With only 50 percent of Americans having access to a workplace retirement plan, the Setting Every Community Up for Retirement Enhancement (SECURE) Act included reforms meant to broaden retirement plan coverage. The Act passed in 2019, but many key provisions are only now taking effect. One example is the pooled employer plan (PEP) provision. One of the most hyped elements of the Act, some say PEPs may become the dominant retirement plan type within the next ten years.

But do PEPs live up to the hype? What about similar SECURE Act provisions that created group of plans (GoP) and enhanced existing multiple employer plans (MEPs)? Let’s take a closer look at all three types to understand which—if any—plan type is poised for long-term success.

What are PEPs?

Pooled employer plans, also known as PEPs, allow unrelated employers that meet certain requirements to band together to participate in a single retirement plan, sponsored by a pooled plan provider (PPP). A PPP can be any entity that registers as such with the Department of Labor (DOL) and the Internal Revenue Service (IRS). Recordkeepers, third-party administrators, payroll providers, and registered investment advisors are the parties most likely to sponsor a PEP.

The idea is that employers in a PEP can take advantage of their collective purchasing power to potentially obtain lower fees and more comprehensive services. And by offloading certain nonfiduciary responsibilities to a third party, an employer’s administrative burden is reduced.

Employers that are not currently sponsoring retirement plans may make strong candidates for PEPs. Plan sponsors that already offer single-employer plans may find PEPs less attractive. This is because the ability to customize is limited. Plan sponsors interested in joining a PEP should fully understand the costs and restrictions associated with the plan, and the responsibilities of all parties involved. Currently 403(b) and governmental 457(b) plans are not permitted to participate in PEPs.

What are MEPs?

Multiple employer plans, or MEPs, allow related businesses to join together to participate in a single retirement plan. Unlike PEPs, MEPs can only be sponsored by certain entities related to the employers. The SECURE Act made MEPs easier to establish by eliminating the unified plan rule, also known as the one-bad-apple rule, which stated that compliance failures of one employer could disqualify the entire plan. Additionally, smaller MEPs (and PEPs), with fewer than 1,000 participants, are now exempt from a potentially expensive audit requirement, if no one employer exceeds 100 participants.

Many of the same benefits and considerations associated with a PEP also apply to a MEP and MEPs will most likely appeal to the same types of employers.

What are GoPs?

The SECURE Act also established a plan type called a group of plans, or GoP, where employers—whether unrelated or related—can file a single IRS Form 5500 for multiple defined contribution plans. A GoP must have the same trustee, administrator, fiduciaries, investments, and plan year. Unlike PEPs or MEPs, GoPs are not single plans, but do allow a single Form 5500 filing, which can reduce cost. Unfortunately, for plan sponsors looking to adopt a GoP, the audit exception for smaller MEPs and PEPs does not currently apply.

Where Do We Go from Here?

For plan sponsors of smaller retirement plans, the expansion and creation of these arrangements is beneficial but may not be a cure-all. For existing MEPs, the SECURE Act provides an opportunity to band together to create a super-PEP, which might dramatically lower fees and enhance services for participating employers.

However, MEPs existed prior to the SECURE Act without widespread adoption. Since they are primarily used by small employers with limited options this makes it difficult for the MEPs to accumulate assets quickly. For example, the average size of an employer plan inside a MEP is under $1 million. Generally, the threshold for price concessions is close to $100 million—a level to which most MEPs never come close. This lack of scale makes it difficult to obtain the type of purchasing power to deliver on the promise of lower fees and enhanced services. Despite the efforts of the SECURE Act to broaden these arrangements, it does not address this fundamental issue of scale, which will likely prevent MEPs and PEPs from becoming a retirement plan industry game-changer.

In practice, GoPs may be the most successful arrangement in the long-term since they alleviate the administrative burden of filing Form 5500. However, retirement plan sponsors need to wait until regulations are issued around filing a single Form 5500 for multiple defined contribution plans. Also, while PEPs and the new rules for MEPs are effective in 2021, the GoP provision is not effective until the 2022 plan year.

The DOL is also expected to provide additional guidance clarifying roles and responsibilities of each party involved with a PEP, including whether a PPP can delegate nonfiduciary administrative responsibilities to a third party, and regulations on PPPs satisfying multiple roles in a PEP—such as being both the PPP and 3(38) investment manager.

The SECURE Act’s expansion of MEPs and creation of PEPs and GoPs may not be a panacea for smaller employers, but these changes are a positive step toward providing Americans greater access to retirement plan benefits.

A glaring regulatory hole in recent years has been the lack of guidance from the Department of Labor (DOL) on the emerging issue of cybersecurity, despite some high-profile cases of theft from participant retirement plan accounts. However, that changed on April 14, when the DOL issued guidance on best practices for maintaining cybersecurity, including tips on how to protect participants’ retirement benefits.

The guidance comes as somewhat of a surprise, as it was not expected until later in the year and the new DOL secretary was only recently confirmed. However, it follows a March 15 report from the Government Accountability Office (GAO) that urged the DOL to expedite its timeline.

Following are some highlights from the DOL guidance:

- The DOL’s service provider review suggestions range from the obvious—such as confirming that the provider is properly insured against participant account theft and asking about the provider’s information security standards—to the more comprehensive—such as inquiring about past security breaches and the provider’s response to them, along with seeking contractual confirmation of the plan sponsor’s notification timeframe in the event of a breach. Though the DOL has communicated these as Tips for Hiring a Service Provider, plan sponsors should review the provisions with existing service providers that maintain plan records and participant data to confirm safeguards are in place.

- The DOL provides a 12-part menu of cybersecurity best practices for plan service providers, which includes implementing a formal and documented cybersecurity program, ensuring that assets or data stored in a cloud or managed by a third party are subject to independent security reviews and assessments, and encrypting sensitive data.

- The DOL provides tips for participants to help protect their own data and dollars, such as registering online accounts, regularly checking account status, using strong and unique passwords, avoiding free Wi-Fi, and reviewing information on identifying and avoiding phishing attacks. Plan sponsors should consider communicating these tips to their participants on a regular basis.

The guidance is concise and practical, offering a variety of best practices. Plan fiduciaries should pay special attention to this guidance and act accordingly to prevent cybersecurity breaches and theft from their retirement plans.

Vendor consolidation has become a common theme in the defined contribution industry. Over the past decade, the universe of retirement plan recordkeepers has been reduced from 400 to approximately 150—and this trend shows no sign of slowing.

This shifting industry landscape means that many retirement plan sponsors have had to endure a transition they were not expecting. What are the considerations for plan sponsors caught in the recordkeeper consolidation shuffle?

The Reasons Behind Vendor Consolidation

While all consolidations are different, the primary driver is scale. Larger scale equates to more profits to invest back into the organization. Today’s recordkeeping business requires significant investment in technology. For vendors that have not achieved enough scale, partnering with another organization may make sense to ensure viability.

Many of the recordkeepers that are no longer in the market were not predominantly focused on recordkeeping services. The retirement plan space has also experienced significant fee compression over the past several years. Because of this, vendors where recordkeeping is an ancillary business may find that it is no longer profitable, and through the divestiture of recordkeeping, they can instead focus on their primary business line (e.g., banking, insurance, asset management, etc.).

It is important to note that not all vendors consolidate due to negative reasons. For those recordkeepers looking to access new markets or services, partnering with another company may help advance their cause. Regardless of the reason, vendor consolidation is a trend that is unlikely to disappear in the near future.

Plan Sponsor Considerations

For plan sponsors faced with a consolidation, there are some key lessons to be aware of. First, consolidation timelines can vary widely—from as little as two months to as long as 18 months. Understanding the timeline, particularly in terms of key dates for paperwork—such as opt-in and opt-out deadlines—is imperative. Additionally, realizing the participant communication cadence is also important to prepare for questions and the integration of any additional communication campaigns.

Plan sponsors should also be aware of the potential for blackout periods following a recordkeeper consolidation, which can result in transaction restrictions, like delays in loans and disbursements. These periods are typically shorter during consolidations than they are following a traditional conversion (i.e., recordkeeping change due to a request for proposal, or RFP); however, it is important to understand the length and timing of the blackout period.

