Historically Disconcerting

With all that happened last year, it’s easy to miss the fact that the major stock market indexes—the S&P 500 Index of large U.S. companies among them—reached record levels last February. Up to that point, things seemed to be going well, with the markets set for another solid year of gains. Just a few weeks later, as news of the novel coronavirus crept into the headlines, the tone began to change.

On Monday, March 9, the markets experienced a tsunami of selling, resulting in a 7.6 percent drop in the S&P 500 Index. At the time, that was the largest single-day point drop in the index’s history. Not to be outdone, March 12 and March 16 both set new records, with the index falling 9.51 and 11.98 percent, respectively. In fact, eight of the 20 largest point declines in the S&P 500’s nearly 100-year history happened last March.

Of course, the market didn’t go straight down. March also witnessed eight of the top 20 largest single-day point increases in S&P 500 history, including big bounces on the days after those historic drops.

While investors fret less about big gains than big losses, they count as volatility too and can be equally confusing. In the fog of war, it’s tough to see clearly.

Different This Time?

Last year proved to be a very bumpy ride that challenged the patience of even the most seasoned investors. The fact that all of this market turmoil happened amid—and perhaps because of—stay-at-home orders, rising virus case counts, skyrocketing unemployment, and social and political tensions made it seem like it really would be different this time. But it wasn’t.

While the details change, the story is always the same. Markets don’t like uncertainty. This is true of all markets—stock and bond markets around the world and currency and commodity markets. When a new uncertainty rears its ugly head, markets react. The uncertainty could be political (e.g., an election outcome or federal budget impasse), geopolitical (e.g., trade negotiations or terrorist attacks), economic (e.g., pandemic lockdown or Federal Reserve policy change), or natural (e.g., hurricanes or earthquakes).

It’s the surprise that matters. Markets need time to recalibrate, finding new levels as they seek to understand the practical impacts of a new reality. In the beginning, when little is known, different investors or analysts may have wildly different views—or they may just be reacting to take risk off the table—resulting in significant levels of volatility. The bigger and more complex the uncertainty, the more volatility.

Over time, views converge as more information becomes known, or, as the range of possible outcomes starts to narrow, volatility subsides. If you need an example, just recall how little we knew about the virus and its effects on society and the economy last spring versus what we knew at year-end.

Of course, realizing this doesn’t make it easier. Even normal levels of volatility—a 10 percent pullback every year or two—can be disturbing and cause investors to question their strategies, especially as they get older. The thought of a major market pullback in the last few years before retirement is enough to cause many to move to the sidelines. And yet that’s a very bad idea.

Boring for the Win

Even as you approach retirement age, you still need to think like a long-term investor. A 65-year-old woman has a life expectancy of 86.6 years; a man the same age has a life expectancy of 84.1 years. That’s a minimum of 20 years to plan for. And remember: Life expectancy is an average. There is a very good chance that you will live longer than that. Perhaps a lot longer.

With interest rates at or near 0 percent, riding out a couple decades in cash is not viable. So how exactly can you get comfortable investing in stocks, knowing that volatility is inevitable? The answers to this question will sound like clichés. They are boring, but that does not mean that they lack merit or are untrue.

Spread It Around

Diversification, investing in a variety of asset classes, is both the single biggest investing cliché and single best way to preserve and grow wealth. True, diversification means that you will never hit it out of the park, but it will help dampen risk and reduce the impact of a stock market pullback on your portfolio. Bonds, in particular, have historically been a powerful portfolio stabilizer and continue to add value, even at today’s low interest rates.

There is also a behavioral trick here. Any individual investment or asset class may be volatile at a given moment. However, viewing your portfolio in aggregate—rather than focusing on a single component—will help moderate your fight-or-flight instinct when volatility rises.

Make a Plan

Investing for your major life goals without a financial plan is like going on a road trip without a map—or, these days, your smartphone. You might get there, but it will probably take a lot longer than you expected.

A solid plan will help you understand the income, expenses, and portfolio mix that will get you where you want to go and help you understand best-case, worst-case, and expected outcomes given a range of portfolio returns and market conditions. Done properly, a financial plan will provide you with a sense of purpose—you know where you’re going and what you need to do to get there. When the markets get rocky, revisiting your plan can provide a sense of confidence that the goals you have set remain achievable.

Find Your Sweet Spot

Putting it bluntly, if your money is keeping you up at night, you should consider how aggressively you’re invested. An investment strategy that is too exciting may be difficult to stick to for the long haul. And that’s important because staying invested in the stock market is how you generate returns.

Missing even a few days can drastically reduce your return. For example, in 2020, stocks (as measured by the S&P 500 Index) returned 16.3 percent. If you missed the best day of the year, that return falls to 6.3 percent. It falls to -19.3 percent if you missed the best five days.

Put It on Autopilot

Our aversion to losses means that, for most people, investing is fraught with angst and emotion. A couple of rules-based strategies that keep your emotions from getting in the way might help.

Knowing when to put money to work is always a difficult question. Is this the bottom? Should I wait for the inevitable pullback? Dollar-cost averaging is a popular strategy for investing cash by splitting it up into a series of installments over a predetermined period, typically months or quarters. While studies report that investing via a single lump sum can be just as effective, systematically investing via dollar-cost averaging can both be efficient and assuage fears of getting in at the wrong time.

Over time, a portfolio can stray from its original risk level. For example, if stocks outperform bonds over time, they become a larger relative portion of your portfolio, and it becomes riskier; if bonds outperform stocks, it becomes less risky. This is completely normal because different investments will perform better or worse in different markets or economic conditions. That’s when rebalancing—a process of systematically selling some of your outperformers to invest in the underperformers—comes in. There are many ways to implement rebalancing that have merit, but they are all designed to keep your portfolio risk on target over time via small, incremental moves.

Scratch the Itch

When the markets get volatile—as they are certain to do from time to time—it’s OK to spring into action. Focus on facts, and don’t act rashly or out of emotion. Ask your financial advisor to rerun your financial plan to make sure you’re still on track for your goals. Take a look at your portfolio’s risk level, and dial it in, as appropriate. Use a pullback as a time to rebalance. Put some of your sideline cash to work in the most beaten-up asset class. Taking action to exert some control over your situation will make you feel better and can turn a crisis into an opportunity.

As the saying goes, “May you live in interesting times.” At first blush, that sounds exciting—a blessing even. But, ideally, your life is more interesting than your money. In fact, when it comes to long-term investing, boring is vastly underrated.

Q: Why hasn’t the explosion in government debt caused a problem for the market? When will it?

A: If the skyrocketing national debt level keeps you up at night, you’re not alone. Many investors have been concerned about elevated debt levels and their effects on the economy, especially since the two pandemic-related stimulus bills have caused it to soar by more than 25 percent.

In the U.S., fiscal stimulus and relief programs in 2020 are estimated to exceed $4 trillion, or nearly 20 percent of gross domestic product (GDP). With an expansion of unemployment benefits, monetary support going directly to households, grants and forgivable loans going out to small businesses, and support to hospitals and health agencies combating COVID-19, the relief programs are targeted at limiting economic damage while supporting virus containment efforts until widespread vaccination is available.

During a crisis, there is no alternative to acting quickly to limit the damage—and markets have so far cheered the actions of policymakers. However, government spending on this scale raises questions about the long-term effects of a growing national debt. The Congressional Budget Office (CBO) estimates that the federal budget deficit will reach $3.3 trillion in 2020, a level (as a percentage of GDP) that has not been seen since World War II. This follows on the heels of a $1 trillion budget deficit in 2019.

One risk of our swelling national debt is higher interest rates. If investors were to become less comfortable lending money to the U.S. government to finance its deficits, they would require more compensation in the form of higher interest rates. Higher rates, in turn, would increase the cost of carrying such high levels of debt and serve as an impediment to growth that leads to even more borrowing and so on.

Fortunately, this scenario is less likely to occur in the U.S. than in other parts of the world, because of the U.S. dollar’s enviable position as the world’s reserve currency. Global demand for dollar-denominated assets serves as a steady source of demand for Treasury bonds, keeping interest rates—and therefore borrowing costs—low.

Another consequence of higher debt levels is the risk that servicing the debt reduces our country’s ability to invest in other important areas, such as education, research, infrastructure, defense, and combating climate change, which could harm our competitiveness on the world stage.

