Your adult child would not have to pay the fees associated with a residential mortgage loan through a bank if you provide the loan at a lower interest rate than commercial lenders would charge. Also, the loan is as an income-generating asset in the fixed-income portion of your investment portfolio, says Jeremy A. Altfeder, CFP®, senior financial advisor at CAPTRUST.

An intra-family loan, in the right circumstances, can be “a really easy tool for parents looking for a way to do something nice for their children,” Altfeder says.

First Steps

This is not a do-it-yourself proposition, especially given the potential tax, legal, and other complications, says Lauren Campbell Maxie, an attorney and partner at NC Planning in North Carolina, whose primary practice area is estate planning for high-net-worth families.

Maxie says she gets the parents involved in a strategic discussion at the start, including their legal advisor, financial advisor, and others, to make sure they understand the details. She also brings in the prospective borrower early on, making sure he or she understands the benefits and obligations. “We tell them it’s a loan, not a gift, and that it has to be repaid,” Maxie says.

Parents may be uncomfortable with formalizing the loan, and they may not want the added expense of engaging various advisors, says Eric L. Green, an attorney with Green & Sklarz LLC, a Connecticut-based law firm, whose practice includes taxpayer representation before the Internal Revenue Service (IRS).

“But the reality is, if you do it correctly, you’re protecting your investment—and protecting the child” from creditors or would-be creditors, says Green, author of The Accountant’s Guide to IRS Collection.

“Everyone hates lawyers. I’m a lawyer, and I hate lawyers. But you’ve got to take the proper steps,” he says. For example, have the loan and related documents formally drawn up, signed, and officially recorded. That also helps avoid family fights down the road. “You don’t want a family to rip itself to pieces” over financial disagreements later on, he says. Also, keep track in writing of each payment to avoid unfavorable tax treatment.

Overall, you have to take a step back and make sure that the intra-family loan is the right fit for all involved, “because there’s lots of tools in the toolbox,” Maxie says. Altfeder agrees, saying, “It’s all about it financially making sense for both parties.”

A True Loan—with Interest

An intra-family loan must be a true loan, not a gift. Otherwise, it can trigger tax snags. To avoid such problems, charge at least a minimum amount of interest, using the rate from the table of applicable federal rates published monthly by the IRS.

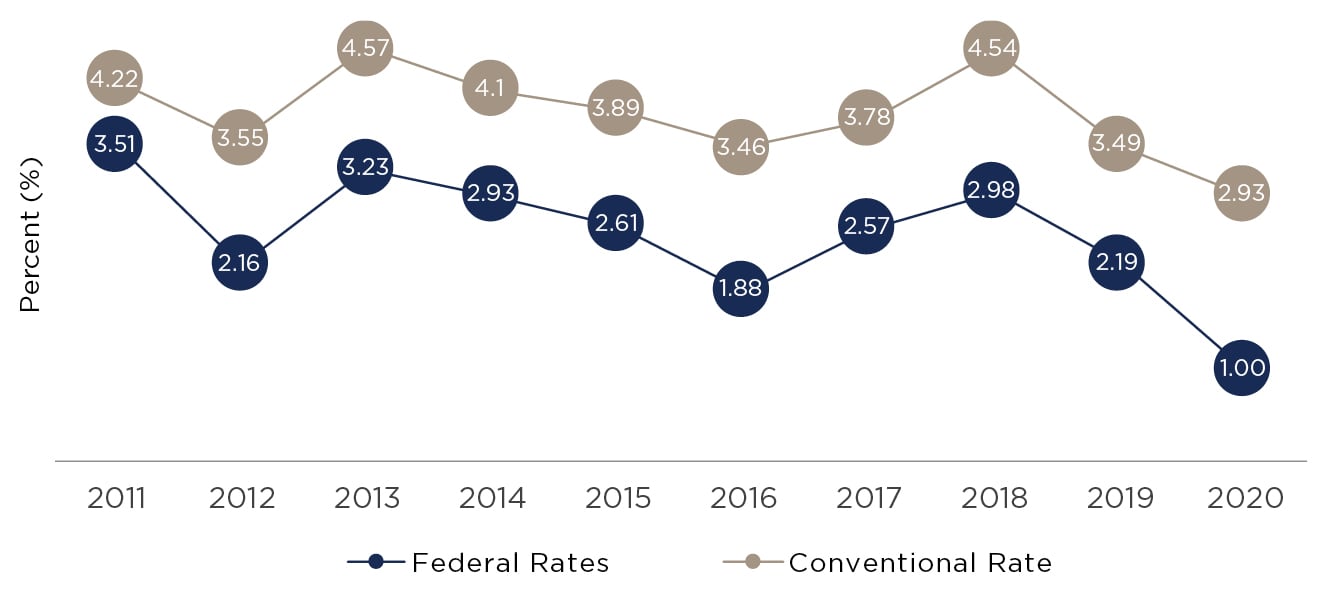

Conventional rates for 30-year, fixed-rate residential mortgages lately have been among the lowest in at least 10 years—and the applicable federal rates for long-term intra-family loans have been even lower, as shown in the rate survey illustrated in Figure One.

Figure One: Interest Rates for Conventional Mortgage versus Applicable Federal Rates for Intra-Family Loans

Sources: Freddie Mac, Internal Revenue Service. Data is for 30-year fixed rate as of first week in September of each year. Data for conventional (i.e., bank) loans is based on Freddie Mac survey. Data for intra-family loans uses Internal Revenue Service’s long-term applicable federal rate.

At the time of the survey, the average fixed rate charged by banks was 2.93 percent, while the applicable federal rate for a long-term intra-family loan rate was 1 percent. That makes the intra-family loan “a great tool to look at while we’re in this low-interest-rate environment,” Maxie says.

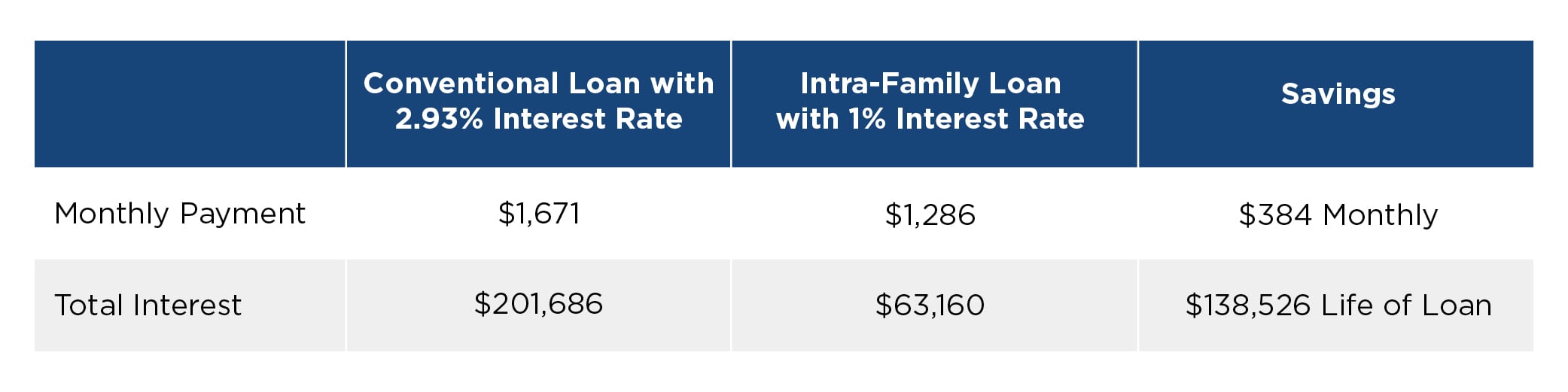

Suppose Harold and Maude plan to lend their son, Bud, $400,000 to buy a house. With a conventional 30-year, fixed-rate loan of 2.93 percent, he might pay about $1,671 a month in principal and interest as shown in Figure Two. But if he takes the loan from his parents, who use the long-term applicable federal rate of 1 percent, he’ll pay about $1,287 a month—saving about $384 monthly.

Figure Two: 30-Year Residential Mortgage versus Intra-Family Loan

Sources: Freddie Mac, Internal Revenue Service

Over the life of the loan, he’d pay about $201,687 in interest on the conventional mortgage, but about $63,161 on the intra-family loan—saving about $138,526 in interest expense overall.