For plan sponsors, there are fiduciary considerations regardless of whether the recordkeeper is the acquiree or the acquiror. For those plans where the recordkeeper is the acquiree, plan sponsors should exercise the same degree of fiduciary due diligence in determining whether to remain with the new recordkeeper as was taken to select the existing recordkeeper. For plans where the recordkeeper is the acquiror, plan sponsors should verify that the acquisition will not impact the recordkeeper’s ability to provide best-in-class service. This could a particular area of concern for larger consolidations.

Using the consolidation as a catalyst to conduct a recordkeeper RFP may be a smart consideration for plan sponsors, particularly those where several years have passed since the last search was conducted. There is no better way to ensure recordkeeping value while documenting fiduciary due diligence process than by conducting an RFP.

Ultimately, it is important for plan sponsors to fully understand the process and potential impact recordkeeper consolidations may have on the plan and its participants.

While consolidations may be challenging to navigate, they can also result in benefits such as technology improvements, additional services, or even lowered fees as the result of a RFP. Due to the continued presence of marketplace drivers, plan sponsors can expect that recordkeeper consolidation will continue.

To learn more about vendor consolidation, click here to view a recording of our recent webinar on the topic.

The American Rescue Plan Act (ARP) of 2021 contains approximately $1.9 trillion worth of fiscal stimulus intended to address issues resulting from the COVID-19 pandemic. While the ARP contains a variety of fiscal stimulus measures, this summary focuses on the provisions impacting multiemployer and single-employer retirement plans. It is not intended to be a detailed analysis of the comprehensive measures contained in the ARP.

Multiemployer Plan Funding Relief Measures

Subtitle H—Pensions: Sections 9701 – 9704 and a new ERISA Section 4262

All multiemployer plans are characterized by an economic risk zone of red, yellow, or green. When plans are characterized in the yellow (endangered and seriously endangered) and red (critical) zones, current law requires certain remediation actions such as funding improvement or rehabilitation plans. The ARP provides relief by temporarily delaying the designation for those in the yellow and red zones, delaying certain participant notices and other requirements. Additionally, the ARP provides an optional and temporary five-year extension of the funding improvement and rehabilitation periods for plans in endangered or critical status.

The most significant provision for multiemployer plans creates a Special Financial Assistance Program for financially troubled plans. This legislation allows for funds from the general fund of the Treasury to be transferred into a special fund in the Pension Benefit Guaranty Corporation (PBGC) at the direction of the Secretary of the Treasury and the director of the PBGC. These funds will provide financial assistance to multiemployer pension plans in danger of insolvency (critical and declining), subject to certain provisions. Those plans will not be required to repay this financial assistance. For potentially impacted plans, the ARP contains further detailed provisions, which should be reviewed to ensure appropriate utilization of the relief measures provided.

Finally, the ARP includes adjustments to the funding standard account rules detailed in the legislation.

Multiemployer plan sponsors should work with their actuaries to determine the appropriateness of available temporary relief provisions offered under the ARP. Additionally, plan sponsors with plans characterized as critical and declining should consult with professionals to determine their eligibility in the Special Financial Assistance Program.

Single-Employer Funding Relief Measures

Subtitle H—Pensions: Sections 9705 – 9706

Corporate pension plan sponsors must estimate their defined benefit pension plan’s funded status on a regular basis to determine if they possess adequate assets to meet the benefit obligations promised to participants and determine minimum required contributions. To provide this estimate, actuaries determine the present value of future benefit payments, or the liability (in today’s dollars) for comparison to current assets. Actuaries discount future payments by an assumed interest rate often referred to as the discount rate. When this discount rate is higher, the present value of liabilities is lower, and vice versa.

The ARP eliminates any existing shortfall amortization basis for historical years preceding the 2022 plan year. This effectively provides plan sponsors a clean slate; prior shortfalls will not be factored into minimum required contribution calculations. It also increases the current seven-year amortization schedule to 15 years, which will reduce minimum required contributions in the coming years. Plan sponsors may elect to apply this fresh start to shortfall amortizations to an earlier plan year, specifically 2019, 2020, or 2021.

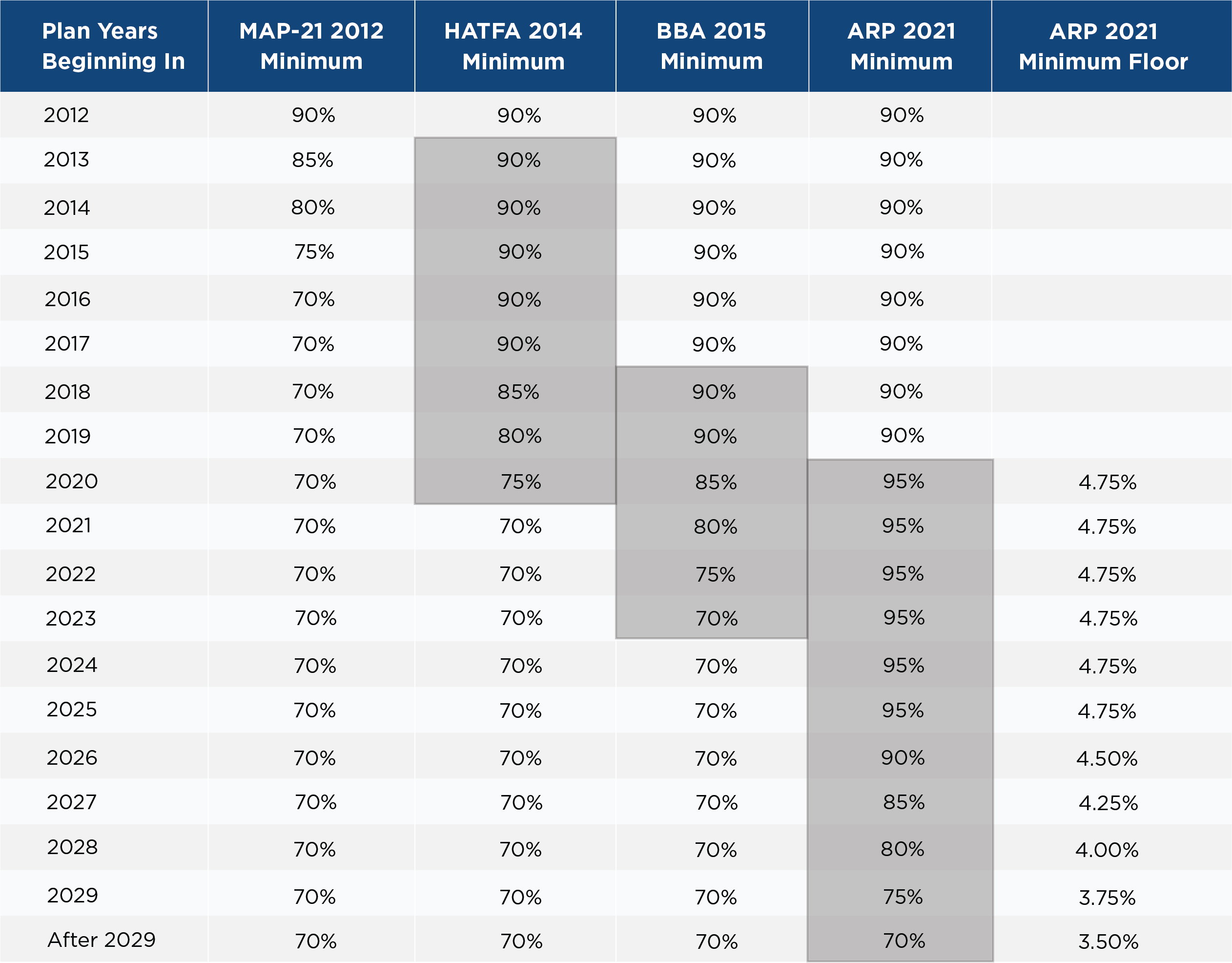

Previous legislation allowed actuaries to shift from using a two-year average of interest rates based on maturity to allowing the use of a corridor around 25-year averages. Essentially, actuaries reference the two-year average of interest rates at a given maturity. If that number is below the corridor relative to the 25-year average, as shown in Figure One, actuaries use the minimum rate, which is defined as a percentage of the 25-year average.

