits are gathering will help identify priorities and goals, such as assessing your organization’s current culture.

For example, what do power and privilege look like in your organization? Could your organizational norms create barriers for diverse staff, members of the board, and senior leadership? These types of questions can be challenging, but they are an essential first step. Nonprofits may discover that they are not ready to act—that they need deeper metrics to understand areas of concern and opportunity. And that’s okay, says Stenstrom. “Once you understand who you’re speaking to, you can align your initiatives and efforts accordingly.”

Stenstrom offers a few more tips in the way of collecting the best DEI metrics possible. For starters, only ask for the metrics you need. “Never collect information that you do not plan to or cannot use,” Stenstrom says. “People naturally expect you to do something with the information they share with you at your request.”

Additionally, nonprofits will want to customize the questions for the organization and sector and be sensitive about it. “When assessing data like sexual orientation, sometimes it is best to consider deferring to a third, neutral party for more accurate results,” he says.

Many respondents polled in CAPTRUST’s 2021 Endowment & Foundation Survey are taking it one step further and finding their own unique solutions to drive racial and gender equity and inclusion. According to Stenstrom, among those ideas is creating new committees to promote DEI with faculty and staff members, participating in third-party DEI assessments, and updating the code of ethics to include DEI. Other reported initiatives included racial equity task forces, DEI training, and increased research focused on diversity issues.

Supreme Court Sides with Plan Participants in Plan Fees Case

The U.S. Supreme Court decided in favor of plan participants in Hughes v. Northwestern University (S. Ct. 2021). This much anticipated decision had the potential to curtail the increasing volume of excessive fee cases by changing what must be included in a complaint (the initial filings in a lawsuit) to survive a motion to dismiss. Rather, it left longstanding rules in this area unchanged. The allegations in a complaint cannot be conclusory; they must include facts that plausibly suggest an entitlement to relief.

A few years ago, several separate cases were filed against major colleges and universities, making the now familiar claims that they had overpaid for recordkeeping services and investments and improperly managed their plans. Three of these cases were brought in different federal judicial circuits, and each complaint made essentially the same claims.

As is often the case, motions to dismiss were filed in these cases. A motion to dismiss contends—without delving further into the facts—that the complaint does not include sufficient allegations for the case to proceed. In two of these cases, the motions to dismiss were denied and the cases proceeded to litigation. In the third, against Northwestern University, the motion to dismiss was granted, and dismissal was upheld by the U.S. Circuit Court of Appeals for the Seventh Circuit. A key factor relied on by the Seventh Circuit was that, in addition to “expensive” funds, the plan also offered lower-cost index funds. The court reasoned that because lower-cost funds were available to plan participants, it did not matter that other funds may have been too expensive. Also, because recordkeeping fees were paid from revenue sharing, participants could select the less expensive index funds to manage the recordkeeping fees they paid.

With the federal judicial circuits split on what must be included in a complaint to survive a motion to dismiss, the Supreme Court accepted the case. In a unanimous decision, the Court reversed the Seventh Circuit’s decision, rejecting its reliance on the availability of a diverse menu of investments—including less expensive index funds—as basis for dismissing claims that the plan fiduciaries overpaid for investments and recordkeeping. The Supreme Court also noted that its guidance in Tibble v. Edison Int’l, (S. Ct. 2015) was not applied by the lower courts in this case. The Hughes decision will make it easier for plan participants to pursue excessive fee claims in jurisdictions that followed the Seventh Circuit’s overruled approach.

The Supreme Court reiterated key points in Tibble v. Edison Int’l that “a fiduciary normally has a continuing duty of some kind to monitor investments and remove imprudent ones.” “Plan fiduciaries are required to conduct their own independent evaluation to determine which investments may be prudently included in the plan’s menu of options. If fiduciaries fail to remove an imprudent investment from the plan within a reasonable time, they breach their duty.” The case was sent back for the lower court to evaluate the sufficiency of the complaint based on Tibble’s guidance.

Perhaps in a nod to the challenges plan fiduciaries face, the Court acknowledged that the appropriate fiduciary inquiry will be context specific, and went on to say, “At times, the circumstances facing an ERISA [Employee Retirement Income Security Act] fiduciary will implicate difficult tradeoffs, and courts must give due regard to the range of reasonable judgments a fiduciary may make based on her experience and expertise.”

