Before You Begin

Before diving into investment options and strategies, take a moment to assess your current financial situation. Start by gathering all your banking and investing statements from the last 12 months, as well as any other financial documents, such as paystubs, tax returns, and an estimated expenses breakdown.

Ask yourself:

- Do you have high-interest debt?

- Is your current cash flow allowing you to save or invest consistently?

- Do you have an emergency fund?

Analyzing your income and expenses will help you understand your cash flow and identify opportunities to invest. These foundational steps matter because investing works best when you’re not constantly pulling money out of your accounts to cover unexpected expenses.

Once your financial base is stable, you’re ready to consider how investing fits into your broader goals.

Saving vs. Investing

Most of us were taught early on to save a portion of what we earn for a rainy day, a treat, or a future purchase. But as we get older, we realize that saving alone often isn’t enough. The math doesn’t lie: if we don’t put those savings to work, we may fall short of major life goals like buying a home or retiring comfortably.

That’s where investing comes in. Saving isn’t just about safety and liquidity, and investing isn’t only about growth and long-term potential. Saving is the act of setting money aside (that is, not spending it). Investing, however, can include assets that are safe and liquid as well as those with long-term growth potential but inherently more risk. Both approaches allow you to put your money to work, but they offer different strategies to help you reach your goals.

Next Steps

The first step in investment planning is determining your goals and understanding the time it may take to achieve them. Your goals give your plan a direction. Why are you investing? Is it for a down payment on a home? Funding a child’s education? Retiring at a certain age? Creating financial independence?

Your goals also help determine how much you need to save and how aggressively you should invest. Once your goals are clear, consider your time horizon.

- Short-term goals (1–3 years) call for safer, more liquid investments.

- Intermediate-term goals (3–10 years) typically allow for moderate risk.

- Long-term goals (10+ years) give you the most flexibility to invest in growth-oriented assets like stocks but also involve higher risk.

Understanding the Impact of Time

Time is one of the most powerful tools in investing. The earlier you start, the more opportunity your money has to grow. Compound interest means your earnings generate their own earnings, typically creating a snowball effect over the years.

For example, suppose you invest $10,000 in an account that earns 7 percent interest annually, compounded once per year.

- In year one, you earn $700 in interest, bringing your account total to $10,700.

- In year two, you earn 7 percent on the new balance of $10,700, adding $749 for a total of $11,449.

- In year three, your interest is calculated on the new balance of $11,449, resulting in $801.43 of interest and a new balance of $12,250.43.

This process continues, with each year’s interest calculated based on a larger amount than the year before. Over time, this compounding effect significantly accelerates your investment growth, especially if you leave the money untouched for many years.

Boosting Growth with Contributions

Allowing your principal amount to compound while continuing to add funds to the account creates even greater growth potential. For example, if you start with the same $10,000 at 7 percent annual interest—but also contribute an extra $1,000 per year—your balance after three years would be $15,690.37, a $3,439.94 difference!

Waiting to invest, even for just a few years, can significantly reduce your long-term growth potential. Starting small and starting now is often better than waiting. Remember, even modest, regular contributions add up over time, thanks to the power of compounding.

Stay Engaged and Consider Help from an Expert

You could choose to manage your investments on your own, assuming you have the skill, will, and time to do so. There are countless educational resources available, and many people enjoy learning about investing independently.

But even professional athletes have coaches. Having a trusted advisor by your side can make the process smoother and more effective. Working with an advisor doesn’t mean giving up control. It means gaining a partner who’s invested in your success. Financial advisors bring experience, objectivity, and strategy to the table. They help you avoid common pitfalls, stay focused during market volatility, and tailor your plan to your unique situation. They can also challenge your thinking and help you see opportunities you might miss on your own.

Investment planning isn’t a one-time event either. Life changes, markets shift, and over time, your needs and goals will evolve. Regularly reviewing your progress ensures that your plan stays aligned with your needs. Whether you’re adjusting contributions, rebalancing your portfolio, or revisiting your goals, staying engaged is key.

Getting started with investing doesn’t require perfection. It requires intention. With a stable foundation, clear goals, and the right support, you can build a plan that grows with you. The journey may seem complex at first, but you don’t have to walk it alone.

Your future self will thank you.

Resource by the CAPTRUST wealth planning team

This material is not individual investment advice. If you have questions or concerns regarding your own individual needs, please contact a CAPTRUST representative for further assistance. This material does not constitute legal, accounting, or tax advice. This material has been prepared solely for informational purposes. Investment advisory services offered by CapFinancial Partners, LLC (“CAPTRUST” or “CAPTRUST Financial Advisors”), an investment advisor registered under The Investment Advisors Act of 1940.

What is a 401(k) Retirement Plan?

A 401(k) plan is a retirement savings account that is offered by your employer. You cannot open a 401k on your own; you must work for a company that offers this type of plan. Because the plan is provided through your workplace, contributions are made via payroll deduction.

Having contributions go directly into your 401(k) plan makes it easier to save for retirement before you even cash your paycheck. Although many components are common across 401(k) plans, certain features vary by employer. Be sure to consult your plan’s rules to understand what applies to you.

When Can I Contribute?

Each 401(k) plan specifies when you can begin making contributions. Some plans require up to a year of employment, while others allow contributions with your first paycheck. To boost employee participation, many employers offer automatic enrollment once you become eligible.

If you are automatically enrolled, it’s important to review your default contribution rate and investment selections to ensure they align with your financial goals and personal circumstances.

What Are the Income Tax Consequences of Contributing to a 401(k) Plan?

The two most common ways to contribute to a 401(k) are on a pre-tax or after-tax (Roth) basis. Contributing on a pre-tax basis means that your contributions are deducted from your paycheck and deposited into your 401(k) before federal—and most state—income taxes are calculated. By contributing to your 401(k) plan on a pre-tax basis, you will pay less taxes than if you did not contribute. In addition to not paying income taxes on the amount you contribute, any investment gains that you earn on your contributions would also not be taxable until you take distributions from the plan.

For example, Taylor earns $65,000 annually and contributes $5,000 to her employer’s 401(k) plan on a pre-tax basis. Because of Taylor’s contribution, her taxable income is reduced to $60,000. She will not pay taxes on the $5,000 contribution, or any investment earnings, until she withdraws money from the plan.

Most 401(k) plans now allow after-tax contributions, or what is known as Roth contributions. Unlike pre-tax contributions, Roth 401(k) contributions are made on an after-tax basis, just like Roth IRA (individual retirement account) contributions. This means you receive no immediate tax break. Your contributions are taken from your paycheck and deposited into the plan after taxes are applied. However, because you already paid taxes on this type of contribution, qualified Roth 401(k) distributions are tax-free when you withdraw them.

For example, Jeremy earns $65,000 annually. He contributes $5,000 to his employer’s 401(k) plan on an after-tax basis. Because these are Roth contributions, Jeremy’s taxable income remains $65,000. However, if his withdrawals qualify under IRS rules, his Roth 401(k) contributions and all investment earnings on those contributions will be income tax-free when distributed. A Roth 401(k) distribution is considered qualified if it meets specific requirements, typically including a five-year holding period and occurring after age 59½, or due to disability or death.

The five-year waiting period for qualified Roth 401(k) withdrawals begins on January 1 of the year you make your first Roth contribution. For instance, if your first Roth contribution is made in December 2026, the waiting period starts on January 1, 2026, and ends on December 31, 2030. This means you could take a qualified distribution starting January 1, 2031, assuming you meet the age and other qualifying conditions.

Withdrawals from pre-tax accounts before age 59½, as well as nonqualified withdrawals from Roth accounts, are generally subject to regular income tax and a 10 percent penalty—unless an exception applies.

2025 401(k) Contribution Limits

Under age 50:

- You may contribute up to $23,500 to your 401(k).

- Combined employer and employee contributions cannot exceed $70,000.

Ages 50 through 59 and over 64:

- You are eligible for a catch-up contribution of $7,500.

- Your total individual contribution limit is $31,000.

Ages 60 through 63:

- You are eligible for a higher catch-up contribution limit of $11,250.

- Your total individual contribution limit is $34,750

Starting in 2026, workers who are over 50 and earn more than $145,000 will automatically have their catch-up contributions made on an after-tax (Roth) basis.

Whether you contribute to your 401(k) on a pre-tax or Roth basis, the total contribution limits are the same. However, you are allowed to split your contributions between pre-tax and Roth contributions in any proportion you choose.

Keep in mind that if you have more than one job and contribute to another employer’s 401(k), 403(b), SIMPLE, or SAR-SEP plan, your combined contributions—both pre-tax and Roth—cannot exceed the annual limit for your age group. If you participate in more than one employer-sponsored plan, it is your responsibility, not your employer’s, to make sure you don’t exceed these limits.

Can I Also Contribute to an IRA?

Yes. Participating in a 401(k) does not affect your ability to contribute to a traditional IRA. In 2025, you can contribute as much as $7,000 to an IRA ($8,000 if you’re age 50 or older) as long as you have earned income equal to or greater than the amount you contribute.

However, your ability to make deductible contributions to a traditional IRA may be limited if you or your spouse participates in a 401(k) and your modified adjusted gross income (MAGI) exceeds certain thresholds. Similarly, your ability to contribute to a Roth IRA may be restricted if your MAGI exceeds certain levels.

What About Employer Contributions?

Employers are not required to make contributions into 401(k) plans. However, many offer matching contributions to encourage participation and provide an employee benefit. Your employer may choose to match contributions made on a pre-tax basis, on a Roth basis, or both. Some employers match catch-up contributions for those age 50 and older, while others do not.

No matter what match your company may offer, their contributions to your 401(k)—even if they match your Roth contributions—are always made on a pre-tax basis. This means both the contributions and any earnings they may generate will be taxable when you take a distribution from the plan.

A company match is essentially free money, making it a valuable way to grow your retirement savings. Be sure to contribute enough to take full advantage of your employer’s matching contributions.

Should I Make Pre-Tax or Roth Contributions?

Choosing between pre-tax and Roth contributions can feel overwhelming. A simple guideline is this:

- If you expect to be in a higher tax bracket when you retire than you are now, Roth 401(k) contributions may be more appealing. You pay taxes now at a lower rate, and qualified withdrawals in the future are generally tax-free.

- If you expect to be in a lower tax bracket when you retire than you are now, pre-tax contributions may be more appropriate. They reduce your taxable income today, and withdrawals will be taxed later at a lower rate.

Because future tax rates are uncertain, a mix of pre-tax and Roth contributions can provide flexibility for retirement income planning. Other factors to consider include your investment time horizon and projected investment returns.

What Happens If I Terminate Employment?

Before you decide what to do with the money in your 401(k) after leaving your job, review your company’s vesting schedule to determine how much of the balance is yours to keep. Your own contributions and any earnings on them are always 100 percent vested (you always own these). Depending on your company’s vesting schedule and how long you have worked there, you may be partially vested or fully vested in your employer’s matching contributions and associated earnings. The longest vesting schedule allowed is six years.

After you figure out how much money in your 401(k) is yours, you will have some options for what you would like to do with that money.

- Keep your money in your workplace 401(k) plan. Be aware of limitations. Some plans require withdrawals at the plan’s standard retirement age—usually 65. If your vested balance is $5,000 or less, your plan may automatically cash you out.

- Roll over your funds to IRAs. You can move Roth 401(k) dollars to a Roth IRA and non-Roth dollars to a traditional IRA. You may also be able to convert your non-Roth dollars to a Roth IRA, but income taxes will apply to any tax-deferred amounts in the year of conversion.

- Roll over your funds to another employer’s plan if the new plan accepts rollovers.

- Take a cash distribution of your balance. This includes your contributions, earnings, and any vested employer amounts. Keep in mind that any tax-deferred funds will be subject to income tax and may incur a 10 percent penalty tax if you are under age 59½, unless an exception applies.

Note: When deciding whether to roll over your retirement savings to an IRA or another employer’s plan, it’s important to carefully evaluate each option’s investment choices, fees and expenses, available services, rules for penalty-free withdrawals, level of creditor protection, and distribution requirements.

What Else You May Need to Know

If your plan permits loans, you can typically borrow up to 50 percent of your vested 401(k) balance, with a maximum limit of $50,000. These loans are not taxable and are repaid through payroll deductions. In cases of immediate and severe financial need, a hardship withdrawal may be permitted, but this should be a last resort because hardship distributions are usually taxable.

Since 401(k) plans are intended for retirement, taking money out before age 59½ (or 55 in certain cases) could trigger a 10 percent early withdrawal penalty unless you qualify for an exception. Depending on your income, you may also be eligible for a tax credit of up to $1,000 on the amounts you contribute.

Your assets in a 401(k)are generally protected in the event of your or your employer’s bankruptcy. Most plans allow you to choose how your money is invested, typically from a selection of mutual funds offered by your employer. While they provide the choices, it’s up to you to pick the investments that best align with your retirement goals.

Sources:

401(k) plans | Internal Revenue Service

401(k) plan overview | Internal Revenue Service

Individual retirement arrangements (IRAs) | Internal Revenue Service

Roth IRAs | Internal Revenue Service

Resource by the CAPTRUST wealth planning team

This material is not individual investment advice. If you have questions or concerns regarding your own individual needs, please contact a CAPTRUST representative for further assistance. This material does not constitute legal, accounting, or tax advice. This material has been prepared solely for informational purposes. The information and statistics in this content are from sources believed to be reliable but are not guaranteed by CAPTRUST Financial Advisors to be accurate or complete. Investment advisory services offered by CapFinancial Partners, LLC (“CAPTRUST” or “CAPTRUST Financial Advisors”), an investment advisor registered under The Investment Advisors Act of 1940.

Families often establish FLPs for three key reasons:

- To share in business ventures,

- To preserve generational wealth, and

- To take advantage of gift tax-free transfers of assets that allow those assets to grow outside the estate of the first generation.

Ownership within an FLP is divided into two categories:

- General Partners—Manage the daily business activities and bear personal liability for any debts the partnership may accumulate. General partners may pay themselves a management fee if that is written in the partnership agreement.

- Limited Partners—Do not participate in business management and have no influence over investments or other business decisions. Their financial responsibility for partnership debts is limited to the amount of their invested capital. Limited partners’ shares afford them the ability to share in the profits generated by the FLP.

How an FLP is set up depends on the nature of the business and the goal of the family. A family may choose the FLP structure by establishing a family business in which the family members all put in capital to purchase shares of the partnership. The capital can then be used to fund the business venture, with the general partners running the business and the limited partners receiving a share of the profits in exchange for the capital they contributed. All profits are shared with all partners in accordance with the percentage of shares they own.

If effective and efficient wealth transfer is a goal, an FLP can serve as an effective estate planning strategy. Depending on the specifics of your financial situation, it may:

- lower income and transfer tax burdens,

- enable you to pass ownership interests to family members while maintaining control over the business,

- help preserve family ownership across generations, and

- offer liability protection for the limited partner or partners.

This type of FLP structure is typically created by one or more senior family members who contribute existing business and income-generating assets to the partnership in return for both general and limited partnership interests. Portions—or all—of the limited partnership interests are subsequently gifted to younger family members.

Ultimately, the general partner(s) do not have to hold a majority of the partnership interests. In many cases, they may own just 1 or 2 percent, while the majority of the interests belong to the limited partner(s).

Benefits of Structuring a Business as an FLP

Choosing an FLP structure offers several advantages for your business. Individuals can gift shares of the FLP to heirs during their lifetime every year, gift-tax free, up to the annual gift-tax exclusion limit. These shares are often valued below the full fair market value of the underlying assets, because reasonable discounts are allowed for lack of marketability and lack of control. As a result, gifting assets through limited partnership interests, instead of directly transferring the assets, can allow you to move more assets outside your estate, using little to none of your lifetime exemption.

At the time of your death, only the value of your interest in the partnership is counted in your gross estate. All growth on shares gifted during your lifetime occurs outside your estate and is not subject to state or federal estate taxes. Heirs receiving shares of the FLP that are part of your estate receive a step-up in basis at your passing.

Maintaining assets in the family line is also often a concern. FLP partnership agreements can be written in such a way that they restrict the transfer of partnership interests to family members only, or even to specific family members, thereby protecting assets from divorcing spouses, individuals who marry into a family, etc., and thus maintaining continuous family ownership of the business.

Using the partnership structure also enables you to shift some of the business income and future growth in value to other family members while retaining management control over the business. Younger individuals, including children or grandchildren, may pay income taxes at a lower rate than their older family members. Transferring shares of an FLP to those in a lower tax bracket will lower the overall taxes the whole family pays on interest, dividends, income, and capital gains.

As with all financial planning strategies, there are always disadvantages that should be considered. Creating and maintaining an FLP can be costly, requiring legal assistance to set up, plus yearly professional tax compliance and advice. Members can be subject to liabilities in the case of mismanagement. Rules governing FLPs are often complex and therefore require understanding and adherence to take advantage of the benefits.

Your CAPTRUST financial advisor can help you understand more and decide if an FLP is right for you.

Sources:

Understanding the ins and outs of a Family Limited Partnership – Littorno Law Group

Unlocking Tax Savings: Family Limited Partnerships in Estate Planning | American Heart Association

Resource by the CAPTRUST wealth planning team

This article does not constitute legal, accounting, or tax advice. This material has been prepared solely for informational purposes. This article is not individual investment advice. If you have questions or concerns regarding your own individual needs, please contact a CAPTRUST representative for further assistance. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness, or reliability cannot be guaranteed.

On August 7, President Donald Trump signed an executive order directing the Department of Labor (DOL) to reexamine fiduciary duties regarding alternative asset investments in ERISA-governed 401(k) and other defined contribution plans. The order defines alternative assets as private equity, private debt, private real estate, infrastructure, digital assets, or lifetime income investment strategies.