An intra-family loan can also be from a grandparent, aunt, uncle, or any high-net-worth family member to a child or other relative. Such loans aren’t just for mortgages. They can also help the child or other relative pay college expenses, start a business, or accomplish other long-term family goals.

By following the proper procedures, no federal gift tax will apply and the interest paid by the adult child can generally be deductible as personal mortgage interest or as a business expense (depending on the purpose of the loan and other factors). And the interest received by the parent will be treated as ordinary income.

Flexibility

Intra-family loans can be more flexible than working with a bank, Maxie says. For instance, you can structure the loan as interest-only, with a balloon payment at the end, she says.

Another option is for parents to forgive some principal, perhaps annually, Altfeder says. Forgiving some principal on the back end can be the “icing on the cake,” turning a 30-year loan into a 15-year or 10-year loan, he says. Altfeder explains that to avoid federal gift-tax complications, be sure that the portion of the principal you forgive is within the annual federal gift-tax limit.

The annual limit—the annual exclusion—applies to each person to whom a gift is made and can increase each year, as shown in Figure Three. For 2020, the limit is $15,000 and the total amount of the gift can double if both spouses agree. In our example, Harold and Maude could forgive up to $30,000 of the loan’s principal each year, with no federal gift-tax consequences.

Figure Three: Federal Gift Tax Annual Exclusion Amount

Source: Internal Revenue Service

Suitability

An intra-family loan is best suited for those who can afford to offer it—typically high-net-worth couples who have a portfolio that sustains them in retirement and who are looking to help their adult children with a life-cycle event, such as buying a house or starting a business, Altfeder says.

Maxie says it’s not suitable if the parents need cash flow, or if the loan would affect the parents’ retirement. And according to Altfeder, he typically only recommends intra-family loans if the parents have at least $3 million to $5 million of liquid net worth.

Consider family issues, too. You may want to avoid making a loan if “it’s going to cause a big upheaval” in the family, Maxie says. Make sure that the family member borrowing the money will be in a position to repay it consistently. Overall, the intra-family loan is “a great tool. It’s just got to make sense for the family,” Maxie says.

Risks

Understand the risks involved. At the top of the list: “The kids stop paying,” Altfeder says. Family relations may suffer, too. So, follow the proper procedures from the start.

If the money is for buying a house, make sure the loan is formalized, with the various parties signing all of the mortgage, security, and related documents that would be involved if a bank were doing the loan, including having the formalized mortgage recorded in the local land-office records, Green says.

The same principle applies if the loan is for another purpose, such as helping the adult child establish, buy, or expand a business. Make sure there’s a promissory note [the written promise to pay], and a security agreement [giving the lender a security interest in the assets], Green says. Be sure, too, that the terms of the security agreement are filed under the Uniform Commercial Code with the Secretary of State and the local land-office records, he adds.

Intra-family lending isn’t for everyone, but in the right circumstances, “It has the opportunity to be mutually beneficial to the parents and the children,” Altfeder says.

Just make sure to get professional advice first, understand the family dynamics and risks involved, and make sure the proper steps are followed.

Faster Internet speeds have helped generate innovative new services and products. Think back to the early days of smartphones. Americans learned patience, along with the word buffering, as they waited in anticipation for a YouTube video to load on their phones. Now, 4G networks allow us to watch live events on our handsets and get real-time traffic reports on apps like Waze.

Game Changer

Proponents of 5G say it will be a greater leap than previous upgrades. “5G is a game changer,” according to Global Head, Telecoms & Media Alex Holt from accounting and corporate consulting firm KPMG. In a blog post earlier this year, Holt wrote that 5G “will connect everything and everyone and unleash the potential of technologies like artificial intelligence (AI), the Internet of things (IoT), augmented reality (AR), virtual reality (VR), and robotics.”

5G will push these technologies forward because of lower latency and greater bandwidth. Latency is the time it takes for data to move from one place to another across the network. Greater bandwidth means more devices can be online at the same time, moving us closer to connecting pretty much everything, including appliances, medical devices, automobiles, trucks, and traffic lights. This will push us further down the path of IoT. Experts say IoT will be the key to innovations in energy, traffic management, autonomous vehicles, and manufacturing because it will allow real-time interactions.

However, there is a darker side to IoT: security. More devices mean hackers with nefarious intentions will have more ways to break into systems like the power grid. Such security concerns will need to be assuaged before certain operators and manufacturers jump into the IoT world with both feet.

Mobile phone and tablet users will experience these advances in the form of very, very fast downloads. For example, Verizon says a video that took over two minutes to download on 4G will take 30 seconds on 5G. That’s fast enough to download an entire season of Game of Thrones in about a minute.

Verizon says a video that took over two minutes to download on 4G will take 30 seconds on 5G. That’s fast enough to download an entire season of Game of Thrones in about a minute.

Let’s look at health care as a sample of the potential of 5G networks. Imagine if you need brain surgery, you’re too sick to travel, and the greatest surgeon for your condition is in Europe. The low latency times of 5G combined with advanced robotics will finally make it possible to do precision surgery remotely. In fact, according to the Robotics Industry Association, a trade group, a surgeon in China successfully operated on a Parkinson’s patient from 1,500 miles away.

5G experts at the consulting firm McKinsey predict a revolution at home for medicine. Sensor devices on or underneath the skin can send heart rate, blood pressure, glucose level, and oxygen saturation readings to your doctor in real time. This can help patients manage diseases such as diabetes, chronic obstructive respiratory disease, heart failure, and hypertension, and cut down on doctor visits.

5G will also make it easier for artificial intelligence to scan vast amounts of data stored in the cloud or online. This will make it possible for physicians to input symptoms they are seeing in patients and make more accurate diagnoses.

Virtual reality headsets may finally stop making people dizzy and nauseous because images load too slowly. Live performances can incorporate virtual reality experiences that can be seen through the lens of a mobile phone as an overlay on reality; virtual balloons or bouncing balls can appear to be thrown in the air by a performer.

Unfortunately, the road to 5G is filled with potholes. Earl Lum, founder of ELJ Wireless Research, thinks many of the promises of 5G, such as remote surgery, will take a while to reach most people. “Availability of something like that is probably five to 10 years away in terms of someone trusting their life to someone thousands of miles away,” he says.

The Lengthy Deployment

Deployment of 5G is being hindered by concerns about security, health, and regulatory issues.

On the health front, there have been some wild conspiracy theories making their way across the Internet, including the belief that 5G causes COVID-19, a claim that has no scientific basis. The Federal Communications Commission (FCC) says “the weight of scientific evidence has not effectively linked exposure to radio frequency energy from mobile devices with any known health problems.”

But health concerns about 5G may have some merit, and they may be a real hindrance to its deployment. In fact, more than 400 scientists in Europe have signed a petition asking for a delay in the rollout of 5G until further study of its health impact.

Some scientists and lawmakers are skeptical of the FCC’s assessment. “The exposure limits aren’t even government standards,” says Joel M. Moskowitz, director of the Center for Family and Community Health at the University of California, Berkeley. “They were adopted from industry in the 1990s.”

Moskowitz argues there is a lot we just don’t know: “With regard to electromagnetic radiation, we hardly do any research.”

Part of the pushback against 5G has to do with the need for many small cells in order to get the lightning-fast speeds of what’s known as high-band or millimeter wave. Current cell towers cover a several-mile radius, but they are the size of tall pine trees. High-band 5G cells are the size of laptops, and they cover only a radius of around a couple thousand feet. Their reach also can be hindered by buildings, trees, and other objects in dense urban environments. So, telecom companies are hanging the cells fairly close together on telephone and light polls, and that is sparking pushback in many communities.

Residents in Northern California have been especially active in fighting against deployment. Cities like Mill Valley have enacted bans on placement of 5G cells in residential areas. However, a recent lawsuit gave the FCC the power to overrule most municipal ordinances, but cities still have some power over the deployment for aesthetic reasons.

There are two other types of 5G that don’t require such close placement of cells—mid- and low-band 5G. Neither mid- nor low-band wave has the lightning speed of millimeter or high-band wave, and low-band 5G is only slightly faster than 4G. But, because they need fewer cell towers and the signals are less easily obstructed, mid- and low-band 5G are likely to be much more common than high-band 5G.

It’s likely to take a while for entrepreneurs to develop applications that take full advantage of what 5G has to offer.