The ARP essentially extends the minimum corridor provisions of several previous Acts, including MAP-21 2012, HATFA 2014, and BBA 2015, which prescribe the use of higher historical interest rates, higher funding ratios, and therefore lower minimum required contributions.

Figure One: Minimum Corridor Percentage Applied to the 25-Year Average Discount Rate*

*If the two-year average discount rate is below the 25-year average under current and previous legislation, which Is also subject to an absolute minimum under ARP.

Source: CAPTRUST Research

Lastly, the ARP creates a minimum deemed 25-year average discount rate, which essentially creates an absolute interest rate floor, as noted in Figure One.

Plan sponsors should work with their actuaries to determine the implications of these new rules on minimum funding requirements. While this legislation will create more flexibility in funding strategies, we encourage plan sponsors to consider a defined funding policy based on their specific objectives. Ultimately, plan sponsors will need to determine the appropriate balance between contributing to their plans to shore up funding and investing in their core businesses and operations as allowed by the law.

As always, we continue to monitor the legislative and regulatory landscape. We look forward to assisting you in evaluating the implications to your organization.

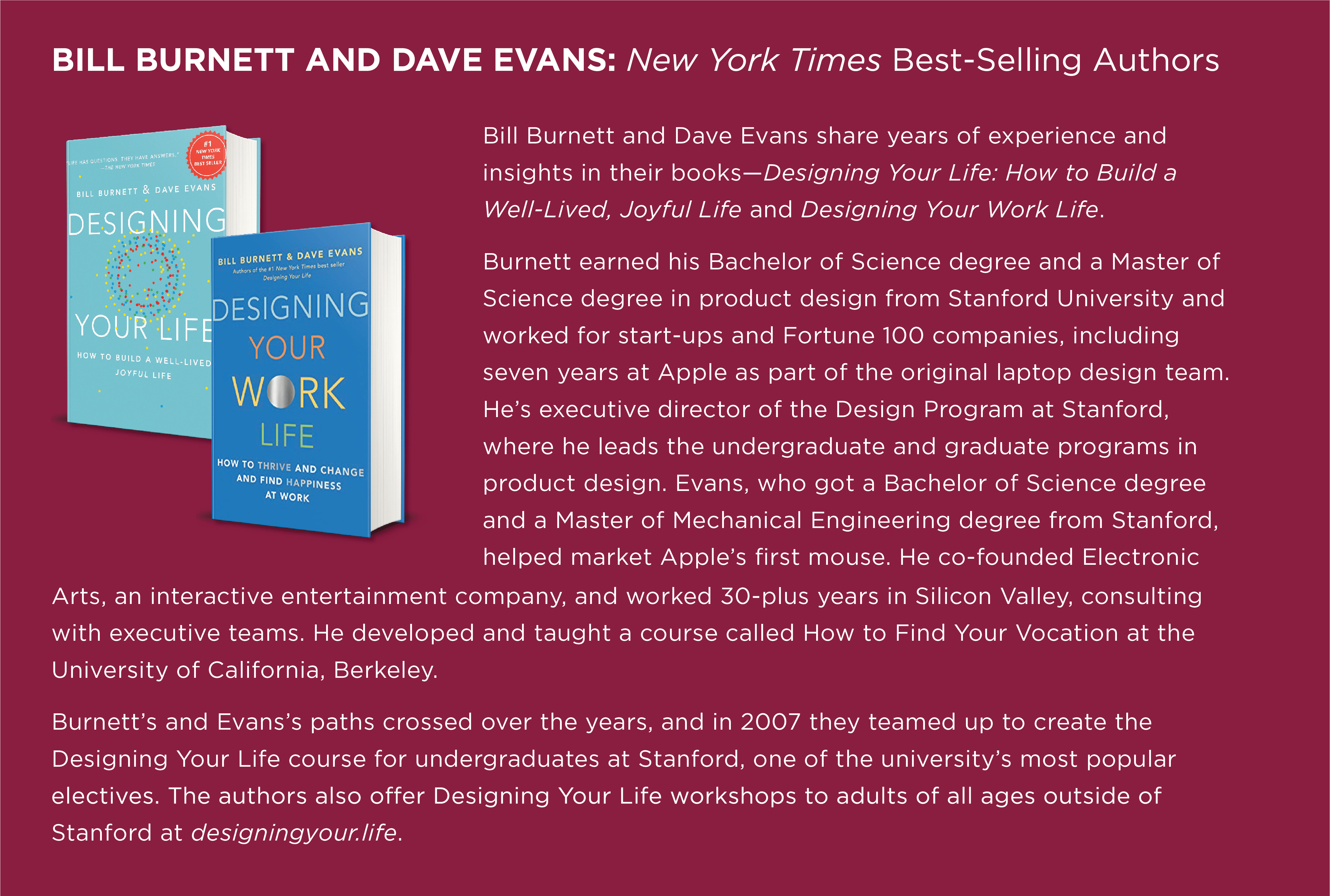

“I’m going to repurpose my time doing things that I find meaningful,” says Burnett, a product designer, who with Dave Evans wrote the bestselling book Designing Your Life: How to Build a Well-Lived, Joyful Life.

The authors, both Silicon Valley veterans who worked on creative teams for Apple, developed Stanford’s Designing Your Life course, as well as workshops for people retooling their careers, considering encore professions, and planning for retirement.

Burnett is applying the same design thinking he used to create the latest technology and products to prepare for the next phase of his life.

“Designers think differently than other people,” says Burnett, executive director of the Design Program at Stanford, where he oversees the undergraduate and graduate product design programs. They approach problems with curiosity, reframe dysfunctional beliefs that hinder creativity, prototype ideas to figure out what works, and form radical collaborations with others.

“People can use these design tools as they move from the money-making phase of their lives to the meaning-making phase,” he says.

Too often busy professionals don’t give enough thought to retirement, finding themselves adrift after leaving careers, Burnett says. “At work, they have a social network, status, a role they play in the organization. The day after they leave that job, they are just somebody sitting in a Starbucks drinking a coffee. It’s pretty jarring for people who haven’t prepared for it or designed for the change.”

Burnett says people preparing for retirement often use one of three strategies:

All these strategies require designing your way forward, he says.

Explore New Ideas

To begin the process, many people must overcome the fear of leaving their job, which often provides them with their identity, routine, and relationships, says Kathy Davies, managing director of the Life Design Lab at Stanford. The teaching lab runs the university’s Designing Your Life classes, develops the life design curriculum, and trains other universities to teach life design.

One key to making this leap is using your curiosity to explore several ideas, Davies says. “People need to reframe the dysfunctional belief that there is just one good direction in retirement. There are many.”

To help you get started, the Stanford experts suggest that you:

- Write a short reflection of 250 to 500 words about your future. This is a general statement of what you consider good and worthwhile in work, where work is not necessarily a paid endeavor but how you use your time and energy to accomplish things in your life and community, Davies says.

- Write another 250 to 500 words about your view of life. These are your critical defining values—what matters most to you, the meaning and purpose of your life, and how spirituality, family, where you live, and the rest of the world fit into your life.

- Review your statements and see where your views complement each other and where they clash.

These two views are your compass for your life and future.

Outline Your Plans

Burnett suggests developing three Odyssey Plans for yourself. Keep a journal and write down the times you feel energized about your life. Consider what you would do in retirement if you didn’t have to worry about money or the possibility of someone laughing at you for doing it.

Create three wildly different five-year timelines filled with activities you might pursue. Developing these three future visions helps people brainstorm ideas for their future, he says.

Maybe you want to become a bartender in Belize or a clown in Cirque du Soleil, Burnett says. “We are not encouraging you to sell the house and join the circus. We’re telling you to let your imagination go for a while.”

Davies says having several routes to explore can open new possibilities and set you free from perfectionist tendencies that could limit you.

Test Your Ideas

After you have plans, prototype some of your ideas, Burnett says. One of the easiest ways to do that is to talk to someone who is living the type of lifestyle you’re considering.

Testing your plan requires a small investment of time and can lead to a big payoff in the long run, Davies says. “The magic of prototyping is that instead of sitting around and talking about your plan, you do something. You get out of your head and into the world to try things.”

