Second Quarter 2025 Investment Strategy | Noise vs. Signal

Key Takeaways

- Markets have been through a full bull-and-bear cycle in just six months.

- Uncertainty narrows investor focus at the exact moment when a long-term perspective likely matters most.

- Long-term returns will hinge on the result of a tug-of-war between two major forces: debt and demographics on one side, and productivity via artificial intelligence (AI) on the other.

Investment Depth Perception

Bifocal lenses have two distinct focal points. One allows the wearer to see clearly things that are near, while the other clarifies vision farther away. Successfully navigating the investment landscape requires a similar, multifocal approach.

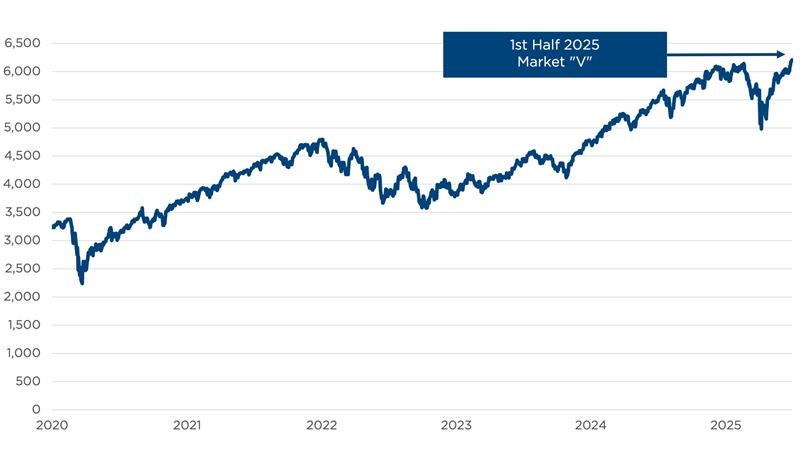

The chaos we saw in the first half of 2025 shortened the focal point for all investors. Against a backdrop of heightened policy uncertainty—fiscal, monetary, trade, and geopolitical—it was nearly impossible to maintain a balanced perspective. The result was an S&P 500 Index that experienced a bear market (-20 percent decline) and a bull market (+20 percent increase) all in six months, while ending the first half at an all-time high.

S&P 500 Index Performance

Sources: Bloomberg, CAPTRUST research

Shifting Landscapes

In “Preparing for the Year Ahead,” our 2025 outlook article published in early January, the CAPTRUST Investment Committee described four potential market scenarios investors could face in 2025:

- Optimism fades (projected probability 10 percent)—In this scenario, enthusiasm surrounding the AI value proposition diminishes.

- Extreme uncertainty (projected probability 25 percent)—In this scenario, policy uncertainty alters the entire investment landscape.

- More of the same (projected probability 50 percent)—In this, the most likely, scenario, we see a concentrated equity backdrop with inflation remaining above the Federal Reserve’s target range.

- An upside surprise (projected probability 15 percent)—Here, inflation pressures ease and productivity begins to accelerate.

In January, we expected one of these scenarios to come true. But since we wrote that piece, three of the four have become reality, at least temporarily. No wonder the markets are volatile, and investors are losing focus. Here’s what happened.

1. Optimism Fades: A DeepSeek Surprise (January 27 – April 1)

In late January, a China-based AI startup company called DeepSeek shocked the technology community and investors alike by announcing that its AI model, R1, had matched the output of its competitors at a fraction of the cost. This marked a huge jump in the development of large language models.

The market response was immediate and record-breaking, especially for U.S.-based tech giants. On January 27, the Nasdaq Composite lost nearly $1 trillion in value. This included a $590 billion drop in Nvidia’s value alone—the largest single-day market cap loss for any company in U.S. history.

The broader tech sell-off was driven by concerns about the long-term profitability of the massive AI-related capital investments made by the mega-cap tech giants, which are projected to exceed $300 billion in 2025. The reason for the outsized Nvidia impact was that most of these capital expenditure dollars, historically and projected, are going toward computer chips manufactured by Nvidia.

2. Extreme Uncertainty: Negotiation, New Paradigm, Negotiation (April 2 – April 8)

In a late 2024 interview with Bloomberg News, President Trump said, “To me, the most beautiful word in the dictionary is tariff, and it’s my favorite word.” And so, it was no surprise that global trade became an important agenda item in President Trump’s second term.

On February 1, less than two weeks after Inauguration Day, the President signed an executive order imposing tariffs on imports from Mexico, Canada, and China. The political reaction was very loud. However, investors and markets mostly dismissed these early announcements as a negotiation ploy to improve trade conditions for U.S. exporters.