Finally, there is the risk of inflation. Policy tools can be imprecise, sometimes with delayed effects—leading to the risk of an overshoot if stimulus that is applied with the intent of limiting economic damage winds up overheating the economy.

The same concerns were expressed in 2008 when a collapse in housing prices triggered a global financial crisis. During that time, we saw (albeit smaller in scale) similar monetary stimulus but no inflation. Also noteworthy, despite decades of large deficits and low or negative interest rates, inflation has not become a problem for Japan.

Economists are divided on the severity of these risks. Some believe that debt concerns are overblown, while others claim that increased debt places our privileged global position at risk. Either way, the debt issue (and this debate) is likely to extend well into the future, as an economy that continues to recover would be less tolerant of higher taxes or reduced spending.

Q: My spouse and I are talking about divorce. What kind of changes should I anticipate around insurance coverage?

A: Few life changes are more consequential than a divorce. In addition to the financial and emotional challenges of ironing out a settlement, attending court hearings, and dealing with competing attorneys, you’ll also face special concerns about your insurance coverage. Since there’s a lot going on during a divorce, insurance may not be top of mind, but it’s important to be aware of how you and your family will be impacted.

Planning for these changes should begin long before the divorce is final. And because it’s common for one spouse to maintain employer-provided insurance for the family, the breakup of a marriage can have serious insurance consequences for the other spouse and young children in the family, especially if he or she was not employed outside the home.

Health Insurance

Often, one spouse participates in a group health insurance plan at work that provides coverage for both spouses. When a divorce occurs, coverage for the other spouse will often end, unless the divorce decree requires continuation of coverage.

If there is no such requirement, temporary protection may be provided by the Consolidated Omnibus Budget Reconciliation Act (COBRA). This federal law protects employees of companies with 20 or more workers and their dependents from losing group insurance coverage as a result of job loss or other life changes like a divorce. Certain governmental and nonprofit enterprises are exempt.

If your ex-spouse maintained family health coverage through work, you may, at your own expense, continue this group coverage for up to 36 months, or until you remarry or get coverage under another group health plan.

If you are eligible for health insurance through your own employer, talk to your human resources department about your options. This can be more cost efficient than COBRA and keeps you out of your ex’s company plan. Although you generally have to wait for certain times of the year to join employer health insurance, losing your previous coverage due to a divorce launches a special enrollment period for you to sign up for your employer’s plan.

Life Insurance

If you’re a custodial parent, make sure the life of the noncustodial parent is insured. You don’t want to end up in a position in which child support payments suddenly end because an ex-spouse dies. The same principle applies to alimony payments. Life insurance can protect you and your children in case of untimely death. If you have trouble paying the policy premiums, you can petition the court to have alimony and child support payments increased to cover the cost.

If you don’t have custody of your children, you’ll still want to insure the life of your ex-spouse. If he or she were to die, you would likely gain custody of your children, increasing your expenses dramatically. If you can’t get new insurance on your ex-spouse, have his or her existing policies transferred to you as the new policyowner and beneficiary. This can be planned as part of the divorce agreement.

Disability Income Insurance

If you receive alimony or child support, another risk to your income may arise if your former spouse becomes disabled. If he or she has no disability insurance and is unable to work, the court may modify the alimony and child support obligation, reducing or eliminating payments to you.

With a disability policy, your ex-spouse will receive benefits each month and may be capable of paying the same amount of alimony and child support. Planning for disability insurance should be completed before the divorce is final. Unlike life insurance, you can’t own a disability policy on someone else. So, the divorce decree may require that your ex-spouse pay the premiums on a policy and that you are entitled to regularly receive proof that the policy is in force.

Property Insurance

At a high level, you’re going to have three options when changing your home insurance after a divorce: You can cancel your joint policy, you can take a person off of your shared policy, or, if you’re ordered to stay in the same dwelling, you can keep the coverage the way it is. However, there are a few different things that you’ll have to do to for each scenario.

Canceling your joint policy will be a group effort—your insurance agent will require consent in writing from both ex-spouses. This method will probably work best if you are both leaving the house and going your separate ways.

If you’re the primary policyholder, you can remove your ex-spouse from the policy by giving your insurance carrier a copy of your divorce decree. If you’re not sure who the primary policyholder is, it’s usually the person who called in to set up the policy (even if you’ve both signed the deed, loan, or policy). If you are not the policyholder, the options you’ll have are to prove that you have insurable interest, remove yourself from the policy, or arrange to be the responsible party for the insurance payments.

Insurance Beneficiaries

During or after a divorce, your choices on beneficiaries may be somewhat limited. For example, if a court ordered that you must continue an existing policy with your ex-spouse as beneficiary, you cannot change it. If you’re under no such constraints, however, your choice usually boils down to either your estate, your ex-spouse, or your children.

Designating your estate as beneficiary will tie up the insurance proceeds in probate. And unless you need to protect alimony or child support payments, you probably have no need or desire to name your ex-spouse as beneficiary. Designating your children as beneficiaries may be your best course but doing so can be very complicated if they are minors. One solution is to create a trust for the children and name the trust as beneficiary.

Remember: Divorce laws may differ from one state to the next, so consult an experienced legal professional before proceeding. Your situation is unique, so make sure that you also sit down with your financial and tax advisors to make sure that your plan is right for you.

On October 30, the Department of Labor (DOL) released a final rule under the name Financial Factors in Selecting Plan Investments. This rule amends certain provisions of the investment duties regulation applicable to plans covered by the Employee Retirement Income Security Act (ERISA) by providing guidance for fiduciaries to follow when selecting and monitoring investments. The rule makes it clear that plan sponsors must never subordinate investment returns or increase investment risk due to nonfinancial factors.

The proposed rule, originally issued in June, garnered a lot of attention from asset managers and plan sponsors. While the final text of the rule does not specifically identify environmental, social, and governance (ESG) investments in ERISA-covered plans and instead focuses only on nonpecuniary factors, the DOL’s preamble to the final rule makes it clear the intent is to clarify long-standing confusion regarding how fiduciaries can incorporate ESG into their plans and respond to a rise in popularity of ESG-themed investments.

Historically, plan sponsors have relied on numerous pieces of subregulatory guidance on this subject, dating back to 1994. However, the historical guidance became ambiguous and changed with presidential administrations.

The final rule includes the following core additions to the current investment duties regulation:

- A specific provision to confirm that ERISA fiduciaries must evaluate investments and investment courses of action based solely on factors that the responsible fiduciary prudently determines are expected to have a material effect on risk and/or return of an investment based on appropriate investment horizons consistent with the plan’s investment objectives and the funding policy.

- This provision also states that the duty of loyalty prohibits fiduciaries from subordinating the interests of participants to unrelated objectives and bars them from sacrificing investment return or taking on additional investment risk to promote nonpecuniary goals.

- Explicitly requires fiduciaries to consider reasonably available alternatives to meet their prudence duties under ERISA.

- New regulations on required investment analysis and documentation requirements for those limited circumstances in which plan fiduciaries may use nonpecuniary factors to choose between or among investments that the fiduciary cannot distinguish based on pecuniary factors alone.

- States that the prudence and loyalty standards set forth in ERISA apply to a fiduciary’s selection of a designated investment alternative to be offered to plan participants and beneficiaries in a defined contribution plan. The rule does not categorically prohibit the fiduciaries of such plans from considering or including, as designated investment alternatives, investment funds, products, or model portfolios that support nonpecuniary goals if the plans allow participants and beneficiaries to choose from a broad range of investment alternatives, as defined in 29 C.F.R. § 2550.404c-1(b)(3). However, the rule makes clear that the fiduciaries must first satisfy the prudence and loyalty provisions in ERISA and the final rule, including the overarching requirement to evaluate investments solely based on pecuniary factors when selecting any such investment fund, product, or model portfolio.

- Prohibits plans from adding or retaining any investment fund, product, or model portfolio as a QDIA (as described in 29 C.F.R. § 2550.404c-5), or as a component of such a default investment alternative, if its objectives or goals or its principal investment strategies include, consider, or indicate the use of one or more nonpecuniary factors.

The final rule will become law 60 days after publishing in the Federal Register. However, the new rule remains subject to the Congressional Review Act, which allows Congress to strike down federal regulations within 60 legislative days.