Davies worked with a retired couple who planned to become what they called silver-haired gypsies by selling their home and touring the U.S. in an RV. They tried it out for a week and found they loved RV life but didn’t like all the driving, so they decided to take occasional trips and maintain a home base.

People sometimes pay a high price for not prototyping an encore career. One example is a woman who left her job in human resources for a large corporation to fulfill her dream of opening a small Italian deli and café. She renovated the space and launched her business. Her café was successful, but she was miserable. She didn’t enjoy hiring staff, tracking inventory, and ordering stock.

The former human resources professional could have avoided a costly mistake by interviewing small café owners, bussing tables at an Italian deli, or working for a catering business. Eventually, she sold her business and went into designing restaurant interiors, which was her favorite part of opening the café.

Burnett suggests giving yourself time to make the transition into retirement. Some people take at least a year’s sabbatical after they leave their jobs before they try something new. He has a friend who retired from his career as a venture capitalist, a lucrative but stressful job. He told Burnett, “I plan to take three years to ride my bicycle and read books because I don’t want to make a decision about the future with a burned-out brain.”

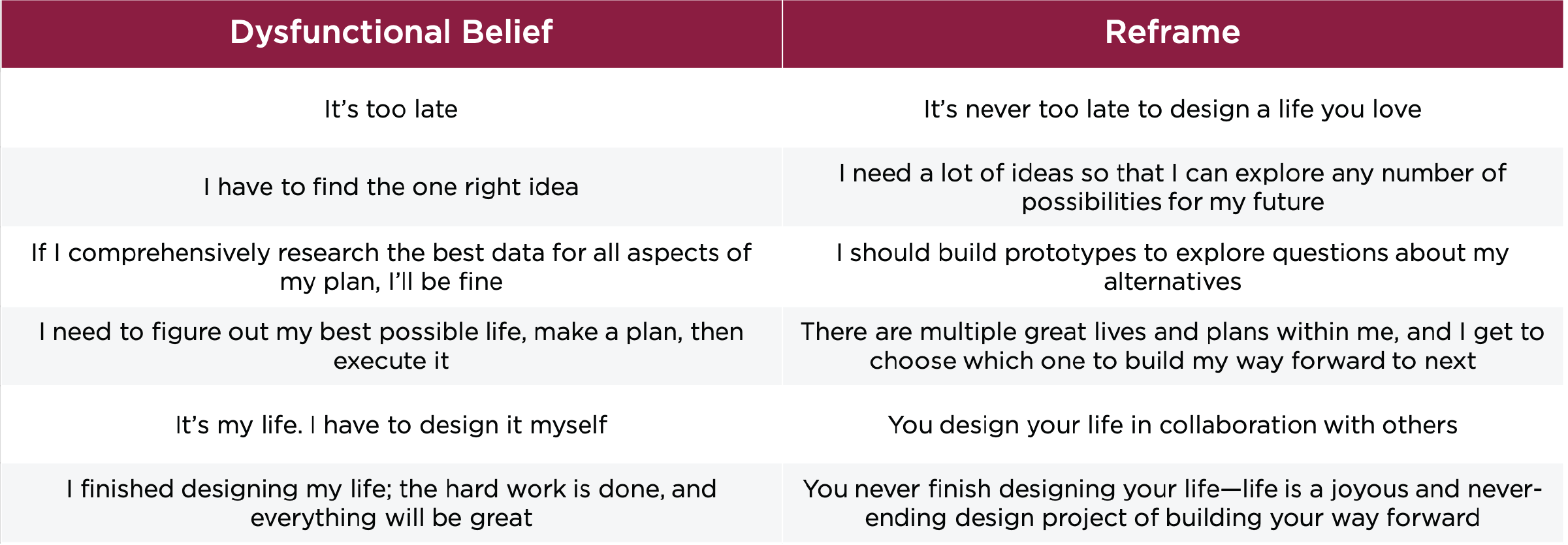

Reframe Your Dysfunctional Beliefs

One of the keys to a well-designed life in retirement is reframing some of your dysfunctional beliefs to create a better life for yourself. Here are some examples, according to Designing Your Life: How to Build a Well-Lived, Joyful Life:

Ask for Help

No matter what your retirement plan is, it’s important to form radical collaborations, Davies says. Talk to your spouse and other people who have retired or are considering it, she says. Get input from people who have different perspectives.

Davies says one woman she worked with created three Odyssey Plans for retirement but didn’t know if her husband would be supportive of some of her more creative ideas. It wasn’t until he also outlined some plans, and they shared ideas, that they both fully appreciated one another’s dreams and began working on plans together. Their lists created lively conversations that helped them prepare for the next stage of their lives.

Burnett has been talking to his wife and others about the future, as well as prototyping some of his ideas. Eventually, he’s going to step back from some of his administrative roles but wants to continue to teach. “I love teaching, I love writing, and I love art.”

He is prototyping his future life with a small art studio down the street from his home. He plans to write a book on designing your life for retirement, and he has other creative projects he’s discussing with potential collaborators.

“I am going to spend the next 10 or 20 years doing something interesting,” he says. “I’d like to hang out more with artists and musicians. I’ve got at least two more lives in me.”

It’s that passion for the acoustic guitar industry that helped him steer the family-owned business through good times and bad for the past 34 years.

Martin, 65, is playing his swan song this summer, retiring as chief executive officer of Martin Guitar, as well as finishing his tenure as chair of the National Association of Music Merchants (NAMM).

His retirement will mark the end of six generations of Martin men running the 187-year-old Nazareth, Pennsylvania-based company, whose guitars have been played by Elvis Presley, Johnny Cash, Hank Williams, Paul McCartney, Eric Clapton, and Gene Autry.

Martin wanted to exit on a high note. “I have been talking about retirement for at least five years. My father retired under duress, and my grandfather forgot to retire,” he says. His father left the business after making some unsuccessful business decisions, while his grandfather ran the company until his death at age 91.

Martin Guitar’s board was “hoping I would work for the next 100 years. I knew I would get pushback about the decision. People said, ‘Are you sure? Don’t you want to wait a year?’ But I thought, ‘I don’t know what I’m waiting for.’”

He wants to focus on his family and health. He is receiving treatment for bladder cancer, and his wife, Diane, is being treated for breast cancer. He says they’re both thankful for the excellent medical care they’re receiving. “It’s the journey Diane and I are on now, and we want to prolong that journey because we have a teenage daughter.”

The company, which also makes guitar strings and ukuleles, is searching for a new leader, and for now, someone outside his family will run the business. But one day, another C. F. Martin, Martin’s daughter, Claire Frances, 16, might want to take over.

Martin has been talking to her about inheriting the business. “I told her, ‘You don’t have to run it, but you have to manage the people who run it. You are going to own it. You are going to have the opportunity to be chairman of the board.’”

In the meantime, he’ll remain chairman and assume a new role as executive chairman, working far fewer hours but still representing the company.

When the pandemic has subsided, he plans to travel to trade shows, distributors, and guitar stores around the world to share the company’s history. “People get a big kick out of me telling the story about my family business,” he says. “It’s not a video. It’s not a salesman telling the story. It’s a Martin telling the story.”

Learning the Business

What a story it is.

Martin’s great-great-great-grandfather was German-born Christian Frederick Martin, the son of a cabinet maker who apprenticed with a renowned guitar maker. He immigrated to the U.S. in 1833 and founded the business.

“For whatever reason, God bless him, C. F. Martin learned how to make guitars, and he decided to make great ones,” Martin says.

Chris Martin IV’s path to CEO took several twists and turns. His mother and father divorced when he was three, and he lived with his mother in New Jersey, but he visited his grandparents, C. F. Martin III and Daisy, in Nazareth during the summer. “I would go to work with my grandfather and pack guitar strings and move wood around in the shop,” he says. “I never got to use a tool, but I got to be around the tools. That was my first exposure to the shop.”

During the summer between high school and college, he worked in the shop. “I followed a guitar through the guitar-making process and gained tremendous respect for my colleagues who do the work. I learned I’m a klutz when it comes to doing woodworking.”

He also didn’t have an affinity for playing the instrument. “I took guitar lessons as a kid,” he says, “but I didn’t click with the teacher, so I never learned to play, which is okay, because I am surrounded by great guitar players.”