Cybersecurity: DOL Enforces Subpoena Against Provider

We have previously reported on cybertheft lawsuits filed by participants in two plans administered by Alight Solutions. In one case a participant in the Estee Lauder 401(k) plan lost more than $90,000, and in the other case, a participant in the Abbott Laboratories 401(k) plan lost $137,000. The Department of Labor (DOL) began investigating Alight in 2019 because it had received information that:

- Alight made unauthorized distributions as a result of cybersecurity breaches;

- Alight failed to immediately report the cybersecurity breaches to ERISA plan clients after they were discovered; and

- Alight repeatedly failed to restore the unauthorized distributions to participants’ accounts

As part of its investigation, the DOL issued an administrative subpoena to get records from Alight. Alight refused to provide all requested information, and the DOL filed suit so a court could enforce the subpoena. An enforcement order was issued during the fourth quarter of 2021. Walsh v. Alight Solutions, LLC (N.D. IL 2021)

This situation illustrates the attention cybersecurity is receiving at the DOL. It is also reported that the DOL has begun plan audits focusing on cybersecurity practices.

Fee Litigation Continues and Is Impacting the Fiduciary Insurance Market

The flow continues of new cases, decisions, and settlements alleging fiduciary breaches through the overpayment of fees and the retention of underperforming investments in 401(k) and 403(b) plans. These cases are also impacting the fiduciary insurance market. Following is a sampling of this quarter’s developments, including a new challenge to the share classes of investments used.

Share Class Challenge—Juniper Networks, Inc., a high tech firm, has been sued in connection with its 401(k) plan. The case includes the now familiar allegations of overpayment for recordkeeping fees and managed account services. However, it also challenges the plan fiduciaries for not using the net least expensive share classes of the mutual funds in the plan, net of revenue sharing.

In the Juniper Networks case, the plaintiffs are alleging that plan fiduciaries failed to use the net cheapest share classes. That is, there were share classes available that would be less expensive after offsetting revenue sharing, which could be allocated to plan participants or used to pay plan expenses. Reichert v. Juniper Networks, Inc. (N.D. CA 2021)

Other Cases:

- BlackRock Institutional Trust Company—Settlement—Familiar allegations against financial products providers, alleging the use of the firm’s own investments in the plan and payment of excessive fees. Settled for $9.65 million, of which $2.8 million will be paid to plaintiff’s counsel. BlackRock denies any liability. Baird v. BlackRock Institutional Trust Company, N.A. (N.D. CA 2021)

- T. Rowe Price Group—Settlement—Familiar allegations against financial products providers, alleging the use of the firm’s own investments in the plan and payment of excessive fees. In the settlement, T. Rowe Price agreed to offer a self-directed brokerage window and pay a total amount of $13.6 million, $6.6 million of which was paid as a partial settlement in 2019. Up to $3.5 million may be paid to plaintiff’s counsel. T. Rowe Price denies any liability. As of December 31, 2020, the T. Rowe Price plan has assets of $3.9 billion. Feinberg v. T. Rowe Price Group, Inc. (D. MD 2022)

- University of Pennsylvania—Settlement—Familiar allegations against 403(b) plans, alleging the payment of excessive fees and multiple providers, among other things. Settled for $13 million, of which $4.3 million will be paid in attorney’s fees. The University of Pennsylvania denies any liability. On average, 2,097 participants will receive $375 each. Approximately 2,000 participants will receive more than $1,000. Sweda v. The University of Pennsylvania (E.D. PA 2021)

Fiduciary Insurance Impacts—The high volume of fee cases, many of which have been settled, has reportedly resulted in increased premiums for fiduciary coverage, and that coverage is now frequently coming with higher retentions (deductibles), in the millions of dollars. It is increasingly common for the renewal and underwriting of this coverage to include a questionnaire asking about a plan’s inclusion of indexed funds and efforts to control costs.

