Giving up car ownership is not something everyone can do, says MacEachern, who has since bought her own hybrid vehicle. But her experience illustrates something she’s learned about greener living: “Almost everything you do to improve your environmental impact improves your own life.”

Living lighter on the land also tends to fatten your wallet, says MacEachern, who runs a blog called Big Green Purse (and wrote a 2008 book by that name). Whether you are talking about insulating your attic, buying energy-efficient appliances, or eating less meat, “in almost all cases, the greener choice is the choice that’s going to save you more money,” she says. “Sometimes it’s in the short run, sometimes it’s in the long run.”

That isn’t to say that there are not trade-offs, sacrifices, or challenges. But they are challenges that an increasing number of Americans, of all ages, may be willing to take on—at least, if they can sort through which actions really make a difference.

Surveys Say: Older Americans Do Care

Surveys conducted by the Pew Research Center in 2021 and the Yale Program on Climate Change Communication in 2019 found that concern about climate change—the most pressing environ-mental issue today—is highest among young people. But the Yale survey also found that majorities of baby boomers (born 1946 to 1964) and the silent generation (born 1928 to 1945) felt that combatting the problem was personally important.

In another survey from the Massachusetts Institute of Technology Age Lab, a majority of boomers said they were more environ-mentally aware now than in their own young adulthoods.

Moreover, many boomers (and slightly younger generation-x adults) have better environmental records than their children and grandchildren give them credit for. The lab’s director, Joseph Coughlin, wrote in a Forbes blog post: “They are, after all, the generation that came of age in the years that included the publication of Silent Spring and the passage of the Clean Air Act … As college students, boomers celebrated the first-ever Earth Day in 1970. Retiring boomers and gen xers may have a new job in retirement—a renewed environmental activism.”

That activism can take collective forms, such as volunteering for community efforts or getting involved in changing local, state, and national policies. But it also can take the form of individual, everyday choices: how we get around, what we eat, what we buy, and how we manage our households.

All of those activities help determine our carbon footprint, the extent to which each of us contributes, directly or indirectly, to the buildup of greenhouse gases, such as carbon dioxide, methane, and nitrous oxide. Those gases, generated mostly by the burning of fossil fuels for heat, electricity, and transportation, accumulate in the Earth’s atmosphere where they trap heat. The result is warmer average temperatures, more extreme weather, more polluted air, and increases in human health problems, ranging from asthma to heat stroke.

But older adults, including retirees, are in a perfect position to limit the damage, experts say. A lot of them are looking for solutions to simplify their lives in ways that happen to be environ-mentally friendly, such as downsizing their homes, eating more healthfully, and moving to more walkable places, says Todd Larsen, executive co-director for consumer and corporate engagement at Green America, a nonprofit advocacy organization based in Washington, D.C.

Retirement Going Green

Gail White, 69, a retired investment advisor, says she became passionate about protecting the environment more than 30 years ago, when a trip to Alaska awakened her to the planet’s vastness and beauty.

That experience inspired her to go to the Arctic as a volunteer citizen scientist to assist researchers studying climate change. When she retired in 2016, she gave up an energy-guzzling house and downsized to an apartment. Then, in 2019, she made another move—to a Shelburne, Vermont, retirement community designed for eco-conscious seniors.

On the wooded Wake Robin campus, White is surrounded by like-minded folks who garden, compost, harvest honey, and maintain walking trails. “I just decided this was the kind of place where I wanted to be,” she says. Her main job, as co-chair of the recycling committee, is green room monitor, meaning she makes sure paper recyclables, plastic bags, composting materials, and other items all end up in the right bins.

More and more retirees are seeking communities that make green living a priority, says Andrew Carle, executive director of The Virginian, a retirement community in Fairfax, Virginia. “I think our industry is beginning to recognize that this is something that our consumers value,” says Carle, who is an adjunct lecturer in senior living administration, aging, and health at Georgetown University.

Carle says his own community gets greener all the time. One recent change: the purchase of an electric SUV to transport residents. “They love it that it gets ‘infinity miles per gallon,’” he says. As part of an ongoing renovation, the community will seek Leadership in Energy and Environmental Design (LEED) certification, a designation for buildings that meet energy efficiency, clean air, and other green standards. Many new communities now meet those standards at opening, Carle says.

Meanwhile, at Wake Robin, “the residents are looking at all kinds of ways to improve our carbon footprint, like doing laundry at off-peak hours,” says Environmental Services Director Leslie Parker.