The immediate question most of us may be asking is: Do I run out and get the latest 5G phone? If you’re an iPhone user, you’re still waiting on Apple to release a 5G phone. For others, “It’s an incredible amount of hype from the operators and the industry,” says ELJ Wireless Research’s Lum.

He thinks most people will be fine with their 4G phones for quite some time. “At the end of the day, you have to ask yourself, what do I really need?” Lum thinks initially the only use for 5G on a handset will be for people who want to take and upload 4K video and photos.

Ultimately, faster speeds have always sparked new innovations—such as real-time traffic maps and live streaming. But it’s likely to take a while for entrepreneurs to develop applications that take full advantage of what 5G has to offer. For most of us, the promise of 5G will only slowly materialize over the next decade. That might be just in time for the launch of 6G.

When the Setting Every Community Up for Retirement Enhancement (SECURE) Act of 2019 became law, it included a long-overdue safe harbor provision for defined contribution plan sponsors interested in offering annuity-based guaranteed retirement income products in their plans.

“The safe harbor makes annuity selection very mechanical, very prescriptive, and very easy to comply with,” says Institutional Retirement Income Council (IRIC) Executive Director Robert Melia.

The SECURE Act’s safe harbor will protect employers from liability related to their annuity selections if they select a provider that, among other requirements, has been licensed by the state insurance commissioner to offer guaranteed retirement income contracts for the preceding seven years; has filed audited financial statements in accordance with state laws; and has maintained reserves that satisfy all the statutory requirements of all states where the annuity provider does business.

“This provision has the potential to alleviate plan sponsor anxiety about evaluating insurers by extending protections to sponsors who offer guaranteed income products,” says CAPTRUST Senior Director of Retirement Services Phyllis Klein. “By reducing barriers for plan sponsors considering in-plan annuities, the SECURE Act makes it easier for fiduciaries to meet the requirements that are imposed.”

Asset managers, insurance companies, and many plan sponsors around the U.S. have breathed a collective sigh of relief in response to the SECURE Act’s safe harbor. And while early indications suggest that a handful of interesting new guaranteed income-oriented products are in the offing, it’s important to remember that adding a new and potentially complicated product or service to a plan investment lineup may not be the solution to participants’ retirement income needs.

As with most things, there is no silver bullet.

State of Income-Oriented Products

Over the past 30 years, plan sponsors have shifted their focus from defined benefit plans to defined contribution plans to reduce benefit costs and fiduciary risk. This shift has brought innovation to defined contribution plans, including features like automatic enrollment, default contribution rates, and automatic escalation, to name a few.

However, while many employees see their large account balances as security for life, this shift has posed problems for many—mainly the loss of a reliable source of guaranteed lifetime retirement income, says Glenn Haskell, New Balance benefits director and New England Employee Benefits Council board member.

Today, fewer retirees are walking out the door with a pension check in hand. More likely, the retiree takes a lump sum 401(k) distribution into retirement with little idea how that balance translates into monthly retirement income.

But things could be changing for the better. Many plan sponsors are looking to help workers with retirement income generation and are offering up new options. Some of these options include modeling tools to help participants evaluate and compare withdrawal strategies, additional distribution options, and investment options such as managed payout funds and yield-focused fixed income funds.

In fact, SHRM.org reports that, last year, 30 percent of large employers offered one or more retirement income solutions, up from 23 percent in 2016. And the SECURE Act’s safe harbor is poised to move the needle even further by clarifying plan sponsor responsibilities around annuity provider selection for guaranteed retirement income solutions.

And while this new legislation is making strides to increase interest around solutions, according to Jeff Eng, managing director at Nuveen, it’s still very early.

“As of now, most plan sponsors are still in research mode,” says Eng. “Plan sponsors that are in the paternalistic camp are starting to wonder, ‘OK, well, how can we incorporate guaranteed lifetime income solutions into our retirement plan?’”

Some might be thinking about rolling out a guaranteed lifetime withdrawal benefit (GLWB). A GLWB is a form of group annuity offered to employers as part of an in-plan option. “It is sort of a cross between systematic withdrawals and the guarantees of a fixed annuity,” says Eng.

A GLWB offers the participant the ability to withdraw a fixed percentage of his or her account balance for life, starting at retirement. The guaranteed amount is based upon the amount invested and investment performance over time. Balances are generally invested in target date funds or asset allocation strategies appropriate for the participant, and the guaranteed amount can then increase if investment returns justify it, but it cannot decrease.

GLWB-based retirement income solutions have been around for years but have not achieved the lift-off that many providers had hoped for.

Eng believes that incorporating annuities within the qualified default investment alternative (QDIA) is the innovation needed to drive mass adoption through the simplicity of a target date fund. Further, offering a default investment with a guaranteed retirement income solution eliminates “analysis paralysis,” he says.

Automatically placing participants in a default investment with a guaranteed retirement income solution is a good thing, says Eng. It’s also going to help plan sponsors make sure participants don’t pass up the opportunity for a lifetime income stream simply because they were not aware it’s available.

“If you don’t make it a choice for them, and you just let them know [they have been placed in the plan default investment option], I think that’s the better option,” says Eng.

Managed accounts are another innovation that has been receiving a lot of attention lately. “Because they are tailored to the participant’s finances, goals, and risk tolerance, these accounts deliver a high level of customization and do not require a high level of participant involvement, if any,” says Klein. However, managed accounts traditionally have only offered investment guidance and advice during the accumulation stage for participants—and no income guarantees.

But that is changing. Some of these programs now include managed distribution modules to help participants move seamlessly from the accumulation to the decumulation phase with the assistance of personalized advice.

Some plan sponsors are addressing the need for guarantees by adding stable value vehicles to their asset allocation strategies, says CAPTRUST’s Mike Pratico, senior vice president, financial advisor. “The incorporation of stable value vehicles into the asset allocation strategy will give participants an element of guarantee.”

“And with the new safe harbor legislation, managed account providers are working on incorporating guaranteed retirement income products like annuities into their services,” says Pratico. It’s a very exciting area of development.”

The SECURE Act’s safe harbor has also nudged some plan sponsors like footwear manufacturing company New Balance into considering including access to an annuity purchasing service at retirement. “What we’re thinking now is to institutionalize the purchase process,” says Haskell. “Folks will be able to buy annuities under the umbrella of say, [an employer like] New Balance.”

“The idea is that New Balance makes that available to participants, to say, ‘Look, you’ve got a million dollars in your 401(k), and it might be prudent for you to take $500,000 of that and annuitize it for $2,500 a month for the rest of your life.’”

Among the newer annuity products available to help bridge the gap to sufficient retirement income are qualified longevity annuity contracts (QLACs), which let participants move 25 percent of their plan assets, up to $135,000, into an individual retirement annuity that typically begins making distributions at or before age 85.

While the number of workers interested in purchasing a QLAC is small, the Employee Benefit Research Institute (EBRI) measured the impact of QLACs in its Retirement Security Projection Model and found the product can provide great benefits for improving financial security for older seniors.

Create Context

Of course, adding a complex product or service—guaranteed or not—to a plan investment lineup is not a silver bullet. Without communication and education targeted at the right participant segments, adoption of new features can be destined for a lackluster future. Plan sponsors need to be prepared to communicate clearly and actively with participants about retirement income solutions if they want adoption.

According to Melia, it’s probably not worth a plan sponsor’s time or effort if they are not committed to a participant launch campaign for the product. “Unless you promote it, unless you really spend the educational capital that you need to educate folks, you’re not going to get a return on the effort that you put in,” he says.

There is a lot of room for improvement on the education and marketing front, especially for guaranteed retirement income solutions, Eng says. “I think the marketplace has to do a better job in education and marketing these types of distributions and not just call them annuities but call them guaranteed lifetime income solutions.”

When properly implemented and communicated, however, lifetime income solutions can make your plan a better human resource management tool that “helps achieve the goals of the organization by managing, protecting, and securing your most precious resource: your human resources,” says Melia.

A good example of an effective communication campaign is Yale University in New Haven, Connecticut. With the help of the university’s recordkeeper and the plans’ investment consultant, Yale’s four defined contribution plans now offer a custom target-date series that includes a guaranteed annuity within the QDIA.

Yale’s Hugh Penney, senior advisor for benefits planning, told Pension & Investments that the university went above and beyond last year to communicate the plan enhancements. Yale officials held dozens of town halls on campus and developed a detailed guide that explained all the moving parts, Penney said.