Intel Wins Target Date Fund Case on Motion to Dismiss

As previously reported, Intel’s 401(k) plan used a custom target date fund solution that included a significant amount of hedge fund investments. Plan fiduciaries were challenged for using hedge funds because their performance and high fees were a significant drag on performance as compared to the performance of target date funds that did not use hedge funds. The district court had previously dismissed the claim because the complaint did not include enough detailed factual support. The plaintiffs were allowed to file an amended complaint, but it also fell short. Finally dismissing the case, the judge pointed out:

- A complaint cannot simply make a bare allegation that costs are too high or returns are too low;

- An allegation that a fund is mismanaged must be fact-specific because there is no one-size-fits-all approach to investing;

- Without presenting a meaningful benchmark, the court cannot evaluate if an alleged violation of the duty of prudence is plausible; and

- ERISA fiduciaries are not required to adopt a riskier strategy simply because that strategy may increase returns. (In this case, the challenged hedge funds dampened risks and returns.)

The judge had previously noted the following:

- The ERISA prudence standard focuses on a fiduciary’s conduct in arriving at an investment decision, not on its results, and asks if a fiduciary employed the appropriate methods to investigate and determine the merits of a particular investment.

- On its own, the failure to select the investment with the lowest fees is not sufficient to plausibly state a claim for breach of the duty of prudence.

Anderson v. Intel Corporation Investment Policy Committee (N.D. CA 2021, 2022).

Annual Plan Financial Statement Audit Changes

Changes are coming to the annual plan financial statement audit that is required for all plans with more than 100 participants. This is the audit performed by a qualified accountant and filed with the plan’s annual Form 5500. The American Institute of Certified Public Accountants (AICPA) adopted a new auditing standard for retirement and other employee benefit plans known as SAS No. 136. It applies to plan years ending after December 15, 2021.

- The limited-scope audit, which is utilized by many retirement plans, is being replaced by ERISA 103(a)(3)(c). The basic idea of a limited-scope audit that relies on data from a “qualified institution” is still available. However, the plan sponsor will be required to certify that the trustee or custodian is a qualified institution. It is anticipated that plan recordkeepers will provide support for this certification.

- The roles and responsibilities of each party (e.g., plan sponsor, auditor) will be clarified and documented as part of the audit process.

- Auditors may be more likely to find and disclose errors and other reportable findings.

Plan sponsors should expect the retirement plan audit processes to be different, with additional data and representations required by plan auditors and more detailed reporting back from auditors.