Over the next 180 days, the Secretary of Labor is directed to “clarify” the DOL’s position on alternative assets and the appropriate fiduciary process for offering asset allocation funds that include such investments. Although the directive comes during a time of industry fervor, promotion, and product launches, the form and timing of regulatory guidance remain unclear.

Alternative investments have long been permitted in defined contribution plans; however, their complex and operationally demanding natures have historically limited access for most 401(k) plans. Over the years, the DOL has issued information letters in response to specific fiduciary inquiries, but it has not yet provided comprehensive guidance.

With more than two decades of experience, CAPTRUST provides plan sponsors with due diligence and advice on private market and alternative investments solutions. For more information, please contact your CAPTRUST Financial Advisor.

How Gift and Estate Taxes Affect 529 Plan Contributions

Gifting money or property during your lifetime may trigger federal gift tax—and possibly state gift tax as well. The federal gift tax generally applies when a gift exceeds the annual exclusion amount, which is $19,000 per recipient in 2026. Certain exceptions, such as gifts to your spouse, are not subject to this tax.

If your contributions exceed the annual exclusion, the excess counts against your lifetime gift tax exemption, which is $15 million for individuals and $30 million for married couples, and applies to both lifetime gifts and assets transferred at death.

Keep in mind that states set their own maximum contribution limits for 529 plans, and their estate laws may differ from federal regulations. Confirm your state’s rules before making contributions to avoid unintended tax implications.

529 Plan Contributions as Taxable Gifts

A contribution to a 529 plan is considered a gift from the donor to the account’s beneficiary and therefore qualifies for the annual federal gift tax exclusion.

For example, if you contribute $30,000 to your child’s 529 plan in a single year, you must report the entire $30,000 on federal gift tax return. However, only $11,000 would be taxable because the first $19,000 qualifies for the annual tax exclusion in 2026. You would not owe gift tax until you have used up your lifetime gift tax exemption of $15 million.

Contributing a Lump-Sum

If you would like to contribute more than the annual exclusion amount in a single year, you can use the five-year election, often called the lump-sum rule. This option allows you to contribute up to five times the annual exclusion in a given year ($95,000 in 2026) and elect to spread the gift evenly over five years. By doing so, you can avoid federal gift tax, provided no other gifts are made to the same beneficiary during the five-year period.

If you contribute more than $95,000 ($190,000 for joint gifts) to a beneficiary’s 529 plan in one year, the excess is treated as a gift in the year of contribution and counts toward the lifetime gift tax exemption.

Grandparent Contributions and Generation-Skipping Tax

When a grandparent contributes to a child’s 529 plan, the federal generation-skipping transfer tax (GSTT) may apply. The GSTT is an additional tax on transfers made during life or at your death to someone more than one generation below you, such as a grandchild.

The GSTT exemption ($15,000,000 in 2026) works similarly to the lifetime gift tax exemption. No GSTT will be due until you’ve used up your applicable exclusion amount. Grandparents may also take advantage of the five-year election (lump-sum rule) when making contributions.

What Happens if the 529 Account Owner Dies?

If the owner of a 529 account dies, the account is included in the owner’s estate. The terms of the 529 plan determine who becomes the new account owner. Some states allow the original owner to name a contingent account owner, who assumes all rights upon the owner’s death. In other states, ownership passes to the designated beneficiary.

An important exception applies if the owner elected the five-year rule and dies before the five-year period ends. In that case, the portion of the contribution allocated to years after death is included in the owner’s federal gross estate.

For example, if you contribute $75,000 to a 529 savings plan in year one and elect to spread the gift over five years, but you die in year three, the allocations for the first three years ($15,000 each) are excluded from your estate. However, the remaining $30,000 would be included in your gross estate.

What Happens if the 529 Beneficiary Dies?

If the designated beneficiary of a 529 account dies, the plan’s terms determine who receives the account. Generally, the account owner retains control and may name a new beneficiary or withdraw the funds.

If the owner chooses to withdraw the balance, the earnings portion of the withdrawal is subject to income tax, but no penalty applies when the account is terminated due to the beneficiary’s death.

If the beneficiary dies with a remaining balance, that amount may be included in the beneficiary’s taxable estate.

Sources:

https://www.irs.gov/pub/irs-pdf/p970.pdf

https://www.nolo.com/legal-encyclopedia/529-plans-for-estate-planning.html

Resource written by the CAPTRUST wealth planning team.

Important Disclosure

This content is provided for informational purposes only, and does not constitute an offer, solicitation, or recommendation to sell or an offer to buy securities, investment products, or investment advisory services. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness, or reliability cannot be guaranteed. Nothing contained herein constitutes financial, legal, tax, or other advice. Consult your tax and legal professional for details on your situation. Investment advisory services offered by CapFinancial Partners, LLC (“CAPTRUST” or “CAPTRUST Financial Advisors”), an investment advisor registered under The Investment Advisers Act of 1940.

Forfeitures Cases Proceed with Mixed Results & DOL Weighs In

401(k) plan fiduciaries have been challenged in approximately 65 class action suits alleging that they improperly used participant forfeitures to offset employer contributions rather than pay plan expenses that were eventually paid by plan participants. Forfeitures occur when a plan participant leaves employment before the plan sponsor’s contributions to the participant’s account have vested.

The Internal Revenue Service has previously approved the use of forfeitures to offset employer-matching contributions. So, these cases were initially thought to lack merit. However, there is a valid argument: If a plan document gives fiduciaries discretion to use forfeitures to either favor the employer by offsetting matching contributions or favor the participants by paying plan expenses, not favoring the participants has been argued to be a breach. The Department of Labor (DOL) had not previously addressed the fiduciary aspects of using forfeitures.

Although many of these cases have been dismissed in the early stages, some are proceeding, and one was recently settled. Three cases are on appeal following dismissals at the district court level. In one of the appeals, the DOL has weighed in by filing an amicus brief supporting the defendant plan fiduciaries. An amicus brief is a way for a non-party to offer their view for a court’s consideration. The DOL’s filing was in Hutchins v. HP Inc. (9th Cir. filed 2025; on appeal from C. D. Cal.). In that case, the plan document permitted forfeitures to be used either to pay plan expenses or to offset the employer’s matching contributions. The district court found that the decision of how to use forfeitures was a fiduciary decision. However, the court characterized the plaintiff’s position that forfeitures must be used to pay expenses as a “novel legal theory.” The district court went on to dismiss the case, observing that requiring forfeitures to be used to pay expenses in all cases was too broad to be plausible. It also said that the plaintiff’s position is inconsistent with the “settled understanding of Congress and the Treasury Department.” The disappointed plaintiffs appealed dismissal of their case.

The DOL’s amicus brief supported the defendant fiduciaries, first saying the plaintiff’s position contradicts the decades-long understanding that forfeitures may be used to offset employer contributions rather than defray plan expenses. The DOL went on to say that the plan’s inclusion of a choice of how to use forfeitures was a settlor (plan sponsor) decision, and the fiduciaries’ decision between those proscribed choices could not support a fiduciary breach claim.

Following the Supreme Court’s elimination of Chevron deference, the DOL’s position is non-binding on the court of appeals—or any other court. Even so, the DOL’s position is likely to be frequently referenced in other forfeiture challenge cases. We will report on the results of the appeal.

In other forfeiture cases:

- Rodriguez v. Intuit Inc. (N.D. Cal. 2025) – settled for $2 million.

- Sievert v. Knight-Swift Transportation Holdings, Inc. (D. Ariz. 2025) – dismissed

- Wright v. JPMorgan Chase & Co. (C.D. Cal. 2025) – dismissed

- McWashington v. Nordstrom, Inc. (W.D. Wash. 2025) – dismissed

- Buescher v. North American Lighting, Inc. (C.D. Ill. 2025) – not dismissed

- Kotalik v. UnitedHealth Group Inc. (D. Minn. filed 5.28.2025) – pending

In Wright v. JPMorgan Chase & Co., the plan dictated an order for the use of forfeitures: first, to reduce future contributions of the company, and second, if no future company contributions are anticipated, to pay plan expenses. This language permitted the court to quickly resolve the matter.

Fees and Investment Performance Cases—The Churn Continues

The flow of cases alleging that plan fiduciaries have overpaid for services and retained underperforming funds has continued. Good fiduciary process continues to win the day. In a new twist, plan fiduciaries have been challenged for assessing recordkeeping fees from only the accounts of participants with a balance of more than $5,000.

- Smith v. Recreational Equipment, Inc. (REI) (W.D. Wash. 2025) – REI’s 401(k) plan provides that recordkeeping and administration fees will be charged on an equal per capita basis, and no fees will be assessed from accounts with $5,000 or less. The plan’s fiduciaries have discretion to change the $5,000 threshold. Participants with account balances larger than $5,000 sued alleging that it was a fiduciary breach to use their accounts to subsidize the costs of participants with smaller account balances. This approach allegedly increased $5,000+ account holders’ annual fee from $38 to $78 per participant. The court was unpersuaded and dismissed the case, saying:

- There is no obligation to charge fees equally to all participants, whether on a per capita or pro rata basis. Every method of allocating fees could be described as resulting in some participants subsidizing the costs of others.

- A plan’s fee structure must be solely in the best interest of plan participants and have a rational basis. Disfavoring one class of participants over another does not violate this rule.

- Applying a $5,000 account threshold is akin to charging fees on a pro rata basis, where those with larger account balances pay more. The DOL has acknowledged that both the pro rata and per capita approaches can be reasonable.

- Snyder v. UnitedHealth Group (D. Minn., filed 2021) – Attorney’s fees of $23 million were awarded following the record-breaking $69 million settlement of the suit against United Healthcare for retaining underperforming target date funds. In this case underperforming funds were allegedly retained to curry favor with one of the plan sponsor’s business partners. The class representative, Kim Snyder, was awarded $50,000. Class representatives are usually awarded $5,000-$15,000.

- Khan v. Bd. of Dirs. of Pentegra Defined Contribution Plan (S.D. N.Y. 2025) – Following a jury award of $38.8 million, Pentegra has settled remaining aspects of the case for an additional $9.7 million, bringing the total to $48.5 million. In this case a plan sponsor affiliate was selected and retained as the recordkeeper with no competitive bidding or fee benchmarking over an extended period.

- England v. Denso International America Inc. (6th Cir. 2025) – Appeals court affirmed the lower court’s dismissal because the complaint failed to provide context-specific facts of alleged overpayment for recordkeeping services.

- Waldner v. Natixis Investment Managers (D Mass. 2025) – After a full trial, the court found no fiduciary breach in the plan sponsor’s process or its use of its own funds in its 401(k) plan.

- All investment selections were made through a thoughtful deliberate process and supported by the independent investment consultant.

- The investment lineup included a range of non-proprietary funds.

- The Committee received periodic fiduciary training.

- Although initially not meeting frequently, the committee moved to a cadence of meeting at least three times a year.

- Although the Committee was “not a shining example of prudence,” a breach was not established by the plaintiffs.

DOL: Negative Cryptocurrency Guidance Rescinded; Fiduciary Caution Still Warranted

As previously reported, in 2022 the DOL issued guidance directing plan fiduciaries to exercise “extreme caution” before adding cryptocurrencies to a 401(k) plan’s investment lineup. That guidance also warned that plans offering cryptocurrencies would be likely targets for DOL audits. Under new leadership this year, the DOL rescinded the prior guidance on using cryptocurrencies in 401(k) plans. DOL Compliance Assistance Release No. 2025-01 (5.28.2025).

Importantly, the new guidance did not support or endorse the use of cryptocurrencies in 401(k) plans. We are left with no guidance from the DOL on this issue.

Caution continues to be warranted for 401(k) fiduciaries who are considering cryptocurrency in their 401(k) plans. Some considerations include:

- ERISA mandates that fiduciaries “diversify the investments of the plan so as to minimize the risk of large losses, unless under the circumstances it is clearly prudent not to do so.” This has generally been viewed as prohibiting the use of investments in 401(k) plans that can result in large losses. Cryptocurrency and investments that provide exposure to this asset class, are highly volatile, and have significant uncertainties.

- Most 401(k) plans have diverse participant demographics with widely varied levels of investment knowledge and sophistication. Many individuals may not be suited to thoughtfully evaluate the use of cryptocurrency in their retirement accounts.

- It seems likely that the legal landscape on cryptocurrencies will continue to evolve. It may be appropriate to consider waiting for this area to gel before acting.

- If there is a need for more immediate action, adding a self-directed brokerage window could provide access to cryptocurrency investments while minimizing fiduciary exposure.

Health Insurer’s Alleged Overcharges with “Flip Logic” Approach Revived

A lawsuit was filed against Blue Cross Blue Shield of Michigan (BCBSM) by one of its plan sponsor customers alleging that BCBSM intentionally overpaid out-of-state claims and then systematically recovered the overpayment—while charging the customer a 30 percent fee on the recovered overpayments. When out-of-state charges are incurred in the Blue Cross Blue Shield network, the local insurer, BCBSM in this case, reimburses at the rate negotiated by other state’s Blue Cross Blue Shield affiliate.

According to the complaint, BCBSM would “flip” the out-of-state provider’s status from “in-network” to “out-of-network” and initially reimburse services at the much higher out-of-network rate. Then the “error” would be corrected and the reimbursement reduced to the in-network rate. Internal documents at BCBSM allegedly referred to this arrangement as “flip logic.” Because the plan sponsor self-funded its insurance, it was charged the 30 percent recovery fee.

The U.S. District Court dismissed the case, finding that it was not plausibly alleged that BCBSM was an ERISA fiduciary. On appeal the dismissal was reversed. The appellate court noted that anyone who exercises discretion or control over plan assets is a fiduciary under ERISA. It went on to observe that BCBSM’s overpayments to healthcare providers were an exercise of control over plan assets and found BCBCM to be a plan fiduciary. With respect to BCBSM paying itself 30 percent of recovered overpayment recoveries, the court of appeals acknowledged that there was no discretion in applying the contracted 30 percent recovery rate. However, BCBSM effectively decided how much to reimburse itself by deciding how much to overpay and then recover. Tiara Yachts, Inc. v. Blue Cross Blue Shield of Michigan (6th Cir. 2025) The above is based only on the complaint in the case. With dismissal reversed, the case will go back to the district court for consideration of the facts and allegations of “flip logic.”

Incomplete Email Leaves Employer Responsible for Lapsed $663,000 Life Insurance Payout

Thayne Watson was employed by a company that was acquired. As part of the acquisition, he entered into a voluntary separation agreement. He continued to be paid and was eligible for health and life insurance benefits for 11 months. Under the separation agreement, he was permitted to continue health benefits at the employee rate on a self-pay basis after the 11-month pay continuation period.

Ten months into the pay continuation period he enrolled in the benefit program so he could continue his benefits after the continuation period. He received confirmation of his enrollment, including that he had $663,000 of group term life insurance coverage.

At the end of the pay continuation period, he sent an email to the HR department asking how to pay for his benefits for the next year. In response he received an email from an HR representative that he would receive a bill from ADP, and “benefits remain active during the transition.” Neither Watson nor the HR representative separately mentioned health and life insurance benefits.

Mr. Watson died about a year later, having paid all bills received from ADP. When his wife tried to collect the life insurance proceeds from MetLife, the claim was denied. The life insurance policy had lapsed at the end of the pay continuation period and was not converted to an individual policy.

Ms. Watson sued her husband’s former employer for breach of fiduciary responsibility, alleging that they should have informed him of the need to convert the group term life insurance policy, and at a minimum the HR representative had a duty to be clear that the ADP bills would cover only health insurance and life insurance premiums would be billed by MetLife.

The court sided with Ms. Watson, finding that Mr. Watson had asked about his benefits as a whole and the HR representative was obligated to respond to his inquiry with complete and accurate information, including that his life insurance had to be converted to an individual policy for that benefit to continue. The former employer was ordered to pay Ms. Watson $633,000 ($663,000 reduced by the unpaid premiums that would have been due). Watson v. EMC Corp. (D. Colo. 2025). An appeal of this decision is pending.

Understanding the Family Office

A family office is a dedicated entity or division that manages the financial and personal affairs of a high-net-worth family. It acts as the central hub for investment oversight, wealth preservation, estate planning, family governance, and more. Traditionally, families created separate entities to manage wealth independently of the operating business. Today, many families choose to integrate the family office functions directly into the business structure. Here’s why:

Benefits of Integrating a Family Office within the Business

Streamlined Operations: Integrating a family office into the business streamlines financial management and administration. This alignment reduces redundancy and improves overall efficiency.

Cost Efficiency: Operational synergies often reduce costs. Housing family office functions within the business minimizes administrative overhead related to talent acquisition and managing a separate entity.

Strategic Alignment. Embedding a family office in a business aligns financial strategies with the operating company’s goals and objectives, leading to better decision-making.

Enhanced Governance: Integrating the family office can foster better governance by facilitating communication and collaboration between the business and the family. It can also strengthen family values and preserve the legacy of the business.

Expertise Integration: Incorporating the family office into the business allows access to key employees who understand both the company’s operations and the family’s financial needs.

Integrating a family office structure into your operating business can be a strategic decision that enhances efficiency, governance, and wealth management. However, success requires careful planning, defined objectives, and effective governance.

When executed thoughtfully, this integration creates synergies between the family’s financial affairs and the business, contributing to the long-term success and sustainability of both. By leveraging the strengths of an integrated family office, you can navigate the complexities of wealth preservation and estate planning while fostering a legacy that will endure for generations to come.

A trusted financial advisor can help you determine if a family office structure suits your specific business and family needs.