Yale leaned on its consultant for help selecting the products in its portfolio, and Pratico says that is a good idea. “A consultant might be helping to select the asset allocation strategy within a managed account or helping a plan sponsor select the best possible guaranteed income or lifetime income product,” he says.

Don’t underestimate how important good-quality advice is, whether it’s coming from the consultants or a recordkeeper, says Pratico. He points out that recordkeepers are often able to help with access to educational and promotional materials, solutions like income tools and calculators, and systematic withdrawal programs that address income needs.

“I think a lot of our recordkeepers working with the plan sponsors are now starting to offer different tool sets that will help [participants] do projections in terms of how much they are saving, how they are investing for retirement, and how much money they will have when converting that into an income stream,” says Eng.

What’s Next?

Not a silver bullet, unfortunately. “I think [the solution] needs to be cheaper, simpler for participants to understand and utilize, and yet still provide them with the ability to not outlive [the benefits] but also to give them access to their assets,” says Eng.

For plan sponsors committed to offering retirement income, consider discussing these questions with your retirement committee and financial advisors to determine what strategy works best for your organization:

- Do you understand the costs of offering a solution, and do you understand your fiduciary obligations in making any decision regarding income solutions for your plan?

- How will retirement income information be communicated to participants—at launch and ongoing? How will it appear on participants’ statements and online accounts?

- What happens when a participant leaves the plan? How will the retirement income solution be impacted?

- Will the solution provide an in-plan guaranteed retirement income option as the plan’s QDIA? Where will it sit in the investment menu?

When it comes to moving the needle on guaranteed retirement income products, Eng says it’s twofold. “We got the safe harbor protection, so that’s going to help from a plan sponsor fiduciary standpoint. … But the other thing is there’s got to be demand. Participants have to see the value in it. And they’re going to be the ones who are going to need it.”

Now is a good time for plan sponsors interested in guaranteed lifetime income products or services to start looking at what opportunities are available to them. With the help of plan consultants and service providers, plan sponsors can work to build a custom retirement income offering that meets the needs of their plans’ participants—whether that’s a product or asset allocation service that provides guaranteed income, a financial wellness and advice program, an annuity placement service, or all of the above. There might not be a silver bullet, but plan sponsors still have plenty of ammunition for the cause.

In March, the Coronavirus Aid, Relief, and Economic Security (CARES) Act, which included several provisions designed to help retirement savers cope with the financial fallout from the COVID-19 pandemic, was signed into law. Among these temporary measures were special rules for required minimum distributions (RMDs), coronavirus-related distributions, and retirement plan loans. In late June, the Internal Revenue Service released Notices 2020-50 and 2020-51, which clarify many of the details for both retirement plan participants and sponsors. Following are some important details covered in each notice.

IRS Notice 2020-50

The IRS has announced a new safe harbor for loan repayments and extended relief for plan participants whose spouses are laid off and have also taken COVID-19-related distributions or loans from their retirement accounts.

The IRS issued Notice 2020-50 on June 19, 2020, to help retirement plan participants affected by COVID-19 take advantage of the CARES Act, provisions providing enhanced access to plan distributions and loans.

Notice 2020-50 expands the definition of qualified individuals to consider additional factors:

- reductions in pay

- rescission of job offers

- an individual’s delayed start date

- adverse financial consequences to an individual arising from the impact of the coronavirus on an individual’s spouse or household member

Under Notice 2020-50, a qualified individual is anyone who:

- is diagnosed with COVID-19; or

- whose spouse or dependent is diagnosed with COVID-19; or

- experiences adverse financial consequences because the individual, the individual’s spouse, or a member of the individual’s household experienced the following due to COVID-19:

- being quarantined

- being furloughed

- being laid off

- having work hours reduced

- being unable to work due to lack of childcare

- closing or reducing hours of a business that they own or operate

- reduced pay or self-employment income

- having a job offer rescinded or start date for a job delayed

Notice 2020-50 clarifies that:

- Employers can choose whether to implement these coronavirus-related distribution and loan rules.

- Qualified individuals can claim the tax benefits of coronavirus-related distribution rules even if plan provisions are not changed.

- Administrators can rely on an individual’s certification that the individual is a qualified individual (and provides a sample certification).

Notice 2020-50 indicates that a person must be deemed a qualified individual to obtain favorable tax treatment and provides employers a safe harbor procedure for implementing the suspension of loan repayments otherwise due through the end of 2020.

IRS Notice 2020-51

Another provision of the CARES Act waives the RMD rules for certain defined contribution plans and individual retirement accounts (IRAs) for calendar year 2020. The waiver applies to both 2019 RMDs required to be taken by April 1, 2020 and RMDs required for 2020. It applies for calendar years beginning after December 31, 2019.

Because these distributions are no longer required, individuals who have already taken RMDs are permitted to roll those funds over into an eligible retirement account to avoid a taxable distribution this year.

IRS Notice 2020-51 was issued on June 23, to provide additional relief and clarification about RMDs. The notice extended the eligible rollover period to the later of 60 days after receipt or August 31, 2020, for all distributions that, except for the CARES Act, would have been RMDs (even if the distribution normally would be treated as part of a series of substantially equal periodic payments). In addition, an IRA owner or beneficiary is also exempt from the one rollover per 12-month limit on IRAs.

This notice also provides a sample plan amendment that, if adopted, would provide participants a choice whether to receive waived RMDs and certain related payments.

The habits that we’ve formed over our lifetimes help define us. We have physical habits, mental habits, habits of character, personal hygiene habits, and productivity habits. We have good habits, and we have bad habits.

Habits are automatic—almost involuntary—behaviors. Actions that happen so automatically, we often don’t recognize they are there. All told, about 40 percent of our daily activities are performed each day in almost the same situation.1 These activities make up our personal collections of habits.

Compounding Results

James Clear, author of Atomic Habits: An Easy & Proven Way to Build Good Habits & Break Bad Ones, became an evangelist on the topic when a freak baseball accident sent him to the hospital with serious injuries to his face and brain. His long road to recovery led him to believe that creating small, simple habits can bring about powerful change over time.

Clear makes the case that individuals can harness the power of these incremental behavioral changes to affect improvements in their productivity, physical well-being, business, and social lives. “Habits are the compound interest of self-improvement,” says Clear. “The same way that money multiplies through compound interest, the effects of your habits multiply over time and as you repeat them.”

And like compound interest, the impact of these tiny changes is difficult to grasp in the short term, but the difference they make over months and years can be enormous. “It’s only when looking back two, five, or 10 years later that the value of good habits and the cost of bad ones becomes striking,” says Clear.

Comparing these incremental changes to compounding—what Albert Einstein supposedly called the “most powerful force in the universe”—has its merits. But is it possible to apply Clear’s ideas to compound interest itself? In other words: Can we make our money multiply faster by creating new, positive money habits—or by cutting out a few problematic ones?

Clear’s answer is, um, clear. “Your net worth is a lagging measure of your financial habits.” Good financial habits create good outcomes; bad financial habits create bad outcomes, he says.

The Power of 1 Percent

Clear believes in thinking small. Small changes are easier to make—and easier to stick with—than bold, life-changing moves. And small changes in your daily habits can guide your life to a very different destination.

“Making a choice that is 1 percent better or 1 percent worse seems insignificant in the moment, but over the moments that make up a lifetime, these choices determine the difference between who you are and who you could be,” says Clear.

If you got 1 percent better every day for a year, after a year, your results would be 37 times better.

Of course, there’s a dark side as well. “When we repeat 1 percent errors, day after day, by replicating poor decisions, duplicating tiny mistakes, and rationalizing little excuses, our small choices compound into toxic results,” says Clear. “If you’re a millionaire but you spend more than you earn each month, then you’re on a bad trajectory; if your spending habits don’t change, it’s not going to end well.”

Decoding Habits

Unless you’re a habit nerd like Clear, you probably haven’t pondered the habits that make up your daily routine. Many habits are ways to automate chores: fastening our seatbelts when we get behind the wheel, pulling out a credit card when the dinner check arrives, and brushing our teeth after flossing. They help us get things done using minimal mental energy so we can focus on more important things.

Habits are small but mighty behaviors made up of four simple steps. “If a behavior is insufficient in any of the four stages, it will not become a habit,” says Clear. The four steps are:

- Cue. A cue is an environmental trigger that prompts you to execute a habit. Habits can be triggered by time, place, emotional state, people, or something that just happened.