After graduating in 1978 from Boston University with a bachelor’s degree in business, Martin joined the family business full-time.

His father, Frank Herbert Martin, struggled toward the end of his tenure as president of the company, so he retired, and his grandfather, C. F. Martin III, assumed control again. “My father and I had a bit of an estranged relationship,” Martin admits. “My grandfather saw my interest in the company and was a great mentor to me.”

His grandfather named him vice president of marketing in 1985. “It was a way for him to say to everyone else, ‘Chris is sticking around, and I want to give him a title that gives him a little bit of heft,”’ Martin says.

After his grandfather died in 1986, Martin was named chairman of the board and chief executive officer. He was 31 and scared to death. He didn’t consider himself a natural leader, and he faced several obstacles. “My father left a whole cadre of mostly male appointees his age who were looking at me a bit skeptically,” Martin says.

Another obstacle: At the time, the acoustic guitar industry was floundering. “Business was terrible,” Martin admits. “We went from making 23,000 guitars a year in the 1970s to 3,000 a year in the early 1980s. And we had some quality issues. It was little stuff that we needed to address.”

However, Martin’s vision and entrepreneurial spirit turned the business around, says Jackie Renner, president of Martin Guitar. “When the company had quality issues in the 1980s, he brought his manufacturing colleagues together and said, ‘What do we have to do to make this company vibrant again?’ The answer was focusing on the musician and making the highest-quality instruments possible,” Renner says.

Evolving Over Time

As the quality issues were resolved, something else happened to turn things around: MTV Unplugged made its debut in 1989, and by the early 1990s, the phone started ringing off the hook, Martin says.

“MTV recognized how cool the acoustic guitar was and promoted it to an audience that was a little jaded,” he says. “It didn’t start out wildly successful for us, but pretty soon, the momentum was building, and people said, ‘I have to get an acoustic guitar like the one Eric Clapton played on MTV.’ We paid attention at the time, and we got very lucky.”

Clapton was a fan of the guitar, saying, “If I could choose what to come back as, it would be a Martin OM-45.”

Martin built on that momentum by starting the Signature Series guitar line, featuring instruments played by acclaimed musicians such as Johnny Cash and Gene Autry.

“If you are famous and you agree to do an artist’s model, we will give you a guitar, and you can buy a few for your friends and family,” Martin says. “Then we give some of the proceeds from the other guitars we sell in that line to the artist’s favorite charity.”

The company has made 175 signature models since it launched the series in 1993.

During his time as CEO, Martin began profit sharing with his employees, offering college tuition reimbursement, and working on sustainability issues. “We use rare exotic timbers—rosewood, ebony, mahogany—for our products,” he explains. “We are trying to find a way to make the supply chain more sustainable.”

Renner says Martin has nurtured the culture of Martin Guitar, which employs about 1,000 people in its two factories—one in Nazareth and the other in Navojoa, Mexico. “He introduces himself to all of our new employees in Nazareth and takes them on a tour of our guitar museum to hear a little more about his family history. Chris is incredibly energetic, passionate, and committed to Martin Guitar,” she says.

Continuing to Contribute

As Martin winds down his role as CEO, he looks forward to what’s next and to reallocating his time to other causes. The first thing he wants to do in retirement is to take a breather. “I want to do nothing,” he says. “I’m test-driving that idea now during COVID.”

After the pandemic, he and his wife plan to travel more, and he wants to build a kit car, a Caterham, in his garage. “A bunch of crates will be arriving soon at my house from England. This kit is relatively simple. You hear stories that people buy a kit car, and it never gets done. I don’t want that to be me. With the help of some friends, I think I can get it on the road.”

Attorney Chuck Peischl, a longtime friend and a member of the company’s board, says he’s glad that Martin will assume the role of executive chairman. “He really is Mr. Martin, just like his grandfather before him. He was the personification of the company, and Chris is in that same image mold.”

“One time, I asked Chris what he would be if he wasn’t CEO of Martin Guitar, and, without missing a beat, he said, ‘a philanthropist,’” Peischl says. He expects Martin will spend more time serving as chairman of the Martin Guitar Charitable Foundation, which gives money to charities in the community, such as food banks, as well as nonprofit music, arts, education, and environmental action organizations.

Martin says he’s grateful for his career in the music industry. “People are passionate about being part of this industry. Once people join it, they never leave it.”

But he’s especially grateful to have served as head of a company in which both employees and customers value a guitar that’s as good as it can be.

It’s a good thing we have collective names for these houseguests. After all, there are about 100 trillion of them, mostly bacteria, in our digestive systems alone. And they are not all alike: Hundreds of species live in the average colon. So, while you don’t need to get to know them individually, you should probably think of them more than you do, health experts say.

These microbes “have a very symbiotic relationship with us,” says Sonya Angelone, a registered dietitian in San Francisco and a spokesperson for the Academy of Nutrition and Dietetics. “We need them for good health. And they need us. They’re like pets, only smaller.”

And, like pets, the microbes in our guts are forced, for good and ill, to adjust to our lifestyle choices. When we choose apples over cheeseburgers and brisk walks over sofa time, our microbes, in their own way, notice. They repay us for healthier choices in ways that scientists are just beginning to understand.

It now appears that these microbes play key roles in regulating the immune system and may affect a long list of conditions, including obesity, diabetes, heart disease, and, of course, disturbances in the digestive system itself. The mix of microbes in your gut might even influence your appetite and your mood.

“We think about our gut health as just about our gut, but it rules the rest of our body,” says Jill Nussinow, a registered dietitian in Santa Rosa, California, who has written several books on vegan cooking. “When something is good for your gut, it’s good for you.”

But what is good for your gut or, more specifically, the bugs that live there? Some of the answers may surprise you.

Diversity Is Good

Like fingerprints, no two gut microbiomes are the same. Your gut is different from your neighbor’s, and intriguingly, the guts of people from different cultures around the world tend to be quite different from one another. That genetic variation has allowed scientists to study the associations between certain microbial patterns and differences in lifestyle and health.

One key finding: People with greater diversity in their gut microbiomes—a higher number of species—tend, on average, to be healthier. While cause-and-effect relationships have not been established, lower diversity has been found in people with conditions including inflammatory bowel disease, type 2 diabetes, psoriatic arthritis, eczema, and cardiovascular disease. Some studies have found a link between obesity and low gut diversity; others have not.

Another key finding: Western diets, high in fat and processed foods, are associated with lower gut diversity than are diets higher in plants and whole foods.

“We are a long way from being able to clearly describe what is a healthy microbiota, and there are likely many pathways to [it],” says Wendy Dahl, an associate professor of nutritional sciences at the University of Florida. But, she says, “It’s generally thought that high diversity is good and low diversity is maybe not.”

The reason diversity might matter, she and other experts say, is that the microbes in our guts are down there doing important work. And they are specialists: Think of a hard-hat crew that includes the equivalent of carpenters, roofers, plumbers, bulldozer operators, and the like. Now imagine that each of these groups prefers a different diet, but you are delivering food that only the bulldozer guys will eat. Pretty soon, the rest of the crew all but disappears, and you’ve got a leaky roof, rusted pipes, and crumbling walls.

And some of the microbes left behind may be real troublemakers—bugs that prefer eating the lining of your gut to eating whatever food you send down. That may be a pathway to a condition sometimes called leaky gut, in which microbes and food particles escape the gut, potentially triggering inflammation, not only in the digestive system but throughout the body.

The good news about a messed-up microbiota? “You can change it,” Nussinow says.

Feed Your Friends

When most Americans think about eating better for gut health, they probably think about probiotics—beneficial microbes found in or added to fermented foods or supplements. Potential sources include some yogurts, sourdough bread, sauerkraut, kombucha teas, kefir (cultured milk), Japanese miso (a soybean paste), and Korean kimchi (a vegetable mix typically served as a condiment or side dish). All contain live microorganisms that might have some beneficial effects. In some circles, fermented foods have become trendy, with aficionados exchanging home fermentation recipes and getting together for festivals and impromptu kraut mobs.

Nutrition educators say these foods can play a role in day-to-day gut wellness. But they are not the secret to long-term microbial bliss. Among the reasons: The microbes in foods (or supplements) do not all survive the digestive process, and even when they do, they do not take up permanent residence in your gut. They are, at best, friendly visitors. There’s also the question of whether the particular bacteria in any batch of sauerkraut or carton of yogurt happens to be what your gut needs that day.

