Don’t worry, this article is not a movie review. It’s the story of a different Magnificent Seven. One in which the protagonists aren’t cowboys but instead seven of the largest and most important companies in the world: NVIDIA, Microsoft, Apple, Alphabet, Amazon, Meta, and Tesla. In this story, you’ll hear about what makes these companies industry leaders, the challenges they’ve overcome, and the ending that’s yet to be written.

Defining Magnificent

Let’s begin with answering the question, what great deeds does a company have to perform to warrant the audacious title of magnificent?

For starters, you would expect it to be the kind of company that conveys durable superiority worthy of the history books. It would have to be so dominant that it becomes a household name. And the industries in which it operates would need to be among the largest and most profitable in the world.

But even that isn’t enough.

Despite its tremendous size, this company would still be growing much faster than the average company. It would also need to be a financial powerhouse with a credit rating that bests most sovereign nations. Most importantly, it would need to be at the forefront of innovation such that its dominant position is not just maintained but strengthened.

All of the Magnificent Seven—except Tesla*—meet these criteria.

*Tesla has a BBB credit rating (the others are all AA- or better), has not grown so far in 2025, and is in the auto industry, which is not one of the most profitable industries in the world. (Source: FactSet Research Systems)

And the company needs to have staying power. In a typical innovation cycle, dominant companies are toppled by innovative upstarts that build a better mousetrap and become the next leaders. But the Magnificent Seven have seen that playbook and sidestepped it; they have remained at the forefront of innovation in their industries and continue to aggressively lead.

And these companies are spending big to stay ahead—not just on buildings and equipment but on top engineering talent, an increasingly rare commodity.

Collectively, these companies are more valuable than China’s stock market—the largest market in the world, other than the U.S. NVIDIA, the largest of the Magnificent Seven by market value as of September 3, 2025, has a market value larger than every country’s gross domestic product, except the U.S., China, and Germany. It’s understandable when regulators get nervous about companies that are this big and powerful.

It’s no coincidence that all of these companies hail from the U.S. The U.S. offers a combination of economic durability, entrepreneurship, availability of capital, reliable markets, favorable regulatory policy, and global influence, among other factors, which allow big ideas to thrive and grow. It’s in this fertile soil that industries that didn’t exist only a few decades ago have grown to become the largest in the world.

Here Comes the Law

As a Yale Law School student, Lina Khan (2016) famously wrote an article, “Amazon’s Antitrust Paradox,” portraying Amazon’s business practices as anticompetitive, even though it hadn’t risen to the traditional standard of antitrust behavior.

Less than five years later, she became the chair of the Federal Trade Commission (FTC) under President Biden—an appointment that likely sent a shiver down the spine of the Magnificent Seven.

Changes to the antitrust guidelines under Khan’s tenure were designed to enhance the agency’s ability to scrutinize mergers that could harm competition, particularly in concentrated markets.

The push to regulate these tech giants has proven bipartisan. The Trump administration’s decision to appoint a chair that had served in Khan’s FTC (Andrew Ferguson) indicates the legal challenges may not be over anytime soon.

But a magnificent doesn’t crumble in the presence of adversity.

For more than a decade, the alphabet soup of regulatory agencies inside and outside the U.S. has been trying to fell these giants without landing a significant blow to any of them. However, a few consequential cases are still winding their way through the courts as of this writing, including the potential breakup of the Google digital advertising platform within Alphabet.

Other Challenges

Not all adversity has been of the legal variety.

In early 2025, Chinese hedge fund High-Flyer released DeepSeek, an AI model that shocked the U.S. technology industry. DeepSeek was created despite a semiconductor export ban that prevented access to the same leading-edge chips that its American competitors used. It was, in many ways, superior and was built at a fraction of the cost. Magnificent Seven shares temporarily sank as investors worried that the Chinese were leapfrogging us and all of that spending was wasted.

There have also been a number of self-inflicted challenges.

In 2021, Meta embarked on a high-profile spending binge on the metaverse—prompting a name change from Facebook. Its stock plunged 75 percent before the company pivoted and declared 2023 a “year of efficiency.”

Apple struggled with underinvestment, failing to deliver on promised artificial intelligence (AI) features for iPhones. The result: a 33 percent decline in shares earlier this year (Source: Gurman and Bennett, 2025).

Tesla may have sabotaged its own business after CEO Elon Musk campaigned and served for the Trump administration. This drew the ire of much of its customer base, many of whom belong to the opposing political party.

These drawdowns were short-lived, and many of the recovery rallies resulted in new all-time highs. Investment continued, benefiting NVIDIA, the primary vendor of the AI-oriented semiconductors.

Meanwhile, Microsoft impressed investors with strong AI revenue. Tesla redirected investor attention to the future of robotaxis and Optimus humanoid robots. Apple visited with the president, which eased tariff concerns. Meta reported accelerating revenue growth in its June quarterly earnings.

Growing Pains or Fatal Flaws?

The next chapter in the Magnificent Seven’s story will almost certainly hinge on the success—or failure—of AI. Despite enthusiasm around the game-changing possibilities AI promises, skepticism abounds.

Skepticism around new technologies is nothing new. Maybe you’ve heard these:

“There is no need for any individual to have a computer in their home.” (Ken Olsen, president of Digital Equipment Corporation, 1977)

“By 2005 or so, it will become clear that the Internet’s impact on the economy has been no greater than the fax machine’s.” (Paul Krugman, Nobel Prize-winning economist, 1988)

Tell the world you’re creating the next big thing, and someone with some extra time on their hands will find an amusing flaw. The early stages of consumer-facing AI have provided plenty of fodder for pranksters looking to make this new technology look foolish.

Known as hallucinations, these responses are based on errors or biases in the data that trained the AI system. From made up legal cases to including glue in a recipe for pizza, these mostly harmless mistakes make it clear that AI always needs to be fact checked and still has a long way to go.

AI Self Reflection

The most credible longer-term argument against AI goes something like this: So the industry is squeezing power supplies and hurting the planet to put people out of work? That isn’t as easily brushed aside. Power outages, climate change, and labor displacement are the kinds of problems that could lead to a severe backlash.

Ask Microsoft Copilot what the primary negatives about itself are, and it responds with a laundry list:

- AI systems can reflect biases from historical data filled with human prejudices.

- Complex models often lack transparency, raising accountability concerns, particularly when AI systems are used in sectors that impact human lives, such as health care and criminal justice.

- Widespread AI surveillance blurs the line between safety and privacy.

- Autonomous AI weapons pose ethical and security risks.

- Superintelligent AI could threaten humanity if it acts counter to human values.

As the leaders of this technological revolution, the Magnificent Seven are the targets of this skepticism and will have to champion the merits. It will take more than generating pictures of cats in space or helping kids cheat on their homework to sell the public on the benefits of AI.

A Bright Future?

Back to the movie from 1960…

Despite well-laid plans, some of the villagers lose faith and betray the cowboys, allowing the bandits to take over and run the Magnificent Seven out of town. But the heroes don’t give up. They ultimately return to save the day, resulting in a happy Hollywood ending.

Is something similar happening with our Magnificent Seven companies today? The regulators, naysayers, and even some in the court of public opinion seem eager to run them out of town.

Of course, it’s not as black and white as it is in the movies. But if the bandits of soaring government debts, demographic headwinds, and inflation continue to terrorize the economy, we may need the pro-growth and deflationary forces of the Magnificent Seven to save the day.

And if they succeed in leading us into the next decade, we may need to find a more impressive superlative to describe them—because magnificent might not be enough.

A: You’re right. Major weather-related disasters are becoming more common. Formerly once-in-a-century events now occur with alarming regularity. If you’re interested, you can find good data about these from the National Oceanic and Atmospheric Administration.

To answer your question about insurance, it is important to first explain that standard homeowner’s insurance policies typically have limitations when it comes to natural disasters. These limitations can create a protection gap, leaving the homeowner vulnerable to catastrophic financial losses after a weather-related disaster. For example:

- Flood damage usually requires separate National Flood Insurance Program coverage.

- Earthquake coverage almost always requires a separate policy.

- Wildfire protection is included in most standard policies, but many insurers are withdrawing from high-risk areas.