- Craving. Cravings are the motivation behind habit. Our desire for a change in state—a relief, reward, or release—is what moves us.

- Response. The response is the habit that you perform. It’s the way you scratch the itch to satisfy the craving.

- Reward. The reward is the goal of every habit, and achieving the reward further ingrains the habit.

That seems a little abstract and impersonal, so let’s bring it to life.

Sitting in your favorite chair after dinner with the TV remote control near your right hand is a cue. You crave entertainment. You respond by reaching for the remote and tuning the TV to your favorite channel. You are rewarded with an emotional news story, a cathartic true crime mystery, or 60 minutes of reality show drama. And by satisfying your craving, the success of closing the habit loop reinforces the habit itself. Over time, you become an evening TV watcher.

“Every action you take is a vote for the type of person you wish to become,” says Clear. If you aspire to be an evening TV watcher, more power to you. But if you’d rather be a better father, guitarist, or Spanish speaker, spending your evenings watching TV is stealing votes from those goals.

That’s why it makes sense to pay attention to your habits and build the right ones. And the sooner the better.

More Money, More Habits

Many of us have developed quite a few bad money habits, and it’s understandable why. We are bombarded by ads that urge us to buy a new car, go to the Caribbean, eat out, buy an exercise bike, and so on. These things or experiences confer status on us, which is a feeling we crave. But these expenditures drain our paychecks and savings accounts when we respond.

Therein lies the problem: Many bad money habits provide instant gratification. Meanwhile, good money habits feel like sacrifices. You’re giving something up today for the future gratification.

But it is possible to end bad money habits. It just takes a little work.

“One of the most practical ways to eliminate a bad habit is to reduce exposure to the cue that causes it,” says Clear. “For example, if you’re spending too much money on electronics, quit reading reviews of the latest tech gear.” Or replace undesirable habits with beneficial habits that provide similar benefits. Over time, these new habits will tend to crowd out the bad ones.

Here are a few examples of good money habits—and the kind of

1 percent changes you can put in place today—to crowd out your bad habits:

- Always pay in full. Open and pay your credit card bills as soon as they arrive. Pay them off each month if you can—or better yet, only pay with cash or debit card. It may hurt at first, but you will grow to love it.

- Auto-pay your bills. Set up automatic payment for your monthly household expenses. You have more important things to think about.

- Automate your savings. Set up an automatic draft to build an emergency fund. Try to max out your health savings account (HSA) and employer retirement plan every year. Start small and increase your contributions annually.

- Eliminate an expense. We all make small, habitual purchases that can add up. Find one that you can lose. Drop your daily latte habit. Then downgrade your super-premium cable subscription.

- Delay a major purchase. Is your two-year-old iPhone really obsolete? Do you need a new car every three years? Try delaying major purchases—even for a few months. The benefits add up over time.

“These one-time choices require a little bit of effort up front but create increasing value over time,” says Clear. The growing impact of these changes will flip the script and soon won’t feel like sacrifices. “You can associate it with freedom rather than limitation if you realize one simple truth: Living below your current means increases your future means.”

Clear cautions that even when you know you should start small, it’s easy to start too big. “You want to take on the smallest possible behavior that gets you moving in the right direction.” He suggests using the Two-Minute Rule, which states, “When you start a new habit, it should take less than two minutes to do.”

“The idea is to make your habits as easy as possible to start,” says Clear. “A new habit should not feel like a challenge; the actions that follow can be challenging, but the first two minutes should be easy.”

1 Society for Personality and Social Psychology, “How We Form Habits, Change Existing Ones,” ScienceDaily, 2014

James Clear: Best-Selling Author and Habit Nerd

James Clear is the author of The New York Times bestseller Atomic Habits: An Easy & Proven Way to Build Good Habits & Break Bad Ones, which has sold more than one million copies since it was published in 2018. Packed with evidence-based self-improvement strategies, Atomic Habits shows readers how to use small changes to transform their habits and deliver remarkable results. Clear’s work has appeared in The New York Times, Entrepreneur, Time, and on CBS This Morning. His website receives millions of visitors each month, and hundreds of thousands subscribe to his popular email newsletter at jamesclear.com. He is currently at work on his next book.

If you’ve ever seen the 2007 film The Bucket List, you probably remember that it’s about a couple of terminally ill but amazingly energetic old guys (played by Morgan Freeman and Jack Nicholson) who set out to complete a mutual bucket list—the things they want to do before they die. They drive race cars, fly over the North Pole, visit the Taj Mahal, and ride motorcycles across the Great Wall of China.

It is easy to forget, though, that the real message of the movie is summed up by one item on their list: Help a complete stranger for the good. That’s what each man does for the other in the few months they share.

The movie popularized the bucket list idea. But the concept that it should include more than exotic trips and adventures seems to have gotten lost along the way. One survey found that 95 percent of Americans have bucket lists and that the most common goals involve travel. The website bucketlist.org says that the most popular goals today include swimming with dolphins, bungee jumping, and visiting a volcano.

There’s nothing wrong with taking a nice trip or seeking a few thrills—especially if you have the money to do it and you pick experiences that matter to you—rather than those that made the latest list of 1,000 things to do and places to see before you die.

But here is a question to ask yourself: If you never swim with dolphins, will you regret it on your deathbed?

“None of us know when our time is going to be up,” says Dorian Mintzer, a Brookline, Massachusetts, psychologist who works as a transition and retirement coach and is the author of The Couple’s Retirement Puzzle: 10 Must-Have Conversations for Creating an Amazing New Life Together.

Mintzer urges her clients to really consider the lives they want to live and the legacies they want to leave behind. That is the path, she says, to building a better bucket list.

Make It Meaningful

In theory, “a bucket list is a great idea,” says Jim Emerman, vice president of encore.org, a nonprofit organization that focuses on intergenerational connection and helps older adults find meaningful second-act roles in the nonprofit world.

“It’s really important for people to think about what they want to do with the years they have left and what they want to leave as their legacy, for their family, and more broadly than that,” says Emerman.

But “a lot of people don’t think it through,” he says. “They tend to go to the usual: ‘Where haven’t I been, and what haven’t I seen?’”

So, what might be on a more meaningful bucket list?

For some people, the answers include nurturing relationships with big gestures like reuniting with an estranged sibling or small daily acts such as handholding walks with a spouse or storytime dates with a grandchild. Some lists might include spiritual or intellectual quests, from reconnecting with a childhood faith to learning a new language to spending more time in museums, libraries, and symphony halls. And many people who want to leave a better world will commit to more acts of kindness, giving, and service. They’ll find ways, Emerson says, to combine the things they enjoy doing with activities that lift up their families, communities, and humanity at large.

“Ultimately, these are things that will change your life more than any trip,” says Erica Brown, director of the Mayberg Center for Jewish Education and Leadership and an associate professor at The George Washington University in Washington, D.C.

Brown, who is the author of Happier Endings: A Meditation on Life and Death, recommends that people considering a bucket list try what might seem like a morbid exercise: writing their own obituaries. Better yet, she says, write one that would run if you died tomorrow and one that could run if you died many years from now.

“It’s a humbling experience that helps you think about how you want to be remembered,” Brown says. Many high achievers may find themselves pondering what The New York Times columnist David Brooks calls résumé virtues and eulogy virtues, she adds.

In a 2015 column, Brooks wrote: “The résumé virtues are the skills you bring to the marketplace. The eulogy virtues are the ones that are talked about at your funeral—whether you were kind, brave, honest, or faithful. Were you capable of deep love?”

Brown also says that it’s important to actually go to funerals, both for the solace you offer others and for your own good.

“No one goes to a funeral and doesn’t think about their own death,” she says. “It does sober us up and makes us think, ‘One day someone is going to stand there and talk about me.’”

If you do not like what your mourners might hear, she says, your bucket list is a chance to do something about it.

Creating the List

Asking yourself a few key questions just might help you come up with a bucket list that will “give more meaning and depth to your life,” Mintzer says. It may well include travel and adventure, but might also include new commitments to mentorship, charity, and other forms of service.

It’s really important for people to think about what they want to do with the years they have left and what they want to leave as their legacy, for their family, and more broadly than that.

Jim Emerman

Brown says she has listened to recordings of many deathbed conversations and is struck by one thing. When people express regrets, they are almost always about relationships—the people they lost touch with, the thanks they never gave, the forgiveness they never sought. Avoiding those regrets should be the starting point for any bucket list, she says.