Key Takeaways

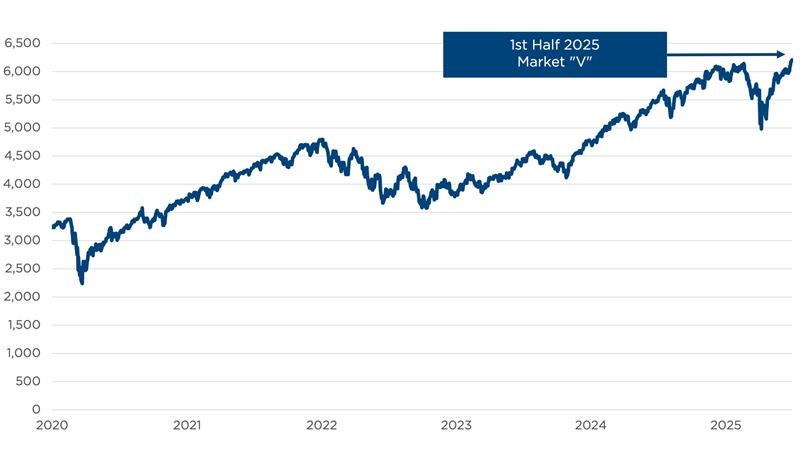

- Markets have been through a full bull-and-bear cycle in just six months.

- Uncertainty narrows investor focus at the exact moment when a long-term perspective likely matters most.

- Long-term returns will hinge on the result of a tug-of-war between two major forces: debt and demographics on one side, and productivity via artificial intelligence (AI) on the other.

Investment Depth Perception

Bifocal lenses have two distinct focal points. One allows the wearer to see clearly things that are near, while the other clarifies vision farther away. Successfully navigating the investment landscape requires a similar, multifocal approach.

The chaos we saw in the first half of 2025 shortened the focal point for all investors. Against a backdrop of heightened policy uncertainty—fiscal, monetary, trade, and geopolitical—it was nearly impossible to maintain a balanced perspective. The result was an S&P 500 Index that experienced a bear market (-20 percent decline) and a bull market (+20 percent increase) all in six months, while ending the first half at an all-time high.

S&P 500 Index Performance

Sources: Bloomberg, CAPTRUST research

Shifting Landscapes

In “Preparing for the Year Ahead,” our 2025 outlook article published in early January, the CAPTRUST Investment Committee described four potential market scenarios investors could face in 2025:

- Optimism fades (projected probability 10 percent)—In this scenario, enthusiasm surrounding the AI value proposition diminishes.

- Extreme uncertainty (projected probability 25 percent)—In this scenario, policy uncertainty alters the entire investment landscape.

- More of the same (projected probability 50 percent)—In this, the most likely, scenario, we see a concentrated equity backdrop with inflation remaining above the Federal Reserve’s target range.

- An upside surprise (projected probability 15 percent)—Here, inflation pressures ease and productivity begins to accelerate.

In January, we expected one of these scenarios to come true. But since we wrote that piece, three of the four have become reality, at least temporarily. No wonder the markets are volatile, and investors are losing focus. Here’s what happened.

1. Optimism Fades: A DeepSeek Surprise (January 27 – April 1)

In late January, a China-based AI startup company called DeepSeek shocked the technology community and investors alike by announcing that its AI model, R1, had matched the output of its competitors at a fraction of the cost. This marked a huge jump in the development of large language models.

The market response was immediate and record-breaking, especially for U.S.-based tech giants. On January 27, the Nasdaq Composite lost nearly $1 trillion in value. This included a $590 billion drop in Nvidia’s value alone—the largest single-day market cap loss for any company in U.S. history.

The broader tech sell-off was driven by concerns about the long-term profitability of the massive AI-related capital investments made by the mega-cap tech giants, which are projected to exceed $300 billion in 2025. The reason for the outsized Nvidia impact was that most of these capital expenditure dollars, historically and projected, are going toward computer chips manufactured by Nvidia.

2. Extreme Uncertainty: Negotiation, New Paradigm, Negotiation (April 2 – April 8)

In a late 2024 interview with Bloomberg News, President Trump said, “To me, the most beautiful word in the dictionary is tariff, and it’s my favorite word.” And so, it was no surprise that global trade became an important agenda item in President Trump’s second term.

On February 1, less than two weeks after Inauguration Day, the President signed an executive order imposing tariffs on imports from Mexico, Canada, and China. The political reaction was very loud. However, investors and markets mostly dismissed these early announcements as a negotiation ploy to improve trade conditions for U.S. exporters.

On April 2, he announced a broader package of import duties that shocked investors with both its scale and magnitude. They could no longer dismiss the potential economic impact and were forced to consider a completely new global trading paradigm. Over the next four trading days (April 3 – April 8), the S&P 500 dropped more than 12 percent.

That same week, the yield on the 10-year U.S. Treasury began to surge, and it seemed foreign owners were beginning to liquidate. The President’s office relented, postponing the effective date of these tariffs for 90 days. The decision to pause stabilized Treasury yields while the S&P 500 roared back, rising more than 9.5 percent on April 9. Investors returned to viewing tariffs as a negotiating tool and now realized there was an economic variable that could cause the new administration to pause: 10-year Treasury yields.

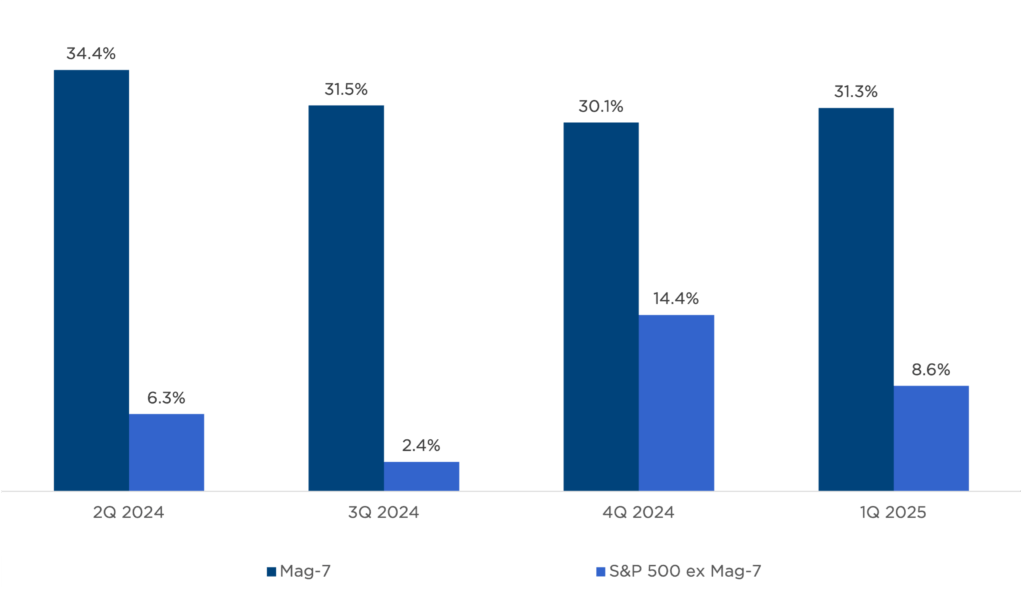

3. More of the Same: Nvidia’s Return (April 9 – Present)

For much of 2023 and 2024, the U.S. equity landscape was dominated by a very small subset of mega-cap securities called the Magnificent Seven (Mag-7), and Nvidia led the pack. Everything appeared to be reversing in early 2025. However, when first-quarter earnings were complete, it was clear that these mega-cap—and AI-driven—growth giants continued to dominate the earnings landscape.

First Quarter 2025 Earnings Growth for the Mag-7 and S&P 500 Excluding the Mag-7

Sources: Factset, CAPTRUST research

Against this backdrop, the Mag 7 surged back to their 2024 leadership position, pulling the S&P 500 to all-time highs. An investor just glancing at their midyear statement would see a +6.2 percent return for the S&P 500 at the halfway point of 2025, with approximately 50 percent of this return coming from Nvidia, Microsoft, and Meta. That person would likely think, “Oh, more of the same.” But the markets went through so many other scenarios to get back to this point.

Market Rewind

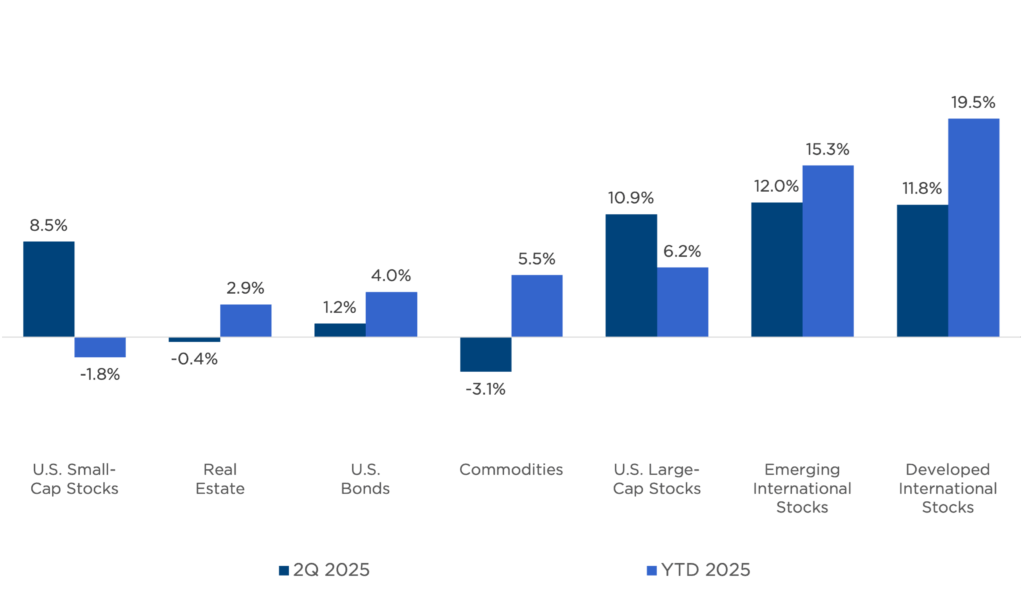

The second-quarter rally lifted most asset classes into positive territory for the year. U.S. small-cap stocks were the exception. Despite a solid 8.5 percent return in the second quarter, the broad benchmark for U.S. small-cap stocks remains negative for 2025, pressured by higher interest rates and interest rate expenses.

Investment grade U.S. bonds have experienced elevated volatility but reached the midway point of 2025 with a 4 percent year-to-date return. Real estate and commodities also delivered low single-digit gains.

Finally, for the second consecutive quarter, foreign equity markets have led the way, benefiting from both improving stock prices and a weakening U.S. dollar. Year to date, nearly half of the foreign equity results have been driven by the weakening U.S. dollar.

Asset Class Performance for the Second Quarter and First Half of 2025

Source: Morningstar Direct; CAPTRUST research. Asset class returns are represented by the following indexes: Bloomberg U.S. Aggregate Bond Index (U.S. bonds), S&P 500 Index (U.S. large-cap stocks), Russell 2000® (U.S. small-cap stocks), MSCI EAFE Index (international developed market stocks), MSCI Emerging Market Index (emerging market stocks), Dow Jones U.S. Real Estate Index (real estate), and Bloomberg Commodity Index (commodities).

2025 Outlook Revisited

If the CAPTRUST Investment Committee were rewriting its 2025 outlook at this midway point, it would look very similar in both possibilities and probabilities.

- The AI hype has returned, making the markets potentially vulnerable to unrealistic expectations (scenario 1).

- Policy uncertainty remains elevated, with little clarity on ultimate trade, fiscal, or monetary policies (scenario 2).

- Unless there is some significant disruption, the Mag 7 tech leaders will likely continue to have broad support (scenario 3) while investors wait for AI to enhance productivity and drive the next phase of global economic growth (scenario 4).

A Balanced Perspective

Against this unsettled backdrop, investors would do well to wear their bifocal glasses and maintain a balanced perspective—aware of things both near and far.

The volume of daily distractions for investors continues to accelerate, exposing them to the rampant dangers of emotion-based reactions. Despite the last two quarters’ extreme volatility, pulling money out of the market would likely have been extremely punitive in the first half of 2025.

Our advice? When reading the daily headlines, remember this: Approximately 85 percent of the value of a healthy, perpetually growing company (i.e., the S&P 500) is derived from earnings that are more than five years in the future. Then ask yourself, what is the likely duration of today’s biggest headline?

Ultimately, the two opposing forces that will drive investment returns over the next decade are debt and demographics on one side, with productivity and artificial intelligence on the other. Monitoring the ongoing progress on these two fronts will have long-term value implications. Nearly everything else will likely be short-term noise.

Index Definitions

Indexes are unmanaged, do not incur management fees, costs, and expenses, and cannot be invested in directly.

S&P 500® Index: Measures the performance of 500 leading publicly traded U.S. companies from a broad range of industries. It is a float-adjusted market-capitalization weighted index.

Russell 2000® Index: Measures the performance of the 2,000 smallest companies in the Russell 3000® Index. It is a market-capitalization weighted index.

MSCI EAFE Index: Measures the performance of the large- and mid-cap equity market across 21 developed markets around the world, excluding the U.S. and Canada. It is a free float-adjusted market-capitalization weighted index.

Bloomberg U.S. Intermediate Govt/Credit Bond Index: Measures the performance of the non-securitized component of the US Aggregate Index. It includes investment-grade, US Dollar-Denominated, fixed-rate Treasuries, government-related corporate securities. It is a market-value weighted index

This long-awaited letter ended with an admonition: “Our residence halls are already full. Attached is a list of off-campus housing we suggest for first-year students.”

Gardener dreamed of living in New York City since she’d first learned about Dorothy Parker’s Algonquin Round Table lunches of the 1920s. Nearly every day, Parker joined other writers, critics, and actors at the Algonquin hotel for food, barbed humor, and sophisticated takes on life.

It formed Gardener’s image of—and yearning for—New York. For her, it was home to the witty, the fashionable, and the egg cream, whatever that was. She couldn’t wait to find out.

But her acceptance letter to NYU ended up in a drawer, never to be answered. “Maybe if there had been a residence hall to live in, I’d have taken the chance,” says Gardener. “But just to be out there in New York on my own? It suddenly felt too scary.”

Gardener attended nearby Michigan State University instead, where she won a scholarship to study in London for a summer, graduated with honors, and, incidentally, met her husband.

Still, Gardener says she has always regretted not going to school in New York.

Where Does Regret Come From?

Regret is the heavy feeling we get when we picture how things might have been if we’d made different life choices. When the feeling arises, research shows that two specific areas—the amygdala and the medial orbitofrontal cortex—are activated in the brain. This same brain activity also shows up in animals, who need to experience regret for survival.

While these pangs of conscience can affect us physically, causing symptoms like muscle tension, headaches, and even a weakened immune system, they also can be a healthy part of self-learning and growth, helping people move on from poor decisions.

What Do We Regret Most?

Dr. Shoshana Ungerleider is an internal medicine physician, host of the podcast Before We Go, and founder of the nonprofit End Well, which strives to reshape negative attitudes toward death and dying.

Over the years, Dr. Ungerleider has heard the deathbed regrets of several patients. These regrets seem to have two common themes: being afraid to take chances and focusing on the wrong things. Specifically, she lists them as:

- not spending enough time with loved ones;

- working too much;

- letting fear control decision-making and risk-taking; and

- focusing too much on the future instead of enjoying the present.

No Regrets

What about people who aren’t bothered by these kinds of feelings and claim to live without remorse? These are the folks who may proudly sport bumper stickers, t-shirts, even the occasional tattoo proclaiming “No Regrets.”

For people who have experienced injury to their medial orbitofrontal cortex, this may be true. Damage to that area of the brain can make it impossible to feel regret. But aside from having a brain injury, is it possible to live a life without remorse?

Dr. Ungerleider says that those who claim to live without regrets are usually expressing a desire to feel at peace with their choices. But this attitude can sometimes prevent people from engaging in meaningful self-reflection and personal growth.

“As someone who has worked with patients at the end of life, I’ve come to realize that the notion of living with no regrets is often an oversimplification of the complex human experience,” says Dr. Ungerleider. “While it’s admirable to strive for a life well lived, the reality is that regrets are a natural part of our journey.”

Acknowledging that we have regrets doesn’t diminish how we have lived, she says. “Instead, it can lead to profound moments of insight, reconciliation, and even personal transformation.”

Living with Regret

Self-compassion is a great way to begin to embrace regret. Instead of rehashing your mistakes, acknowledge that you did the best you could with the knowledge and resources you had at the time, says Dr. Ungerleider. “Treating yourself with kindness can shift the narrative from blame to understanding, allowing those painful moments to feel less overwhelming.”

Also, try to live in the present. When you dwell on past decisions, you are sending electricity to your medial orbitofrontal cortex. Do this often enough, and you create a well-traveled electrical pathway that can make you feel stuck or like you’re not in control of your thoughts. Instead, look forward to the choices ahead of you, which can be guided by what you’ve learned so far.

“It’s never too late to learn from regrets, no matter how old we are,” says Dr. Ungerleider. “Middle age and beyond offer a unique opportunity to reflect on past experiences with greater wisdom.

“While we can’t change the past, we can change how we respond to it, finding ways to reframe regrets and use them as a catalyst for growth,” she says. “What matters is how we interpret and integrate those experiences into the story of our lives, allowing us to embrace both the paths we’ve taken and the ones we haven’t.”

By Karen Sommerfeld

For more than a decade, Karen Sommerfeld has written content for the finance industry. She’s drawn to the behaviors and emotions around money. Karen joined CAPTRUST in the spring of 2024 as a marketing specialist. E.B. White inspired her retirement dream, which is to run a farm animal sanctuary.

Over the years, through regulation changes and plan design mandates, the three predominant types of defined contribution retirement plans—403(b), 401(k), and 457(b)—have grown more similar.

However, a number of key distinctions remain.

Understanding the nuances between these plan types can be daunting. But for those plan sponsors with a choice, like private tax-exempt 501(c)(3) charitable organizations, digging into the differences may help clarify which plan type, or combination of plan types, to offer. Below are the most significant distinctions among the three types of plans, in order of importance.