- Hurricane damage may be partially covered but, often, with higher deductibles.

Supplemental disaster insurance can narrow the protection gap. Without proper coverage, a single disaster could wipe out a homeowner’s home equity and savings. For many, knowing they are protected allows them to better focus on their family’s safety during emergencies. Some policies also include living expense coverage to help ease the stress of rebuilding in the event of a claim.

Before purchasing disaster insurance, do your homework:

- Review your existing policies to identify coverage gaps.

- Research specific disaster risks for your location.

- Get several quotes for relevant supplemental policies.

- Consider home-hardening measures.

- Create an emergency fund for deductibles and uninsured losses.

Disaster insurance represents an additional expense. However, for many homeowners, especially in vulnerable areas, it has become less of a luxury and more of a necessity. The right coverage provides both financial protection and some peace of mind when facing natural disasters. As always, consult with your financial and insurance advisors to tailor protection to your needs.

A: We’ve been hearing a lot about this too, especially in the past few years. Tech companies and automakers have promised a transportation revolution that will make our roads safer and our commutes more productive.

Despite the hype, fully autonomous vehicles that can drive anywhere, in any conditions, without human intervention, remain elusive.

What we have today is a spectrum of automation. Many vehicles now come equipped with driver-assistance systems like automatic emergency braking, lane-keeping assistance, and adaptive cruise control.

These technologies help human drivers but don’t replace them.

Tesla, Waymo, and Cruise operate more advanced automated vehicles in specific locations. For instance, you might have heard about Waymo self-driving taxis in Phoenix, San Francisco, and Los Angeles. These systems can drive the vehicle autonomously under limited conditions, but a human must still be ready to take control.

Several significant hurdles have slowed progress:

- Technical challenges. Developers struggle to create systems that can handle unusual road or weather conditions. Computer vision may fail in unpredictable scenarios that human drivers navigate intuitively.

- Regulation. Lawmakers face difficulty establishing consistent rules and liability across regions. Questions about who is responsible when self-driving cars make mistakes have led to a cautious regulatory approach.

- Infrastructure. Many autonomous systems rely on high-definition maps and connectivity that aren’t available everywhere. Rural areas and developing countries may lag due to infrastructure limitations.

- Trust. Accidents involving test vehicles have damaged public confidence. Surveys show that many people remain skeptical of autonomous vehicle safety.

Despite these challenges, self-driving technology offers promising benefits:

- Improved safety. Human error contributes to most crashes. Autonomous systems don’t get distracted, tired, or impaired, potentially saving thousands of lives each year.

- Enhanced mobility. Self-driving vehicles could provide independence to elderly and disabled individuals who cannot drive, thereby improving their mobility and quality of life.

- Economic efficiency. Autonomous delivery vehicles and trucks could reduce shipping costs, address driver shortages, and let commuters use travel time more productively.

- Environmental benefits. Optimized driving patterns could shrink the number of cars on the road and reduce pollution and energy consumption.

When will they be ready? The timeline for widespread adoption continues to shift. Early predictions suggested they would dominate the roads by 2020, which didn’t turn out to be true. More likely, self-driving technology will continue its gradual rollout. Geofenced autonomous taxi services may expand in urban areas with favorable regulations and weather conditions. Long-haul trucking routes may see early adoption. And consumer vehicles will continue to get more autonomous features with each model year.

Most realistic projections suggest that fully autonomous vehicles—those that can drive anywhere, anytime, without human oversight—won’t become common until the early 2030s at the soonest. The self-driving revolution is still coming, just more slowly and incrementally than the most optimistic predictions suggested.

A: The answer depends on your personal financial picture. To make this decision, examine your financial needs, your risk tolerance, and the economic climate. Before proceeding, ask yourself:

- What will I use the funds for?

- Can I afford higher payments if my interest rate rises?

- Am I disciplined enough to avoid overborrowing?

- Have I considered other options to access liquidity?

Also, make sure you understand how home equity loans work. Often called home equity lines of credit (HELOCs), these loans provide a credit line secured by your house. During a draw period of typically five to 10 years, you can withdraw funds and make interest-only payments. After that, a 10- to 20-year repayment period begins with both principal and interest payments. Most HELOCs have variable interest rates that will rise or fall with market conditions.

HELOCs offer a few distinct advantages:

- Interest rates are generally much lower than those on credit cards or personal loans.

- They provide flexibility, allowing you to borrow only what you need.

- In some cases, interest may be tax deductible.

- They can fund major expenses like home renovations or debt consolidation.

However, today’s economic conditions require caution. Rising interest rates could raise your monthly payments; flexibility can lead to overborrowing; and falling home values could leave you owing more than your home is worth.

Remember, your home secures the loan, so missed payments could lead to foreclosure.

Another consideration: Preserving your home equity can be a strategic long-term move, offering financial resilience and future opportunities that might outweigh the immediate benefits of borrowing.

Deciding whether to use a HELOC is a personal choice. Yes, your home equity can be a powerful financial tool, but it requires careful consideration and a clear understanding of the risks and rewards. Take your time, do your research, and consult your financial and tax advisors for their perspectives.

The gift tax and estate tax share a lifetime exemption. Transfers made during life or through the estate are applied against this exception. If the exemption is exceeded, estate or gift tax is due. In 2024, this exemption was $13.99 million, and it is set to increase to $15 million for 2025, which will also be indexed for inflation.

Gift Tax

Within the federal gift tax system, certain transfers can be made gift-tax-free without impacting your lifetime gift exemption. This includes the following:

- Gifts to your U.S. citizen spouse

- Gifts of up to $190,000 to a noncitizen spouse

- Gifts to qualified charities

- Gifts of up to $19,000 to any one person or entity during the tax year, or $38,000 if the gift is made jointly by spouses who are both U.S. citizens

- Amounts paid directly to an educational institution for tuition, or to a medical provider for someone’s medical expenses

Gifts may still need to be reported on your tax return, even if no gift tax is due. Any gifts made outside the categories above must be reported on Form 709 and will reduce your lifetime exemption, unless you elect to pay the gift tax.

Estate Tax

To calculate potential estate tax, begin by determining your gross estate: the total value of everything you own. From the gross estate, subtract any amounts going to a U.S. citizen spouse or to charitable organizations, as these transfers are excluded from estate tax. The amount remaining after these exclusions becomes your taxable estate.

If your taxable estate is less than the lifetime exemption, no federal estate tax is due on the transfer of your assets. Assets exceeding the exemption are subject to federal estate tax.

Married individuals who do not use their full exemption can transfer the remaining amount to their spouse by electing portability on Form 706. This provides the surviving spouse with a larger exemption, in case the value of assets increases.

Note that even if assets are not subject to estate tax, they may still be taxable to beneficiaries.

State Gift and Estate Tax

Outside the federal system, about 18 states have a gift or estate tax for their residents. These state exemptions can differ significantly from the federal exemption, so it is important to know the rules in your state. Some states also may have an inheritance tax, which is levied on the recipient and varies based on their relationship to the decedent.

Federal Generation-Skipping Tax

The federal generation-skipping transfer tax applies to property transfers made either during your lifetime or at death to individuals who are at least two generations younger than you—typically grandchildren or other similarly related beneficiaries. This tax is assessed in addition to, not in place of, the federal gift and estate taxes.

Sources:

Estate and Gift Tax FAQs | Internal Revenue Service

Estate tax | Internal Revenue Service

Gift tax | Internal Revenue Service

Instructions for Form 706 (09/2025) | Internal Revenue Service

Instructions for Form 709 (2024) | Internal Revenue Service

Resource by the CAPTRUST wealth planning team

This material is not individual investment advice. If you have questions or concerns regarding your own individual needs, please contact a CAPTRUST representative for further assistance. This material does not constitute legal, accounting, or tax advice. This material has been prepared solely for informational purposes. Investment advisory services offered by CapFinancial Partners, LLC (“CAPTRUST” or “CAPTRUST Financial Advisors”), an investment advisor registered under The Investment Advisors Act of 1940. Data contained herein from third-party providers is obtained from what are considered reliable sources; however, its accuracy, completeness, or reliability cannot be guaranteed.