The community recently replaced gas lawn mowers with electric versions, and it gets 20 percent of its power from a nearby solar farm. Ladybugs, released by the thousands each year, are the pesticides of choice. “It’s all part of the fabric of our community,” Parker says.

Calculate Your Footprint

Still, choosing a place to start as an individual—or a way to expand your efforts—can be daunting. A good way to get a reality check and a sense of direction is to calculate your current carbon footprint.

Several online calculators are available, including one offered by Berkeley at coolclimate.berkeley.edu/calculator. The U.S. Environmental Protection Agency also offers a version at www3.epa.gov/carbon-footprint-calculator.

The calculators let you see how your household compares with others of the same size and income when it comes to generating emissions from travel, your home, your food choices, and the other goods and services you consume. Once you know where you have room for improvement, you can take on new challenges one at a time.

“It’s good to look at where your actions will have the most impact and where your interests lie and find the correlation between the two,” Green America’s Larsen says.

Alexandra Zissu, an eco-lifestyle expert and author of several books, including The Conscious Kitchen, says it’s important to acknowledge that changing lifelong habits can be difficult. She says she often hears from older adults who are mystified or angry about the environmental changes that their children or grandchildren want them to make. Her advice: “Don’t do the stuff that makes you angry. Think about what you want to do and do what’s most compelling to you.”

Start Small

Recycle, of course. Check the website of your local collection agency and whatever you do, don’t guess what’s allowed in your bins. Stop wasting paper—remove yourself from catalog mailing lists, and opt for digital receipts instead of printed copies. Find new uses for old things, and throw as little into the trash as possible. It’s also a good idea to get yourself into the habit of shutting off lights when you leave a room. Once your smaller changes become habits, consider some bigger changes.

Apocalypse Now?

While the website’s readers included several great films from the past decade, including Parasite, The Shape of Water, Knives Out, and a few other Academy Award Best Picture nominees, they also included nine superhero movies, 12 sequels, and any number of movies that will certainly fail the test of time.

Rotten Tomatoes’s readers seem to have some fondness for classic films, as shown in Figure One, but the 50-year period from the 1960s through the 2000s appears to have been a vast movie wasteland—with only eight movies on the list. Surprisingly, E.T. the Extra-Terrestrial and Schindler’s List are the only films on the list for the 30-year period from 1980 until 2009.

What about The Big Chill, Titanic, and Million Dollar Baby? More importantly, what is going on with Rotten Tomatoes readers?

Answer: Like most humans, they suffer from recency bias.

Figure One: Top 100 Movies by Decade

Source: Rotten Tomatoes

Invasion of the Body Snatchers

Recency bias is a cognitive bias that causes us to place too much emphasis on recent events or experiences—even if they are less relevant. Conversely, recency bias causes us to deemphasize events further into the past. Specifically, recency bias is a memory bias, a type of cognitive bias that enhances, impairs, or alters the recall of a memory.

In a nutshell, recency bias results from our brain’s preference for more easily accessible information over the harder work of analysis and decision-making. We prefer matching patterns from recent memory to deeper, intentional thought.

Maybe misremembering movies—like how good Road House really is—isn’t such a bad thing, but, like many cognitive biases, recency bias can also keep us from making high-quality decisions in other aspects of our lives.

For example, after an hour-long job interview, you’ll likely recall the last 20 minutes of your conversation more vividly than the first half. That means you will perceive a candidate who starts strong and finishes weaker more negatively than you would have otherwise. The converse is true as well. And candidates interviewed later in your process will be more likely to advance.

Meanwhile, in competitions such as the Eurovision Song Contest and world and European figure skating, Wändi Bruine de Bruin, provost professor of public policy, psychology, and behavioral science at the University of Southern California, found in her research that judges gave higher marks to competitors who performed last.

Wall Street

Of course, recency bias affects us as investors as well, and it can be hard to avoid, partly because it is informed by facts. Not just facts—but recent facts that may seem indisputable due to their freshness.

During a stock market selloff, it’s easy to believe that stock prices will keep falling. Think back to early last year when the first coronavirus-induced waves of selling hit the market. It seemed like the bottom dropped out. And it did … right up until the breathtaking rally that recovered all of their lost ground (and more). Conversely, investors tend to jump on board during the tail end of a market rally only to be surprised that the rally doesn’t continue.

Here are three investing narratives supported by recency bias that will be true right up until they aren’t.

The market’s at an all-time high, so it’s not a good time to invest. If you’re prone to believe this, you will find ample proof, even as the market continues to hit new record levels. Rather than failing to invest, it might be more productive to create a dollar-cost-averaging program to move into the market in increments. That way, you can both participate in any future records and take advantage of an eventual pullback.