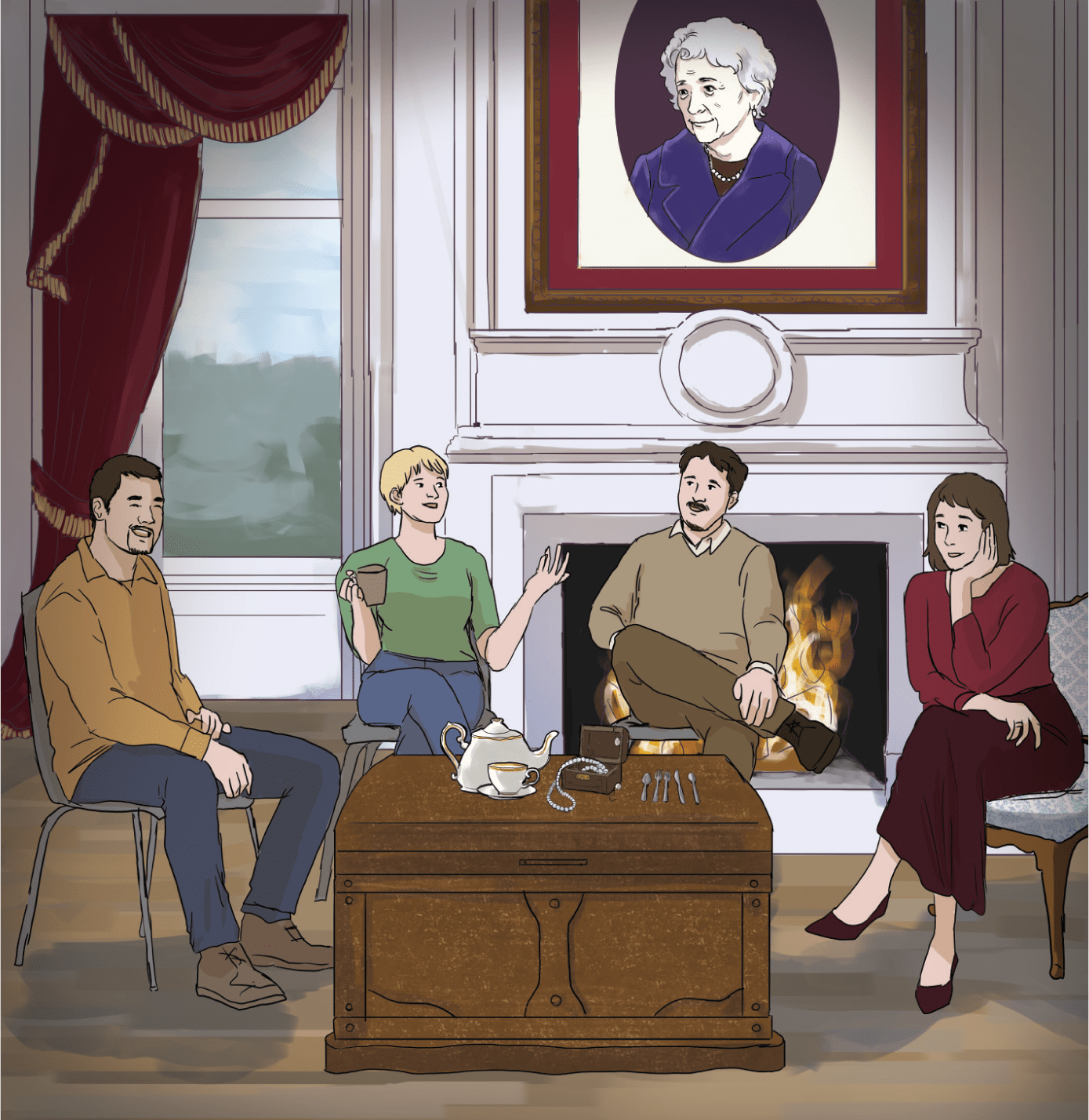

Instead, it’s the personal items left behind by the family member that can have the most potential to trigger hurt feelings between siblings or heirs.

Take the case of film legend Audrey Hepburn. Like many parents, she left instructions for her worldly possessions to be divided equally between her two sons after her death. Unfortunately, she didn’t foresee that her children would be unable to agree who would get which of the memorabilia items, including the scarves, hats, and gloves that Hepburn had worn with such inimitable glamour.

More than 20 years later, a treasure trove of her costumes and other belongings remained in a storage locker as her sons battled it out in court, according to press reports.

After a parent’s death, family tempers can flare over beloved objects even when all parties are satisfied with the distribution of the financial assets. It’s often the case that “so much of the estate planning is focused on the large financial assets,” says Richard Orlando, Ph.D., founder and legacy consultant at Legacy Capitals and the author of Legacy: The Hidden Keys to Optimizing Your Family Wealth Decisions.

When a parent or grandparent leaves no clear plan for personal assets that carry a great deal of family history and meaning, a rift can be all the more likely. That’s because decisions about distributing them will then have to be made once someone has passed away— when emotions are high.

What happens if more than one person feels attached to, say, the piano that was used for childhood lessons and family celebrations, and the parent is no longer around to referee? Families take great care in making sure wills and estate plans account for Dad’s individual retirement account, real estate investments, or family business holdings. Yet many neglect to spell out a parent’s final wishes for personal or household belongings.

Too often, families just never get around to discussing the distribution of personal items like a special jewelry box, a favorite jacket, or the holiday ornaments that were used year after year. Sentimental items may have little or no monetary value, so they’re not included in a will. Yet they may be loaded with memories and tremendous emotional significance and have the potential to cause family discord. “If not talked about ahead of time, then it could cause unnecessary stress in relationships,” says Orlando.

No parent or grandparent wants strife and legal fees to be their legacy. That’s why it’s worth setting aside some time to consider your own personal items and how you would want them distributed after you’re gone. It’s a favor to your heirs to make decisions about personal property ahead of time. Here are some steps to consider in planning for distributing personal assets.

Plan a Family Conversation

Find a time to have a family conversation about which items the next generation might be interested in, whether that’s a collection of baseball cards or a piece of artwork. Don’t assume you know who wants what. “Some family members might be interested in the sentimental value of jewelry that has been passed down, or the grandfather clock, and others are focused more on the monetary value of items,” says Orlando.