Forfeiture Cases: A More Consistent Trend

401(k) plan fiduciaries have been challenged in approximately 75 class action suits alleging they improperly used participant forfeitures to offset employer contributions rather than to pay plan expenses that were eventually paid by plan participants.

Forfeitures occur when a plan participant leaves employment before the plan sponsor’s contributions to the participant’s account have vested. As reported last quarter, the U.S. Department of Labor (DOL) has provided in an amicus (“friend of the court”) brief its non-binding opinion that these cases are meritless. It has been a long-accepted practice for 401(k) plan sponsors to use forfeitures to offset employer contributions rather than to pay plan expenses when the plan allows either. This also has been the long-held understanding of Congress and the Treasury Department.

This quarter, a number of reported cases have followed what is becoming a relatively consistent pattern of these claims being dismissed, although one case was allowed to proceed. Here are examples:

- Becerra v. Bank of America Corp. (W.D. N.C. 8.13.25)—Dismissal denied

- Polanco v. WPP Group USA, Inc. (S.D. N.Y. 10.24.25)—Dismissed

- Middleton v. Amentum Parent Holdings, LLC (D. Kans. 8.5.25)—Dismissed

- Armenta v. WillScot Mobile Mini Holdings Corporation (D. Ariz. 9.15.25)—Dismissed

- Fumich v. Novo Nordisk, Inc. (D. N.J. 8.19.25)—Dismissed

- Barragan v. Honeywell International, Inc. (D N.J. 8.18.25)—Dismissed

- Cain v. Siemens Corp. (D. N.J. 7.31.25)—Dismissed

- Cano v. Home Depot, Inc. (N.D. Ga. 8.26.25)—Dismissed

- Estay v. Ochsner Clinic Foundation (E.D. La. 9.15.25)—Dismissed

- Dimou v. Thermo Fisher Scientific, Inc. (S.D. Calif 9.9.25)—Dismissed

American Airlines Loyalty Breach Remedy: No Payout, but Future Restrictions on Plan Fiduciaries

As previously reported, American Airlines and its 401(k) plan fiduciaries were found to be liable for breaching ERISA’s duty of loyalty to plan participants. The plan fiduciaries prioritized American Airlines’ business relationship with BlackRock, one of the plan’s investment managers, over prudently managing the plan’s investments for the benefit of plan participants. As the judge observed, BlackRock actively supported environmental, social, and governance (ESG) efforts and social change by making investment decisions and voting proxies on this basis, which the American Airlines fiduciaries did not challenge.

BlackRock was a significant investor in American Airlines, holding more than 5 percent of American Airlines’ stock and approximately $400 million of its corporate debt. The judge found that American Airlines’ “incestuous relationship with BlackRock and its own corporate goals disloyally influenced administration of the plans.” Spence v. American Airlines, Inc. (N.D. Tex. 2025). A decision on remedies was delayed.

The judge has now issued his decision on remedies, first finding that the plaintiff did not establish any financial losses to the plan from the breach. As a result, no monetary relief could be awarded. Spence v. American Airlines, Inc. (N.D. Tex. 9.30.25). The judge went on to observe that it was necessary for him to award equitable relief to ensure that the plan’s fiduciaries act “solely for the pecuniary benefit of the plan.” He ordered the following, with no end dates except as noted.

- There must be no proxy voting or other activities on behalf of the plan that are motivated by or directed toward non-pecuniary ends—in other words, nothing that is not in the exclusive best financial interest of plan participants and beneficiaries.

- The fiduciary committee must have at least two members who are independent from—having no connection or relationship with—any service provider or investment manager to the plan, for 5 years.

- The fiduciary committee or its successor must annually:

- Report to each plan participant on all transactions and financial relationships between American Airlines and all plan service providers and investment managers.

- Certify to each plan participant that the committee and each service provider and investment manager will pursue only investment objectives based on provable financial performance, not diversity, equity, and inclusion (DEI), ESG, sustainability or any other non-financial criteria. This applies also to the voting of proxies.

- American Airlines must publish on its corporate website its membership in organizations dedicated to achieving DEI, ESG, climate-focused, or stewardship objectives. It must also publish the memberships of the plan’s service providers and investment managers in those same organizations.

- The plan may not use BlackRock or any other investment manager that owns more than 3 percent of American Airlines stock or any of its fixed debt, unless corporate executives responsible for the business relationships are excluded from being plan fiduciaries or managing the plan.

Cases Alleging Fee Overpayment and Investment Underperformance Continue

The flow of cases alleging that plan fiduciaries have overpaid for services and retained underperforming funds continues. In cases where details of the fiduciaries’ process was evaluated, good fiduciary process was imperative.

Any plan can be sued and be forced to defend itself—that is a cost of doing business. Winning is the result of having and executing a good process. The importance of this cannot be overstated.

Here are some highlights of this quarter’s decisions.

- In one case that went to trial, the plan fiduciaries demonstrated that they prudently monitored recordkeeping fees and the share classes of the plan’s investments. The fiduciaries’ thorough process and diligence won the day. McDonald v. Laboratory Corporation of America Holdings (M.D N.C. 2025)

- One case that was initially dismissed for failing to state a claim was resurrected by the court of appeals based on the Supreme Court’s decision in Cunningham v. Cornell University, which provides an avenue for virtually any plan to be sued and not win a motion to dismiss. Collins v. Northeast Grocery, Inc. (2nd Cir. 2025)

- Claims challenging the retention of underperforming stable-value funds are becoming more common. A suit has been filed against Molson Coors alleging imprudent retention of Fidelity’s stable-value fund. Hensley v. Molson Coors Beverage (E.D. Wis. filed 9.9.25)

- As part of settling a different employment-based claim, one plaintiff signed an agreement not to sue the employer under ERISA. As a result, a subsequent suit challenging retention of a stable-value fund was dismissed. Gonzalez v. JPMorgan Chase Bank, NA (D. N.J. 2025)

- A case alleging fiduciary breaches in the retention of an allegedly underperforming stable-value fund survived dismissal. The complaint alleged that, along with underperformance, the plan’s fiduciary committee did not have a process to evaluate the fund. Carter v. Sentara Healthcare Fiduciary Committee (E.D. Va. 2025)

- A motion to dismiss was denied on a claim alleging payment of excessive recordkeeping fees. The plaintiffs’ recordkeeper data showing lower fees appeared—at least initially—to be an apples-to-apples comparison. Cina v. CEMEX, Inc. (S.D. Tex. 2025)

- A motion to dismiss was granted where plaintiffs did not provide apples-to-apples recordkeeper comparisons. Gosse v. Dover Corporation (N.D. Ill. 2025)

- A case alleging overpayment of recordkeeping fees was settled for $750,000. Cure v. Factory Mutual Insurance Company (D. Mass. 2025)

- A separate case alleging overpayment of recordkeeping fees was settled for $1.25 million. In the process of approving the settlement, the judge reduced the attorney’s fees from the requested 35 percent to 30 percent. Coppel v. Seaworld Parks & Entertainment, Inc. (S.D. Calif. 2025)

- A case alleging improper selection and retention of a target-date-fund series was dismissed. The court would not substitute the plaintiffs’ preferences for the plan fiduciaries’. Phillips v. Cobham Advanced Electronic Solutions, Inc. (N.D. Calif. 2025)

These cases illustrate the wide range of suits being filed against plan fiduciaries and demonstrate the importance of having a sound and thorough process to prudently evaluate investments and recordkeeper fees.

Fiduciary Committee and Discretionary Investment Consultant Sued: Fiduciary Committee Wins, Discretionary Investment Consultant Must Proceed

Caesars Holdings hired Russell Investments to be the discretionary investment manager for their 401(k) plan. Soon after, Russell replaced many of the plan’s investments with Russell’s investments, including their target-date funds. The Russell target-date funds underperformed the funds they replaced, as well as Russell’s own internal benchmarks.

Disappointed participants sued both the Caesars fiduciaries and Russell. After conducting discovery, both Caesars and Russell moved for summary judgment. (Unlike a motion to dismiss, which contends at the outset that there is no basis for a claim, a motion for summary judgment contends that, based on the evidentiary record that has been developed through discovery, a trial is not needed, and the filer wins.)