Importantly, the rule will apply only on a prospective basis, meaning fiduciaries will not have to divest or cease any current investment, even if originally selected using non-pecuniary factors in a manner prohibited by the final rule (with the exception of the prohibition of QDIA investments that use nonpecuniary factors as a primary investment objective, which must be removed from plans by April 30, 2022). However, plan sponsors still maintain responsibility for any actions or decisions made prior to the enactment of this rule and subject to their fiduciary duties of prudence and loyalty in effect at the time.

For more information, please contact your CAPTRUST Financial Advisor at 800.216.0645.

The movie opens with this pithy and prescient quote (erroneously attributed to Mark Twain): “It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.”

No doubt Adam McKay, the film’s director, was making a statement about the massive financial risks hiding in plain sight in the mid-2000s while the rest of the world remained oblivious to the imminent collapse. In hindsight, a growing housing bubble, lax bank lending standards, and risky mortgage products were obvious warning signs.

But if these risks were there to be seen by everyone, why did so few people notice and sound the alarm? Why were the rest of us caught off guard?

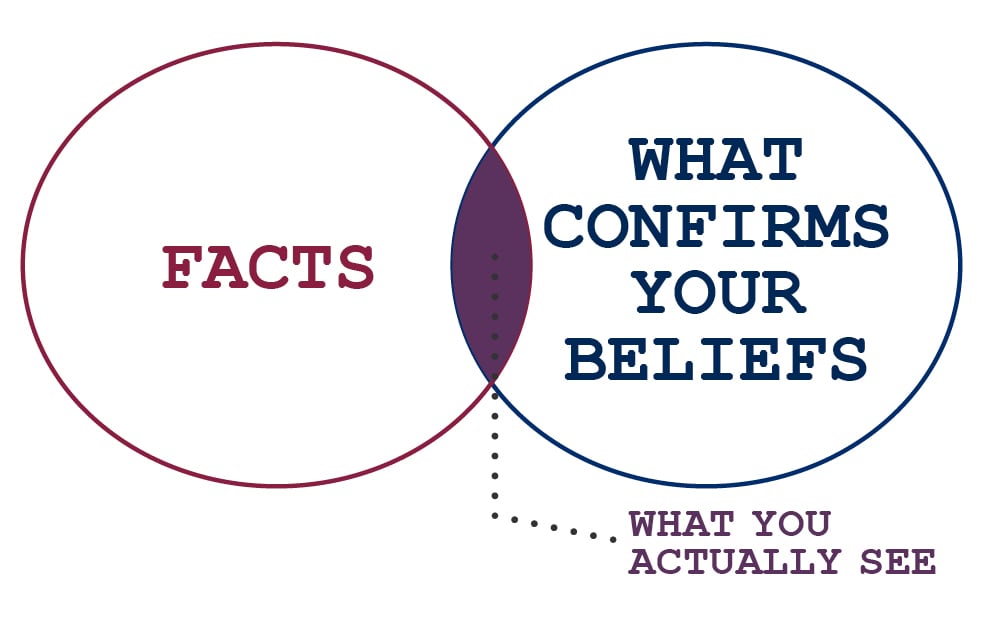

The answer: The rest of us saw what we wanted to see, a growing economy with rising stock prices and real estate values. This phenomenon is known as confirmation bias, one of several behavioral biases that affect us all.

Confirmation bias is at work when we look for, interpret, and remember information in a way that confirms our existing ideas. No matter how impartial we believe ourselves to be, we cannot help but favor information that supports what we already believe (or want) to be true. It contributes to overconfidence in personal beliefs and can support or strengthen beliefs—even in the face of contrary evidence.

For it is a habit of humanity to entrust to careless hope what they long for, and to use sovereign reason to thrust aside what they do not fancy.

Thucydides, Greek historian

Find What You’re Looking For

Many examples of confirmation bias’s influence exist in our day-to-day activities. For example, if you decide to buy a car and fall in love with the look of a particular model, you will certainly find ample evidence—reviews, videos, celebrity endorsements, whatever—to confirm your desire. Conversely, if your dinner date suggests a restaurant that you’re not wild about, you can easily find ample evidence of poor service and bad food.

Confirmation bias can also create costly mistakes for investors. Imagine talking to a friend at a party. He shares with you his latest money-making stock idea and suggests that you check it out—but don’t wait too long, he says, or you might miss out on a big move. Because you are a savvy investor, you jump on the Internet and do your own due diligence.

Unfortunately, confirmation bias causes your brain to latch on to information that supports your friend’s suggestion. Meanwhile, it rejects data that goes against your beliefs. Your research complete, you make your trade the next day. A week later, the stock tanks on a disappointing earnings release.

We’ve all done it, and it’s not our fault. Confirmation bias is tricky to detect in ourselves.

While the Internet certainly enables it, social media has amplified confirmation bias in recent years. Social media platforms like Facebook use algorithms to target users with content that they will agree with—and exclude content they are likely to oppose. The content presented strengthens one’s views, resulting in what experts call filter bubbles, where an individual becomes closed off to new ideas, subjects, and information.

But confirmation bias is not all bad and, like many behavioral biases, likely developed to help our ancient ancestors cope with the world. It drives us to surround ourselves with people who share our values, traditions, religious beliefs, and political leanings. The upside is that this behavior leads to more enjoyable and fulfilling lives as we surround ourselves with like-minded people who validate the way we live.

But how can we know the difference between a positive effect and a negative effect? And what can we do to make sure we are making better decisions?

What the human being is best at doing is interpreting all new information so that their prior conclusions remain intact.

Warren Buffett, American investor and philanthropist

Hold on Loosely

The best cure for confirmation bias’s negative effects is to hold onto your opinions less tightly. But that, of course, is easier said than done. Here are a few tips and tricks that might help:

Stew on it. Don’t act immediately. Giving yourself time to conduct research, talk to experts, and seek out different or opposing points of view can reduce the risk of confirmation bias. Take it all in and refuse to jump to conclusions. Put it in the stew, let it simmer for a while, and draw your own conclusions.

Be humble and open to change. Recognize that you don’t know everything and practice humility when listening to others. As the saying goes, “We have two ears and one mouth so that we can listen twice as much as we speak.” Give yourself permission to change your mind as you encounter new information on a topic.

Challenge your thinking. Confirmation bias partly explains why two people can see the same information or fact pattern and come to opposite conclusions—and neither will be completely correct. Make it a personal policy to seek opposing views or other possible explanations to problems or topics you’re exploring. The more viewpoints the better. This will add nuance to your thinking and help you draw richer conclusions.

Find a sparring partner. Whether it’s your spouse, best friend, or a trusted colleague, find someone to become your thinking partner. Authorize him or her to challenge your views by playing devil’s advocate—and return the favor. Many people process their thinking by speaking, so having a trusted sparring partner to debate—one who won’t judge you—can be a helpful way to expand your thinking.

In our role as financial advisors, we often act as thinking partner with our clients when they find themselves in a filter bubble.

Most recently, during the depths of the COVID-19-related market sell-off in March, we found ourselves helping clients manage fight-or-flight responses induced by their fears of lost money and stoked by an inflammatory news media. The fire was further fueled by the virus’s then-unknown impact on lives and our healthcare system.

In most cases, our counsel and long-term perspective on the markets and investing helped expand clients’ thinking enough to stifle their knee-jerk reactions. And time has brought new information—on the virus, economy, and markets—to the discussion that has tempered reactions.

Whether you are hoping to become a better investor, a better businessperson, or just a better thinker, overcoming behavioral biases is a challenge—but one worth accepting. If philosophers, astronomers, and scientists had been closed to new information, we would still believe the world is flat and that the sun revolves around the Earth.

Thinking for yourself doesn’t require you to follow every new idea that comes along. It simply means being humble enough to realize that no matter how much you know, a fair amount of what you know for sure just ain’t so.

“There’s no question we all do not age at the same rate—just go to a high school reunion and look around,” says S. Jay Olshansky, a professor of epidemiology and biostatistics at the University of Illinois at Chicago.

Slow biological aging is what we perceive in a friend who looks younger than her chronological age. Fast biological aging is what we fear when we say stress has taken years off our lives.

In 2020, biological age is more than just a feeling—it’s a science. Researchers are developing new ways to measure it. They also are working on ways to slow it down with drugs, dietary regimens, and other approaches. They don’t expect to cure aging, “but what we’d like to do is change the rate at which that happens so that, in 20 years, you might age 10 years,” says Steven N. Austad, a distinguished professor and biology department chair at the University of Alabama at Birmingham.