But there is one kind of food that experts agree is good for every gut, every day—and it’s something woefully lacking in most American diets: good old-fashioned fiber.

“In the past, we thought that all fiber was good for was to relieve constipation and, in the case of soluble fiber—like that found in oatmeal—lower your cholesterol,” Angelone says.

But now, she and other experts say, fiber is known to be the most important food source for the microbes in our colons that produce the most benefits. These microbes have evolved to make use of food remnants that travel through the upper digestive tract largely intact—the hard-to-digest fibers in fruits, vegetables, whole grains, beans, and nuts.

The average American adult gets just 17 grams of fiber each day, instead of the recommended 25 to 35 grams, recent research shows. That’s the result of a diet with too few whole, unprocessed foods, Dahl says.

“Probably the biggest problem with our ultra-processed diet is that we are starving our microbes,” she says. That’s the root cause of our often-underpopulated guts, she adds.

And the answer, according to Dahl, is not to load up on fiber supplements or any one food. It turns out that different beneficial microbes feed on different kinds of fiber. So, “a diverse, fiber-containing diet is going to support diverse microbes,” she says.

Details, Details

That’s not to say that all foods with fiber are created equal. Some foods are particularly rich in so-called prebiotics, substances known to feed beneficial microbes. The list includes onions, garlic, leeks, jicama, asparagus, and Jerusalem artichokes.

Another kind of fiber with special benefits is resistant starch. Unlike starches that are digested quickly, raising blood glucose levels, these are starches that arrive undigested in your colon, where they feed some especially helpful microbes. Sources include plantains, green bananas, white beans, lentils, and whole grains such as oats and barley.

Resistant starch also can be created in your kitchen from a few foods that might surprise some healthy eaters: potatoes, rice, and pasta. The secret is that you have to cool these foods after cooking them to produce high levels of resistant starch. You can then eat them cold or reheated. In practical terms, that means leaving cooked rice, potatoes, or pasta in the refrigerator overnight before enjoying them, Angelone says.

Lifestyle Factors

A healthy gut is about more than what you eat. It’s also about what you do.

One big factor: exercise. Regular exercisers tend to have healthier guts with higher counts of bacteria thought to fight inflammation. It’s unclear why. Exercise may be especially important in establishing the microbiome in childhood. And it might be one way for older adults to stave off age-related declines in microbe diversity.

Another factor: stress. Stress hormones can disrupt gut microbes in ways that promote inflammation. Stress-eating can also wreak havoc, of course.

And then there are antibiotics. Antibiotics are meant to kill harmful bacteria, but often kill helpful strains too. The gut fallout—which can range from brief bouts of diarrhea to life-threatening infections with drug-resistant bacteria—is a good reason to avoid these medications except when needed.

The bottom line: There’s a lot you can do to nurture a healthy gut. Start with a varied fiber-rich diet. Sprinkle in foods containing probiotics that might help keep digestive microbes in balance. Consider supplements only in consultation with your doctor. Get or stay active. And do what you can to avoid and manage stress. Be good to your gut and your gut will be good to you.

The Biden-Sanders Unity Task Force Recommendations on the Biden campaign website say that estate taxes should be raised back to the historical norm. In other words, if Biden has his way, estate taxes would increase. That means more of a person’s estate would go toward federal taxes, leaving less for heirs and other beneficiaries.

Even if such a plan were to fail in Congress, there’s another issue to consider: The Tax Cuts and Jobs Act. That law, enacted in December 2017, more than doubled the amount of assets that can be shielded from the federal estate tax and its companion, the federal gift tax. But those provisions apply only for estates of decedents dying (and gifts made) before January 1, 2026. After that, the old, less-generous provisions return.

Then there’s the coronavirus. Much of the money the federal government has spent fighting the coronavirus—and stimulating the economy—has been borrowed. At some point, the debt must be repaid—and the federal estate tax is an easy target for raising revenue, says Financial Advisor Brodie Barnes, who works in CAPTRUST’s Salt Lake City, Utah, office.

If you have a sizeable estate, consider taking advantage of current law by reducing the size of your estate to minimize how much may be eaten up in federal taxes later on, Barnes says. “Make moves now, because things are going to change one way or the other,” he adds.

Background

When a person dies, that person’s estate may be subject to federal estate tax. The federal gift tax operates alongside the estate tax to prevent individuals from avoiding the estate tax by transferring property to heirs before dying, according to a Congressional Research Service report.

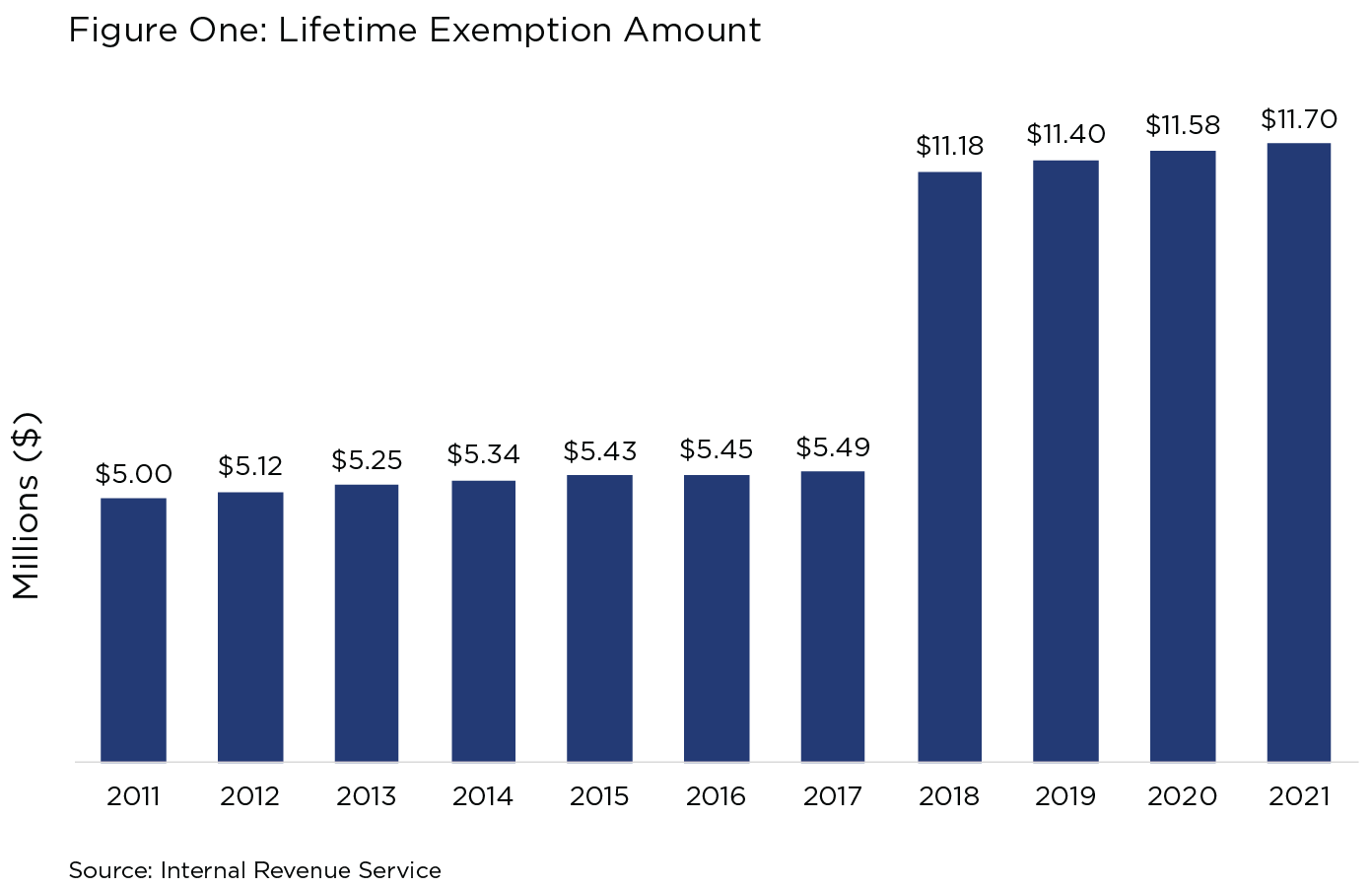

There is, however, a lifetime exemption amount. It serves to shield a certain amount of assets from both the federal gift tax and the federal estate tax. That lifetime limit, which is subject to an annual inflation adjustment, is $11.7 million for 2021, as shown in Figure One.