Caesars undertook a careful process with the assistance of an independent third party to evaluate providers when they retained Russell. Then, the Caesars committee met quarterly and received reporting from Russell on investment performance. With little fanfare, based on this record of diligence, the court found no disputed facts on this front and granted Caesars’ motion for summary judgment.

The court then turned to Russell. It detailed several apparent conflicts of interest in Russell’s decision to use its own target-date funds. The court noted the complaint’s allegations that Russell’s self-serving swap of the target-date funds was a life preserver for its struggling funds, bringing in $1.4 billion, while other plan sponsors were leaving Russell’s funds. At the end of 2019, the Caesars plan held 74 percent of the reported assets in Russell’s target-date funds. An internal Russell report identified low assets under management as a reason other plans had left the Russell target-date funds. The judge viewed this as a material issue in dispute to be addressed at trial on whether Russell breached ERISA’s duty of loyalty.

Russell argued that its agreement with Caesars was a cost-plus arrangement, concluding that there was no reason for it to favor its own funds. The judge discounted this assertion, noting that it fails to address other incentives that motivated Russell to use its own funds.

With respect to breach of prudence allegations, the judge noted that, based on internal Russell documents, Caesars received advantageous pricing based on the assumption that Russell could use the Russell target-date funds. Also, Russell was unwilling to serve as a discretionary fiduciary on non-Russell target-date funds, because “the economics don’t support it.” These facts suggested that the decision to use the Russell target-date funds—and not consider competitors—demonstrate a lack of prudence by Russell in fund selection. This issue will also proceed to trial. Wanek v. Russell Investments Trust Company (D. Nev. 2025)

This case demonstrates the fiduciary committee risk mitigation that can flow from retaining a discretionary investment advisor—and the risk discretionary investment managers take on. It is also a reminder that discretionary investment advisors are subject to the full range of ERISA’s fiduciary responsibilities and must make prudent, evenhanded decisions, putting participants’ interests ahead of their own.

Key Takeaways

- Markets rallied in the third quarter as trade tensions abated, technology infrastructure investment abounded, and the Federal Reserve delivered its first cut of 2025.

- Economic dependence on the AI theme continues to expand. A small group of tech companies have delivered about half of the S&P 500 Index’s year-to-date return while also accounting for almost a third of capital expenditures.

- U.S. corporations continue to outperform expectations, with higher revenue and profits that support a virtuous cycle as robust earnings fund further investments.

- Progress rarely follows a straight line. Investors can celebrate recent gains and optimism for the future while remaining grounded by their financial plan and investment discipline.

Global equity indices extended gains in the third quarter, with several major benchmarks setting fresh highs. A combination of macroeconomic strength, solid corporate profits, and heavy investment in technology has powered the climb. Even with lingering inflation, fast-changing policy, and unproven AI payoffs, financial markets continue to look ahead.

Third Quarter Recap: Markets Remain Focused on the Positives

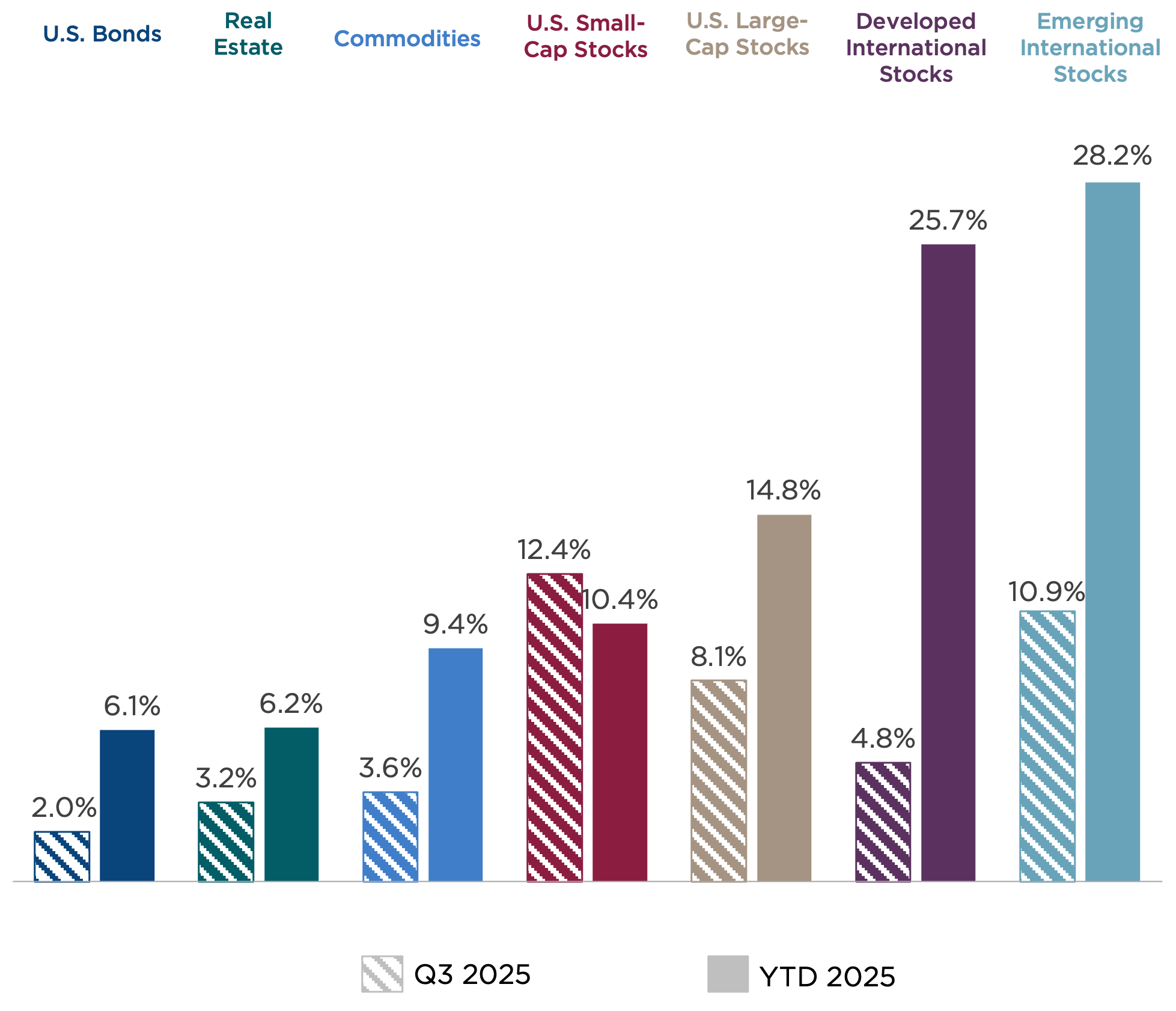

A wide range of asset classes, led by global equity markets, enjoyed a strong third quarter.

Within the U.S., the S&P 500 Index delivered an 8.1 percent return as only one sector (consumer staples) posted a loss. Yet gains continue to be narrowly led, as just three growth-oriented sectors, technology, communication services, and consumer discretionary, delivered the lion’s share of returns.

Small-cap stocks performed even better, as rate-cut expectations suggested relief was on the way for more interest-rate-sensitive companies. Risk appetites rose as less-profitable, lower-quality stocks outperformed their more profitable peers.

Outside the U.S., equity returns were uneven. Emerging market stocks returned close to 11 percent over the period, with semiconductor leaders in China, Korea, and Taiwan benefiting from global demand. Progress on U.S. trade talks provided further support. Developed market international stocks also advanced, led by European banks, a growing global services sector, and ongoing market-friendly reforms in Japan.

U.S. bonds benefitted from falling yields, particularly within shorter-dated maturities, on expectations of Fed rate cuts. Investment grade corporate bonds continue to reflect credit spreads at multidecade lows, signaling continued investor confidence in company fundamentals.

Commodities rebounded, led by an acceleration of gold’s spectacular rally, as investors sought hedges for a variety of risks: economic, policy, and geopolitical.