Growth stocks are doing so well, I don’t need to own value stocks. Growth stocks have, indeed, done well for the past several years when compared to value stocks. While it might be tempting to jump ship on your value stocks, mutual funds, or exchange-traded funds, ensuring that you have exposure to both is wise. This trend will end at some point, perhaps with a vengeance.

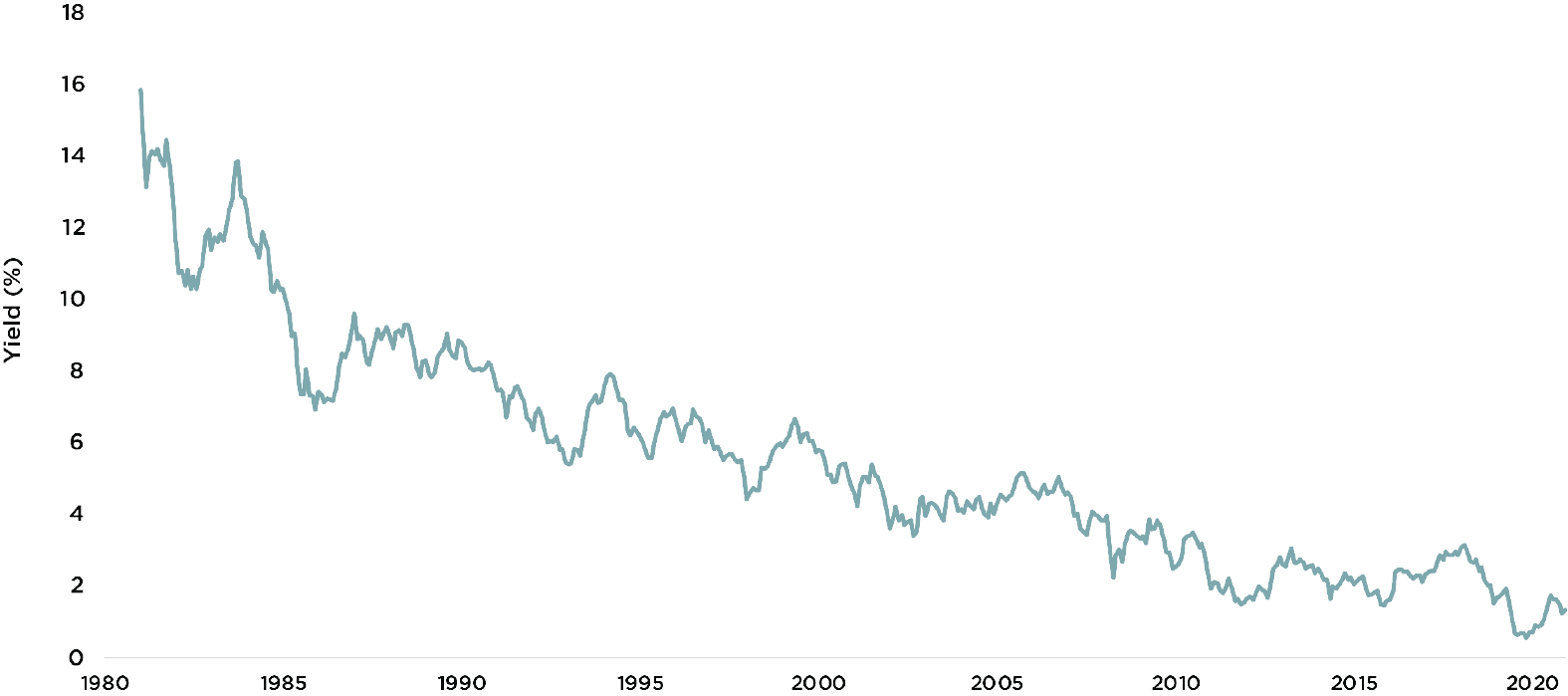

All I need is a simple portfolio of 60 percent U.S. stocks and 40 percent bonds. According to Morningstar, if you had invested $100,000 in a simple, cost-effective strategy like this in 1980, rebalanced it quarterly, and stayed the course—fees and taxes aside—your portfolio would be worth $6.8 million. That’s a 10.86 percent annualized total return over a 40-plus-year period. Wow! Why wouldn’t you just do that?

The easy answer is that the next 40 years cannot possibly look like the past 40 years. Much of the return of that minimally diversified portfolio came from exposure to U.S. bonds during an extended period of falling interest rates. During that period, the yield on the benchmark 10-year U.S. Treasury fell from 13.6 percent to 1.3 percent today. That literally cannot happen again.