To start with, let your kids and relatives know that it is just an initial discussion. “Everything doesn’t need to be worked out to every item having a sticker on it saying, ‘This will go to John,’” Orlando says. Instead, the goal is more to establish your baseline intentions and perhaps set the scene for future conversations as your family grows and changes over the years.

“Even if the parents make the final decisions, it’s typically a good idea to at least get the pulse of their rising generation’s hopes and questions,” says Orlando. “If the family believes it will be helpful, a third party can facilitate the conversation and process for the family, culminating with it being codified via an attorney.”

Use a Personal Property Memorandum

One way to codify your wishes is through a personal property memorandum. While you can certainly make specific bequests in your will—like leaving a vintage dollhouse to your niece—it can be a good idea to create a separate document if you have many special belongings that you want to give instructions for. This memorandum is simply a list of things with the people you want to receive them. By spelling out which child or family member gets which items, you save your heirs from having to negotiate among themselves.

For example, you might list particular pieces of furniture, art, photos, or household items with the name of the desired recipient. You would not list financial assets, such as money, stocks, bonds, or real estate, in this type of document.

When making the list, it’s fine to type it and print it or just write it out by hand. Be careful to describe the items in enough detail to avoid any confusion. Also, don’t contradict instructions you’ve left in your will. Your list needn’t account for every single item, but overall wishes and intentions should be captured, says Orlando.

In about 30 states, you can then make the personal property memorandum legally binding by specifically mentioning it in your will. Be sure to sign and date the list, because if you end up changing it later, the document with the latest date will be the one that’s used. Keep this document together with your will.

Write a Letter of Instruction

Unlike a will or a personal property memorandum, a letter of instruction is not a formal legal document. It’s a personal letter expressing your wishes. You can use one to clarify what you want done with specific items. While not legally binding, it allows your heirs to understand exactly which heirlooms or property should go to which relative.

In addition to specifying the distribution of personal property, your letter of instruction can include many other types of preferences and information. You can spell out your hopes for how your children will spend their inheritance, what you want done with your social media accounts, or what your cherished values and beliefs are that you’d like to pass down to your heirs. You can also include directions for the care of your pets or the charities you’d like to support. This is a personal letter to your family, so feel free to include any messages you want to convey.

Gift Items During Your Lifetime

Another popular strategy is to gradually give your personal items or financial assets to your children so they can enjoy them during your lifetime—and you get to witness their pleasure. For example, pass on jewelry, furniture, or a portion of financial assets as a wedding gift, or give some items to each child every year on their birthday. Doing so also gives you an opportunity to test the waters.

You can present a certain amount of assets to your kids as a way to see how they will steward them. “It might point out how ready and mature an adult child is, or maybe that they need a little more mentoring and education. Or maybe it goes sideways, and the parent has time to update their estate plans accordingly,” says Orlando.

If you make such gifts, be aware of the potential tax consequences for items of value. The federal gift tax exclusion is $16,000 in 2022.

It’s important to plan for your financial assets in your estate plan and will, but that’s not the only area where you should make your preferences known. By making the effort to organize your wishes for your personal belongings, valuable or not, you might be providing your heirs with another gift—that of family harmony, long after you’re gone.

Q: I have been offered the chance to participate in my company’s nonqualified deferred compensation plan. Is that something I should consider ?

I have been offered the chance to participate in my company’s nonqualified deferred compensation plan. Is that something I should consider?

Nonqualified deferred compensation plans can be an effective way to boost retirement savings, but the decision to participate depends on your personal financial circumstances. For example, you should think twice about participating if you are not already taking full advantage of your company’s 401(k), including maxing out your contributions (plus a catch-up contribution, if you’re eligible). You might also want to fully fund your health savings account (HSA), if you have access to one, before you start nonqualified plan contributions.

Of course, with today’s tight labor market, you probably wouldn’t want to participate if you think you might leave your company since these plans are for long-term savings—and that would likely trigger a distribution. But if your 401(k) and HSA are maxed out and you want to defer more pre-tax dollars, it’s worth a look. Let’s talk nonqualified deferred compensation plans.