Figure 1: Q3 2025 Market Rewind

Asset class returns are represented by the following indexes: Bloomberg U.S. Aggregate Bond Index (U.S. bonds), Dow Jones U.S. Real Estate Index (real estate), Bloomberg Commodity Index (commodities), Russell 2000® (U.S. small-cap stocks), S&P 500 Index (U.S. large-cap stocks), MSCI EAFE Index (international developed market stocks), and MSCI Emerging Market Index (emerging market stocks).

Echoes of Innovation

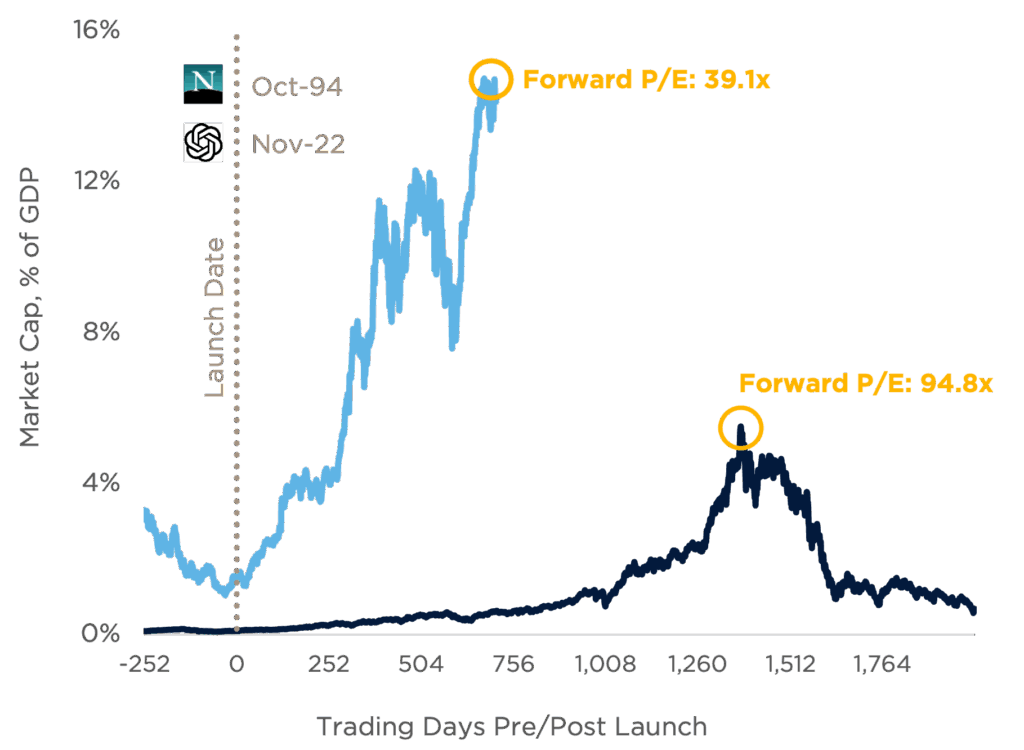

Entirely new economic eras can be triggered by a single innovation. The steam engine, the Wright brothers’ Flyer, Sputnik 1, and the launch of the first web browser each marked inflection points with massive economic implications.

The launch of ChatGPT 3.5 in November 2022 can be viewed as such an event. In the three years since, over $1 trillion has been invested in advanced chips and stadium-sized data centers to provide the computing horsepower required for cutting-edge AI models.

The parallels to the dot-com bubble of the late 1990s are striking. As telecom companies raced to wire the world with high-speed internet, Cisco Systems, a leading maker of network routers and switches, saw its share price rocket 3,800 percent in about five years. At its peak, investors were willing to pay nearly 95 times Cisco’s future earnings per share, driven by the belief that the sky was the limit for internet innovation.

Today’s AI frenzy has accelerated even faster than the dot-com bubble. The internet reached 100 million users in seven years, while ChatGPT achieved this threshold in just two months. Following that trajectory, the market capitalization of NVIDIA, a key supplier of advanced AI chips, has grown from $400 billion to $4.5 trillion since the launch of ChatGPT. This is equivalent to nearly 15 percent of the entire U.S. economy, as measured by Gross Domestic Product (GDP).

We know how the dot-com era ended: Economic realities caught up with unbridled optimism. Experimental business models failed to deliver profits, and the speculative buildout of internet infrastructure led to investment in over 300,000 miles of fiber optic cable, much of which remained unused for a decade or more before real-world demand caught up.

However, the current environment also has some important differences from the dot-com era, including:

- Earnings underpinning. While NVIDIA’s stock price has climbed, insatiable demand and dominant pricing power have also accelerated profits. At quarter-end, NVIDIA was trading near 41 times forward earnings—certainly rich, but well below bubble levels.

- Cash flows, not speculation. The majority of funding for AI infrastructure is coming from cash flow powerhouses. Amazon, Alphabet (Google), Microsoft, and Meta are among the most profitable companies in the world.

- Early payoffs. Unlike many dot-com darlings with farfetched business models, early investments in AI infrastructure are already translating to revenue for major tech firms. AI users are also reporting productivity gains, with one Fortune 500 firm reporting a 14 percent improvement in efficiency for its customer support agents provided with an AI assistant.[1]

Figure 2: Cisco Systems and NVIDIA Market Cap Expansion (% of U.S. GDP)

Sources: Bloomberg, World Bank, Wall Street Journal, CAPTRUST research. Data as of September 19, 2025.

This year has also delivered evidence of what can happen when doubts creep into the narrative. In late January, China‑based DeepSeek rattled markets by delivering competitive AI performance at a fraction of the cost of existing flagship models. This announcement triggered a massive tech selloff. NVIDIA alone shed nearly $600 billion in market cap in a single day—the largest single-day market cap loss in stock market history—as investors questioned whether its advanced chips justified the premium valuation of its stock.

Investor hopes for AI’s impact are elevated. Although the dot-com era is an imperfect analog, it does remind us that breakthroughs don’t always pay off on schedule. Even if the technology ultimately overdelivers, the economic benefits may arrive on a timeline at odds with current market expectations.

Higher Margins Drive Investment and Growth

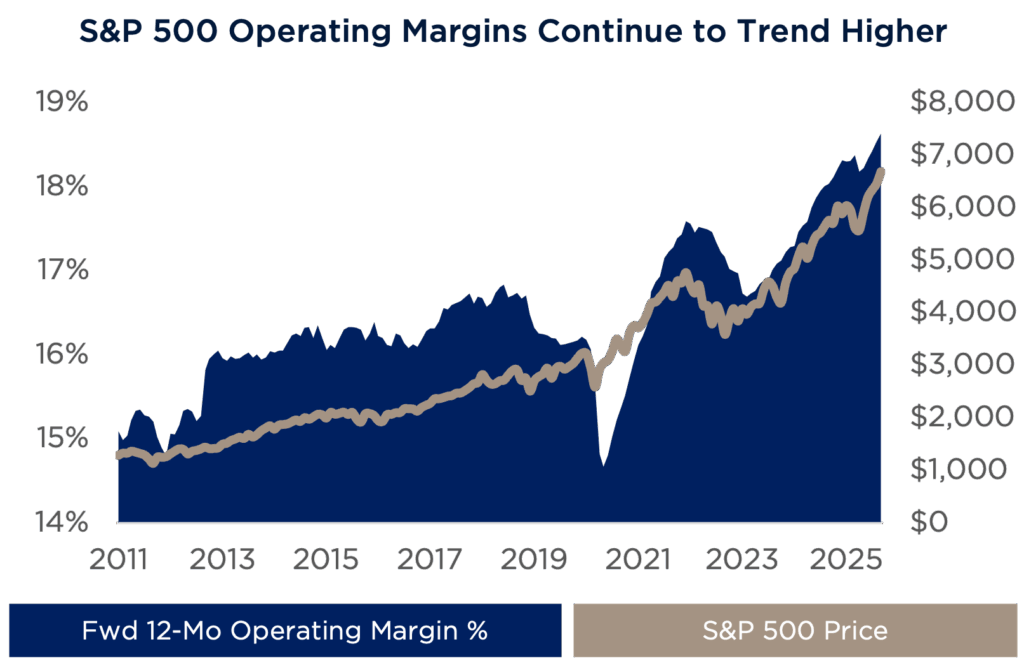

This year, U.S. corporations have performed better than expected, growing revenue and earnings despite tariff-related cost pressures. Nearly 80 percent of S&P 500 Index companies outpaced earnings targets in the most recent reporting period. Higher profitability has been driven by selective price increases and product mix adjustments, tighter operating discipline, supply chain optimization, and productivity gains. As shown in Figure 3, profit margin expansion has amplified earnings growth, providing continuing support for equity prices even at above-average valuations.[2]

Figure 3: S&P 500 Operating Margins Continue to Trend Higher

Sources: FactSet, CAPTRUST research. Data as of September 30, 2025.