And there’s the rub. Under Biden’s plan, the lifetime limit would be reduced to what it was under the old law—somewhere around $5 million. Even if Congress were to reject such a plan, the lifetime limit, under current law, is scheduled to drop to an inflation-adjusted $6.5 million starting in 2026, Barnes estimates.

That’s why he recommends taking advantage of today’s higher lifetime limit. By giving away up to $11.7 million now, you move that amount out of your estate, perhaps transferring it to your children or other beneficiaries. Neither that amount, nor any future appreciation, will be subject to federal estate and gift taxes.

Suppose you do this now. When the lifetime limit drops in 2026 to about $6.5 million, will you be penalized for gifts you previously made? No. The Internal Revenue Service has officially stated that individuals taking advantage of the higher lifetime limit in effect until 2025 will not be adversely impacted after 2025 when the limit drops to prior-law levels.

Basic Steps

Before considering more complicated maneuvers, remember that you can give away a certain amount each year with no federal gift or estate tax consequences—and without even touching your lifetime limit. It’s technically known as the annual exclusion for gifts, and it’s subject to an annual adjustment for inflation. For 2021, the annual exclusion amount is $15,000, says Patricia A. Thompson, former chair of the Tax Executive Committee of the American Institute of Certified Public Accountants and tax partner at Piccerelli Gilstein & Company, LLP, of Providence, Rhode Island.

That means, for example, in 2021, you can give $15,000 to your son, $15,000 to your daughter, $15,000 to your longtime friend, and $15,000 to your helpful neighbor—for a combined total of $60,000.

If you’re married, each spouse may give up to $15,000, says Thompson. So you and your spouse can give a total of $30,000 to your nephew and a total of $30,000 to your niece for an overall total of $60,000, she says.

In each example, you’d move $60,000 out of your estate, legally sidestepping federal estate- and gift-tax consequences.

Another basic technique involves paying for someone’s education or medical expenses. There’s no dollar limit, and the beneficiary need not be related to you. But it’s important to make sure that you make the payment directly to the educational institution or healthcare provider, Thompson says.

For example, you can pay for your grandson’s law school tuition, no matter how much that is, and pay for your old friend’s medical expenses, no matter how much that is. In both instances, you would reduce the size of your estate; there would be no federal gift-tax and no federal estate-tax consequences, and you would preserve your lifetime limit of $11.7 million.

Other Options

Beyond the basic steps, consider making outright gifts to family members or others, up to the amount of your lifetime limit. This will reduce the amount of your estate that will eventually be subject to the federal estate tax—and its tax rate of 40 percent or more.

Suppose a widow has $50.3 million in assets. If she gives away an amount equal to her lifetime limit ($11.7 million in 2021), no federal gift taxes or estate taxes would apply, and she’d be left with $38.6 million to live on, Barnes says.

Some of his clients have no problem giving away large sums, he says. Others are reluctant, perhaps concerned that they may need the money later on. For them, Barnes recommends other options with more flexibility.

For example, you could make a gift to a spousal lifetime access trust, he says. That would let you move money out of your estate—taking advantage of your lifetime limit—but the assets in the trust would still be available to your spouse and other beneficiaries, such as your children, he says. To maximize this strategy and avoid certain pitfalls, he says, you could establish such a trust one year, to benefit your spouse and others; your spouse could establish such a trust the next year, to benefit you and others; and each trust would hold different kinds of assets.

Another option: Put some of your assets into a family partnership or family limited liability company, Barnes says. You could give your children an ownership stake in the entity, while you maintain overall control. The assets’ value and any associated appreciation would be removed from your estate.

The Right Fit

There are charitable options to consider, too, Thompson says, “but the client has to be comfortable giving his or her money away,” she says.

Any strategy should be part of an overall plan, and “it really needs to be customized to a client’s specific objectives and comfort level,” Barnes says. When considering such steps for clients, he says he looks at the client’s need for cash flow, the client’s charitable objectives, the type of assets the client holds, the client’s tolerance for complexity (and ongoing costs), and family dynamics. As always, before you implement any of these strategies, you should consult a tax advisor who can help you understand how they work and how they might best work for you.

While the global COVID-19 pandemic hasn’t brought us much good news, it has edged us a little further down the road to our digital health future, and many experts think that’s good. Dr. Euan A. Ashley, director of the Stanford Center for Digital Health, says the pandemic bulldozed over one big obstacle to advances in telemedicine—insurance payments—and as soon as the pandemic hit, Medicare and Medicaid began providing full reimbursement for telehealth visits.

Telehealth

Though a Zoom call might appear to keep the doctor at arm’s length from the patient, Ashley sees it differently. He says meeting with patients over Zoom during the pandemic reminds him of his childhood, when he would go with his physician father or midwife mother to make house calls. “You actually see [patients] in their home environments,” says Ashley.

He says this kind of information can really provide insight into someone’s lifestyle so he can give better recommendations on how to stay healthy. “The person who is most important is the patient, and we really have the technology to bring the medicine to them,” says Ashley.

Dr. Michael Blum, chief digital transformation officer at the University of California, San Francisco, and a practicing cardiologist, says technological advances are only one part of the equation. The technology needs social acceptance, and the pandemic has helped that along.

“The pandemic has changed the mind space about how health care is delivered,” says Blum. “Patients are now more comfortable with telehealth visits.”

Wearables

Telemedicine is just a small part of the way in which digital technology is transforming health care. Wearables are the start of being able to monitor health between visits to the doctor and detect health problems sooner. Google, Apple, and Amazon are investing heavily in the market.

Google is acquiring Fitbit, Apple has its Watch, and Amazon just released the Halo. Fitbit and the Apple Watch have Food and Drug Administration clearance for an electrocardiogram (ECG) monitor, and they can detect and notify a user of an irregular heartbeat.

Blum says he now has patients who tell him, “I have this device that is measuring my heart rate, or my Apple Watch is telling me I have atrial fibrillation.” Atrial fibrillation, or a-fib, is an irregular heartbeat that, if untreated, can be a warning sign that you are at risk for a heart attack, have an increased risk of stroke, or have another kind of heart disease.

Blum says these devices provide more than sufficient quality and amounts of data for use in making health and lifestyle decisions. However, he and other medical experts caution that any reading on these devices must be confirmed by professional-grade equipment.

There are also medical-grade wearables. For example, wearable glucose monitors and insulin pumps for diabetics can monitor 24 hours a day, seven days a week, and send data directly to your physician over the Internet. “That’s one of the chronic disease spaces that is really going to benefit [from wearables], or is already benefiting,” says Blum.

One thing both consumer-and professional-grade wearables are doing is collecting data—lots and lots of individualized data. Ashley, who is also a consultant for Apple, says that as wearables become more sensitive to changes in gait and motion, they will be used to detect early warning signs of neurodegenerative diseases such as Parkinson’s.

“It is very characteristic for a person with Parkinson’s disease to walk with a shuffling gait. People you live with don’t notice small changes. But now … we’ll be wearing devices that know us electronically over many years and recognize how we walk,” says Ashley.

Artificial Intelligence and Deep Learning

The rapidly advancing field of artificial intelligence and deep learning will help medical professionals predict who might be more vulnerable to a disease.

AI is able to sort through massive amounts of data and find patterns in a way that the human mind cannot. Data collected in hospitals and from healthcare providers can be fed into an AI system to predict the best treatment for allowing a particular individual to recover faster from surgery.

AI will be used to analyze individual DNA and protein-to-protein interactions to detect which traits are manifesting in an individual patient—an important part of the equation, since not everything in a gene sequence shows up. Blum says this will allow physicians to tailor health recommendations to the individual.