A nonqualified deferred compensation plan is an arrangement between an employer and employee that allows the employee to defer receipt of currently earned compensation. Employers can also make contributions to participant accounts. Because these plans are not required to comply with many of the rules that govern qualified plans—like 401(k) plans—they can offer appealing options in terms of contribution amounts, investment options, and distribution options.

Unlike cash compensation that is taxed in the current year, deferred compensation plans generally aren’t subject to federal income taxes until you begin receiving distributions from the plan. So, contributing can both reduce your current tax bill and boost your savings.40

So far, that sounds pretty good, right? What’s the downside?

Probably the biggest consideration is that, unlike your 401(k) account, the compensation that you defer into the plan is not your money. This means that, when it comes time for you to receive the compensation you deferred, your employer may be unwilling or unable to pay the amount or that a creditor may seize the funds through foreclosure, bankruptcy, or litigation. Typically, employers set aside funds deferred, but they remain part of the general assets of the company, subject to the claims of creditors.

That said, your employer may also take steps to help make you comfortable that your funds (plus earnings) will be there when you need them, including setting assets aside to pay your future benefits and securing them in a rabbi trust. An irrevocable rabbi trust, adequately funded, can help provide you with the assurance that your benefits will be paid in all events other than the insolvency or bankruptcy of your employer.

Nonqualified deferred compensation plans offer unique benefits and come with some important considerations, so they are not right for everyone. As always, you should speak with your financial and tax advisors about your company’s plan and your personal financial situation before you make any decision to participate.

Q: I am thinking about retiring early. How can I cover healthcare costs if I retire before I am eligible for Medicare at age 65?

Congratulations! If you’re considering early retirement, hopefully this means that your years of saving and investing well have resulted in a nice nest egg that— combined with Social Security and other income sources—will allow you to maintain your lifestyle without career work.

Given the cost of health care and the growing need for medical care as you age, it’s important to have some form of health insurance coverage. And, if you retire before age 65, you’ll want a plan to cover medical costs until Medicare kicks in.

If you are being offered an early retirement package from your employer, check to make sure that it includes post-retirement medical coverage. Often, these packages provide medical coverage until you reach age 65 and become eligible to receive Medicare.

If your package does not include post-retirement coverage—or if you’re just plain retiring early—you will have several options for health insurance. One easy option: If you’re married and your spouse is still working, you may be able to secure coverage through his or her employer.

Otherwise, you can explore coverage through the Consolidated Omnibus Budget Reconciliation Act (COBRA) or private health insurance to close the gap to Medicare eligibility age. COBRA only provides temporary benefits—up to a maximum of 18 or, in some cases, 36 months—but that may be enough for you. And private health insurance premiums can be expensive, depending on factors such as your age and health status. You may also be able to find and purchase an individual health insurance policy through either a state-based or federal health insurance Exchange Marketplace.

Once you have found coverage, remember that money that you have saved in an HSA can be used to pay insurance premiums and other qualified medical expenses tax-free. Tapping into those funds, if you have them, could close—or at least narrow—the gap if you need private insurance for a year or two.

Lastly, while working during your early retirement may not be part of your plan, taking a different or part-time job to keep health insurance might be an option.

Q: Home prices in my area have been booming. Why is this happening, and do you expect it will continue?

This question is on the minds of many Americans—partly because of the prevalence of home ownership in the U.S. and partly because it’s hard not to notice surging home prices.

On average, U.S. home prices have climbed 4.1 percent on an annual basis since 1987, according to Fortune magazine. However, in its latest forecast, Fannie Mae indicated that it expects median home prices to rise 7.9 percent between the fourth quarter of 2021 and the fourth quarter of 2022—twice the long-term average.

There are several drivers of this phenomenon. But, as always, market behavior comes down to supply and demand. There has been too much demand for the supply of available homes.

The housing supply has been low for more than a decade. The housing crash in the late 2000s devastated the construction industry, and a variety of factors, including labor shortages, tariffs, limited land, and restrictive permit processes, have kept the supply of new homes below historical averages. This placed more pressure on existing homes to meet demand from prospective buyers.

More recently, with the shift to remote work and education and low interest rates, many people looked for more space. This increase in demand happened as pandemic-induced labor shortages, supply-chain issues, and rising raw material costs stymied construction of new homes.