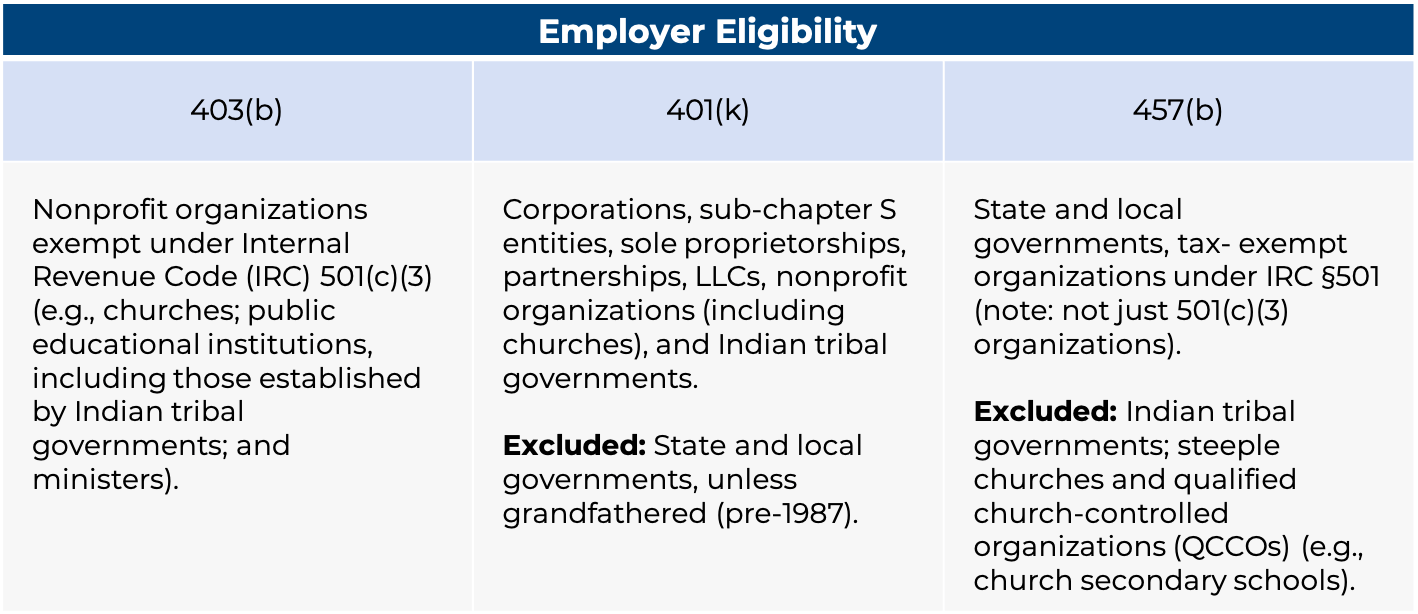

Employer Eligibility

One of the primary differences is the type of employer eligible to sponsor a particular type of plan. For example, state and local governments, public colleges, and universities may not offer a 401(k) plan unless their state maintained a 401(k) plan that was established before 1987.

Likewise, private tax-exempt organizations that are not 501(c)(3) educational or charitable organizations, such as associations and clubs, may not maintain a 403(b) plan. And while public and private colleges and universities may maintain a 457(b) plan, the rules governing these plans vary widely depending on employer type.

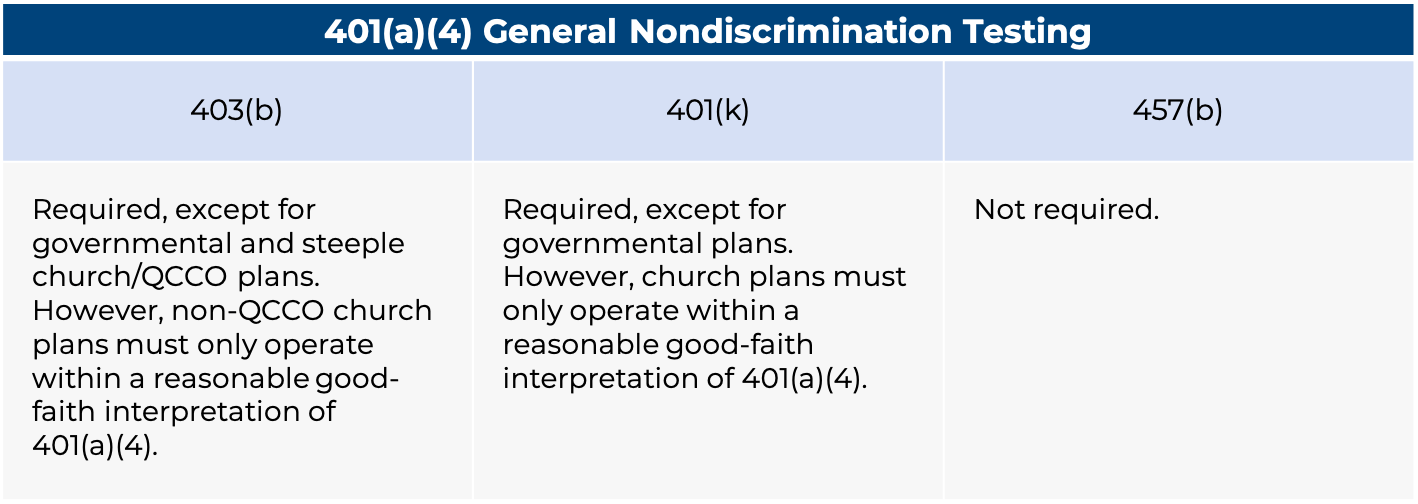

Nondiscrimination Testing

Nondiscrimination testing in 401(k) plans requires that highly compensated employees (HCEs), defined in 2025 as those earning more than $155,000 in 2024, stay within a specific contribution rate determined by the average contribution rate of non-highly compensated employees (NHCEs).

This testing is one of the key reasons why many private tax-exempt 501(c)(3) charitable entities, such as hospitals and colleges and universities, continue to use 403(b) plans instead of 401(k) plans. For 403(b) plans, it is unnecessary to test salary-deferred employee contributions. As a result, these HCEs have no additional limitations imposed on their ability to save other than the overall IRS 402(g) restrictions.

For example, in a typical private 501(c)(3) tax-exempt organization, unmatched elective deferrals for NHCEs average 2 percent (this average includes individuals not deferring anything). At this level, HCEs in a 401(k) plan are limited to approximately 5 percent of pay rather than the 2025 IRS limit of 100 percent of pay up to $23,500 per year (or $31,000 if age 50 or older, $34,750 if age 60-63). Thus, these higher-compensated plan participants face significantly restricted deferral limits, which are otherwise moot in a 403(b) plan.

A 457(b) plan presents the opposite problem for private tax-exempt entities. A 457(b) plan, sponsored by a private college or university that is not a 414(e) religious organization, is of limited use, since these top-hat plans are required to discriminate in favor of HCEs. Thus, they do not serve as the primary retirement plan for these organizations but are instead used as a supplemental plan for select groups of management employees.

An advantage of 457(b) plans is that employer contributions of any type can be discriminatory, whereas in 401(k) and 403(b) plans, employer contributions must be tested for nondiscrimination (with the exception of certain organization types exempt from testing).

Nondiscrimination testing is not a consideration for certain types of organizations. For example, governmental plans, such as those sponsored by public universities, are not subject to nondiscrimination testing, and 457(b) plans can be offered to all employees at these organizations.

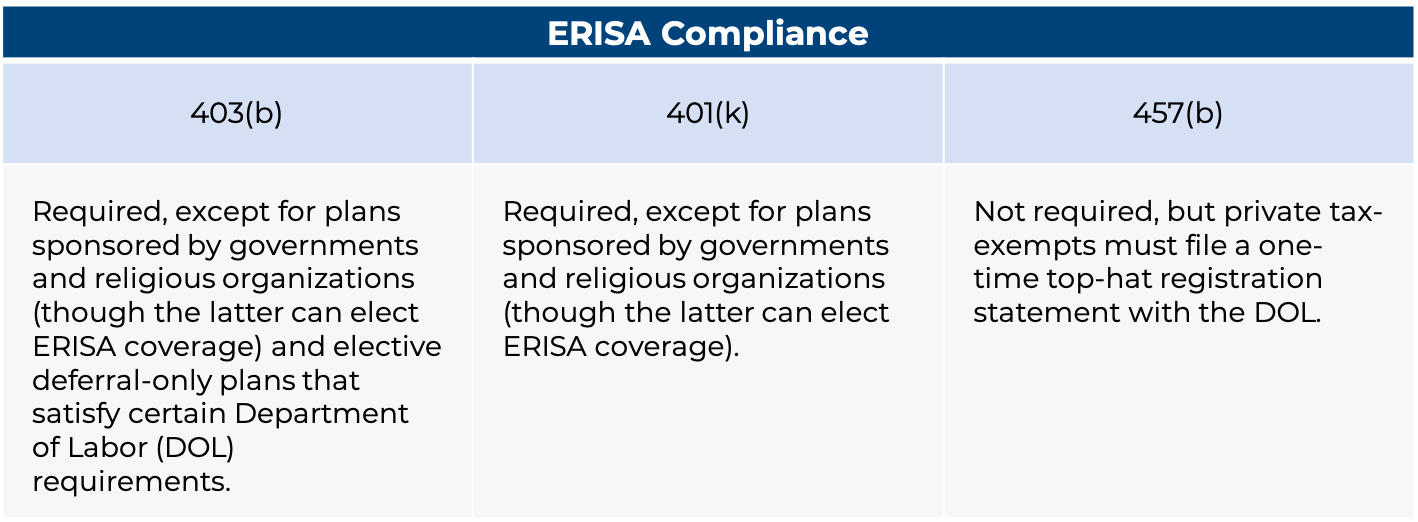

ERISA Coverage

Another defining feature of 403(b) and 457(b) plans is that elective deferral-only plans of private 501(c)(3) charitable organizations are generally exempt from the Employee Retirement Income Security Act (ERISA). While this is uncommon among 403(b) plans, ERISA exemptions are not a possibility for 401(k) plans. Note, however, that public entities and churches are not subject to ERISA, regardless of plan type; churches may elect ERISA coverage, but it is rare.

Private education employer 457(b) plans are technically subject to ERISA, but a single top-hat filing with the government essentially exempts the plan from ERISA requirements.

For 403(b) plans to be exempt, plan sponsors must only permit elective deferrals (no employer contributions) and satisfy several other requirements that generally restrict employer involvement in the plan. This exemption means that for these plans, no summary plan descriptions are required, no annual Form 5500s or summary annual reports are required to be filed and distributed, and an annual audit is unnecessary—the audit alone can be a significant cost factor as well as an administrative burden. While the 403(b) exemption is not as attractive as it once was due to new regulatory requirements, the ERISA exemption remains an important option for 403(b) and 457(b) plans, one that is unavailable in the 401(k) world.

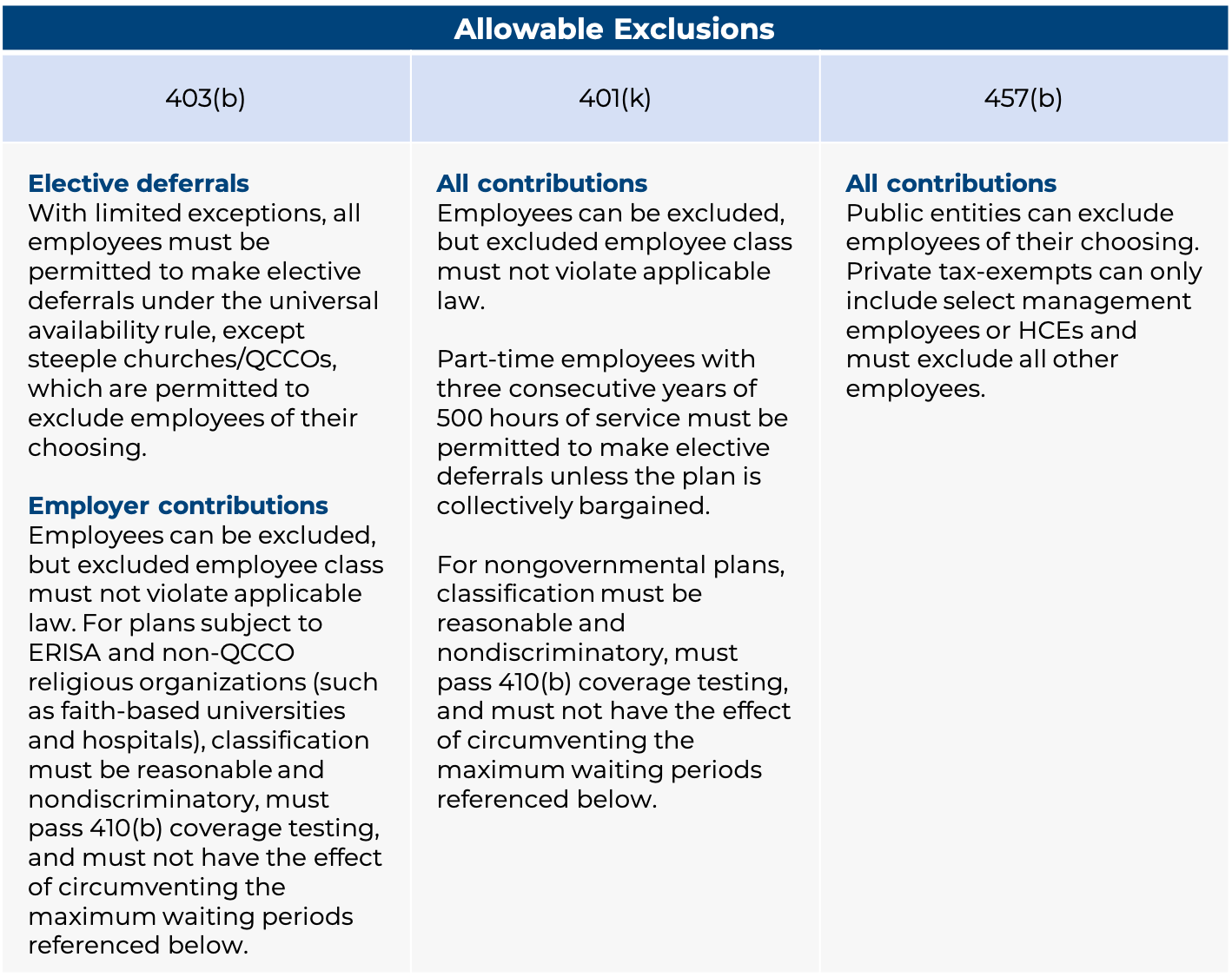

Universal Availability

The universal availability requirement is unique to 403(b) plans. Universal availability requires that all employees, with limited exceptions, be permitted to make elective deferrals from the date of hire. This contrasts with 401(k) plans, for which eligibility to make elective deferrals can be restricted, subject to nondiscrimination testing requirements. It is important to note that the recently enacted Setting Every Community Up for Retirement Enhancement (SECURE) Act now requires the inclusion of certain part-time employees in these 401(k) plans.

Public 457(b) plans have no eligibility requirements, meaning that plan sponsors can allow all or any employees of their choosing to participate. As previously noted, private tax-exempt 457(b) plans can only permit select management and HCEs to participate. Additionally, independent contractors are permitted to participate in 457(b) plans, but not in 401(k) or 403(b) plans.

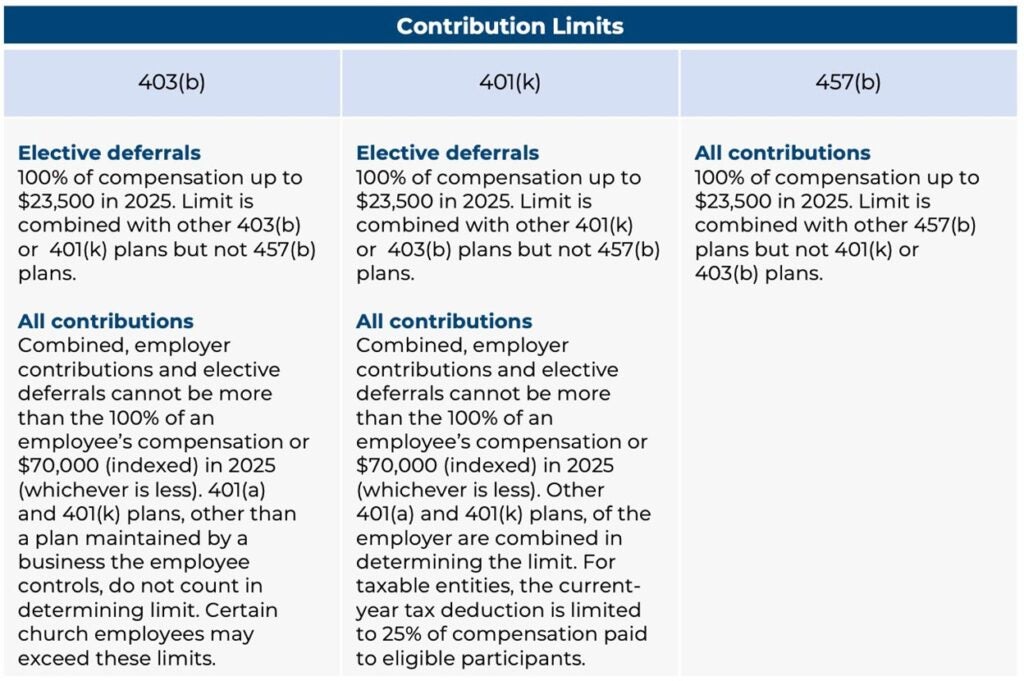

Contribution Limits

While elective deferral limits to all three plan types are $23,500 in 2025, there are some other important contribution limit distinctions. In 457(b) plans, the limit on combined elective deferral and employer contributions is the same as the elective deferral limit ($23,500). In both 401(k) and 403(b) plans, the combined elective deferral, and employer contribution limit is significantly larger—up to $70,000 in 2025, depending on compensation.