We aren’t there yet, he and other researchers say. But we already know enough for all of us to take biological aging seriously and to try to do something about it while the scientists keep working on better braking systems.

Differences Start Early

Young adults often live like they are invincible, and most are outwardly pretty healthy. They are free of deep wrinkles and gray hair and have yet to develop any chronic ailments. But researchers have discovered something that might startle many young people. By their late 30s, some will be biological 60-year-olds.

That was the conclusion of a study of nearly 1,000 people born in the same New Zealand hospital in the same year. Using 18 different biomarkers—measurements that included cardiorespiratory fitness, body mass index, cholesterol counts, liver and kidney tests, immune status, and even gum health—researchers compared participants at ages 26, 32, and 38.

While most people aged about 1 year biologically for each calendar year, some aged more than twice as fast and some aged barely at all. At 38, their biological ages ranged from 28 to 61. Rapid agers felt older, according to their own health reports, and looked older, according to strangers asked to guess their ages. They also did worse on tests of physical and mental agility.

Those striking results upended the view that aging differences begin much later in life, says researcher Daniel Belsky, assistant professor of epidemiology at Columbia University.

There are a lot of studies that show about 25 percent of how healthy you remain and how long you live is due to genetics, which you can’t control. The rest is due to environment, much of which you can control.

Steven N. Austad

The differences that start in young adulthood accelerate from there. By their mid-70s, “some people are bedridden, while others are active and working,” says Eric Verdin, president and chief executive officer of the Buck Institute for Research on Aging.

“What happens when you are 70 is a reflection of things that have been happening to you throughout your life,” says Verdin.

Our bodies “are constantly subjected to stress and damage,” Verdin says. Mental and physical trauma, gravity, radiation, and other forces take a daily, invisible toll. Still, most of us manage to function well and recover from illness and injury for many decades, thanks to repair mechanisms built into our cells.

“What happens is that the repair mechanisms eventually become damaged and we get into trouble,” Verdin says.

Trouble tends to begin sooner in people with a history of stressful childhood experiences, such as poverty and abuse, according to research by Belsky and others.

Well-known health risks, such as smoking, obesity, and poor diets also speed up aging, research shows. Genes matter, but maybe not as much as people assume.

“There are a lot of studies that show about 25 percent of how healthy you remain and how long you live is due to genetics, which you can’t control,” says Austad, the Alabama researcher. “The rest is due to environment, much of which you can control.”

We can affect our aging rates, even in our 60s and beyond, Austad says, with basic healthy habits and, perhaps, some still-experimental interventions. Belsky agrees but adds, “It can be true that it’s never too late, but also be true that to get the best response, it’s best to start early.”

Testing, Testing—How Old Are You Really?

Of course, most of us don’t know our biological ages. That suggests there’s both a scientific need and a commercial market for more streamlined tests. Several have been developed.

For example, consumers have long been able to buy blood or cheek-swab tests that estimate biological age based on the length of telomeres, the protective caps at the ends of chromosomes. In studies of large groups of people, short telomeres are associated with short lives. But the measure has never been shown to accurately track individual aging rates.

“The telomere length thing was a bit of a fad,” says David Stewart, founder of a media company called Ageist. Stewart recently tried a newer kind of test.

He sent off a saliva sample to a company called Elysium Health. The company is one of several that sell tests to consumers based on epigenetic markers—chemical tags that attach to the DNA in our cells, turning genes on and off. While our genes do not change as we age, these epigenetic markers do. Certain epigenetic patterns are thought to reflect not only the ravages of time but the cumulative effects of our habits and environments. Scientists have developed aging trackers, dubbed epigenetic clocks, based on these patterns.

According to the Elysium test called Index, the 61-year-old Stewart is biologically 54. “I thought I was doing OK, but I didn’t know,” says Stewart, who swears by a low-glycemic diet, intense exercise, and plenty of sleep. “Now I know I’m doing OK. That’s a good data point.”

But consumers considering shelling out $499 should know that the test has not been reviewed or approved by the Food and Drug Administration and can’t predict longevity or the risk of any disease. The same is true of other aging tests on the market.

The test is intended to give you a snapshot of how quickly you’ve aged so far, says Morgan Levine, bioinformatics advisor for Elysium.

“It’s a readout of how you are doing, almost a report card for your health,” she says. While Levine hopes users will be inspired to maintain or add healthy habits (and take follow-up tests to track their progress), she does not have data showing that changes in health habits can alter future results.

Several other aging tests are under study. Some, used in research labs, look at blood proteins that change with age. One experimental test uses a scanner to look for signs of molecular aging in the lenses of your eyes.

Another idea: Using a computer program to analyze facial features that change with age. Olshansky, the Illinois aging researcher, is a leading promoter of that concept.

Verdin, of the Buck Institute, says he’s tried a variety of lab and photographic tests and, at age 63, consistently tests about five years younger. “I take it as a sign that I might be doing something right.”

Doing the Right Thing—and Wondering What’s Next

We all want to do the right things to slow down aging. So, what are they?

“I always tell people that we know what to do,” Verdin says. “We could gain ten years of life expectancy if everyone would start exercising, eating well, sleeping well, and managing their stress.”

Belsky agrees that such lifestyle changes “are the best prescription for healthy aging that science has today.”

Olshansky concurs, and says that exercise, in particular, is like an “oil, lube, and filter change” for your body and brain, better than any theoretical fountain of youth.

That’s not to say that scientists are not looking for new interventions. Studies of eating patterns, medications, and supplements that might affect the pace of aging are underway.

Among the experimental approaches:

Calorie restriction. Mice and worms put on very low-calorie, nutrient-dense diets have been shown to live longer, healthier lives. But humans are not mice or worms, and studies in people have yet to show longevity benefits, according the National Institute on Aging (NIA).

Fasting (also known as time-restricted eating). Some preliminary studies suggest that people who limit eating to a few hours a day or limit calories on some days each week might get some protection from age-related decline. But the evidence is not strong enough to recommend such practices, the NIA says.

Medication. Several medications appear to extend the lives of animals. One that has shown some promise in humans is an inexpensive, already-available diabetes drug called metformin. A large human trial that will look at whether metformin can delay the onset or slow the course of heart disease, cancer, and dementia in older adults without diabetes is getting underway.

Supplements. No supplement has been proven to slow down aging. That includes resveratrol, a substance found in red wine that some people take in concentrated pill form, despite a lack of safety or effectiveness data. And it includes newer supplements that promise to increase levels of nicotinamide adenine dinucleotide (NAD), a molecule important to energy metabolism that declines with age. Supplements that increase your NAD levels have not been proven to affect health or longevity.

For now, the best advice, Levine says, is “doing everything your mother told you to do.”

As many people nearing or past their 65th birthdays can attest, you haven’t really experienced the byzantine nature of the nation’s health insurance system until you face signing up for Medicare, the federal insurance program for seniors.

The complexity of a system that contains an alphabet soup of parts may come as no surprise. But the costs of health care in retirement might come as a shock.

“A lot of people think that, once they retire, they are going to go on Medicare and they’ll pay nothing out of pocket,” says Ted Lew, a CAPTRUST vice president and financial advisor based in San Ramon, California.

The truth: Healthcare costs in retirement are significant and should be a major part of your financial planning, Lew and other experts say.

Yet, a survey from the Insured Retirement Institute found that just 25 percent of people aged 56 to 72 in 2019 had factored healthcare costs into their retirement savings plans. The number was a little better, 48 percent, among those consulting with financial advisors.

The number one reason for leaving health care out of planning was the misperception that Medicare would cover everything, the survey found. And the number two reason for lack of planning was uncertainty about how much health care might cost.

How Expensive Is It?

Cost estimates vary. One calculation, from Fidelity Investments, found that a 65-year-old couple retiring in 2020 could, over their lifetimes, expect to pay $295,000 in current dollars for insurance premiums, co-pays, and out-of-pocket expenses, not including non-prescription drugs or most dental services.

HealthView Services put the lifetime bill for the same couple at $387,644 in 2019, with a calculation that included some additional expenses, such as hearing, dental, and vision care. Neither estimate included the costs of long-term care, which can be substantial and are not covered by Medicare.