Strong cash generation has translated into aggressive investment plans. In addition to the AI infrastructure build-out, utilities firms are investing heavily to harden and expand the power grid, manufacturers are committing to flagship projects, and tax policy tailwinds are pulling orders forward. When strong fundamentals provide companies with the means and confidence to invest in the future, the economy and markets can often power through headwinds.

Rate Cut Hopes, Real Risks

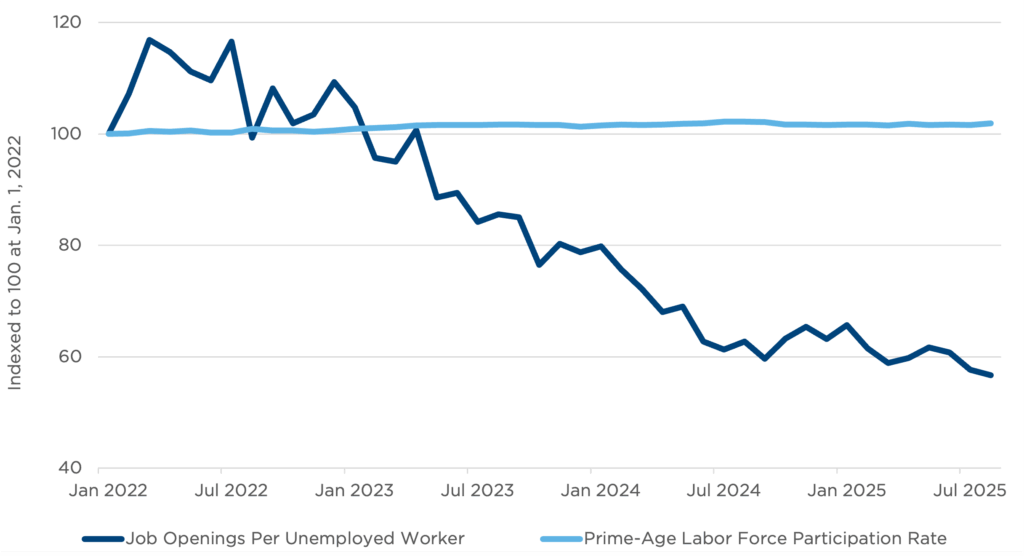

In September, the Federal Reserve began easing monetary policy with a quarter-point risk management reduction in its federal funds target rate. What made this move so notable is the relative strength of the economic backdrop: Inflation is still above the Fed’s 2 percent target, the unemployment rate remains near multidecade lows, equity indices are hovering near record highs, and financial conditions are loose.

Federal Reserve Chair Jerome Powell framed the move as a policy recalibration rather than a pivot to easy monetary policy. He described current labor market conditions as “unusual,” noting a slowdown in both the supply and demand for workers, as well as payroll gains slipping below the breakeven pace required to hold unemployment steady (Figure 4). Nevertheless, financial markets are currently pricing in two more rate cuts this year, and an additional three cuts in 2026. Expectations for aggressive easing could create downside risks for markets if they fail to materialize.

Figure 4: Labor Market: Cooling Demand, Stalled Supply

Sources: U.S. Bureau of Labor Statistics, Federal Reserve Bank of St. Louis, CAPTRUST research.

The current environment represents a tightrope walk for the Federal Reserve amid growing political pressure for lower rates. Inflation has stalled at around 2.7 percent, with tariff-sensitive goods prices rising as services prices fall. Cutting rates too quickly risks exacerbating inflation, while a delay could serve to lock in labor market fragility. As Powell noted, “Two-sided risks mean there’s no risk-free path.”

Consumers: Feeling Low but Spending Freely

The state of the U.S. consumer is both resilient and restless. Although household budgets remain challenged by high interest rates, stubborn inflation, and a cooling labor market, spending remains firm. Consumer spending rose 2.7 percent in August, providing ongoing support for strong U.S. economic growth.

Although spending keeps chugging along, sentiment rests near crisis‑era lows. In addition, the distribution of consumer activity is highly skewed. Top‑decile earners now account for nearly half of all spending, while the bottom 40 percent contribute less than 10 percent of spending. Affluent households may be able to sustain economic momentum in the near term, but broader participation is necessary to provide a stronger foundation for growth.[3]

A future source of consumer spending strength could have an unlikely origin: tax season. As a result of the recently passed One Big Beautiful Bill Act (OBBBA), tax withholding table adjustments should lift paychecks early next year, followed by a tax season that is expected to deliver an incremental $150 billion in refunds. While this household budget boost will create meaningful economic support, the OBBBA is also expected to exacerbate the U.S. budget deficit. Tax breaks for corporations and consumers will contribute an additional $3.4 trillion to the budget shortfall over the next decade.[4]

Priced on Promise

When expectations get stretched, even small disappointments can earn outsized reactions. Companies and investors are placing their faith, and vast sums of money, in the promise of AI to deliver higher productivity, economic efficiency, and new profit engines. Although these gains may take years to unfold, the AI push is delivering current economic benefits in the form of capital investments that support the real economy.

Investor hopes are also pinned to the ability of the U.S. economy to operate within a narrow growth channel that allows the Fed to continue easing monetary policy. This will require a balance between softening labor market conditions and persistent inflation pressures, against a backdrop of political pressures and fast-moving policy changes.

The path of progress is rarely linear, and investors should be prepared to recalibrate their expectations in the event of bouts of volatility and changes in market leadership. Three years of outsized gains, led by mega-cap technology giants, have increased market concentration risk. If investors haven’t been disciplined in rebalancing portfolios to their strategic targets, risk profiles could be out of tolerance.

Investors should celebrate recent gains while also bracing for the possibility that blips in the path of progress could manifest as market pullbacks. When expectations live in the clouds, it pays to remain grounded.

Index Definitions

Indexes are unmanaged, do not incur management fees, costs, and expenses, and cannot be invested in directly.

S&P 500® Index: Measures the performance of 500 leading publicly traded U.S. companies from a broad range of industries. It is a float-adjusted market-capitalization weighted index.

Russell 2000® Index: Measures the performance of the 2,000 smallest companies in the Russell 3000® Index. It is a market-capitalization weighted index.

MSCI EAFE Index: Measures the performance of the large- and mid-cap equity market across 21 developed markets around the world, excluding the U.S. and Canada. It is a free float-adjusted market-capitalization weighted index.

Bloomberg U.S. Intermediate Govt/Credit Bond Index: Measures the performance of the non-securitized component of the US Aggregate Index. It includes investment-grade, US Dollar-Denominated, fixed-rate Treasuries, government-related corporate securities. It is a market-value weighted index.

Bloomberg Commodity Index (BCOM): Measures the performance of 24 exchange-traded futures on physical commodities which are weighted to account for economic significance and market liquidity. BCOM provides broad-based exposure to commodities without a single commodity or commodity sector dominating the index.

MSCI Emerging Markets Index: Measures the performance of large and mid-cap stocks across 24 Emerging Markets countries. It aims to capture the performance of equity markets in emerging economies worldwide and covers approximately 85% of the free float-adjusted market capitalization in each country.

Sources

[1] “Generative AI at Work.” The Quarterly Journal of Economics.

[2] FactSet Insight

[3] Moody’s Analytics, The Wall Street Journal

[4] Strategas, Bipartisan Policy Center

History of 529 Plans

In the late 1980s, Michigan, Florida, Ohio, and Wyoming introduced prepaid tuition programs to help families manage rising college costs. In 1994, a federal court ruled that Michigan’s plan was tax-exempt. Following this decision, the IRS announced it would review the tax status of each plan individually, prompting states to intensify their lobbying efforts in Congress for federal tax benefits and to encourage college savings.