While the combined 457(b) limits are lower, the 457(b) elective deferral limit is not offset by 401(k) or 403(b) deferrals. Thus, the maximum deferral limit of $23,500 may be contributed to a 457(b) plan, regardless of whether any deferrals or employer contributions have been made to a 403(b) or 401(k) plan. For organizations offering a combination of these plans, this presents an opportunity for a participant to contribute to both.

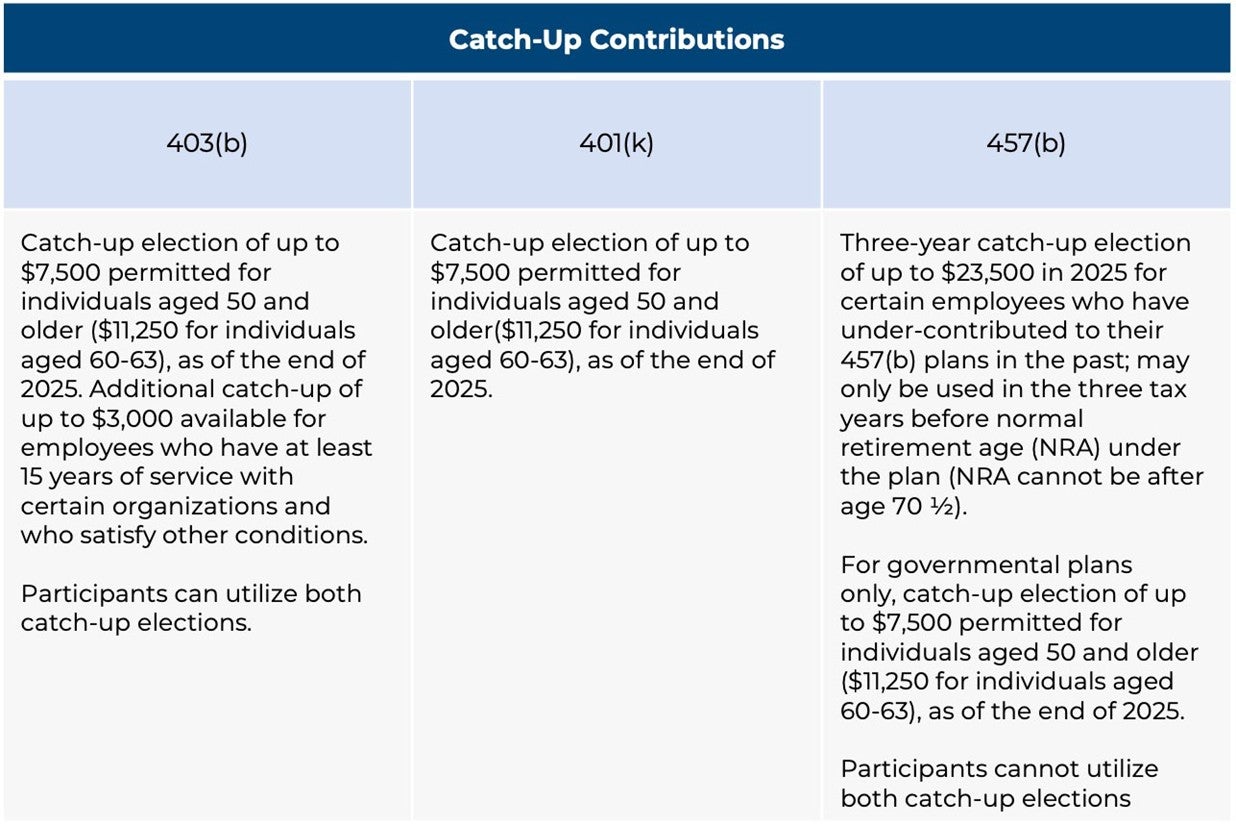

Special elections allow additional elective deferrals based on certain factors. The age 50 catch-up election, which expands the $23,500 limit in 2023 to $31,000, is available in 403(b), 401(k), and public 457(b) plans but is unavailable for 457(b) plans of private tax-exempt organizations. The same is true for the new Age 60-63 catch-up election under SECURE 2.0, which expands the $23,500 limit to $34,750.

Unique to 403(b) plans is the 15-year catch-up election, which allows a plan to permit employees who have 15 or more years of service and who satisfy additional requirements to defer up to an additional $3,000 beyond the 402(g) limit of $23,500 ($31,000 if age 50 or older, $34,750 if age 60-63) in 2025. However, this election can be complicated to calculate. The 457(b) election permits those in their final three years of employment prior to retirement to defer up to an additional $23,500 in 2025.

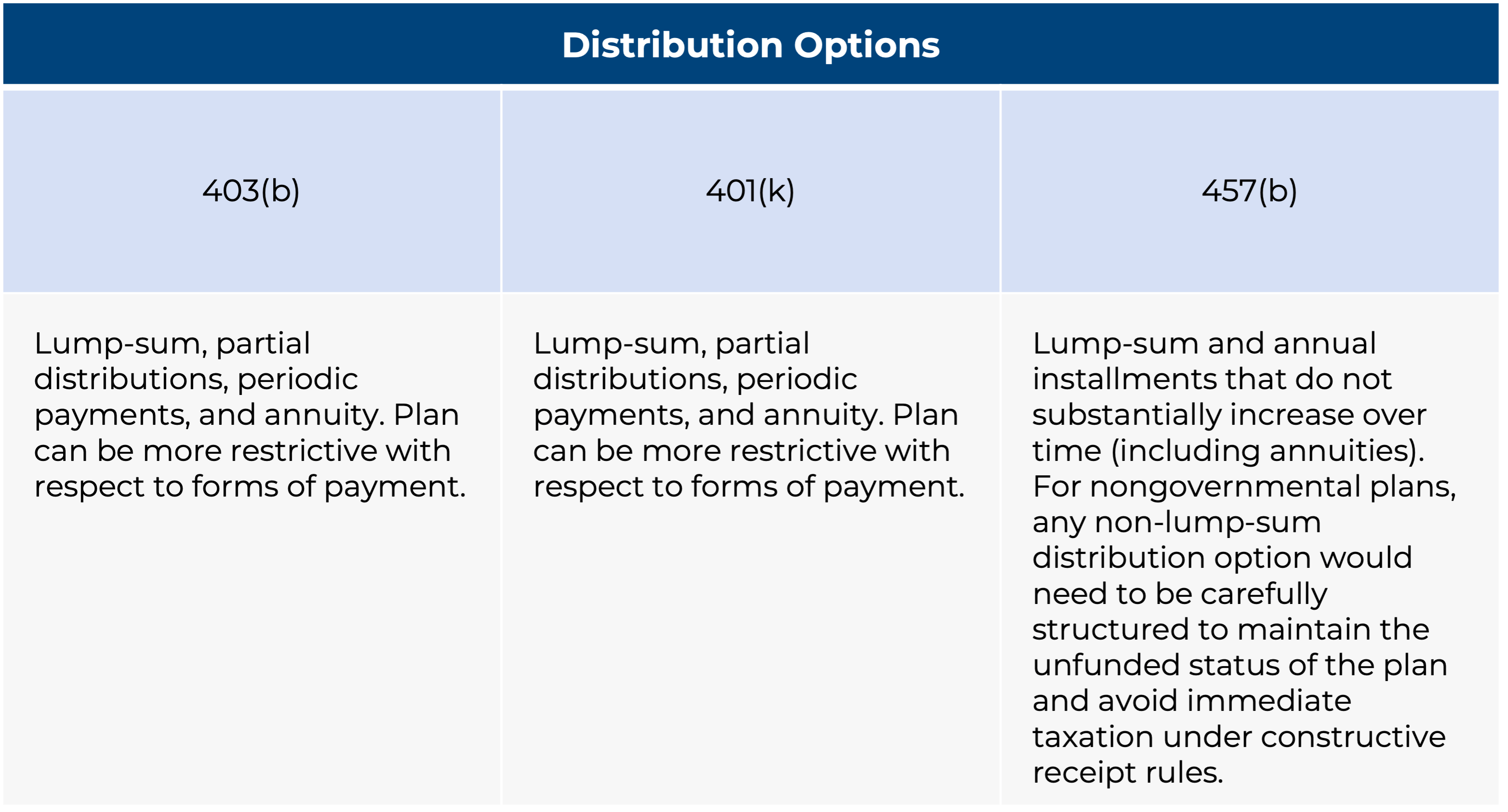

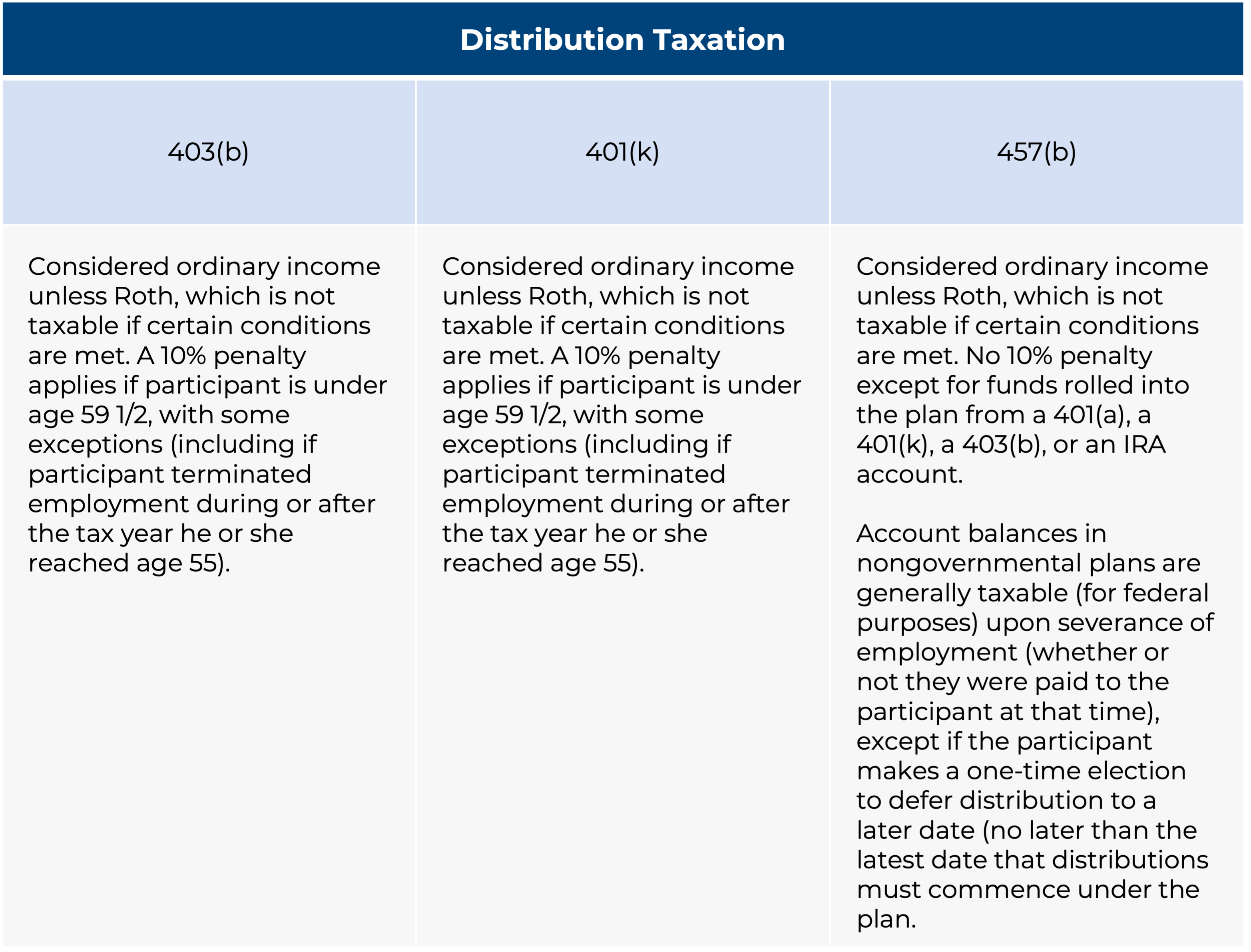

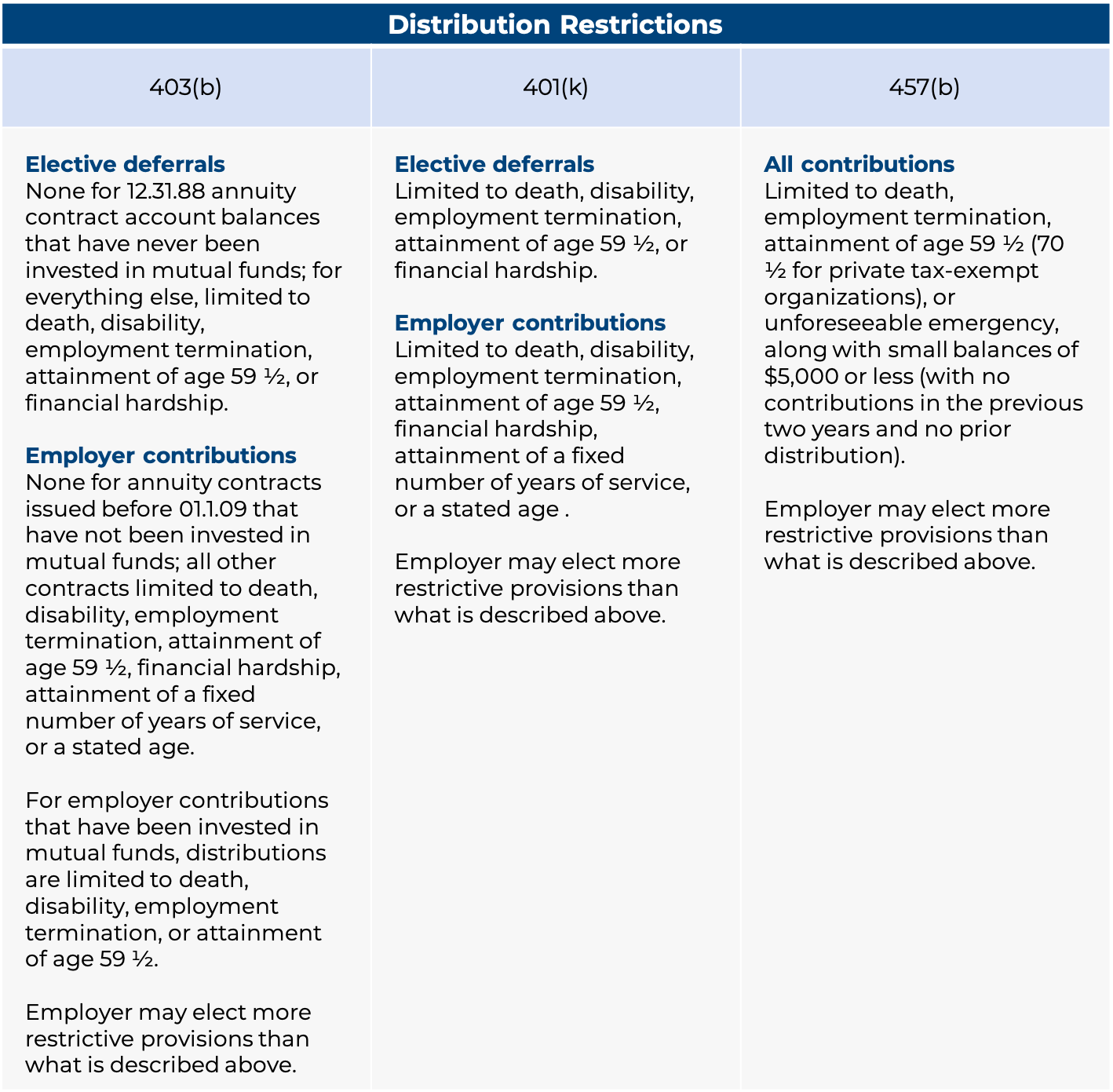

Distributions

The 403(b) and 401(k) plans generally mirror each other in terms of distribution restrictions. For example, elective deferrals may not be withdrawn in either plan type until the attainment of age 59 1/2, termination of employment, hardship, death, or disability.

However, 457(b) plans have different restrictions. Contributions may not be withdrawn until severance of employment, attainment of age 59 1/2 (70 1/2 for private tax-exempt organizations), or occurrence of an unforeseeable emergency (different rules than hardship withdrawals). For 457(b) plans at private tax-exempt organizations, there are additional restrictions as to the type of distributions that can be taken, and rollovers are not permitted. One advantage of 457(b) plans, however, is that the 10 percent excise tax for distributions prior to age 59 1/2 does not apply.

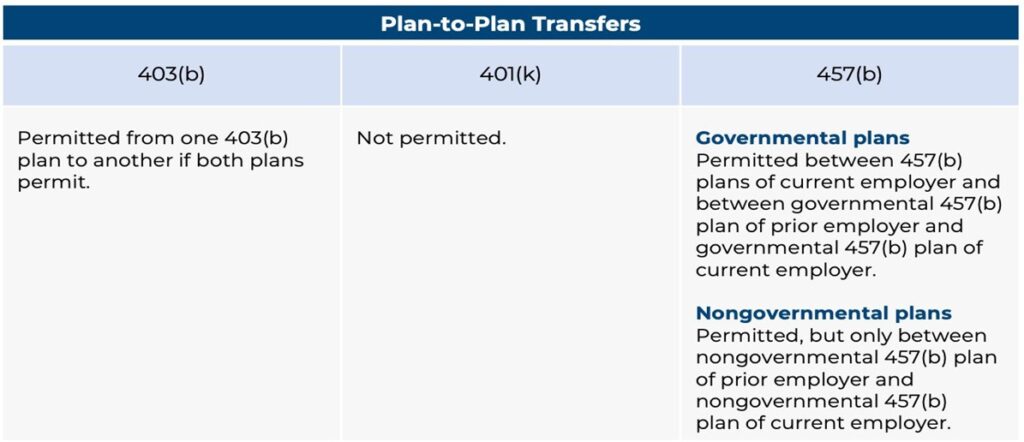

Transfers and Exchanges

In 401(k) plans, the most common reason for plan-asset movement is employer-directed transfers due to the transition to a new recordkeeper. The situation is similar for 457(b) plans; however, some participants use plan-to-plan transfer provisions for cases in which a rollover is not permitted (i.e., private tax-exempt plans).