Not Mission Impossible

While it might seem difficult to do, you can thwart recency bias—or at least minimize it—to help yourself make higher-quality investment decisions.

Get historical. In the immortal words of Mark Twain, “History never repeats itself, but it does often rhyme.” Pulling back the lens to view the longer sweep of history is often a helpful input into decision-making. For example, in the turmoil of a market pullback, looking at the frequency of past corrections could inform your view. History tells us that 5- and 10-percent pullbacks happen every year or two and that a 20 percent pullback is likely every seven years or so.

Look downstream. Making sure that you understand the implications of your decision may be helpful. Are there transaction costs? Will you owe significant taxes if, for example, you sell a highly appreciated position? How will you reinvest the proceeds? The answers to these questions may cause you to think twice.

Revisit your plan. Your financial plan can also provide important information for investment decision-making. Knowing, for example, the portfolio hurdle rate needed to fund your important life goals can be invaluable. You may find that it will be quite easy to achieve, so you can worry less about market pullbacks and won’t need to take an extraordinary amount of investment risk to get there.

Kick it around. You may want to seek opposing views to investment ideas you’re exploring. Many people process their thinking by speaking, so having a trusted sparring partner (or partners) to debate with can be a helpful way to expand your thinking. The more viewpoints, the better. This will add nuance to your ideas and help ensure you are thinking rationally.

Successful tactics to address recency bias tend to have two complementary characteristics to help you make better decisions: They provide both additional perspective on a topic, and they slow down the decision-making process.

While it is unlikely that Rotten Tomatoes is concerned about the influence of recency bias on its Top 100 Movies of All Time list, you might want to slow down and gather more information before your next movie night.

Exploring other sources—like the American Film Institute’s 100 Greatest American Movies of All Time or the Academy of Motion Picture Arts and Sciences’ list of past Oscar-nominated best pictures—can provide a much richer picture of quality films to spend your time on.

A lot of ways exist to help kids—grandchildren, nieces, nephews, godchildren, or any other young people in your life—build their financial muscles. Many of us utilize common practices like helping a child fill up a piggy bank over time, involving youngsters in small purchases using cash, helping them join the local bank or credit union to open an account, or by the different examples we set, such as sticking to a budget.

But it’s also important to teach kids lessons in investing, says father of two and Wilmington-based CAPTRUST wealth management advisor Buck Beam.

So, when it came time to pass on some of these lessons to his own two sons, Beau, 12, and Wayland, 9, Beam was “looking for a way for the kids to connect real money to the stock market and learn about how the stock market works,” he says.

All the Action in Just a Fraction

For the Beam family, it all started with the ubiquitous delivery trucks driving through their neighborhood, dropping off brown boxes adorned with a smile logo. “How about Amazon?” Beau and Wayland asked. There was just one problem: The boys’ stock pick was totally out of their budget, with a price tag in the thousands of dollars for a single share, says Beam.

Then he looked into fractional shares. While buying entire shares of stock in big name companies can get expensive, Beam quickly discovered that fractional shares are a fantastic way to get young people excited about investing and to help them develop valuable financial skills that will be with them for life, without committing a lot of money.

Since then, Beam has seen his two sons bloom into precocious investors. While working from home in the early days of the pandemic, the family even got into a routine of eating breakfast together while watching the business news, which led to the kids peppering their dad with questions about companies and how the stock market works.

“The idea of investing some of their own money was thrilling to the boys,” Beam says. They already had some savings—from birthday money and allowances—and Beam was excited to foster their interest. He even upped the ante by pledging to match their investments dollar for dollar.

A Long-Term Lesson

“Fractional shares of stock are a great opportunity for young investors because it can teach kids how money actually grows,” says Beam. “And kids are eager to learn—particularly when Disney and Apple could be involved.”

The idea is simple: Instead of buying whole shares of stock, parents, aunts, uncles, grandparents—or anyone with a young person in his or her life—can buy partial shares by the dollar amount. Also called dollar-based investing, this capability was first offered by some technology startup companies and then introduced by companies like Fidelity and Charles Schwab in 2020. With dollar-based investing, even someone with just a little bit of money can buy in and diversify his or her small-dollar portfolio.

“Investing in fractional shares is a neat activity to do with the kids,” says Beam, “and it has the long-term benefit of helping create savers and investors out of your kids and grandkids without putting a lot of money down.” According to Beam, fractional shares are for everyone—at the collective age of 21, his boys hold investments in Amazon, Microsoft, Roblox, Disney, and Apple.