In 1996, Senators Bob Graham of Florida and Mitch McConnell of Kentucky—both representing states with prepaid savings programs—led a bipartisan effort to secure federal tax relief for all college savings programs. This effort resulted in the creation of Section 529 of the Internal Revenue Code.

Today, 49 states and the District of Columbia offer 529 plans, helping dramatically increase savings to meet the rising costs of education. While 529 plans evolved from prepaid savings programs, they are not the same. Many states offer one or both options.

Getting Started with Plan Selection

Step One: Determine Which 529 Plan to Use

While most states offer their own 529 plans, you can invest in any state’s plan. If your home state provides a tax deduction or credit, it often makes sense to use that plan. Some states also allow state income tax-free withdrawals for qualified expenses, and more than 30 states offer some form of tax benefit.

If your state does not provide a tax advantage, consider comparing plans based on:

- features,

- costs, and

- investment options.

Step Two: Determine the Owner of the Account

Parents or guardians are typically the best choice as account owners because they maintain control over the account and can help ensure funds are used as intended. Grandparents and other relatives can open their own 529 accounts or contribute to an existing one. The beneficiary is the student who will use the funds.

Financial Aid Considerations

Funds in a 529 plan count toward the student aid index (SAI), which measures a family’s ability to pay for college and affects need-based aid eligibility. Parent-owned accounts are assessed more favorably on the Free Application for Federal Student Aid (FAFSA) than student-owned accounts.

Beginning with the 2024-25 academic year, grandparent- or other relative-owned accounts do not affect FAFSA eligibility, although they may impact the College Scholarship Service (CSS) profile used by some private colleges.

Unlike a custodial account, the owner maintains oversight of investments and can change the beneficiary for any reason.

Contributions

Each state sets a lifetime contribution limit for its 529 plan, typically between $235,000 to $550,000 per beneficiary. Unlike individual retirement accounts (IRAs) or 401(k)s, there is no annual federal contribution limit for 529 plans. Yet, gift tax rules still apply. An individual can contribute any amount up to the annual gift exclusion amount per beneficiary each year without triggering gift tax consequences. In addition, 529 plans allow a special five-year election that lets clients front-load up to 5 years’ worth of annual gifts for each beneficiary.

Although anyone—parents, grandparents, relatives, and friends—can contribute to a 529 plan, the account owner retains control over the funds. Contributions must be made in U.S. dollars, and non-cash assets such as stocks or property cannot be held within a 529 plan.

Investments Within a 529 Account

Each investment provider will offer different options, but most plans include target-date funds, objective-based portfolios, and individual mutual funds. Target-date funds are designed around the year that the beneficiary is expected to begin withdrawals. They simplify asset allocation by automatically rebalancing to become more conservative as the withdrawal date approaches.

Objective-based portfolios focus on specific investment goals rather than risk level or asset class. For example, a growth portfolio may seek long-term capital appreciation by investing in companies with strong growth potential. This approach can be suitable for investors who typically buy individual stocks but want greater diversification to meet long-term goals.

Some plans also allow you to build a custom portfolio using a mix of mutual funds, giving account owners flexibility to tailor investments to their preferences.

Withdrawals from a 529 Account

One of the most appealing features of 529 savings plans is that withdrawals used for qualified education expenses—including the earnings within the plan—are exempt from federal income tax. Qualified expenses include tuition, fees, books, room and board, and computers for higher education and post-secondary programs. Additional qualified expenses include up to $10,000 per year per beneficiary for K-12 tuition and a lifetime limit of $10,000 per person toward student loan payments. To receive tax-free treatment, withdrawals must occur in the same calendar year that the expenses were paid.

Nonqualified expenses include transportation, sports, entertainment, and student phone bills. The earnings portion of withdrawals for nonqualified expenses is subject to federal and state income tax and a 10 percent federal penalty.

It is important to note that not all states conform to federal tax rules for 529 plans. For example, some states impose income tax on earnings used for K-12 tuition, while others apply their own rules and penalties on non-qualified distributions. Clients should be sure to review their state’s specific rules before making withdrawals.

Additional Options for unspent 529 Funds

If the original beneficiary does not use all the funds in a 529 plan, there are several ways to reallocate the money.

- Change the beneficiary. You can transfer the account to another eligible family member, which includes blood relatives and relatives by marriage and adoption. Transfers are generally tax-free, involve a simple beneficiary change, and can be done as often as needed.

- Roll over to another 529 plan. A rollover can only occur once in a 12-month period. Common reasons for rollovers include moving to a state that offers tax benefits, consolidating multiple accounts for the same beneficiary, or switching to a plan with lower fees.

- Convert to a Roth IRA. Under certain conditions, up to $35,000 of unused funds can be rolled into a Roth IRA. The 529 account must have been open for at least 15 years and maintained for the same beneficiary. Rollovers are subject to annual Roth contribution limits.

- Transfer to an ABLE account. 529 funds can also be rolled over to an Achieving a Better Life Experience (ABLE) account. Both accounts must share the same beneficiary, or the new beneficiary must be an ABLE-eligible member within the family. Transfers are limited to the annual ABLE contribution limit. This option allows families to use funds for qualified disability expenses without affecting eligibility for most public disability benefits.

Sources:

Internal Revenue Service. n.d. “Internal Revenue Service | an Official Website of the United States Government.” Irs.gov. https://www.irs.gov/

Resource by the CAPTRUST wealth planning team

Important Disclosure

This content is provided for informational purposes only, and does not constitute an offer, solicitation, or recommendation to sell or an offer to buy securities, investment products, or investment advisory services. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness, or reliability cannot be guaranteed. Nothing contained herein constitutes financial, legal, tax, or other advice. Consult your tax and legal professional for details on your situation. Investment advisory services offered by CapFinancial Partners, LLC (“CAPTRUST” or “CAPTRUST Financial Advisors”), an investment advisor registered under The Investment Advisers Act of 1940.

As nonprofit governance practices and policies have evolved, the adoption of board member term limits has varied widely among different organizations, sectors, and regions. However, in general, the percentage of nonprofits that utilize term limits has increased over time, according to BoardSource data. Although term limits can create challenges around succession planning and annual turnover, they can also be a helpful tool for improving board performance, increasing board diversity, and attracting new board members.

CAPTRUST’s 2025 Endowment & Foundation Survey showed that 66 percent of surveyed nonprofits have formal board member term limits in place. Almost half (40 percent) of the larger nonprofits with more assets ($100 million dollars or more) reported term limits of four years or longer and a high percentage of investment committee members that stick around.

According to a Leading with Intent study, the most common nonprofit term limit structure is two three-year terms. Many boards allow former members to rejoin after a one-year sabbatical.

Here, it’s worth noting that nonprofit governance practices, including board member term limits, are subject to the laws and regulations of the jurisdiction in which the nonprofit operates. Some states have regulations or guidelines regarding term limits for nonprofit boards, while others leave term limit policies to the discretion of the organization.

Limits Foster Strength

How do board members feel about term limits? “In one word, I’d say they feel relieved,” says Eric Bailey, endowment and foundation practice leader at CAPTRUST. “Of course, we all want to give our time and talents to make a positive difference in the world, but I don’t know of anyone who wants to be a permanent volunteer on a nonprofit board.”

By creating a sense of urgency and accountability, term limits often improve board performance and can reduce organizational anxieties about leadership turnover. “Almost everyone works better when they’re working under a deadline,” says CAPTRUST Principal and Financial Advisor Bill Altavilla. “When board members know their tenure will be limited, they may be more motivated to optimize their time, instead of letting responsibilities linger.”

This is something Altavilla has experienced firsthand, both as a financial advisor to endowments and foundations and as a board member of multiple nonprofit organizations. Altavilla says boards are sometimes concerned that term limits will disrupt established relationships and group dynamics. “And that’s true, of course, but usually term limits disrupt things in a good way,” he says.