For 403(b) plans, there is more flexibility; however, even this has been somewhat restricted by the final 403(b) regulations that became effective a few years ago. Employers may transfer plan assets from one provider to another, but these transfers are more likely to be restricted at the provider contract level than in the case of a 401(k) plan. Plan participants may transfer plan assets in the form of an exchange to any approved provider in a 403(b) plan. Plan-to-plan transfers are also permitted, though employees often opt for a rollover instead.

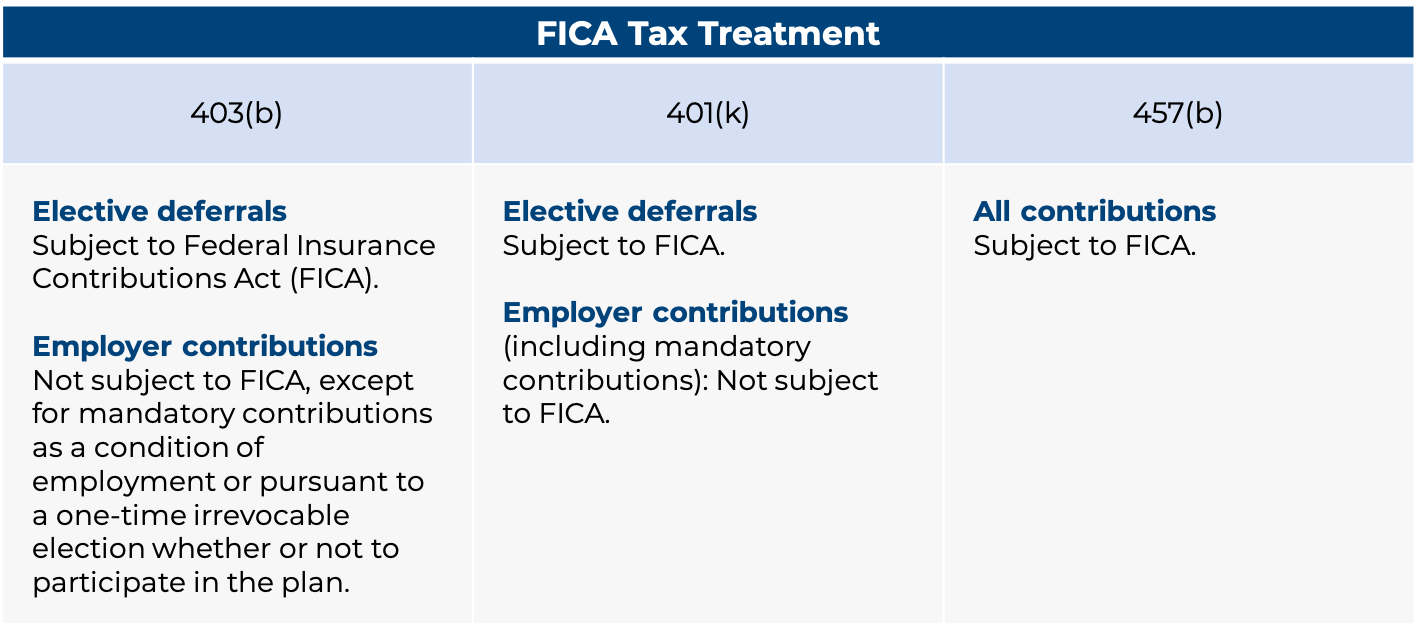

Payroll Taxes

Contributions from employers with 401(k) and 403(b) plans are generally not subject to payroll taxes, such as FICA or Medicare. Since 457(b) plans are deferred compensation plans rather than retirement plans, employer contributions are treated as compensation that is subject to payroll taxes.

Provider Availability

A myriad of recordkeepers service 401(k) plans. Meanwhile, 403(b) and 457(b) plan assets are concentrated among a smaller selection of vendors. While this relative lack of competition can affect pricing and marketplace advancements for larger plans, 401(k), 403(b), and 457(b) product and service offerings are often comparable. While it is not uncommon for multiple recordkeepers to be offered within a 403(b) plan, it is less frequent in 457(b) plans and rare in 401(k) plans.

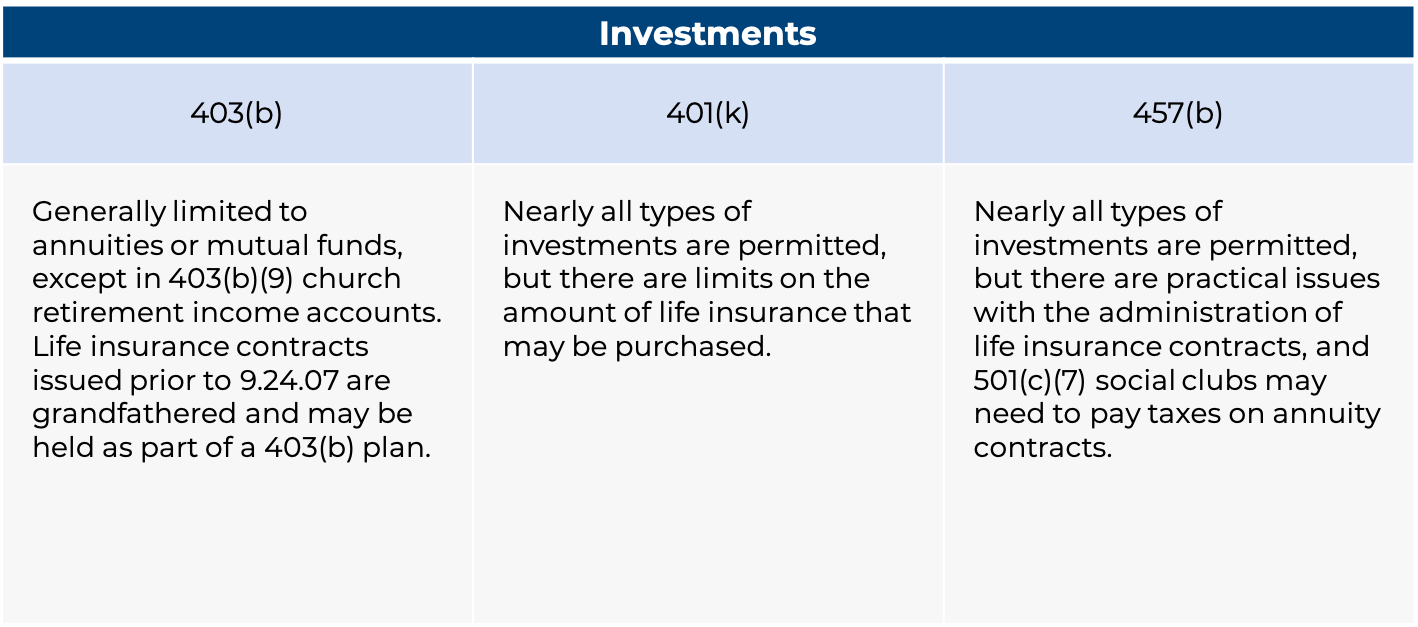

Investments

Another important distinction for 403(b) plans is their limitation in terms of the investment types that can be offered. In these plans, investment types are limited to 403(b)(1) fixed and variable annuities and 403(b)(7) custodial accounts (known more commonly as mutual funds). Investments that are permitted in 401(k) and 457(b) plans, like individual securities, are prohibited in 403(b) plans. As of this writing, there is legislation pending that would permit Collective Investment Trusts, or CITs in 403(b) plans, but that legislation has not been passed as yet. It should also be noted that some 457(b) plans are subject to investment-type restrictions by law.

Providing a competitive retirement plan benefit is often an important component of an organization’s recruitment and retention efforts. Understanding the availability, benefits, and limitations of the different plan types can help plan sponsors craft and maintain the most impactful retirement plan offering.