Hands-On Investing

For Beam’s sons, their dad’s idea of investing in fractional shares meant they could afford to get into some of the brand-name stocks that they were familiar with. And that got their attention. The boys became very engaged and excited to talk with Beam about their personal stock holdings and their own investment ideas.

Beam quickly noticed a stark difference from his previous attempts to educate his kids on the workings of the stock market. In the past, his lectures were largely ignored. But kids, like adults, absorb complex concepts much better through experiencing them than by passively listening.

“A lot of kids don’t make financial decisions,” says Beam. “So it’s very interesting to them to have some skin in the game and then get to live with their decisions and see how it goes.”

In fact, one day last winter, Beau watched a news report about the airline sector being hard hit by travel bans and pandemic restrictions. Since the sector was down, he pondered, wouldn’t it be a good time to buy some airline stocks and hold them until they recovered? Beam was delighted to encourage him to follow his instincts. “I said, ‘Maybe! For the amount of money we’re talking about, it’s worth a try.’”

Beau invested $40 in an airline stock when the share price had dipped to the high $30s, getting a bit over one share’s worth. Since then, the stock has had ups and downs, trading above $50 at one point and back down to around $40.

“Beau and Wayland have seen the markets go up and go down,” Beam says. “They’ve watched Amazon trade at its highest price ever and then come down significantly.” It’s a small amount of money that they’ve invested, but to them, he says, it’s a really big life lesson.

Hungry for More

When Beam comes home from work these days, Beau or Wayland will rush to him, asking, “What’s my stock worth now?” Father and sons pull up the Fidelity mobile app and put their heads together, checking on the latest progress of their investment portfolios.

The experience has shown Beam how he can talk with his kids about the stock market. “This has been the first time in their lives they would ask me questions, instead of me just explaining what I do and why it matters. Now they’re curious. They want to understand. Once their money was on the line, they were hungry for more information,” says Beam.

What to Do with Winnings

Another important lesson for young investors is what to do with winnings. “When one of the stocks went up, their natural question was, ‘Can we get the money out and buy something?’” says Beam.

While Beam and his wife, Caroline, have not allowed the boys to take any money out, they have been asked by the boys repeatedly. While we can’t blame the budding investors for fantasizing about cashing in, rightfully so, Beam has “encouraged them to look at this money as a long-term savings account, not a source of money for buying a toy or a treat or a video game.”

Beam also wanted the boys to avoid short-term gains, which might have tax consequences. More importantly, he was teaching them to become savers and long-term investors—a habit that is truly a valuable gift to impart on a child.