As of 2019, a private room in a nursing home cost a median of $8,500 a month, and a home health aide cost more than $4,000 a month, according to Genworth, an insurance company.

“People can experience a bit of sticker shock” when they read such numbers, says Matthew Rutledge, a researcher at the Center for Retirement Research at Boston College.

In a paper published in 2019, Rutledge and a colleague reported that people over age 75 spend an average of 20 percent of their annual incomes on out-of-pocket healthcare costs. They concluded that, while most people can manage those costs, the picture becomes more worrisome when long-term care is included—and when those with the greatest healthcare needs are considered.

Using data that included long-term care, they found that, at ages 75 to 84, the top 10 percent of spenders needed more than half of their incomes for health care; at ages 85 and over, the top 10 percent needed 142 percent of their incomes to cover health costs.

“It gets scary when you are in the top five to ten percent,” Rutledge says.

Of course, no one knows whether they will end up as a big spender, needing years of support after developing dementia, frailty, or other costly problems.

But here’s an important consideration: If you are quite healthy in your mid-life and early retirement years, you are likely to spend more than your unhealthy peers.

“It’s a surprising fact,” Rutledge says. “We tend to think that the unhealthy ones will be the big spenders, but they tend to die sooner, so they don’t spend as much.”

HealthView Services provides this example: A healthy 55-year-old woman can expect to live to age 89, paying $13,165 a year for health care, while a 55-year-old woman with type 2 diabetes can expect to live to age 80, spending $16,635 a year. That nine-year gap in life expectancy means the healthy woman will spend $424,875, while the woman with diabetes spends $266,163.

Such calculations are no reason to give up healthy habits. But they are a reminder that even the healthiest among us need to plan for substantial costs.

The Medicare Decision

Ready or not, at age 65, most people face a decision: whether to sign up for Medicare. Usually, the answer should be yes, says Sarah Murdoch, director of client services at the Medicare Rights Center, a nonprofit advocacy and education group.

That’s because you could face costly penalties and gaps in coverage if you do not sign up when you become eligible for Medicare Part B, the part that covers most routine care and requires premiums, she says. That initial eligibility period spans the three months before and three months after your 65th birthday.

If you are working for and insured by a large employer, you don’t have to sign up for any part of Medicare until you leave your job. That also goes for your covered spouse.

Just about everyone else needs to take action. That includes people without health insurance, but also those with individual policies, retiree coverage, COBRA policies, or coverage from an employer with fewer than 20 workers, Murdoch says. Those policies no longer have to act as your primary insurance once you are eligible for Medicare, meaning they could stop covering your bills.

That’s not all. If you sign up for Medicare Part B late, you pay higher premiums for the rest of your life. You also can expect to wait months for coverage to kick in.

“It is really important for people to know their timelines,” Murdoch says. “We see people making truly innocent mistakes all the time, and it can have sad consequences.”

When you do sign up, you face another choice. Your first option is to stick with traditional Medicare, with its core Part A (hospital) and Part B (doctor and outpatient) coverage. The alternative is Medicare Advantage, coverage from a private insurer that combines Parts A and B, often with additional benefits. Medicare Advantage typically restricts you to a network of providers.

The best choice varies, Lew says. He says some clients go for traditional Medicare because they have doctors who don’t participate in an Advantage plan or because they are retiring in an area with few or no network providers. Others like the one-stop shopping of a network plan.

If you do choose traditional Medicare, be sure to add a supplemental Medigap plan. That’s because traditional Medicare puts no cap on out-of-pocket costs, but all supplemental policies do.

Ted Lew, Financial Advisor

But buyer beware: While your mailbox may overflow with pitches from supplemental insurers, you can get better information at medicare.gov, Lew says.

Tailoring a Plan for You

When Doug and Teresa Wright started retirement planning a few years ago, the couple realized they would face some new costs when Doug left his job that provided health insurance for both of them. They would have to pay Medicare premiums for Doug and buy individual coverage for Teresa, who is a decade younger.

“When I worked, I didn’t pay anything,” says Doug, 65, now retired from his job as vice president of a Silicon Valley manufacturing company. The couple now pays about $1,000 a month just for premiums, mostly for Teresa, “but we planned for that,” Teresa says.

Planning for such individual circumstances is crucial, Lew says. How much you need for health costs can vary widely, depending on factors ranging from your health history to where you plan to live. For example, if you live outside the country, you won’t be able to use Medicare while abroad.

How you save for retirement healthcare expenses can also vary. One increasingly popular choice is to fund a health savings account (HSA) while you are still working. The accounts are not available to everyone—you can only contribute if you are enrolled in a high-deductible health insurance plan. But, if you are eligible, it’s smart to open an HSA as soon as possible, Lew says, because the accounts “have a triple tax advantage.” Contributions, earnings, and withdrawals for eligible health expenses are all tax-free.

Many people also consider buying long-term care insurance, but that can be a difficult decision, Lew says. Generous, affordable policies available years ago turned out to be a bad deal for insurers, who “lost their shirts,” he says. As a result, “the current policies tend to be very pricey,” but some people will find them worthwhile, he says.

An alternative is to set apart some money as a self-insurance pot for long-term care, says Lew.

In the end, he says, health isn’t just one more thing to consider in your retirement planning—it may be the most important thing.

“If you don’t have your health,” he says, “nothing else really matters.”

Ready for Medicare?

If so, you need to know your ABCs and D—the major parts of the government health insurance plan for people over age 65 (and for some younger disabled people).

PART A | Hospital Coverage

This covers hospital stays, hospice care, and some short-term skilled nursing care—such as when you need a rehabilitation center after you’ve been hospitalized for an illness or injury.

Most people don’t pay premiums for Part A because they’ve already paid for it through payroll taxes. But you still pay deductibles and co-pays for certain services. The 2020 deductible for a hospital stay is a hefty $1,408. Many people buy supplemental Medigap policies to help cover such costs.

PART B | Doctor and Outpatient Services

This covers doctors’ bills, outpatient lab tests, preventative services, mental health visits, ambulance transport, and some medical supplies.

You pay a premium for Part B. The 2020 rate is $144.60 for people with individual annual incomes up to $87,000. Those with higher incomes pay more—as much as $491.60. There’s also a modest annual deductible and a 20 percent co-pay for many services.

PART C | Medicare Advantage

This is not really a third part of Medicare. It’s private insurance that covers everything in Medicare’s Parts A and B. These plans often cover services, such as routine vision, hearing, and dental care and fold in prescription drug coverage. You may pay an added premium on top of your Part B premium.

These plans are generally run by health maintenance organizations (HMOs) or preferred provider organizations (PPOs) that restrict you to network providers. Costs and coverage vary. Some rural areas have no Medicare Advantage providers; some urban areas have dozens.

PART D | Prescription Drug Coverage

You buy this coverage through a private insurer, as part of a Medicare Advantage plan or in addition to traditional Medicare Parts A and B.

These plans generally come with premiums and other out-of-pocket costs, which can include deductibles and co-pays. Different plans cover different medications, so it’s crucial to check their drug lists—called formularies—through medicare.gov for any medications you take regularly. This coverage can be invaluable given the high prices of many medications.

To Learn More: In addition to medicare.gov, you can get free counseling from the Medicare Rights Center at 800.333.4114. The center also offers Medicare Interactive, a free online reference tool for consumers, and Medicare Interactive Pro, paid online courses for professionals.

At 64, she made history as the oldest contestant ever on the show, which features up-and-coming designers, mostly in their 20s and 30s.

Yet Beringer herself was an up-and-coming designer.

Rewind just seven years, and you would find a 58-year-old Beringer behind a desk for her 18th year at the New Jersey Education Association.

It had been a good journey for a good mission. The association promotes excellence and equity in public schools and colleges across the state. Beringer helped drive that cause in many roles, from advocacy to program development, communications, and outreach.

She had recently married, gotten a much-sought-after promotion, and enjoyed a financially secure life. However, that coveted promotion landed her in an ill-fitting realm. Throughout her career, her roles had always had a creative component; now, she was managing people.

Her creative side was stifled. “I felt like my oxygen was being siphoned off when I was at work,” said Beringer. “I felt like I was suffocating.” It was time for a change.

That Aha Moment

Beringer remembers the exact moment she made the life-altering decision. “It was three in the morning, and I wasn’t sleeping again because I was not happy with my job.”