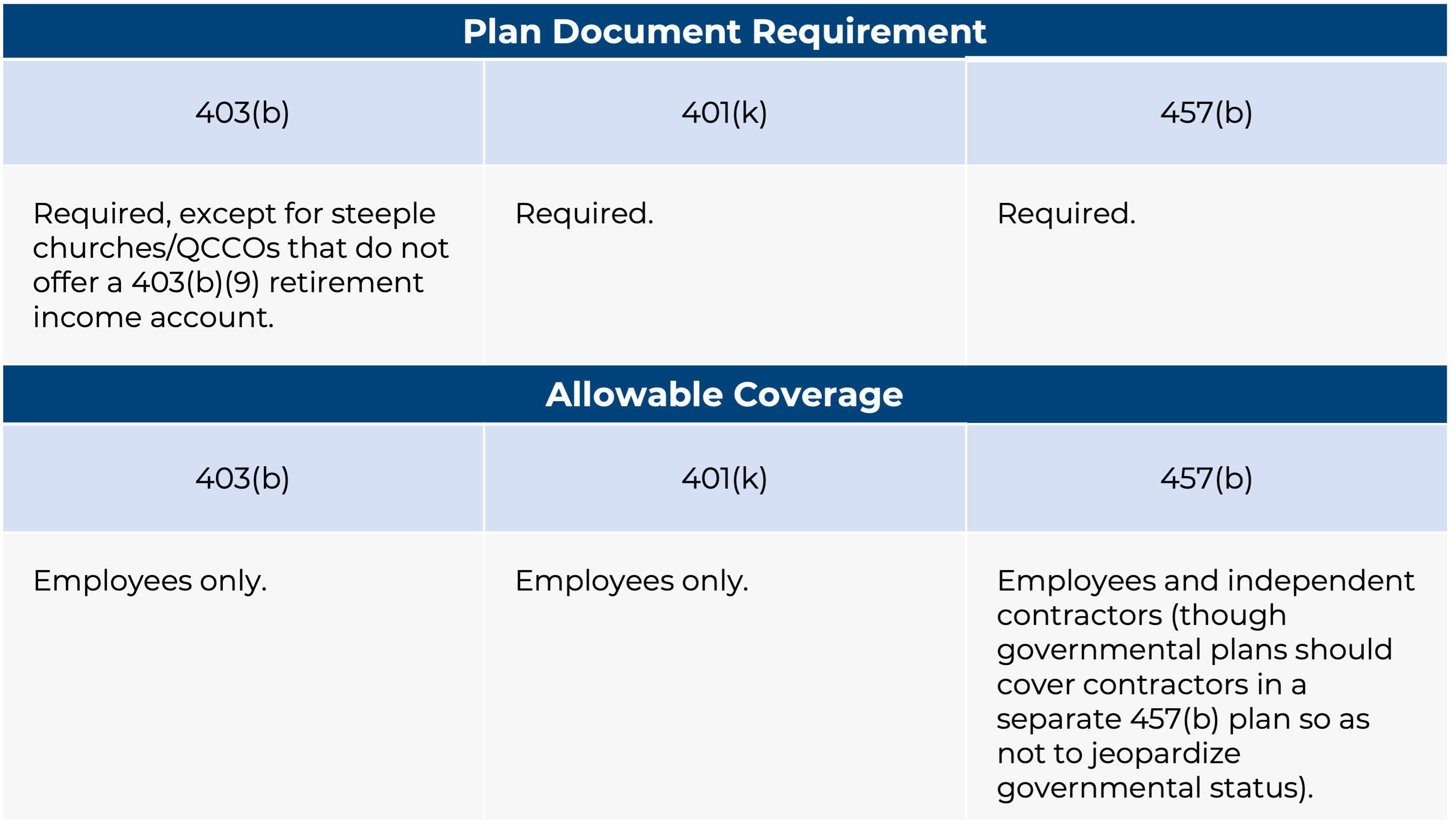

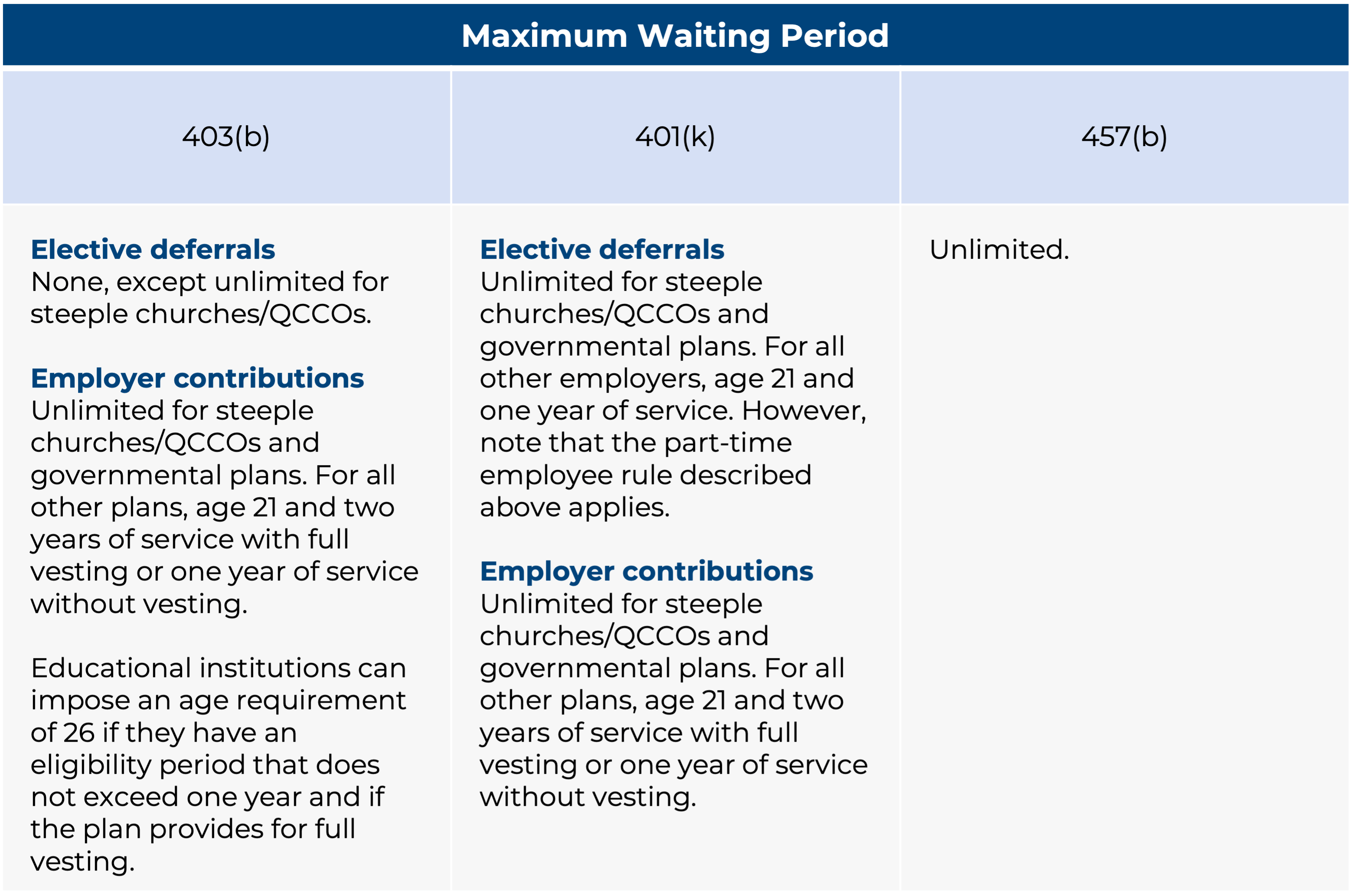

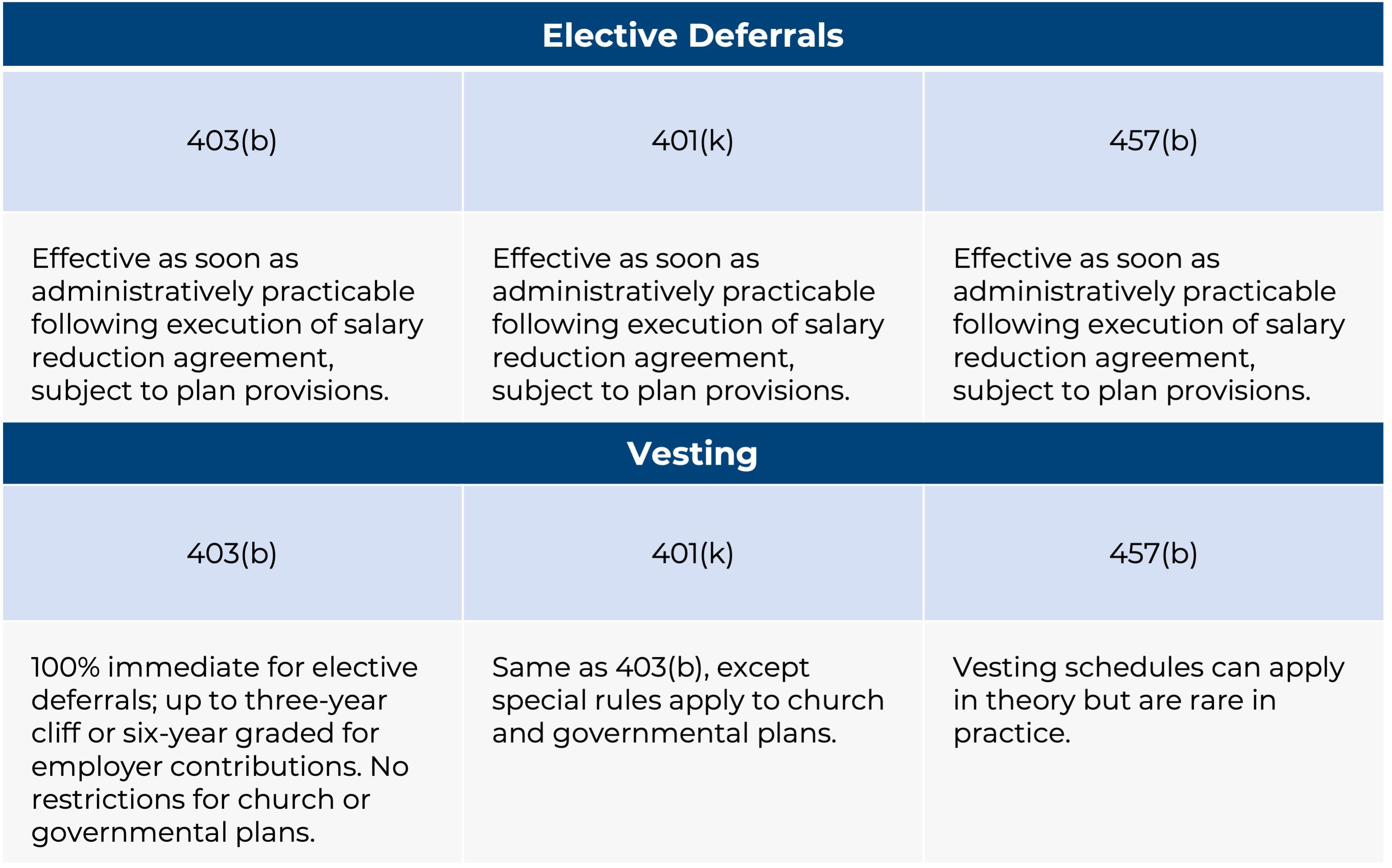

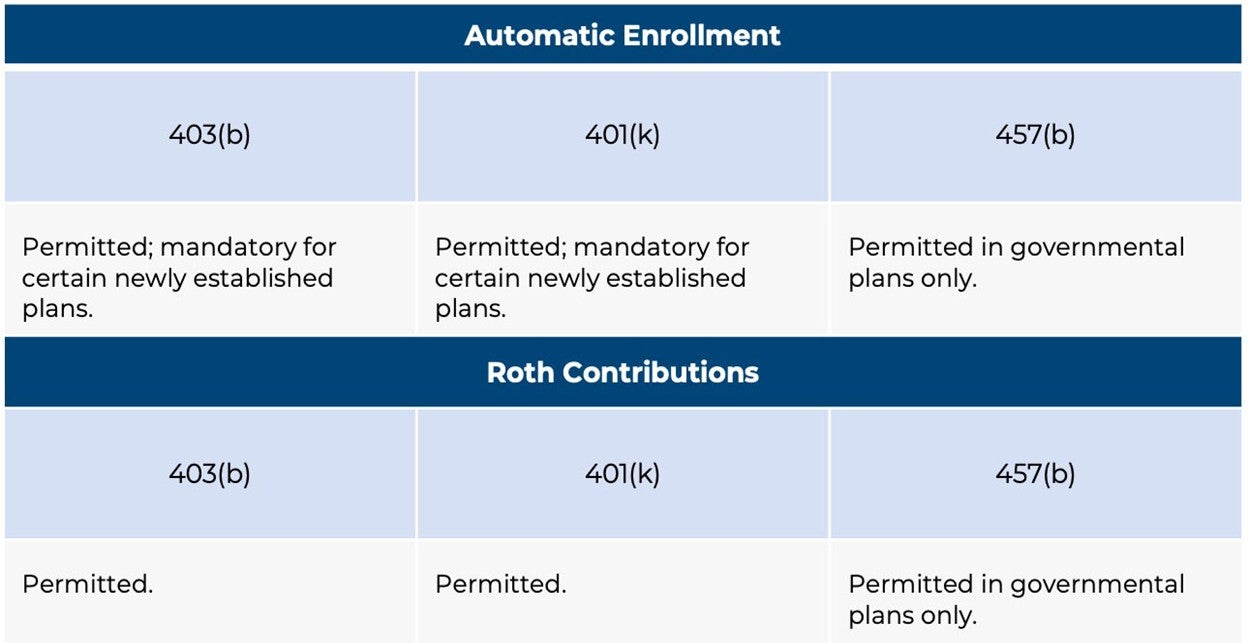

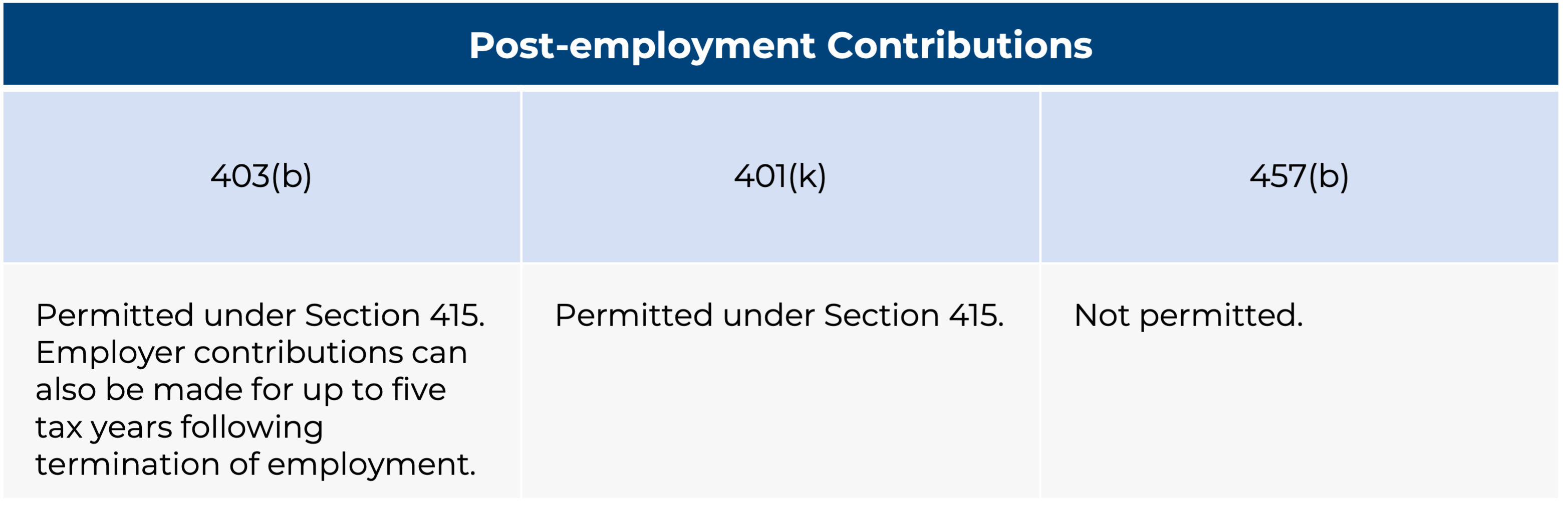

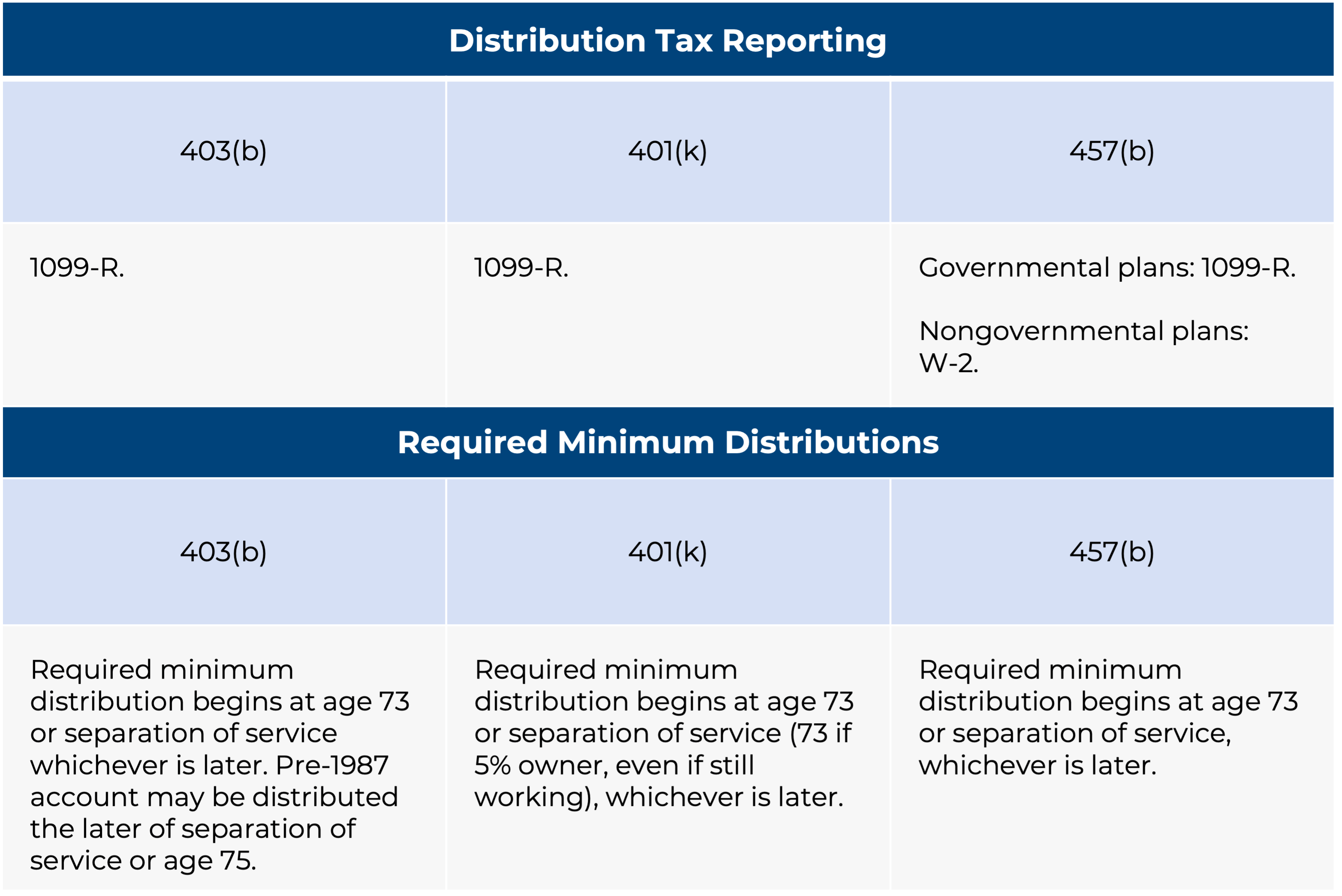

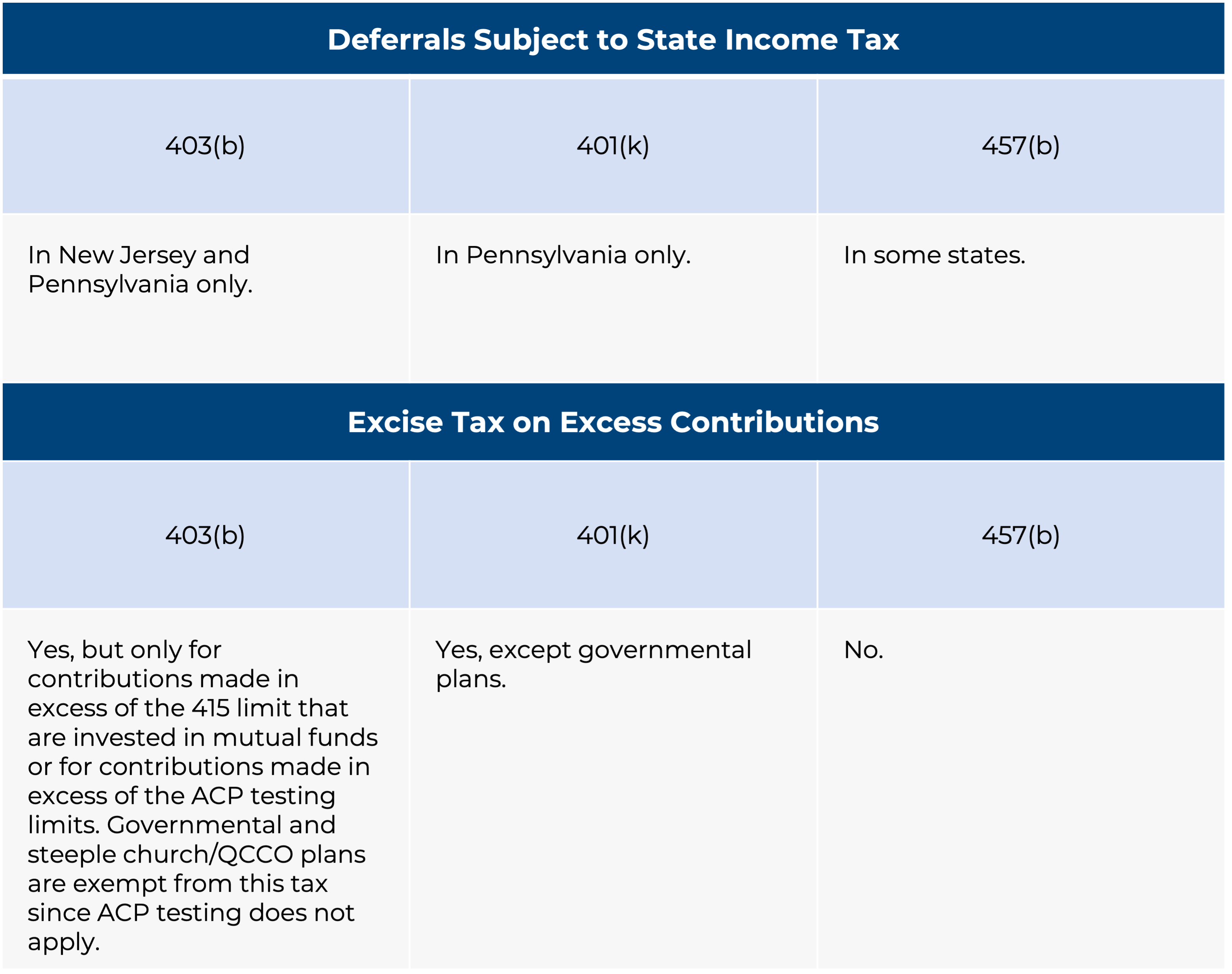

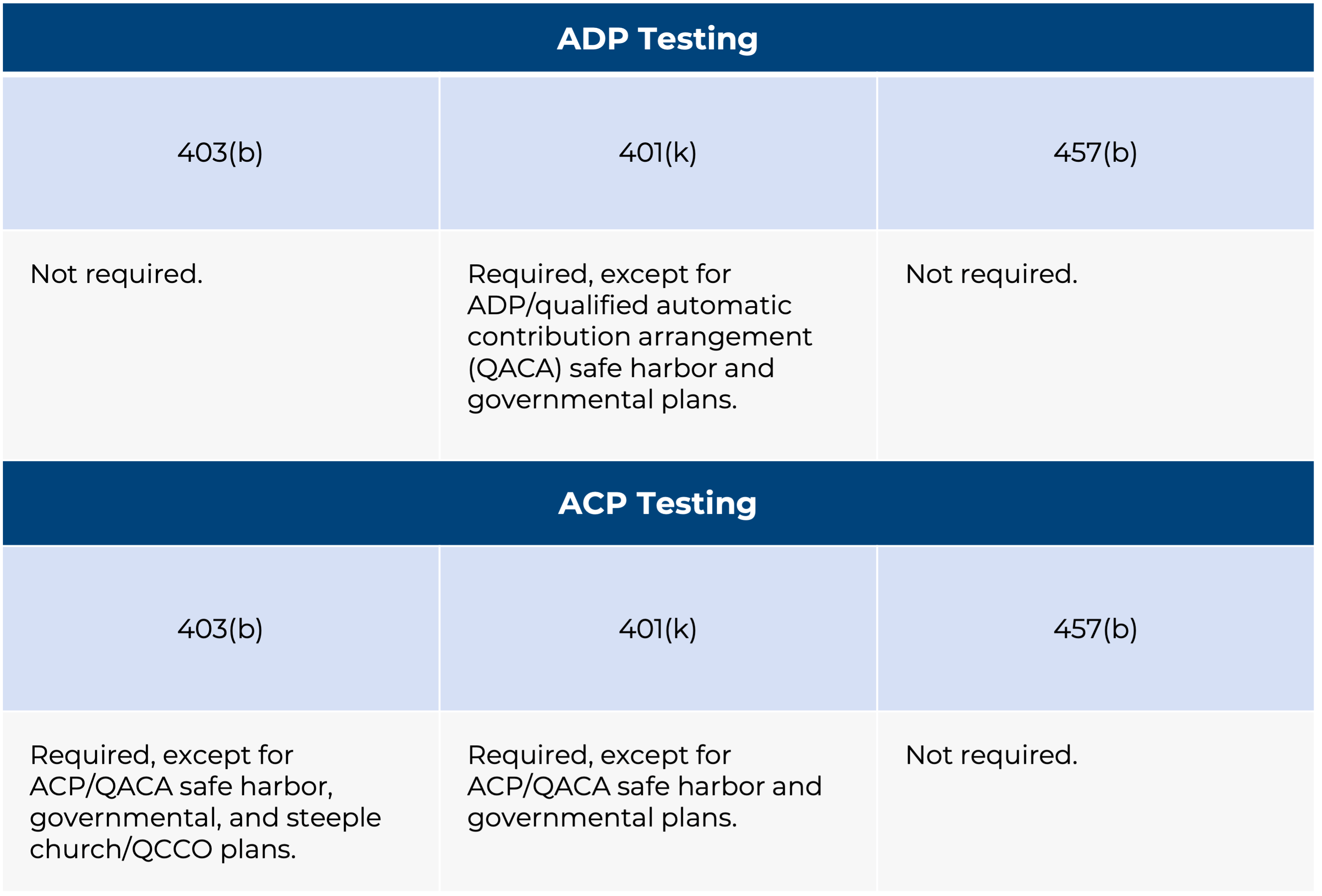

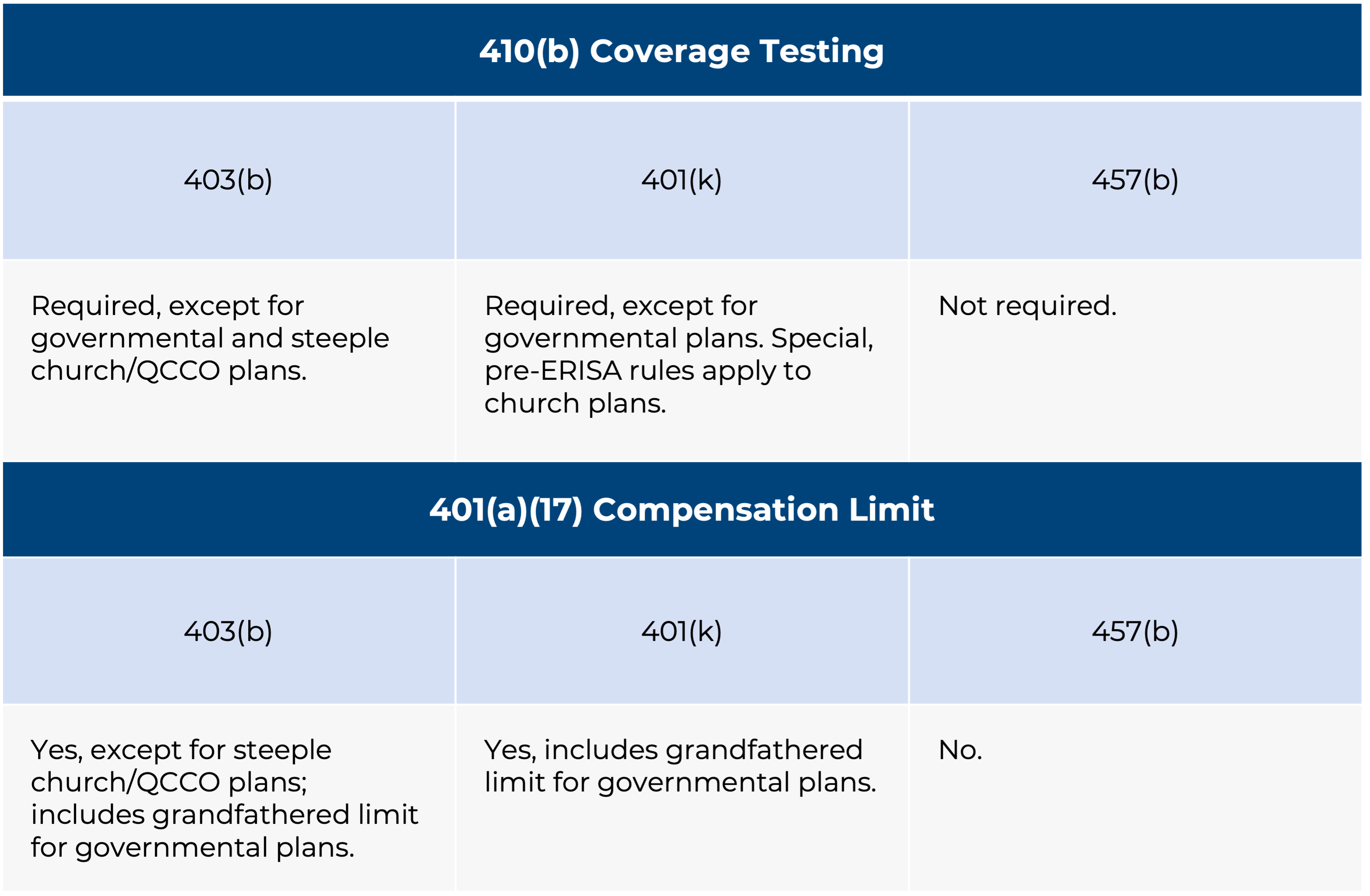

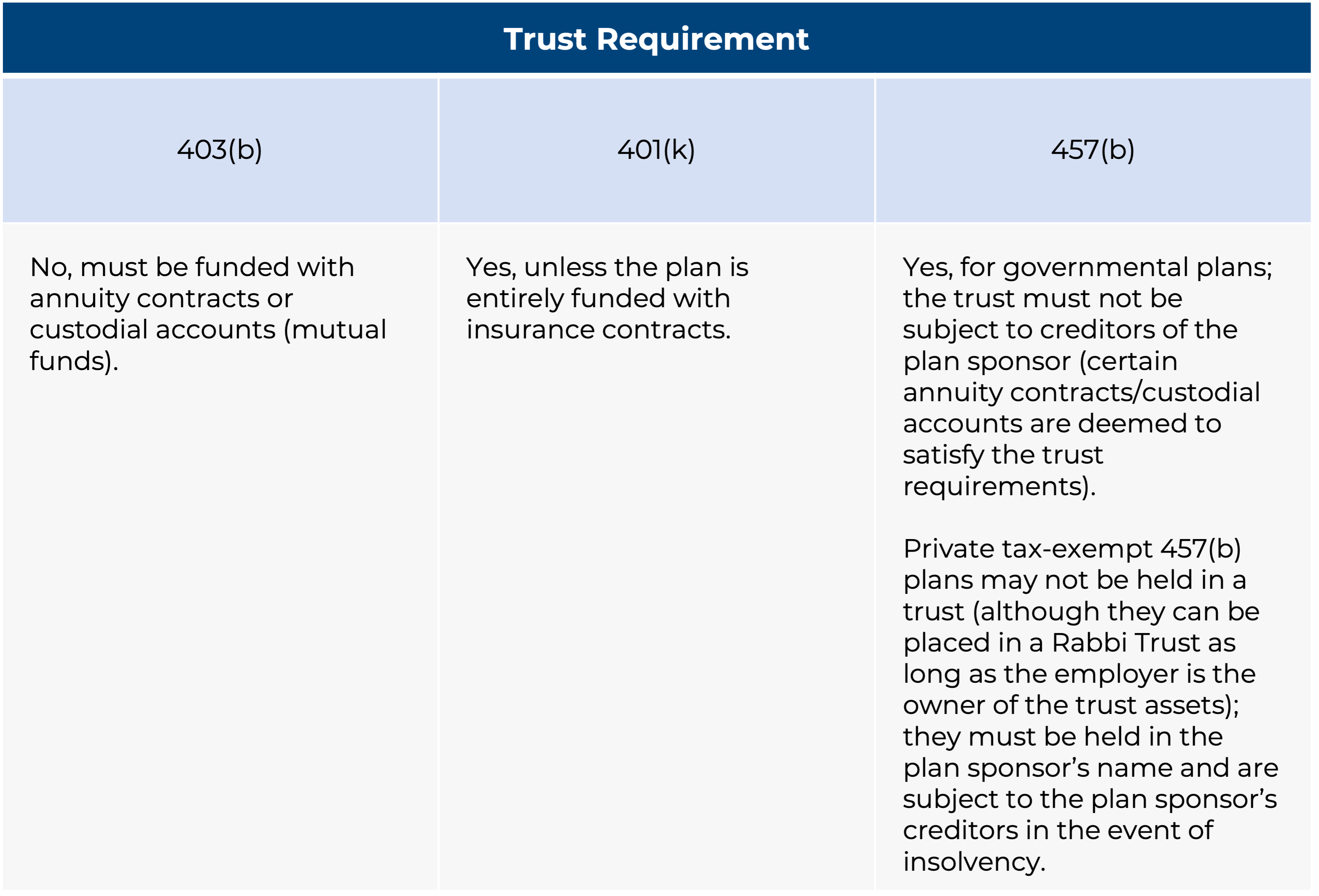