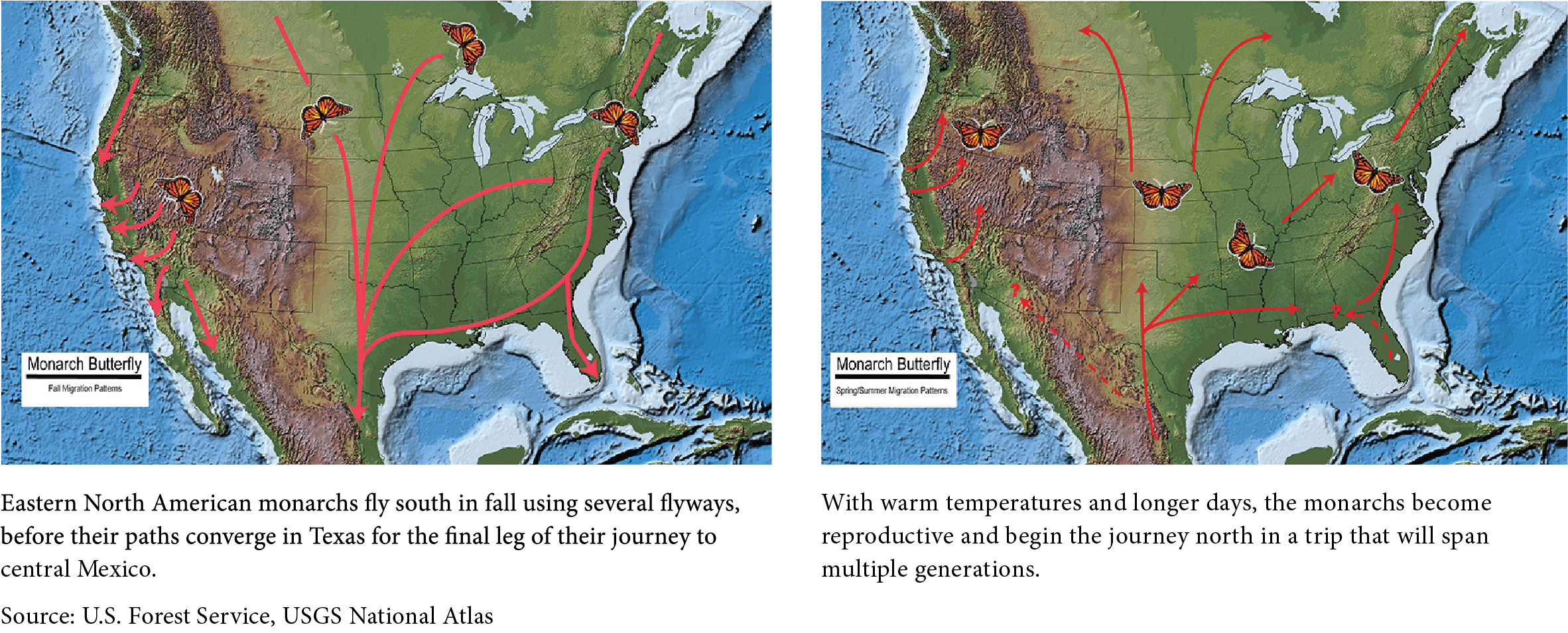

A good illustration of the long-term investing mindset comes from an unlikely source: the migration pattern and lifecycle of the monarch butterfly. In one of the most amazing feats of the natural world, each spring, these fragile insects migrate as much as 3,000 miles from a small mountainous region in central Mexico to as far north as the coastal Canadian province of New Brunswick.

However, no single monarch makes the trip—it can take up to four generations to travel the entire distance. Individual insects contribute and play their small parts knowing that, although they may not see the conclusion of the journey, a future generation will arrive safely at their destination to restart the cycle.

Environmental scientists have a term for this type of behavior: biological altruism. An organism is considered altruistic when its behaviors benefit its species at a cost to itself, as survival of the fittest makes way for the collective survival of the generous.

This analogy can be applied to the mindset of long-term investors, whether a private investor or family whose goals may extend far beyond their own lifetimes or an institutional investor, such as an endowment, foundation, or perpetual benefit plan. Altruistic investors will frequently be tested by their emotions and market volatility as they seek to provide security and opportunity to future beneficiaries.

The Long-Term Advantage

The first step in developing a long-term mindset is to recognize the unique advantages and risks posed to investors with multigenerational investment objectives, then designing approaches to optimize the former and manage the latter.

The long-term investor’s greatest advantage is his or her extended time horizon. This is particularly true when the investor has limited liquidity needs from the portfolio. Because such investors can focus on objectives measured over many decades, short periods of poor performance and market volatility have minimal impact and are barely noticeable. In this way, individual investors can learn from large institutional investors, such as university endowments, charitable foundations, and public and private sector benefit plans with long time horizons.

In fact, because institutional investors are typically governed by investment policies that specify portfolio target weights and rebalancing methodology in an unemotional way, studies have shown that endowments tend to invest countercyclically during times of crisis by paring allocations to risk assets during the run-up to a crisis and increasing those allocations during periods of market stress.1

One simple way that individual investors of all types can replicate this strategy is through the use of mental accounting. Instead of viewing and managing their investments as a single portfolio, investors divide their portfolios into several buckets with different risk, income, and liquidity profiles. For example, a three-bucket approach could include:

- Liquidity—contains a comfortable amount of cash and other highly liquid short-term securities to provide for current cash or spending needs.

- Income—a portfolio designed to satisfy near-term income needs via higher-yielding securities, such as credit-focused fixed income and dividend-oriented equity strategies, with an eye toward tax efficiency.

- Growth—a portfolio with higher expected risk and return for long-term growth potential. Investors will often maintain several such buckets earmarked for different objectives, such as college savings, retirement, and lifetime giving, as well as longer-term legacy objectives.

The presence of each bucket allows a longer-term perspective for each successive bucket. During times of market stress, the liquidity bucket provides the investor with the breathing room and time for recovery in the income bucket, and the income bucket reduces the liquidity required within the growth bucket. This strategy is also intended to be dynamic so that, over time, the relative weights of each bucket can be recalibrated to meet the investor’s current situation.

Long Journeys Require a Map

The annual monarch migration brings millions of butterflies, scattered across all corners of the North American continent, together to a few isolated mountains in the Sierra Madre range—a feat of navigation that biologists still don’t fully understand. Many (if not most) human beings, in contrast, require a map or smartphone app to navigate across town, let alone across long, never-before-traveled routes.