On April 2, he announced a broader package of import duties that shocked investors with both its scale and magnitude. They could no longer dismiss the potential economic impact and were forced to consider a completely new global trading paradigm. Over the next four trading days (April 3 – April 8), the S&P 500 dropped more than 12 percent.

That same week, the yield on the 10-year U.S. Treasury began to surge, and it seemed foreign owners were beginning to liquidate. The President’s office relented, postponing the effective date of these tariffs for 90 days. The decision to pause stabilized Treasury yields while the S&P 500 roared back, rising more than 9.5 percent on April 9. Investors returned to viewing tariffs as a negotiating tool and now realized there was an economic variable that could cause the new administration to pause: 10-year Treasury yields.

3. More of the Same: Nvidia’s Return (April 9 – Present)

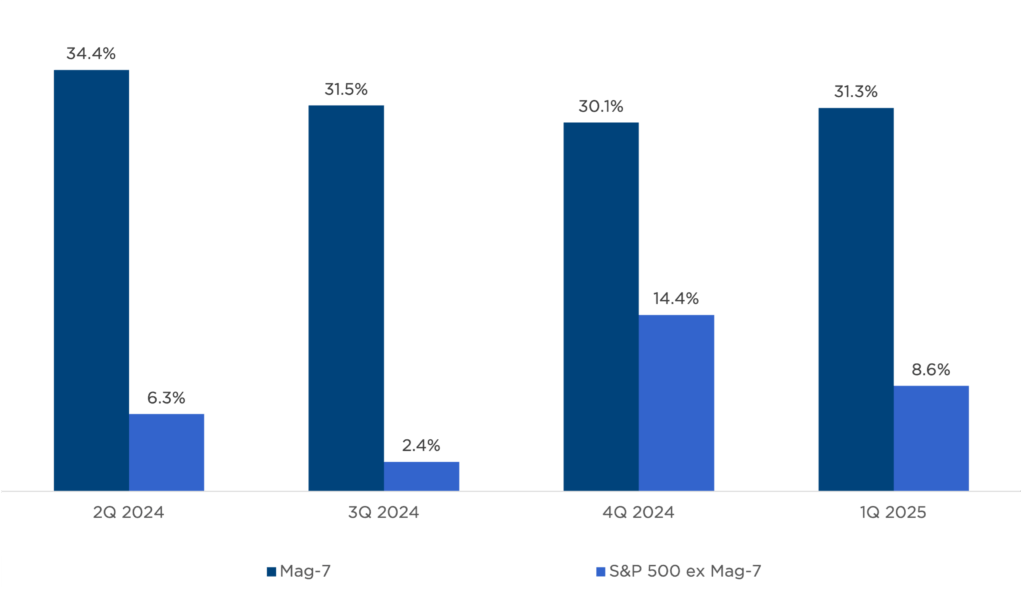

For much of 2023 and 2024, the U.S. equity landscape was dominated by a very small subset of mega-cap securities called the Magnificent Seven (Mag-7), and Nvidia led the pack. Everything appeared to be reversing in early 2025. However, when first-quarter earnings were complete, it was clear that these mega-cap—and AI-driven—growth giants continued to dominate the earnings landscape.

First Quarter 2025 Earnings Growth for the Mag-7 and S&P 500 Excluding the Mag-7

Sources: Factset, CAPTRUST research

Against this backdrop, the Mag 7 surged back to their 2024 leadership position, pulling the S&P 500 to all-time highs. An investor just glancing at their midyear statement would see a +6.2 percent return for the S&P 500 at the halfway point of 2025, with approximately 50 percent of this return coming from Nvidia, Microsoft, and Meta. That person would likely think, “Oh, more of the same.” But the markets went through so many other scenarios to get back to this point.