Inspired by her sons’ successes as young college grads following their dreams, she felt a twinge of envy and asked herself, “If I was young again, what would I want to learn?”

“It was a simple question, but that question changed my life. I had that aha moment. It was fashion design,” says Beringer.

She had learned to sew at age 12 and enjoyed vintage and thrift store shopping to create her own distinctive looks. But she had no other fashion experience, and her degree was in business education. So, this was a bold leap into new territory.

With encouragement from her husband and sons, Beringer left her education career at the top of her game and enrolled in a three-year Master of Science program in fashion design at Drexel University’s Westphal College of Media Arts & Design.

“I loved it,” says Beringer. “Once I got to Drexel, I felt like I found my home,” she says. “I felt like this is where I belonged, and most times, I forgot that I looked different than my classmates.” Beringer even came to see the humor in frequently being mistaken for the professor.

She was having the time of her life, but it wasn’t an easy path. The intensive program consumed 70 or 80 hours a week, often more. She had little time for anything else and was coping with the onset of painful arthritis. Ultimately, Beringer graduated at the top of her class, with a 4.0 grade point average and a record-setting seven awards at the 2016 Drexel Fashion Show.

And, while many of her classmates went to New York or Los Angeles to apprentice with other designers after graduation, Beringer didn’t have the luxury of time. She immediately started designing under her own label out of her Philadelphia studio.

Joan Shepp’s Window

For nearly 50 years, Joan Shepp in Philadelphia has been a premier fashion destination. The store is known for its collection of creative European, Japanese, and hard-to-find designers.

Beringer recalls that during her time at Drexel, it was always “‘You’ve got to see Joan Shepp’s new window.’ They are pieces of art.”

Recognized as one of the country’s style leaders by publications such as Harper’s Bazaar and Departures, the store welcomed fashion students and encouraged them to explore the collections. “It is just an iconic place; I thought of it as a research lab, and that’s where I would always go.”

Beringer’s first sale was at Joan Shepp. “I remember it well because the woman came out of the dressing room in the Dior-inspired skirt and just started twirling and got teary-eyed. She said, ‘I haven’t felt this beautiful in years.’ That’s when it really hit me how the power of fashion goes beyond the aesthetics; it goes into how you feel inside your heart and soul.”

I remember it well because the woman came out of the dressing room in the Dior-inspired skirt and just started twirling and got teary-eyed. She said, ‘I haven’t felt this beautiful in years.’ That’s when it really hit me how the power of fashion goes beyond the aesthetics; it goes into how you feel inside your heart and soul.

Nancy Beringer

Beringer started freelancing with Joan Shepp and designing those window displays, including one featuring her 2016 collection of evening wear. “This was in my first year out of fashion school. It was such an honor to be able to offer some of my work at her store.”

One garment in the Joan Shepp window would catapult Beringer’s new career to the next level.

Beringer poses with one of her futuristic fluid designs

Beringer poses with her mentees from the Refugee Women’s Textile Initiative

Mistake Gone Magic

Beringer was designing for a runway benefit based on a progressive dark-to-bright theme, symbolic of the emergence from substance abuse. A rainbow-colored swath of faux fur beckoned. A cape, perhaps? The organizers asked for something more dramatic—one of her sweeping, oversized Rosa coats.

“So, I designed this big coat,” says Beringer. “The funny thing is when I cut the first piece, I made a mistake. I cut it upside down.” Beringer goes on to explain.

“Picture your hair as we’re sitting here; it’s just flat. If I hold you upside down, [your hair would be] fighting gravity, and that’s what this faux fur did. So that mistake was the magic of the coat.”

After the charity show, the coat went into the window at Joan Shepp, where it was spotted by Philadelphia-based musical artist Tierra Whack. The 22-year-old star was looking for something to wear on the red carpet at the 61st Annual Grammy Awards. As soon as she saw the coat, she said, “That’s it.”

Beringer and Whack struck up a friendship on social media. “I wanted her to know the back story—that it represented empowering and helping women,” says Beringer.

Whack was enchanted by the coat. When she shared the news of her nomination for a Grammy for best music video, Beringer asked the artist to come to her studio in Philadelphia. When Whack stepped out of the car, “it was like a lightning bolt,” says Beringer, “a creative explosion. We had this instant connection.”

What followed was a whirlwind of preparations. One fitting, then another, and Whack leaves for Los Angeles before deciding on shoes. The coat will have to be hemmed on location.

In Los Angeles, Beringer finds herself at a private party with Whack’s entourage. “I look around the room and I realize I’m the oldest person in the room, designing for the coolest person in the room. Lucky me.” The coat and its wearer were a sensation on Grammy night.

“As a designer of evening wear,” says Beringer, “you fantasize of designing something for the red carpet, but what was important to me was that I had the trust of this genius artist in this big moment of her life.”

The next day’s New York Times featured three looks. The Technicolor Coat was one of them. Adding to the notoriety, E! named the ensemble one of the night’s most outrageous outfits. The coat earned Beringer a Best in Philly fashion design award.

As the Grammy event was going on, Beringer was invited to be a featured designer for Philly Fashion Week. A few months later, Philadelphia Magazine named her Best in Philly Fashion Designer for Artsy Dresses.

A Gift and an Opportunity

Beringer first saw Bravo’s Project Runway 10 years earlier. She harbored a secret, unspoken desire to be a contestant, vying to become the next great American designer. She didn’t even tell her Drexel classmates, thinking they might scorn reality television.

As a fresh Drexel graduate, she applied to be on the show. After making it to the second selection—the callback in New York—she was cut from the cast. But she didn’t take the rejection personally.

When I didn’t make it to the final stage, I viewed it as a gift and an opportunity, because I had affirmation from the judges and former contestants that my work was good enough to be on the show.

Nancy Beringer

“When I didn’t make it to the final stage, I viewed it as a gift and an opportunity, because I had affirmation from the judges and former contestants that my work was good enough to be on the show.”

Beringer viewed it as having another year to improve her craft. She took an intense online draping class out of Paris, a two-week patternmaking class in London, and couture classes.

In 2019, she made it onto the show. Sixteen designers showcased their talents in weekly challenges, with experiments directing them to use animal prints and thrift shop clothes, even taking a shot at designing the tuxedo of the future.

Beringer won the episode 11 challenge, which paired the designers with Olympic and Paralympic athletes to create a victory night celebration outfit. Beringer worked with Tatyana McFadden, a Russian-American athlete who has won 17 Paralympic medals in wheelchair track and field. Beringer wowed the judges with a silver ensemble: a feather bustier with fantasy skirt that doubles as a cape.

Week after week, Beringer kept up with the frenetic energy of the show and its time-constrained challenges, rising to the final four contestants by the last week. “That whole time, I felt it was my destiny,” she says.

Beringer’s on-air effervescence belied the personal physical challenges. “I’m 65 now, and I wake up in pain every day, but, because I’m active in designing, I feel better throughout the day,” she says.

Her Project Runway final collection featured futuristic, metallic, and fluid designs. A sculptural cut-out jumpsuit. A printed, tailored pantsuit. Shimmering dresses in liquid-look fabrics that danced in the runway lights.

The looks are eclectic, often androgynous and fantastical. “I don’t have a checkbox of ‘I design for this particular clientele or this look.’ It’s really a journey of exploration with my fabric, and I’m just delighted when it finds the right person to wear it, that it makes them feel empowered and gives them a sense of joy.”

Beringer finished as a runner-up and earned high praise from the judges, who admitted they had initially underestimated her. “I didn’t get the title. I didn’t get the money, which would have been really nice, but I did walk away as the winner because I left it all out there.”

Beringer chose the 10 models for her final collection to represent diversity and inclusion. “When we brought the models together for their first fitting, they looked around at each other, and they all got it,” says Beringer. “They saw that we were making a moment. They felt it.”

Dali Wearable Art Coat and Bottoms

This magical Wearable Art Coat is a tribute to Spanish surrealist painter Salvador Dali, displaying his most well-known pieces.

Fast-Forward to 2020

Life in pandemic days is quieter, with travel and shows on hold. The Joan Shepp store is temporarily closed. Beringer is self-quarantining in her studio, working 12 or more hours a day, seven days a week, on her craft. She avoids the news as much as possible.

When the world emerges from this forced pause, Beringer will be ready with unexpected new designs born out of the colorful chaos of her studio. She is where she is meant to be. “I found out fashion designing is not something I want to do; it’s something I need to do. It is pure oxygen for me.”