Although long-term investors measure their journeys in years (or decades) instead of miles, they still require a road map. For long-term institutional investors, this guidance takes the form of a comprehensive investment plan called an investment policy statement (IPS). This document is a powerful tool that establishes a set of guardrails and guidelines for the long-term management of investment assets, including the roles and responsibilities of the various parties involved, clear definitions of success and risk, asset classes and investment types allowed within the portfolio, and the target, minimum, and maximum weights of each category.

Individual investors can replicate this approach through the development of a comprehensive financial plan that considers all aspects of their financial lives, their near- and long-term goals, and how they will measure progress toward those goals. Such a plan should consider not only the preferences, constraints, and risk tolerance of the individual but also the nature of the risks that jeopardize long-term success, how sensitive the portfolio is to each of those risks, and how they can be managed.

To succeed, investors need to clearly define their goals, have an objective analysis of the strategy needed to accomplish them, and then a detailed plan for execution and ongoing monitoring.

Having such a plan also provides a systematic structure for managing emotions. Rebalancing to strategic targets allows investors to harvest gains, remain in balance when returns are strong, and add to positions when markets are challenged.

The Importance of Teamwork

Another example of animal altruism can be seen in the migration of Canada geese. While these birds may seem a bit mean-spirited and aggressive when encountered at a park or golf course, they exhibit incredible teamwork along their migration journeys. It’s well known that the key to their long-distance migration is the iconic V-formation that allows for much longer distances than any single bird could fly on its own. But when an individual bird is sick or injured, two other geese will fall from formation to help the injured bird until it either recovers and can rejoin the flock or dies.

Teamwork is also an important element of successful long-term investing. Other advantages enjoyed by institutional investors, such as endowments and foundations, are the presence of a team of professional investment staff or investment consultants and the oversight of an investment committee. These teams provide a diversity of ideas and perspectives that can help reduce one of the greatest threats to the long-term success of individual investors: the risk of emotional investing.

Teams of people provide a wide array of perspectives. Some members may be bullish and aggressive, while others may be more cautious. Some may seek specialized, alternative, or private investments in search of diversification and excess return, while others are laser-focused on keeping investment expenses low. The result in well-functioning committees is a diversification of emotions that helps temper the biases of any individual.

Individual investors can replicate these benefits by surrounding themselves with capable teams of advisors and professionals who bring a diversity of views but are all on the same page with regard to goals and objectives. It can also be important to include family members as part of the team to help build awareness and alignment with long-term goals and strategies.

Managing Long-Term Risks

Managing emotions is, without a doubt, the greatest challenge faced by any investor. This is true when markets are on a tear—leading to the temptation to take additional risk—but is particularly important when markets face challenges. Long-term investors must avoid the temptation to alter their investment strategies based upon current conditions. In other words, avoid market timing. However, this doesn’t mean that long-term investors should turn a blind eye to the markets, set it and forget it, and bury their heads in the sand.

Long-term investors should be far less interested in whether this year’s S&P 500 companies’ earnings estimates are 5 or 6 percent higher than last year’s or the current level of stock price valuations or investment-grade bond credit spreads. Rather, the focus should shift to structural changes within the markets and the economy that either pose risks to accomplishing their objectives or introduce new investment opportunities.

Capital market assumptions. Although the asset allocation of long-term portfolios should remain relatively stable, material shifts in the long-term risk and return expectations of asset classes, levels of inflation, and economic growth may influence how portfolios are designed for maximum efficiency and can point to the kinds of investment strategies that provide the greatest opportunities for success. For example, investing in fixed income today—after the 40-year secular decline in interest rates illustrated in Figure Two—should be different from the approach taken decades ago.

Figure Two: 10-Year U.S. Treasury Yield (1981—2021)

Sources: CAPTRUST Research, Bloomberg

Demographics. Perhaps no other economic force holds more power than demographic shifts. Consider the impact of the baby boom generation on the U.S. and global economy. Most of the largest countries are expected to see material declines in population in the second half of this century, along with major shifts in the age structure that may see the number of people over age 80 exceed those under age 5 by a ratio of two to one.2 More favorable demographic trends are expected to occur within emerging markets, albeit with heightened risks of political and economic instability.

Global conditions. One of the most significant trends of the past 50 years has been globalization and an increasing degree of global economic interconnectedness. This trend has contributed to corporate profitability and helped keep inflation low. However, it also presents increased risks of ripple effects of geopolitical or trade tensions, or economic, social, or political upheaval across the globe.