Market Rewind

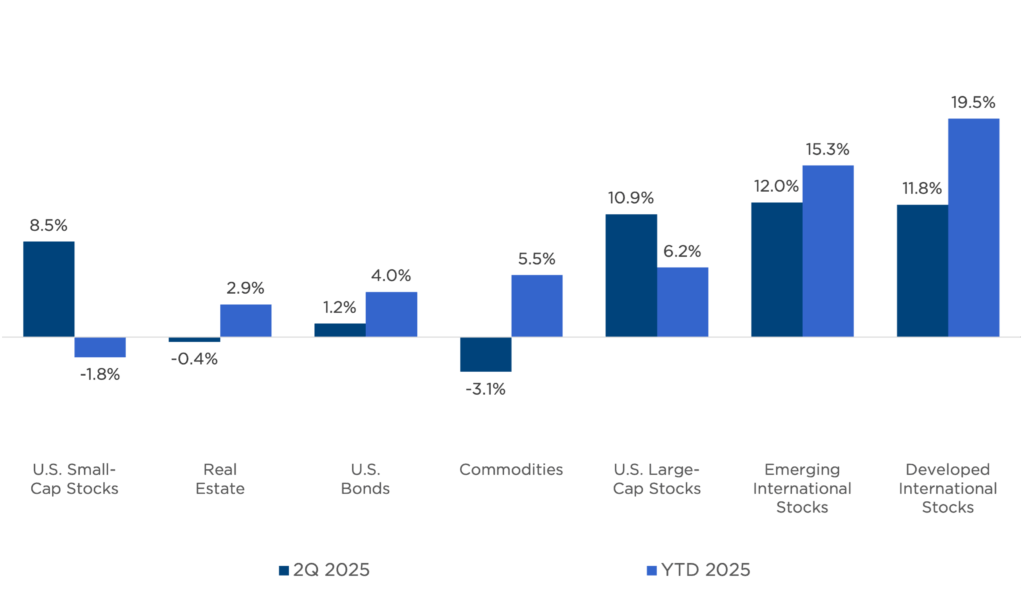

The second-quarter rally lifted most asset classes into positive territory for the year. U.S. small-cap stocks were the exception. Despite a solid 8.5 percent return in the second quarter, the broad benchmark for U.S. small-cap stocks remains negative for 2025, pressured by higher interest rates and interest rate expenses.

Investment grade U.S. bonds have experienced elevated volatility but reached the midway point of 2025 with a 4 percent year-to-date return. Real estate and commodities also delivered low single-digit gains.

Finally, for the second consecutive quarter, foreign equity markets have led the way, benefiting from both improving stock prices and a weakening U.S. dollar. Year to date, nearly half of the foreign equity results have been driven by the weakening U.S. dollar.

Asset Class Performance for the Second Quarter and First Half of 2025

Source: Morningstar Direct; CAPTRUST research. Asset class returns are represented by the following indexes: Bloomberg U.S. Aggregate Bond Index (U.S. bonds), S&P 500 Index (U.S. large-cap stocks), Russell 2000® (U.S. small-cap stocks), MSCI EAFE Index (international developed market stocks), MSCI Emerging Market Index (emerging market stocks), Dow Jones U.S. Real Estate Index (real estate), and Bloomberg Commodity Index (commodities).

2025 Outlook Revisited

If the CAPTRUST Investment Committee were rewriting its 2025 outlook at this midway point, it would look very similar in both possibilities and probabilities.

- The AI hype has returned, making the markets potentially vulnerable to unrealistic expectations (scenario 1).

- Policy uncertainty remains elevated, with little clarity on ultimate trade, fiscal, or monetary policies (scenario 2).

- Unless there is some significant disruption, the Mag 7 tech leaders will likely continue to have broad support (scenario 3) while investors wait for AI to enhance productivity and drive the next phase of global economic growth (scenario 4).

A Balanced Perspective

Against this unsettled backdrop, investors would do well to wear their bifocal glasses and maintain a balanced perspective—aware of things both near and far.

The volume of daily distractions for investors continues to accelerate, exposing them to the rampant dangers of emotion-based reactions. Despite the last two quarters’ extreme volatility, pulling money out of the market would likely have been extremely punitive in the first half of 2025.

Our advice? When reading the daily headlines, remember this: Approximately 85 percent of the value of a healthy, perpetually growing company (i.e., the S&P 500) is derived from earnings that are more than five years in the future. Then ask yourself, what is the likely duration of today’s biggest headline?

Ultimately, the two opposing forces that will drive investment returns over the next decade are debt and demographics on one side, with productivity and artificial intelligence on the other. Monitoring the ongoing progress on these two fronts will have long-term value implications. Nearly everything else will likely be short-term noise.

Index Definitions

Indexes are unmanaged, do not incur management fees, costs, and expenses, and cannot be invested in directly.

S&P 500® Index: Measures the performance of 500 leading publicly traded U.S. companies from a broad range of industries. It is a float-adjusted market-capitalization weighted index.

Russell 2000® Index: Measures the performance of the 2,000 smallest companies in the Russell 3000® Index. It is a market-capitalization weighted index.

MSCI EAFE Index: Measures the performance of the large- and mid-cap equity market across 21 developed markets around the world, excluding the U.S. and Canada. It is a free float-adjusted market-capitalization weighted index.

Bloomberg U.S. Intermediate Govt/Credit Bond Index: Measures the performance of the non-securitized component of the US Aggregate Index. It includes investment-grade, US Dollar-Denominated, fixed-rate Treasuries, government-related corporate securities. It is a market-value weighted index