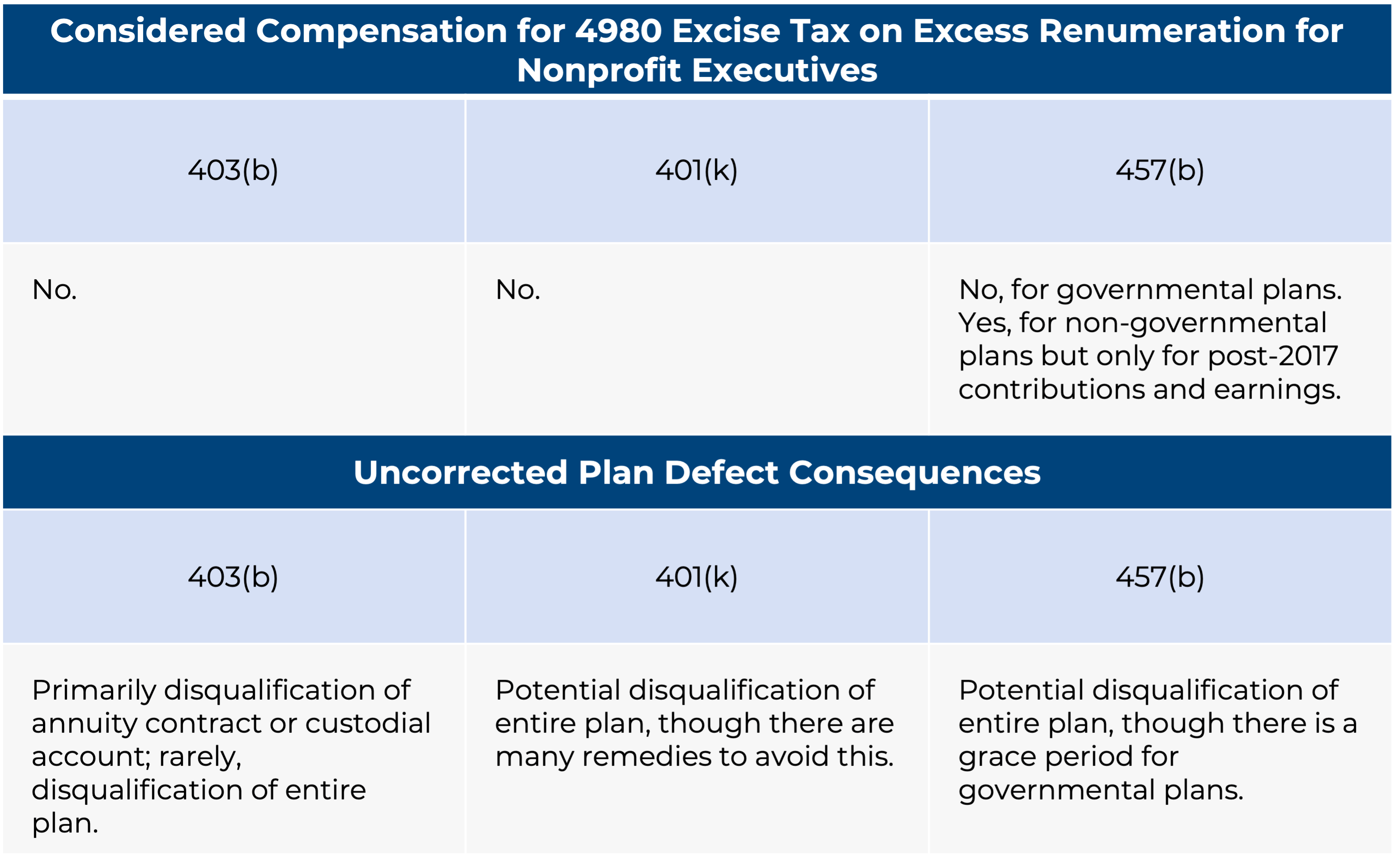

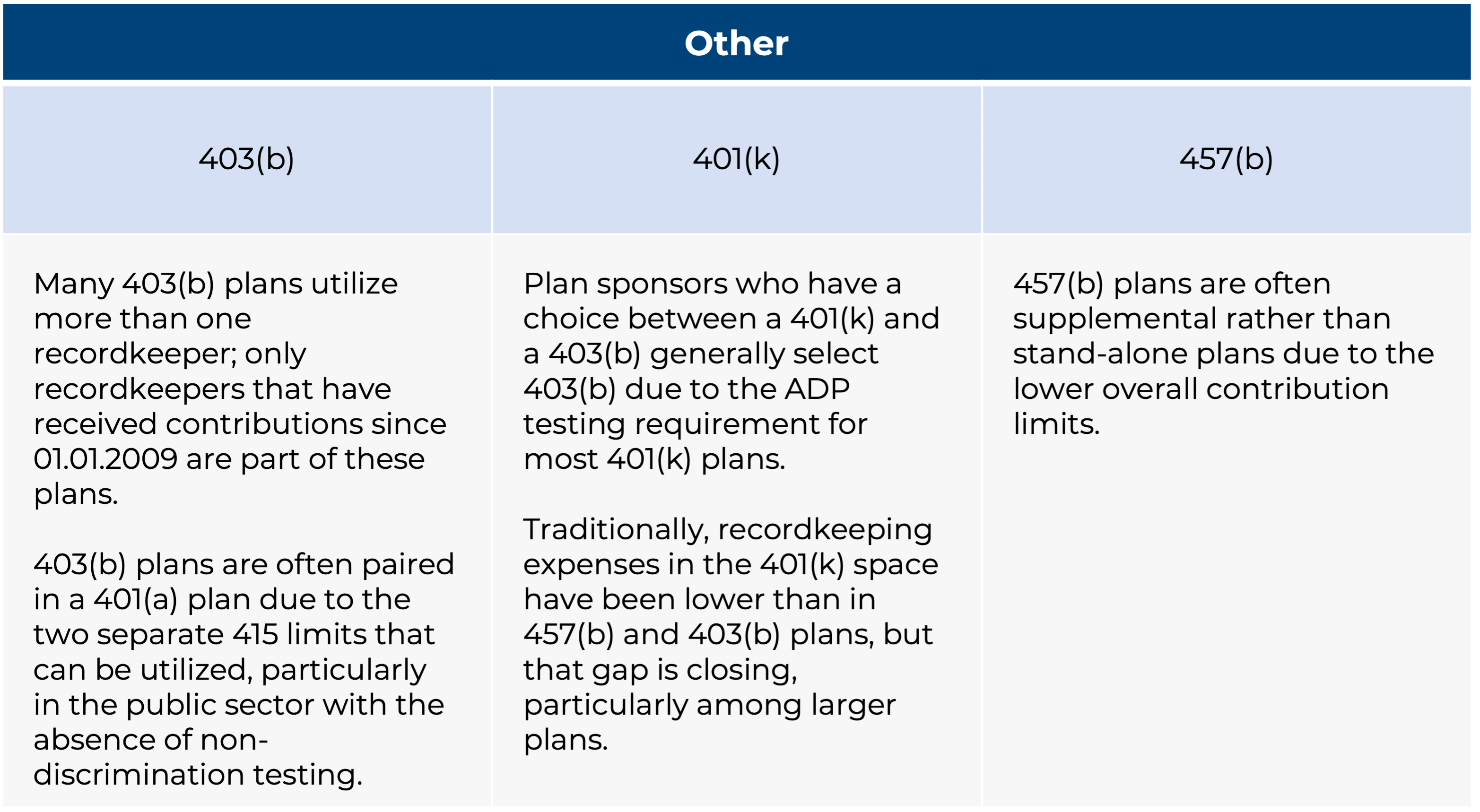

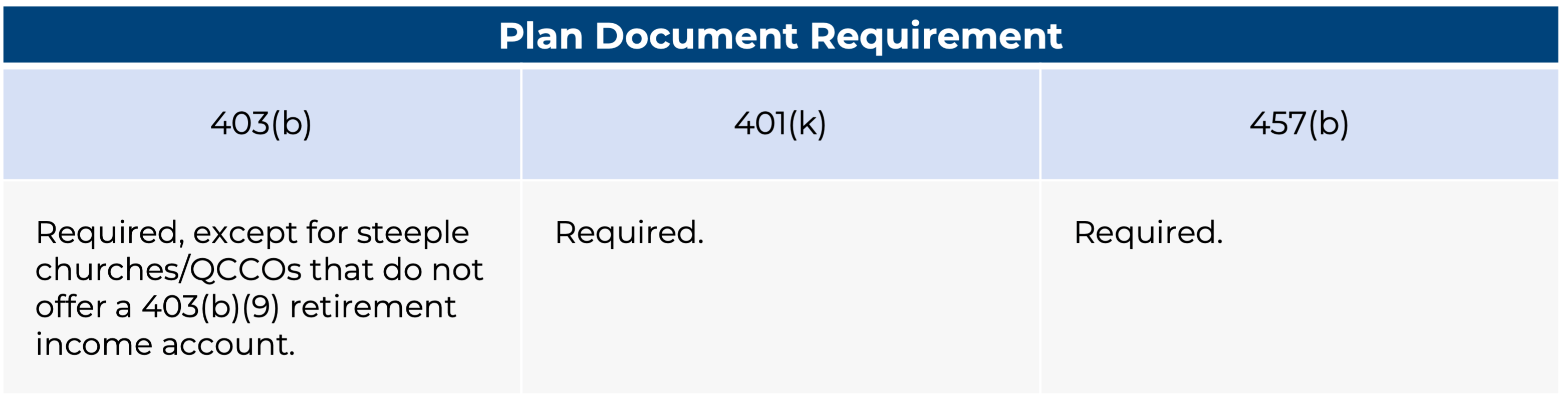

In addition to the key distinctions listed above, Figure One provides a comprehensive comparison of the remaining similarities and differences between 403(b), 401(k), and 457(b) plans.

Figure One: Digging Deeper into the Similarities and Differences of 403(b), 401(k), and 457(b) Plans