British psychologist Philippa Perry put it this way in an interview with The Guardian newspaper: “What we should be doing in our bucket lists is learning how to be open with our own vulnerabilities so that we can form connections with other human beings … We don’t all like swimming with dolphins, but we are all made to connect to each other. That’s the really fun thing to do before you die.”

Go-To Gurus

With more than 40 years’ experience at her craft, psychologist and author Dorian Mintzer presents at a number of local, national, and international events and conferences each year, speaking on retirement transition issues. In her book The Couple’s Retirement Puzzle: 10 Must-Have Conversations for Creating an Amazing New Life Together, she shares smart, practical advice, engaging anecdotes, and helpful exercises.

Dr. Erica Brown is an accomplished author specializing in books about leadership, the Hebrew Bible, and spirituality. Brown has degrees from Yeshiva University, the University of London, Harvard University, and Baltimore Hebrew University. Her book Happier Endings: A Meditation on Life and Death was one of two of her 12 books to win the Wilbur and Nautilus awards for spiritual writing.

Today’s healthy retirees may live 25 years or more beyond their primary working years. That’s a lot of years. But more importantly, that’s a lot of days—more than 9,000 days to wake up, greet the dawn, and then . . . What?

Maybe you picture days filled with tennis, boating, reading, travel, volunteer work, or a part-time job. You may imagine spending time with your spouse, friends, grandchildren, or new acquaintances who share your pastimes.

But what if you did more than just imagine—and gave your retirement at least as much consideration as a new car? In other words, what if you took your retirement plans for a test-drive?

Kevin Deiters, 60, of Austin, Texas, has done something like that twice in the past decade, when he voluntarily left jobs and took several months off, knowing he would return to work eventually. During those career breaks, he says, he learned how important it was to have a sense of purpose. In his case, that included increasing his volunteer work with the National Forest Service and a trail-building group.

“The thing with having a regular job is that you are kind of on autopilot,” says Deiters, who is now executive director for the Texas state pension system for volunteer firefighters.

When you get a taste of retirement, you learn that “you have to get up and plan each day,” he says. “You need something to belong to, something to do.”

It’s a lesson more of us might learn if we took off a few weeks or even a few months to wake up each day and live like retirees—and find out just how much mileage we really might get out of our plans (and our budgets). But retirement experts say that if you can’t do that, it’s still possible to test-drive aspects of retirement.

The goal: to avoid the scenario that executive coach Marilyn Bushey, of Dallas, says she heard about from one client. The man’s father always said that when he retired, “he was going to go fishing every day,” says Bushey, who, with fellow coach Gail McDonald, is the co-author of a book called Retirement Your Way. “When he actually retired, he went fishing three times the first week, two times the second week, and then he never went fishing again.”

If the fishing enthusiast had test-driven his boat-based lifestyle, he would have learned that he needed a bigger retirement plan. Many people do, experts say.

I ask people all the time, ‘What are you going to do in retirement?’ and they say, ‘We’re going to golf, we’re going to travel,’ and I tell them that’s not going to be enough.

Steven Morton, a CAPTRUST financial advisor in Greensboro, North Carolina.

Morton says he has not had any clients who took significant time off work to test-drive their plans. “In the real world, it’s very difficult to take a sabbatical,” he says.

Patrice Jenkins, a retirement consultant and author of What Will I Do All Day?, says many people, especially those in corporate jobs, are hesitant to “show their cards” while plotting career exits because they fear they will be sidelined prematurely.

But those concerns should not stop anyone from test-driving aspects of their retirement plans, she and other planning experts say.

“I advise a modular approach,” says Joe Casey, a coach at Retirement Wisdom in Princeton, New Jersey. “Start to look at the different parts of your life that are most important … and find ways to test those.”

Here are a few common retirement goals and how you might test them out.

Making a Big Move

One of the biggest mistakes new retirees make is immediately selling their home and buying one in a new community, says Seattle-based career and retirement coach Robin Ryan, author of Retirement Reinvention. Too many end up isolated and unhappy in a place that’s not right for them, she says.

The best way to avoid that mistake is to rent for at least a few months in your target location, she says. You could do that during a sabbatical or other career break.

Another option: living part time in a new locale while starting to scale back on your career.

That’s what Jenkins, 61, and her husband, a 68-year-old veterinarian, have done. They own one home in the rural area where he continues to practice part time and another in downtown Saratoga Springs, New York. They rented before they bought in their new neighborhood.

If you can’t manage a months-long rental, you should at least spend a week or two in your prospective location “not in vacation mode,” Casey says.

Check out the medical facilities, educational facilities. Spend time talking to the locals. Really get a sense of what a week would be like, what a day would be like, if you were living there.

Joe Casey

If you are thinking of living somewhere year-round, visit that spot year-round. If it’s a tourist spot, visit at busy and less busy times.

“Some people will find that places that they really liked when they visited as a tourist are a lot more boring when they go there not in vacation mode,” Casey says.

Something you don’t notice or don’t mind as a tourist can turn into a deal-breaker when you are a resident. Morton says he knew one man “who always wanted to retire next to the beach.” So he bought some property and, while he was having a house built, rented nearby. “What he discovered was that he had to wash sand out of his sheets every night—and he hated it,” Morton says. When the new house was finished, the man sold it and moved elsewhere.

Devoting Yourself to a Favorite Activity

You may think you will never get too much golf or tennis. But most people do find “that playing endless rounds of golf every day gets really boring,” Morton says. And there are other realities that might become apparent during a long-enough retirement test-drive.

“The truth is that your body is not going to allow you to play golf every day or play tennis seven days a week,” Ryan says.

Maybe you think you would take up some new hobby. Even if you can’t take a lot of time off to explore your interests, it’s a great idea to experiment while you are still working, experts say. You may find a new passion, or you may find disappointment.

That’s what happened to Bushey, who is 72 and working fewer hours than she used to. “I thought I might like to build kaleidoscopes in my retirement,” she says, so she signed up for a kaleidoscope-building class. “I found out that I didn’t like to use a soldering iron,” she says. “So instead of building them, I started a collection.”

Jenkins had a similar experience with pottery-making. “I took a couple of lessons and found out that it’s really hard and that I’m not passionate about it,” she says. Jenkins adds the caveat “that sometimes you have to give something time to find out whether you might become passionate about it.” Think about what “your future self” might like, she suggests.

Jenkins says, with that in mind, she might give pottery another try someday—but now she knows it won’t be easy.

Spending Time with Your Spouse or Friends

“Work has all this built-in socialization,” Jenkins notes. In retirement, maintaining relationships and social ties can take a new level of effort. And the effort may need to start at home.

Retiring couples may find they have differing plans, interests, and expectations. A retirement test-drive period is a good time to work on reconnecting, Ryan says.

“Develop a couple’s activity you can do together,” she says, even if it’s as simple as going to dinner and a movie together once a week. And talk about how much time you expect to spend together.

What about friends?

One thing many younger retirees or test-drivers discover is that they struggle to find golf, hiking, or card buddies on a random Wednesday morning. And the last thing they want to do is to check out the local senior center—which many perceive, rightly, as geared toward much older folks.

Robin Ryan

The solution, Ryan says, is to become an organizer. So, if you have some time off, “host a poker game or a new book club,” she says. “Invite people you know and invite new friends.”

Also, reconsider groups you may have overlooked in the past. Ryan says she’s found that her local Rotary Club is a great place to make social connections.

Going Back to School

Many retirees are eager to learn, and options abound. You can take courses online or in person, for credit or not, for new career skills, or just for fun. If you are thinking of investing in an advanced degree or any other option that will require a lot of time and money, it’s a good idea to test yourself first, Ryan says. The best way to do that, she says, is to audit one or more college courses. You can often do it free or for a minimal fee, especially if you are over age 60. Rules vary state to state.

Though auditing students do not get credit, “you should buy the books and do the work,” Ryan says, to see if the rigors of academia are a good fit for you at this life stage.

Leading for a Good Cause

Hard-driving careerists often see retirement as a chance to use their leadership skills for the greater good. That’s a wonderful thing, Morton says, but too many people end up charging into situations that are not good fits. In his book, Ten Common Mistakes Retirees Make, Morton says that the best way to test your fit is to work in the organization’s trenches.