Barriers and Risks

While there is great promise and optimism about how new technologies will transform health care, there are also some barriers and risks ahead. AI and deep learning find patterns in the data. But data can reflect class differences, racial divisions, and other biases.

In his private practice, Ashley sees higher-income patients with good jobs in Silicon Valley tech firms, as well as patients from the lower-income communities of California’s Central Valley. It’s the richer patients who have a Fitbit or an Apple Watch, so it’s their data that’s getting collected. “That’s teaching the AI to begin with,” says Ashley.

There are also complex privacy and security issues that need to be sorted out as we move into the digital health age. Healthcare data is extremely valuable on the black market because it holds personal information that can be used for blackmail or identity theft. There have been numerous attacks on hospitals by hackers who have held data hostage for a price.

All the big tech companies are now looking to disrupt the healthcare industry. But their effort does raise questions about who owns the data these companies collect about you. In fact, the approval of Google’s acquisition of Fitbit has faced hurdles in Europe and elsewhere because of concerns over how the company might use the data it collects, especially when that data is combined with what Google already gathers from YouTube and its search engine.

Most physicians are moving or have moved over to electronic health records. However, you may have noticed that different doctors and health systems choose different electronic record systems, making it harder for each individual provider to get a complete picture of your medical history.

The different companies that digitize medical records have proprietary software. Blum says that for many of his patients, “I still don’t know … what happened to them previously or what’s happening now, if they go to see multiple different doctors.” In this respect, countries like the UK that have a single nationalized healthcare system are able to make better use of digital records.

Despite the hurdles, Blum says, “I’m highly confident [health care] is going to look dramatically different from the prior decade.” As Microsoft co-founder and philanthropist Bill Gates once said about the computer revolution, “You ain’t seen nothing yet.”

As he wound down a career in public relations, Tedino actively searched for ways to turn his passion for the sport into a fulfilling second act. He became a certified tennis pro and got increasingly involved with his local club.

“For me, any day on the tennis courts is a great day,” Tedino says. “I love tennis.”

These days, Tedino spends pleasant afternoons helping high school athletes improve their games as head tennis coach at St. Ignatius College Prep, a private school in downtown Chicago. He also keeps his communications skills honed as an advisor to the Chicago District Tennis Association, a board member at Lincoln Park Tennis Association, and a published tennis writer.

Tedino firmly believes people of all ages and abilities can get into the game and reap its many rewards, just as he does. “It’s such a great sport in terms of health benefits, socialization, and the ability to learn and continually improve,” says Tedino. “There is no prior experience or skill that’s needed, just the desire to learn the sport. And it’s fun to be out there playing.”

Stay Strong as You Get Older

Unlike, say, tackle football or ice hockey, tennis is truly an activity that can be enjoyed for a lifetime—and it pays enormous dividends in physical fitness as you get older. Tennis involves vigorous use of the upper body and core as much as the lower body. Working out the full range of muscle groups is vital for staving off age-related muscle loss.

Playing tennis regularly is associated with heart-healthy factors like lower body fat, better cholesterol levels, and aerobic fitness. Tennis players tend to have stronger cardiovascular, metabolic, and bone health. They also often exhibit more agility, balance, and coordination than nonplayers.

Keep Your Brain Sharp

Concentrating intensely on that fast-flying ball forces your brain to quickly size up a multitude of different variables. “In addition to the physicality of it, your mind is constantly working,” says Tedino. “If you’re playing singles, it’s just you, figuring out how to win points against your opponent. Tennis teaches people how to problem solve.”

It’s a feat to simultaneously consider the angle of the bounce, speed, and physics so you can line up your body in the right way to direct the ball where it should go. “You have to develop resilience and have a really good mental attitude,” says Tedino. “You have to be able to shake off the errors, get them out of your mind, and keep going.”

Promote Longevity

Tennis has been called the single best sport for a longer life. A 2017 British study found that regular players of tennis and other racket sports tended to live longer, not only compared to sedentary people, but also compared to people who exercised solo through jogging, swimming, or biking, The New York Times reported.

Another study followed in 2018, in which Danish researchers observed over 8,000 participants for about 25 years to compare the effects of a variety of sports on longevity. Again, tennis was a clear winner, associated with an astonishing 9.7-year-longer life span. By comparison, badminton was shown to add an average of 6.2 years to life expectancy; soccer, 4.7 years; cycling; 3.7 years; swimming, 3.4 years; and jogging, 3.2 years.

One possible explanation the researchers offered was that tennis mimics interval training, an especially efficient form of exercise characterized by a mix of high- and low-intensity bursts of exertion. This type of physical workout is believed to improve health more than moderately paced efforts like walking or jogging.

Foster Friendships

Another reason tennis may pack an extra wallop for health is that it involves being with other people. Humans thrive on social interaction and companionship. Getting outside, talking, and bonding with friends provides nourishment for the soul and an all-important sense of belonging. Supportive relationships naturally arise when you play tennis with friends, join a club, or organize a regular tennis meet-up with a partner.

Over the summer, Tedino was at a mixed-doubles event when he met a woman in her 70s. “She had picked up tennis in her 40s,” he says. “She’d gotten remarried, and her new husband played a lot of tennis. She said that as a kid, she couldn’t throw, couldn’t catch, and had always been picked last in all sports, so her goal was just to learn enough tennis to be able to say yes to someone if they asked her to play.”

She practiced, took lessons, and eventually became a solid player, making a lot of friends along the way. Years later, “She’s actually now a widow,” Tedino says. “She’s been able to maintain her social connections through tennis. Tennis is something that brings you together. You’ve got this activity, and then you go out for lunch or a drink afterward. It’s not just for older people—it’s for everybody.”

Relatively COVID-19 Safe

While the COVID-19 crisis has put a damper on people’s ability to stay active or get to the gym, tennis is particularly well suited to play during a global pandemic. When you’re outdoors on a court that measures 36 feet by 78 feet, it’s easy to stay a healthy 60 feet apart in a singles game. Doubles is often played with a spouse or a household member, though you can still keep well apart without much effort.

“Tennis is a sport where you can maintain social distancing without being socially distant,” says Tedino. “With [COVID-19], we’ve had an outpouring of people wanting to play. At my tennis club, we have bookings sunup to sundown every single day of the week.” Many people are working from home, so “they can steal an hour or two with a friend and head back in time for the next Zoom meeting.”

The United States Tennis Association (USTA) has a set of recommendations and guidelines on its website for playing tennis as safely as possible, including wearing masks appropriately, avoiding high fives, observing distancing rules, and leaving the area as soon as possible after your game is over.

Anyone Can Play

People of any age can play, and even play competitively. “Anyone with reasonably good mobility and eye-hand coordination can play,” says Tedino. “You don’t have to be particularly athletic, although fitness from other activities will serve you well on the court.”

The International Tennis Federation sponsors world competitions for seniors age 50 to 64 and super-seniors 65 and up. (In competitive tennis, players in their mid-30s and 40s are categorized as young seniors.)

Even if you’re mobility-impaired, don’t rule out tennis. “An area that has taken off is wheelchair tennis for adults or kids,” says Tedino. “It’s the exact same game, except wheelchair tennis players are allowed to have the ball bounce up to twice before they hit it.” There are wheelchair tennis programs around the U.S., and wheelchair tennis players have competed in the Paralympic Games since 1992.

To get started, all you need is a racket, a good pair of shoes, and some tennis balls. To find an appropriate racket, “Go to your local tennis or sporting goods store and get a mid-priced racket with the right-sized grip for your hand,” Tedino says.

No special clothing is required—just comfortable tops and bottoms that are breathable. Pockets are helpful for holding a tennis ball. If you’re older, investing in a good pair of supportive shoes is essential.

“I’d start out spending more money on shoes than a tennis racket,” says Tedino. “Don’t try to play tennis in running shoes, because you do a lot of side-to-side movement on the tennis courts.” Running shoes aren’t made for that.

To find beginner lessons and to find people with similar skill levels to play with, “Most people can find a way to get into tennis through a local parks and recreation department,” says Tedino. “Many cities offer instruction on weekends or in the evening. Tennis clubs do the same thing.”

The USTA website also has helpful information on its local chapters around the country. So, it might be time to consider picking up a tennis racket and trying out your swing. It’s a hobby that could add years—and years of fun times—to your life.