Alone in her studio, she will pick up fabrics, drape them over dress forms, transform them with novel techniques, and immerse herself in the joyous journey of letting the materials say what they want to be.

“I have this creative outlet. I can bring empowerment and joy to people, and I can also use my platform to give back and help make the world a little better. I just hope I am inspiring people to see that no matter what their challenge, age, or situation, it’s OK to hope, persevere, and pursue their dream.”

Four Keys to Following Your Dream

Feather Your Nest Egg. In making the career shift, Beringer was walking away from financial security. “But I could do it because of how financially conservative

I had been all along. I led a life that allowed me to follow this dream.” From her first job out of high school, making $100 a week, Beringer still set aside savings, then faithfully maxed out 401(k) contributions, invested, and minimized debt.

Rejoice in the Process. In today’s world, we are accustomed to instant gratification, information, and results, says Beringer. Everything is so immediate, right there. “It doesn’t always happen the first time or the second. My professional background easily translated into an understanding that design is a process.”

Be Fearless. Beringer is all about pushing the boundaries. “When working on a design or experimenting on a fabric, I’m like, ‘I’ll try it.’ What’s the worst that can happen? When you look at what’s happening in the world right now, whether or not it works or I need to start over, that’s not really significant.”

Don’t Wait for the Perfect Time. Had she waited until she was ready to be a red-carpet designer, that moment would have never arrived, says Beringer.

“I seem to be drawn to jobs I don’t know how to do,” she says with a laugh. “It’s OK to not know how to do something. Ask questions. Embrace the unknown. Embrace the learning and find your own joy.”

Q: I have inherited jewelry and collectibles from family members over the years. Are they covered under my homeowner’s policy?

It depends. Typically, insurance carriers don’t assume you have expensive items or rare collections. If you have valuable jewelry, a coin collection, furs, or a room full of expensive guitars, it might be worth getting extra coverage to insure them. You don’t want to find out too late that your policy doesn’t cover them.

Start by understanding what your homeowner’s policy includes and how much coverage is in place to ensure your items are going to be covered in the event of a claim. Know what situations the policy does cover: fire, theft, accidental breakage, water damage, and damage while traveling, for example. And be sure to understand what your responsibilities are under the policy requirements, such as storing your collection under certain conditions like out of direct sunlight, in a temperature-controlled room, or in a dry space.

If the value of your items exceeds the limits on your policy, you can increase your coverage by purchasing either an endorsement or floater. You can also purchase a standalone policy designed to cover specific valuables, such as a collection of expensive handbags or couture clothing.

Your insurer will require you to have a professional appraisal to obtain additional coverage for your valuables. The appraisal establishes an objective value for your property, which may be significantly different from what you think it’s worth. And remember that you’re adding premium for the endorsement on top of what you’re paying on your regular homeowner’s insurance policy.

If you’re interested in such a standalone policy, talk with the insurance professional from whom you purchased your homeowner’s policy. That’s the best place to start. You may also be able to save money by insuring your valuable items with the same company that carries your auto, life, or homeowner’s insurance.

When you’re confident that you’ve purchased the proper coverage at a good price, then it’s time to go enjoy your possessions with the peace of mind that comes from being well-protected.

Q: I want to go live in a warmer state. What do I need to think about from a tax perspective?

Moving to another state for the weather, greater access to the outdoors, or to be closer to loved ones is a big life decision—one that will impact the taxes you pay no matter where you land.

But to make a good decision, it’s important to consider all the taxes that can apply to a state resident. In fact, it’s possible you could pay higher or lower property taxes, income taxes, or sales taxes when you move. How much you’ll pay depends on the individual state’s laws:

- Property taxes. Many states, such as Nevada and Florida, that don’t have income taxes make up for them with property taxes. These spots draw a lot of retirees, but it’s important to consider that they have relatively high property taxes. Some states offer property tax relief programs for older individuals or those with limited income or disabilities. If you’re set on moving to a high property tax state like Texas or California, consider renting as a cheaper alternative to owning a home.

- Income taxes. Many states’ income tax rates range between 1 percent and 10 percent. Some states have no income tax. In Tennessee, for example, regular income is generally not subject to state tax, but a flat tax rate applies to dividends and interest income. Income tax rates will affect different forms of retirement income, as well, such as Social Security, retirement accounts, and other investments. New Mexico and West Virginia are two of the 13 states in the country that apply taxes to Social Security benefits.

- Sales taxes. Thirty-eight states have local sales taxes that can vary widely. A state with a moderate statewide sales tax rate like Louisiana and Alabama could actually have a very high combined state and local rate compared to other states.

Paying attention to tax efficiencies can help you stretch your savings; however, these implications are just one piece of the bigger picture.

It’s important to get an accurate analysis of the true cost of living in your desired location. In addition to state and local taxes, get familiar with the day-to-day life and expenses in the areas you are interested in moving to, such as transportation, groceries, access to good health care, and cultural resources. While it’s important to consider taxes, deciding to move solely based on this factor might have you missing the bigger picture.

Moving to another state can save you money if you plan ahead to maximize all available benefits. Just be sure to consider all the implications before you start packing those boxes. Do some research and contact a financial planner and a tax professional for perspective on your new state. Taking these steps will help you look at the many factors that come with moving and help you avoid making a bad decision that could be difficult and expensive to unwind.

Q: I am planning to retire next year. What should I be doing to prepare given uncertainties in the markets and economy?

Your question is understandable in light of current economic and market circumstances. In addition to the pandemic’s human and healthcare impacts, we will feel the economic fallout for years to come. But that doesn’t necessarily mean you have to rethink or postpone your retirement.

Much of what you should do has nothing to do with the pandemic or current market realities. If you have not worked with an advisor to create a plan for your retirement, do so. If you already have a plan, now is a good time to refresh it to make sure it provides the assurance you need to retire with confidence.

Here are a few recommendations as you enter your home stretch before ending career work:

- Understand your income sources. Social Security benefits provide a foundation for most Americans’ retirements. When do you plan to file for benefits? What benefits do you expect? Do you have other sources of income, such as a pension plan or rental real estate? While you may not be thinking about work during retirement, it’s a great way to stay engaged and keep you from dipping into your savings.

- Get a handle on your expenses. This can be tough. While you will spend less on some things during retirement, you will probably spend more on others. Less on dry cleaning, for example, and more on travel or entertainment. Paying off your mortgage or downsizing your home can also have a big impact on your expenses. Keep a log of expenses to get a sense of your current spending—and note items you think will increase, decrease, or go away altogether. This can provide a good starting point.

- Assess your portfolio. It’s important to remember that, even if you’re retiring in your 60s, you are still a long-term investor. You should plan for your portfolio to sustain your expenses (plus inflation) for 30 years—more if you have extra-long-lived family members. Your portfolio needs a growth element that is balanced with more stable investments to moderate volatility. Make sure to use up-to-date capital market assumptions that reflect the low-interest-rate environment we expect for quite a while.

- Run the numbers. With an understanding of your income, expenses, and portfolio mix, you can validate your plan. Try a retirement calculator that uses Monte Carlo simulation. This kind of simulation incorporates a range of potential market conditions and provides a sense of best case, worst case, and expected outcomes. Tweak the inputs to come up with a plan that you can live with. You may decide to work a little longer to provide a bigger margin of safety—or to retire immediately if the numbers look good.

- Stress test your plan. While a Monte Carlo simulation incorporates a wide range of market conditions, you may find it comforting to further stress test your plan. What if the market falls 20 percent during your first year of retirement? What if you decide to spend more early in retirement? What if you run into a big healthcare expense? Exploring these possible scenarios can provide further confidence in your plan’s durability.

It’s important to realize that retirement is not a set-it-and-forget-it endeavor. Make your decision to retire based upon a thorough analysis that builds in a comfortable margin of error in case things don’t play out as expected. Then, rerun your plan every three to five years or when something significant happens—like a big market move, selling your home, receiving an inheritance, or the death of your spouse.

Remember: Your goals and situation are unique, so make sure that you sit down with your financial, tax, and legal advisors to make sure that your plan is right for you.