So, before you start a new chapter of Habitat for Humanity and promise to build 200 houses in six months, he writes, “why not be one of the rank-and-file [volunteers] and drive 200 nails? By then, you’ll know whether you really want to be involved in Habitat for Humanity for the rest of your life, or whether it was an idea that didn’t quite pan

out … The best advice: Try before you buy.”

It’s June 2008. Tom Forst, a regional vice president at Cox Communications Group, is about to walk away from 25 years as a corporate suit to chase a lifelong passion. The dream to be a full-time musician had been on hold since his post-college touring days, circa 1974.

He recalls the exact moment his life changed course. “My wife was sitting in the living room. She pays the bills, and she said, ‘Look at that, I’m paying our last two $30,000 college tuition bills for our last two kids.’ I looked at her and said, ‘I’m going to quit.’”

“My wife simply said, ‘Go ahead,’ and that’s kind of the way she is. Her attitude was, what’s the worst that can happen?” She only wanted assurances they wouldn’t starve.

So Forst, then 57, gave his six-month notice at Cox Communications. At the end of that year, he stepped away from legions of direct reports, the jet-setting lifestyle, power, prestige, and pay. Big pay. What followed is a wild ride of a second act—from boardroom to bandstand, Forst was on his way to be a successful indie blues musician.

Now 69, Forst, known as The Suit, has gained acclaim as a guitarist, vocalist, and songwriter performing and recording with well-known musicians from the Johnny Winter Band and Saturday Night Live Band to the Allman Brothers Band, Paul Nelson Band, Stephen Colbert Show Band, and Grammy-winning artists and producers.

He has played hundreds of live shows and toured China as the headliner with a Chinese-American blues band. In 2018, he was inducted into the Connecticut and New York chapters of the Blues Hall of Fame.

In February 2020, he released his second album, followed by a sold-out release party at a Hartford, Connecticut, blues hot spot. When he isn’t performing, teaching a guitar master class, writing new music, or recording, Forst hosts a weekly podcast, Chasing the Blues. The postponement of his second China tour due to the coronavirus outbreak opens up creative space to produce yet another album in 2020.

It’s an aggressive schedule, and Forst thrives on it.

Follow the journey, and it’s clear that the leap from media executive to music was not as rash as it might sound. It was actually the next step in a plan that had been set in motion nearly a half-century earlier and driven with intention for a quarter-century.

The Early Days

Forst didn’t always cotton to the guitar. When he was eight years old, his parents offered him the choice to take up an instrument, with the proviso that if he did, he couldn’t quit. “It seemed like the guitar was the way to go, because, you know, Elvis.”

“I hated it, I just hated it,” Forst recalls. He admits to flinging the guitar out a second-story window at one point. “But my parents wouldn’t let me quit.”

The elder Forsts were on to something. By 13, Forst had landed paying gigs. By 15, he was invited to teach guitar at a local music store.

He recalls sneaking into clubs and even playing a strip club at age 16. All through college, music helped make tuition money. A week after graduation, Forst was in a band that hit the road. “In those days, around ’74, you could make good money doing that,” he says.

After two years as a musical nomad, Forst changed course. He got a Master of Science degree in education. He taught first grade for five years, then changed course again. “I realized there was no money in teaching, so I went into the business world.”

In the next 25 years, he would get an Executive Master of Business Administration degree from the University of Connecticut and advance to regional vice president at Cox in Atlanta, overseeing advertising sales operations across the country.

But Forst never stopped playing whenever he could.

Working for The Man

“Everyone wants to hear I really hated working for The Man,” Forst says. He enjoyed his job, but clearly, for Forst, the dream of being a musician never flagged.

“I had always planned to go back into the music business, but I had a family—and I had wants and needs myself that music wasn’t going to support. I said: OK, I can put it off as long as I need to.”

Forst would do what it took to advance his earning power, and frugality would channel those earnings into freedom reserves.

“There’s luck in there, for sure, but I kind of made my own luck. I knew I needed an MBA to get up to the next step. The sooner I could get to that next step, the sooner I could make the choice to leave. An MBA takes two years out of your life. Every night, you come home from work, you’re going to work until 1:00 or 2:00 in the morning, but I just did it. Yes, it’s inconvenient, but so is being broke,” says Forst.

“People who make a good amount of money also spend a good amount of money,” he says. “They get the big McMansion, the really top-of-the-line car, and all that. I never did that. We got a really nice farmhouse, and I drove a Ford, then a Prius for my last couple of years. I wanted to have freedom more than I wanted any kind of status. Even if I didn’t want to be a musician, I wanted the freedom to make a choice.”

Building a New Career

When it finally happened, chasing the dream was a stark change. At Cox, Forst was a prominent executive with 1,000 people reporting to him. In New York City, he was just another musician going from audition to audition.

He had given up a lot, says Forst. “The first-class life, the limos waiting—you can really get caught up in it. The transition was tough. It was the loss of some status, the loss of some security, because I really did give up a ton of money to do this. I felt a little guilty about it, because I still have a family, and I could have made a ton more money.”

Then there were the travails of building a new career. Even though Forst was an accomplished musician, he had to build his name almost from scratch, because he’d been out of the scene for 30 years. And music can be a young person’s game. He admits to being self-conscious about his age at first.

“One time I auditioned in this place in the middle of New York City, and there were about 50 guitar players. They all looked like my kids, the perfect rock stars. I’m 57, standing there in my short hair, and I’m thinking, ‘This is going to be brutal.’” To Forst’s disbelief, he got the gig, playing in a hip-hop band of 20-somethings.

It didn’t always go so well, he explains. “Sometimes I auditioned for things and was told, ‘You’re a little too old for the person we want.’ As I gained self-confidence, now my age is a benefit. I see myself kind of as a mentor.” His young audiences are sometimes dumbfounded when he talks about listening to this kind of music in the 1960s, decades before they were born. But he relishes it. “Now I want my age.”

If the Suit Fits

Shortly after Forst left Cox, his son, Michael, then 22, was keyboard player and leader of a hardcore punk band. Michael invited his dad to a gig in Brooklyn at a good-sized venue filled with young people, none older than 25. Michael had planned a surprise.

“He said, ‘You just sit in the front row. We’re not going to say anything. I’m going to set up your guitar and amp, and I’ll give you the nod.’ Finally, Michael calls me upstage. The punk rockers are in red long johns with the flap in the back. And there I am on the edge of the stage with a blue blazer, gray wool slacks, and penny loafers. The audience is staring at me,” recalls Forst.

“Then Michael gives me the nod where I’m supposed to do the lead, and I do, and the place is just shocked. You wouldn’t expect a guy who looks like me to do what I did.”

As the band moved on to the next song, somebody started to yell, ‘Suit, suit,’ and then the whole audience started to yell, ‘Suit, suit, suit.’ Michael turned to me and said, ‘I guess that’s your new name.’

Tom Forst

Known thereafter as The Suit, Forst hasn’t entirely given up his corporate persona. He has grown a neat beard and traded the executive haircut for shoulder-length waves. He still dons a jacket everywhere he goes—some with elaborate embroidery, others more subtle and classic, but always with panache.

“The stage is a temple in a way. When I get up on stage, you’re never going to see me in ripped jeans and an old shirt. I think that’s disrespectful to the art. So it’s not quite a suit, but I always wear nice jackets,” says Forst.

He has had some good-natured differences of opinion with Factory Underground, his label, that wants him to adopt a more stereotypical blues image—more ragged. “Just last week, I said to them, what you don’t understand about me is that I’m a very neat person. I like to have every hair in place, my beard has to be trimmed, I wear well-fitting clothes. I’m not going to look like the guy who just stepped out of a weeklong binge.”

For his latest video, they compromised on a brooding Johnny Cash-style look. Black hat, plain black denim suit, black Chuck Taylors. It works.

Bona Fide Blues Guitarist

On Valentine’s Day 2020, Forst released his second album, World of Broken Hearts—a five-song extended play record, or EP—of Forst originals and a unique cover of “Hoochie Coochie Man,” originally recorded by Muddy Waters in 1954.

“EPs can feel like speed dating,” wrote Steven Ovadia in a review for American Blues Scene. “Artists are trying to get across their essence in a few pithy moments. It’s not just a hard thing to do, it’s arguably impossible. Yet Forst has managed it here, wisely selecting strong songs that, while thematically similar, also spotlight his range. Also helping things are stellar performances, all of it making you grateful that Forst traded his suits for a guitar.”

Ovadia praises Forst’s “soulfully worn voice, huge rock grooves, and thoughtfully layered tracks.” Another reviewer characterizes Forst’s style as “a force of nature controlled with journeyman precision.”