“What I’ve seen is that when term limits do hit, the board is usually reinvigorated and refreshed,” says Altavilla. “People get excited, and they remember that change is good because it brings new perspectives and approaches.”

While continuity has its benefits, boards grow stronger not despite turnover but because of it, as new members infuse fresh energy, ideas, and perspectives. Term limits also offer a healthy way for the organization to rid itself of existing board members who are inactive, ineffectual, or misaligned.

For instance, Altavilla says, “I’ve seen a few cases in which the organization has given a board seat to a major donor but later realized the person was inhibiting their progress or was detrimental to the culture of the group. If there are no term limits in place and this person is donating a large amount of money, the board can feel indebted and therefore obligated to keep them involved. But when you have a normalized process in place with defined term limits, you can rely on the natural course of action to create predictable turnover.”

Term limits can also be used to increase board diversity. In fact, one study published in the Alabama Law Review showed a strongly negative correlation between incumbency and board diversity, suggesting that—even without a board member matrix or developed pipeline of diverse board members—term limits stimulate board diversity by opening the door to new talent. This can help prevent stagnation and ensure that the board is better able to represent the communities the nonprofit serves.

Turnover and Recruitment

Of course, term limits also pose challenges, especially when it comes to recruitment. Firm limits mean current board members must commit continued time and attention to recruitment efforts and succession planning. “Recruiting nonprofit board members is difficult, even in the best of times,” says Bailey.

Yet there is evidence that term limits can make it easier to attract new board members, since people are more likely to consider serving when they know the commitment will be limited. “There’s only so much energy you can give to an organization before you know you’re ready to move on,” says Bailey. “Typically, what board members want is to get involved, add some value, then rotate off at predictable intervals, leaving them with the time and energy to explore new endeavors.” In other words, for most board members, term limits are both appreciated and embraced.

Best practices suggest that boards should turn over no more than one-third of their board seats each year. Bailey and Altavilla say things are typically more complicated. “Term limits are wonderful when everything is operating normally,” Bailey says. “But if a quarter of your board is due to roll off because of term limits and then another quarter of the board members quit, either because of leadership or their jobs or just sheer coincidence, that’s a serious challenge. We saw this frequently during the pandemic.”

Altavilla agrees. He says one of the boards he serves on is now facing a similar dilemma. “Four of us came on the board all in one year,” he says. “And that’s the majority of our board. Now, we’re all supposed to roll off at the same time.” But this could create a tremendous lack of continuity and a gap in leadership for the organization.

To solve the problem, the organization passed a resolution offering these four board members the option to remain on the board for two additional years. Two members accepted the offer. “This at least buys us a little time to find and integrate qualified replacements,” says Altavilla. It’s not an ideal solution, he says, but recruiting candidates for unpaid board roles feels exceptionally difficult right now.

And finding volunteers who are interested in leadership is an even bigger challenge. “Lots of people want to participate on a board but don’t want to be in a leadership position,” Altavilla says. “So many boards end up playing musical chairs within their executive committees. Year after year, the same three or four people take turns being secretary, treasurer, vice chair, and chair.”

This leadership succession problem shows the challenge and complexity of selecting the right term length and limits. “If board terms are too short, new members won’t have enough time to grow into leadership positions,” says Bailey. “You want to make sure you can vet people appropriately and give them the chance to vet the organization. Otherwise, you basically need to tap someone immediately after they join the board and get them in the pipeline to become the board chair.”

Implementing or Revising Policies?

For endowment and foundation board members who are implementing term limits or revising their term limit policies, there are several considerations to keep in mind. First, it’s important to establish a clear and transparent process for implementation. Usually, this means amending the organization’s bylaws or governance policies to outline board term limits, name the specific criteria for reappointment, and define the process for succession planning. Next, be sure to clearly communicate the rationale for all term limit decisions.

Finally, it’s important to regularly evaluate how effective the organization’s term limit policies have been and adjust as necessary. As a best practice, boards should reevaluate their bylaws and term limits at least every five to seven years, or each time they address their strategic plans. “This helps ensure that board governance policies are working in alignment with the nonprofit’s strategic goals,” Altavilla says. It’s also a good idea to monitor the impact of term limits on board performance, diversity, and overall governance.

By implementing term limits thoughtfully and strategically, nonprofit leaders can harness the potential benefits of term limits while mitigating the potential downsides, leading to improved board performance and organizational effectiveness. In this way, board term limits can be a good governance tool to help the organization achieve its mission and demonstrate its values.

Allowances

An allowance gives children a taste of financial independence. It empowers them to save, budget, and plan for their goals and desires. How much to give depends on family values and the household budget. Parents should also decide which expenses allowances will cover and how much should be set aside for savings.

There are several approaches to allowances:

- No strings attached. Give a set amount regularly without requiring chores.

- Chore-based allowance. Tie the allowance to household responsibilities.

- A hybrid model. Provide a base allowance and offer opportunities to earn extra by completing tasks beyond normal duties.

If you choose to give your child an allowance, keep these three tips in mind.

- Set clear parameters. Discuss what the allowance can be spent on and how much should go toward savings.

- Establish a schedule. Pay the same amount on the same day each week to build consistency.

- Teach goal-setting. Help your child create short- and long-term savings goals, such as buying a toy or saving for a special outing.

- Plan for raises. Reward responsible money management with occasional increases.

Opening a Bank Account

A child’s first bank account is an excellent way to introduce the concept of saving. It provides a hands-on lesson in how a savings account works and gives children the satisfaction of making deposits and watching their money grow.

Many banks and credit unions offer kid-friendly programs with activities and incentives to teach financial basics.

Beyond opening the account, parents can reinforce good saving habits by showing children the power of compounding—how deposits earn free money over time. Additionally, offering matching contributions toward a long-term goal can further motivate consistent saving. It’s also important to allow occasional withdrawals; young children may lose interest if the money only goes in and never comes out.

Saving for Financial Goals

Getting children excited about saving for financial goals can be challenging, especially when money from birthdays, holidays, or milestones feels like it should be spent immediately. The value of saving for the future isn’t always obvious, so parents play a key role in making it engaging and actionable.

Let children set reasonable goals. This creates a sense of ownership and incentive to save. Encouraging bucketing, where money is divided into portions for saving, charity, and savings is an example of this approach. Make the plan actionable by writing down the goal and the amount that must be saved during each period. This distinction between short-term and long-term goals helps children understand the process. Visualization also matters. Taping a picture of the goal to a savings jar or to regularly scheduled deposits can strengthen the connection between saving and achieving the goal. Three other tips include:

- Celebrate small wins. Young children often lose interest in long-term goals, so keep objectives short—just a few weeks at most.

- Teach through experience. Don’t rescue your children from disappointment. Missing a goal can be a powerful lesson in planning and discipline.

- Build gradually. Saving is an iterative process, nourished by achieving small milestones over time.

Raising Savvy Consumers

Commercials, peer pressure, and advertising are designed to influence behavior. Children are naturally tempted to spend, and learning to make wise purchasing decisions takes time and guidance. To help them grow into savvy savers and consumers:

- Explain why you say no. Use shopping trips as teachable moments by discussing why certain purchases aren’t allowed.

- Create a wish list. Encourage your child to try an item in the store and then add it to a birthday or holiday list.

- Plan a monthly shopping day. Designate one day each month for shopping together. This approach promotes saving for meaningful purchases rather than impulsive spending.

Build Financial Confidence for Life

Teaching your children about money is one of the most valuable investments you can make in their future. Start small, stay consistent, and turn everyday moments into lessons that last a lifetime. If you’d like more ideas for building financial confidence at home, a CAPTRUST advisor can help.

Resource by the CAPTRUST wealth planning team

Important Disclosure

This content is provided for informational purposes only, and does not constitute an offer, solicitation, or recommendation to sell or an offer to buy securities, investment products, or investment advisory services. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness, or reliability cannot be guaranteed. Nothing contained herein constitutes financial, legal, tax, or other advice. Consult your tax and legal professional for details on your situation. Investment advisory services offered by CapFinancial Partners, LLC (“CAPTRUST” or “CAPTRUST Financial Advisors”), an investment advisor registered under The Investment Advisers Act of 1940.