The mood of an era is perhaps best captured by its futurists’ visions of tomorrow. An article by John Elfreth Watkins Jr., published in the December 1900 issue of The Ladies’ Home Journal (LHJ) titled “What May Happen in the Next Hundred Years,” envisioned a future of pneumatic tubes, airships, two-day Atlantic crossings, fantastically large fruits and vegetables, and other strangely specific predictions, such as the elimination of the letters C, X, and Q from our alphabet.

However, a few of the author’s predictions are strikingly relevant today, in the wake of the jarring disruption caused by the COVID-19 pandemic. Although many of the changes predicted in the article have been underway for years or decades, the pandemic has served as a growth catalyst for some.

Food

Watkins writes, “Ready-cooked meals will be bought from establishments similar to our bakeries of today. They will purchase materials in tremendous wholesale quantities and sell the cooked foods at a price much lower than the cost of individuals cooking. Food will be served hot or cold to private houses in pneumatic tubes or automobile wagons.”

Today’s pandemic has rapidly accelerated online ordering and delivery of food, whether restaurant meals (Uber Eats, GrubHub), groceries and other staples (InstaCart, Postmates), or meal kits (Blue Apron, HelloFresh). Of course, these meals are delivered not by pneumatic tube but by a decentralized workforce of smartphone-wielding gig-economy contractors. The widespread availability of food-delivery services during lockdowns helped both consumers and restaurants struggling to keep their doors open, although there are concerns about the long-term impact on restaurant profitability with such services often charging restaurants a 15 to 30 percent commission on every order.

Entertainment

With entertainment and sports venues shuttered by social distancing requirements, we turned in record numbers to at-home digital streaming entertainment. The digital availability of the Broadway megahit Hamilton helped drive more than 60 million paying subscribers to the Disney+ streaming service in the first nine months the service was available.

Watkins hits the mark again, writing in the December 1900 LHJ article, “Grand Opera will be telephoned to private homes and will sound as harmonious as though enjoyed from a theatre box. Automatic instruments reproducing original airs exactly will bring the best music to the families of the untalented.”

Consumer Staples

Watkins even forecasted a sophisticated system of package delivery in his LHJ piece. “Pneumatic tubes, instead of store wagons, will deliver packages and bundles. These tubes will collect, deliver, and transport mail over certain distances, perhaps for hundreds of miles.”

Again, the fascination with pneumatic tubes! E-commerce has grown at a breakneck pace since 2000 when Amazon extended its platform beyond books to a wide range of product categories. The pandemic has rapidly increased the range of products bought online, especially supplies difficult to find on store shelves, such as paper goods, personal protective equipment, home office equipment, and other essentials.

In this article, we will explore how technology has impacted our response to the COVID-19 pandemic and how the crisis rapidly accelerated trends already underway. As with any disruption, winners and losers have emerged, with potential impacts to investment strategy. Pneumatic tube investors of the 1900s were likely disappointed, while fortunes were made in the auto industry—and we seek to understand which firms will prosper, strengthen, and gain market share in our post-pandemic future.

The Quick Shift

As the COVID-19 pandemic forced the global economy into suspended animation earlier this year, markets reacted with the fastest-ever bear market. The S&P 500 Index fell 30 percent in just 22 trading days. Yet amid this uncertainty, businesses, organizations, and communities quickly adapted and found creative ways to do business in a bubble.

Clearly, many have suffered and continue to suffer from illness and the loss of loved ones, employment, and income, and we do not minimize the remaining challenges. But a potent combination of technology platforms—including widespread connectivity, e-commerce, cloud computing, and collaboration technologies—allowed many businesses to adapt to a fully remote, work-from-home world far more quickly than feared in mid-March. Technology is the only way to remain connected while physically distant.

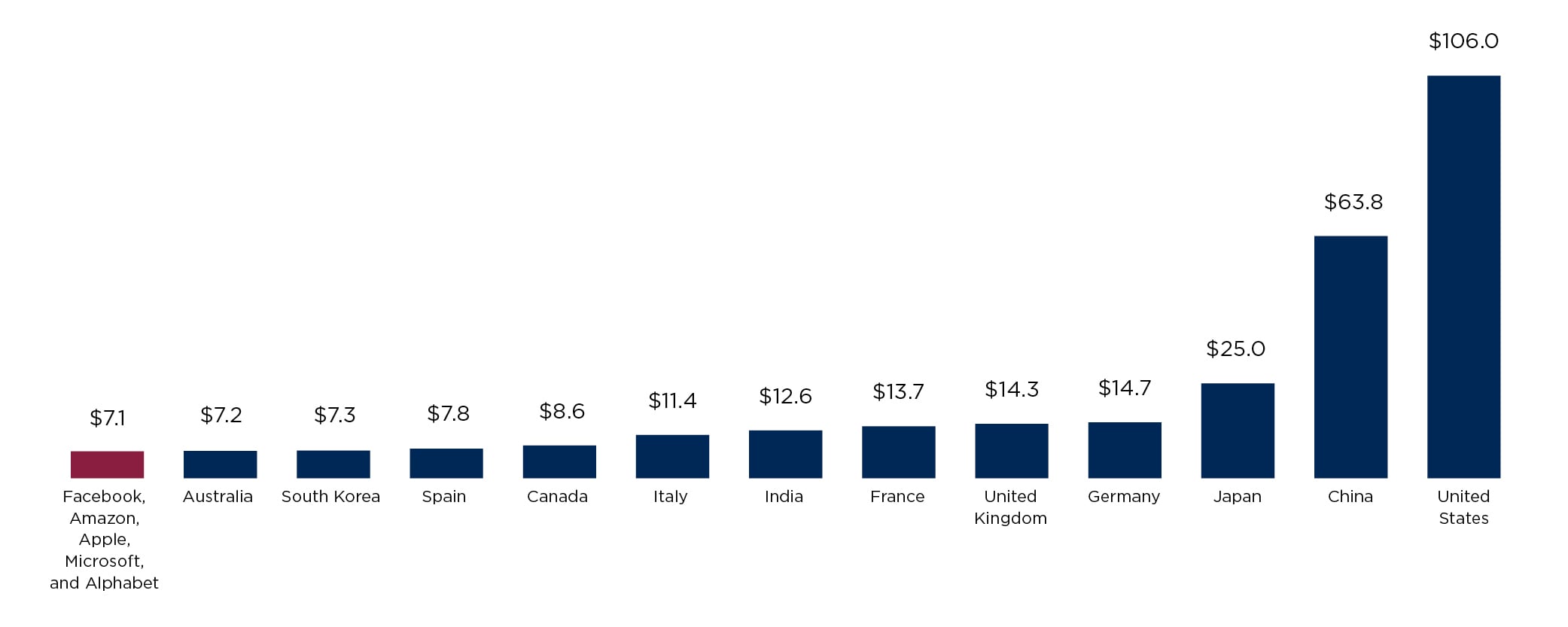

The digital platforms underpinning this transition were richly rewarded in the ensuing stock market recovery. Today, Apple alone has a larger weight in the S&P 500 Index than the entire energy and utilities sectors combined. And, as shown in Figure One, at $7.1 trillion, the combined market cap of the five largest U.S. firms— Facebook, Apple, Amazon, Microsoft, and Alphabet (Google), otherwise known as the FAAMG stocks—is greater than the national wealth of all but the 12 wealthiest nations on earth.

Figure One: Wealth of FAAMG versus 12 Wealthiest Nations (Amounts in Trillions)

Sources: visualcapitalist, Bloomberg

In addition to these technology providers, businesses and organizations that were leaders and early adopters of digital transformation also benefited relative to their competitors. Firms that were well on their way to moving infrastructure to the cloud and collaboration platforms; retailers with online and mobile ordering, curbside pickup, and contactless payment systems; and educational institutions with mature virtual learning platforms found themselves in a strong competitive position. Meanwhile, laggards that had resisted change faced a stark decision: invest in digital transformation or close their doors.

A 2019 study by Accenture sought to measure the performance gap between technology leaders and laggards. The authors surveyed more than 8,000 companies across the globe and assigned scores in three categories, including implementation of a wide range of key technologies, degree of adoption of these technologies once implemented, and their organization and culture of innovation. The performance gap was significant, with companies scoring in the top 10 percent (the leaders) showing double the revenue growth of the laggards in the bottom 25 percent.

This performance gap has likely grown significantly in 2020, creating a winner-take-all environment where larger, better-capitalized, and more innovative firms stand to gain significant market share from those less willing or able to innovate.

Tubes in the Walls