“I definitely poured my heart out into the album,” Forst said. “It took more than a year to put it together. The whole album is about relationships, the idea that no matter how bad it is or was, the sun is still going to shine the next day, and we just have to realize this is what happens in life, and you can’t be surprised. This is what happens, and deal with it.”

The haunting video for “Late Night Train,” the first track on the EP, puts a modern-day take on the classic blues train theme, updated to the streets of Harlem and the New York City subway. The video went viral, garnering more than 225,000 views in the first 30 days and landing on YouTube’s recommended list.

Magic Inside the Music

“People who know my story will say to me all the time, ‘Wow, what a wonderful thing; you’re living the dream.’ I want to say, ‘Be careful what you wish for.’ You’ve got to be realistic. I don’t wake up every day and go, ‘Oh, you know, it’s the dream.’ I wake up every day happy that I’ve got another job that I really, really like. Music is a business like anything else.”

“I always knew it would be difficult. In the music business, people aren’t quite the same; they’re loosey-goosey on things. Some days get frustrating. I still have not calmed down in that area,” says Forst. Will the musicians arrive an hour late? Will the show get a good audience? Will the sound man say there’s not enough room for the equipment? Will audiences like the new music?

According to Forst, while work and worry surround the halcyon moments of actually making music, he says that to him, “There’s a magic inside the music. It’s not just the music, it’s how you approach it and the dynamics. Music is about emotion. You have to know how to sell it, and that’s how I approach it every minute.”

There’s a magic inside the music. It’s not just the music, it’s how you approach it and the dynamics. Music is about emotion. You have to know how to sell it, and that’s how I approach it every minute.

Tom Forst

In the opening to the Chasing the Blues podcast, Forst quips that he sold his soul to the devil to become a corporate executive, then quit it all to play the blues.

“Not my soundest financial decision, as you can imagine, but I am working as hard on this as I possibly can, and I’m enjoying every second of it. I live every note that I play and breathe every lyric that I write. To have others be touched by my music is the ultimate reward.”

Tom FORST: Snapshot of a Music Man

Rolling out two albums of rocking blues tunes in three years is something to boast about. Tom The Suit Forst’s collection includes the 2017 album On Fire, perfectly sized with just under 45 minutes of soulful music and featuring 11 songs. The Suit also released a second album, World of Broken Hearts, on Valentine’s Day 2020. The five-song EP features harmonic rock grooves with cozy rhythm, and, of course, a healthy dose of blues.

His unique story, which has been chronicled by Forbes Magazine, television news programs, radio, and newspapers, includes the two aforementioned albums, touring China, and induction into the New York and Connecticut Blues Hall of Fame. The weekly podcast he started in 2018, Chasing the Blues, just completed its 50th episode, the finale of its first season. The podcast, endorsed by the Blues Foundation, explores the history and impact of the blues as world music and features interviews with other blues artists such as Mike Zito, Anthony Gomes, and Joe Louis Walker.

Imagine 10 or 20 years from now, telling our grandchildren and great-grandchildren about the coronavirus pandemic of 2020. What will we say?

For many of us, we will first think of the great tragedy.

We will recall the trauma and mourn the loss of life. We will remember how we faced the burdens of being separated from loved ones and, for some, isolated entirely from the outside world. We will grieve the long-anticipated milestones that will never be reached and the embrace of those lost forever.

Some of us will share an Orwellian version, one of partisan divides and conspiracy theories, fake news, and shifting predictions. We could speak of stranded travelers, dystopian policies, and standing in seemingly endless lines because each person had to be six feet apart. We could tell how every day brought some new anxiety-provoking development—how people worried about themselves, their families, and their livelihoods.

Those lucky enough to emerge on the other side of this crisis emotionally and physically intact might share the silver-lining version. They could say that 2020 was the year we met the unique character Joe Exotic, rediscovered sidewalk chalk, vegetable gardening, home-baked bread, and family dinners at home.

We will tell them about drive-in church services, livestreamed concerts, virtual happy hours via Zoom and FaceTime, and the previously absurd prospect of doing corporate work at home in pajamas for weeks on end. We will tell them about teacher car parades, virtual proms, and teddy bear window scavenger hunts.

Whichever version becomes most pronounced in our memories, what is certain is that we will not soon forget the year of COVID-19. In fact, many of us are just beginning to grapple with the challenges of an uninvited new normal.

Alone, Together

Measures to suppress the spread of coronavirus profoundly changed our lives—in ways good and bad. For many of us, stay-at-home orders gave us back our commute time. Gone were the distractions of group activities. Gifts of newfound time offered the freedom to plant a garden, read those books on the nightstand, explore hobbies, study a language, or learn to play banjo.

That freedom also marked the loss of the in-person communion of school or work environments—and of life rituals such as graduations and weddings.

“The comfort, predictability, and familiarity of my routine is gone due to the pandemic,” wrote human resources consultant Kevin Yates in a recent LinkedIn essay. “I used to travel to our offices in Menlo Park, New York City, and Austin. Hugs, handshakes, and fist bumps were how we’d greet each other.”

“We worked shoulder to shoulder in conference rooms. We ate lunch together and talked about our families, our projects, or whatever came up in conversation. We laughed together. We brainstormed together. We looked for answers to the hard stuff together. I don’t do any of that now,” Yates wrote during the initial outbreak. “The bond and connection I had through physical proximity is gone due to the pandemic. No, I’m not okay.”

Humans are social creatures. We need that bond even more in times of duress. “At a moment of profound dread and uncertainty, people are being cut off from soothing human contact,” wrote Ed Yong, a staff science writer at The Atlantic. “Hugs, handshakes, and other social rituals are now tinged with danger.”

Humans Are Wonderfully Adaptive

“People are reaching out to form new types of social bonds across the divide of spaces,” said Caela O’Connell, assistant professor of anthropology at the University of North Carolina at Chapel Hill. “A lot of those ways are digital, which of course has limitations. A virtual hug doesn’t have the same warmth and biofeedback of an actual hug, but it goes a long way compared to no hug at all.”

As COVID-19 locked down travel and in-person gatherings, we adopted visual remote tools to work and socialize. “Rather than ‘social distancing,’ we should be framing this as physical distancing that includes a lot of social connection,” explains O’Connell.

Rather than ‘social distancing,’ we should be framing this as physical distancing that includes a lot of social connection.

Caela O’Connell

Will we see a wholesale shift to remote work? Not necessarily. Some love it, while others confirmed that they never want to work from home again. Granted, a pandemic is not an ideal time to assess the options, said O’Connell.

“None of this was a very good natural experiment for what working at home actually entails,” says O’Connell. “As parents, we are trying to provide childcare while doing our jobs, and our jobs are not the same as they were. The dynamic acrobatics of this is like extreme parenting and extreme working, not a good example of the work-at-home experience.”

Extreme Parenting: K-12 Edition

With schools closed, K-12 students became home-based learners. Parents became educators and facilitators—roles for which most had little preparation.

“The burden right now on parents with school-age children is a very high one,” said O’Connell, who was homeschooled until college and is working from home with her three-year-old son, who is home from his shuttered preschool. “Parents are trying to replicate a formal model from traditional education institutions, yet the actual practice of homeschooling is very different.”

“There’s a subtle expectation that parents must find creative ways to handle this on their own,” says Chloë Cooney, writer and advocate for global health and human issues. “My inbox, social media feeds, and countertops are filled with creative ideas for educating and caring for your kids.”

“Workbooks, games, creative projects and experiments, virtual yoga, virtual doodling, virtual zoo visits, virtual everything,” says Cooney. “I honestly am too tired and stretched thin to read the suggestions, let alone try them. The few I have tried have been met with astounding and fierce rejection by my son.”

Businesses Pivot and Press On

After only four weeks under restrictions, small businesses were already struggling with the economic impacts. By late March, one-third of businesses surveyed by the news site WalletHub had already laid off workers, and another 36 percent planned to do so, while 35 percent feared the closure of their businesses.

Others pivoted on what they do best and adapted to a new order.

For example, IL Palio, a AAA Four Diamond restaurant, offered patrons the option to cook alongside executive chef Adam Rose from the comfort of their kitchen. The Chapel Hill, North Carolina, landmark is offering meal kits and a live, online class with Rose, as well as curbside pickup from a special dinner takeout menu.