Inflation. Perhaps the most potent risk to long-term investors is the preservation of purchasing power over long time horizons. Stable and modest inflation also represents an important precursor to economic stability and growth.

Technology. Keeping an eye on technological shifts is critically important for long-term investors as a source of significant growth and obsolescence risk. Technology has permeated all aspects of our daily lives, and technology stocks now represent the largest component of the S&P 500 by market capitalization. This does not, however, imply that the long-term investor should chase every hot innovation. Indeed, many traditional, old-economy companies may see material benefits from improving productivity and efficiency through the application of new technology.

Evolving to Succeed

Not all animals are wired to demonstrate the same kind of altruism as the humble monarch butterfly. Some Antarctic penguins will shove their mates from the ice to ensure that the water is safe before taking the plunge themselves. Although this may improve the odds of group survival, it only works because penguins seem to lack the ability to hold a grudge. Another example can be found in the many species of animals that are known to eat their offspring—even species that, paradoxically, also care for their young.

Although it’s hard to understand this behavior, we must recognize that Mother Nature—with a time horizon of hundreds of thousands or millions of years to evolve behaviors that improve the odds of survival—is the ultimate long-term investor. Even if investment goals are only a few decades away, maintaining the right mindset, building a team and a plan, and continually monitoring for environmental threats and opportunities represent the best approach to arrive at your destination.

1 Chambers, Dimson, Kaffe. “Seventy-Five Years of Investing for Future Generations,” Financial Analysts Journal, vol. 76, no. 4, Fourth Quarter 2020

2 “Global population in 2100,” The Lancet, 2017

Q: Are criminals targeting retirement accounts? If so, what do I need to know to protect myself?

Attempts to steal from 401(k), 403(b), and other retirement accounts are, in fact, on the rise. But while it might feel like crooks always seem to be a step ahead of the good guys, you should know that stealing from a retirement account isn’t easy.

Criminals try to steal from retirement accounts using both old-world and thoroughly modern techniques. They might try calling the plan’s recordkeeper and impersonating you or sending a faxed distribution request with your signature.

That’s right—crooks can even lift signatures from other documents to create an initial online identity or steal the one you have in place through hacking.

Each approach requires different knowledge about you, and there are several barriers in the way. In addition, 401(k) accounts are more difficult to steal from than typical bank accounts because they often require additional paperwork from the employer to access the money, but these retirement accounts can also be easily subject to fraud if the crook has the right information.

Experts say criminals use a few common tactics. One is acquiring an account holder’s statement or website credentials and contacting the financial institution pretending to be the account holder trying to get his or her money out.

The other way crooks make off with retirement savings is by using a technique called social engineering (which is what used to be called a con or a grift), persuading the account holder to transfer funds out of the account.

Fortunately, there are some things you can do to protect yourself from frauds like these. Taking the following steps can help safeguard IRAs and retirement plan accounts like 401(k)s.

Create an online account. Experts recommend setting up online account access even if you prefer paper statements. It’s easier for impersonators to take control of your account online if you haven’t claimed online access for yourself.

Check in regularly. Check your retirement account, including your email and street addresses, at least monthly. Sign up for text alerts that notify you of changes or transactions, and use multi-factor authentication (MFA). MFA is a security enhancement that allows you to present something you know—like your password—with two credentials when logging into an account. Credentials fall into any of these three categories: something you know, like a password or PIN; something you have, like a smart card; or something you are, like your fingerprint.

Practice good internet hygiene. Avoid public Wi-Fi, and never click on suspicious or unfamiliar links in emails, text messages, or instant messaging services seeking personal information, including passwords.

Design good passwords. Choose unique passwords that you keep confidential. Long passwords are stronger, so make your passwords at least 12 characters. Try using a lyric from a song or poem, a meaningful quote from a movie or speech, or a passage from a book.

Dispose of printed statements carefully. Shred printed statements along with other sensitive documents. Local office supply stores offer shredding by the pound in case you have lots of old statements to dispose of.

If you see something, say something. If you are personally affected, immediately call your recordkeeper and employer and have a freeze put on your account. You may also want to report it to the Federal Trade Commission (FTC) at ftc.gov, the Treasury Inspector General for Tax Administration (TIGTA) at tigta.gov, and your local police department.

Q: I’ve heard Congress might raise the age for taking RMDs. What do I need to plan for if the age moves to 73?

It is true. The age when Americans must start making withdrawals from traditional individual retirement accounts (IRAs), IRA-based accounts, and most employer-sponsored retirement plans could change again, and potentially soon.

The proposed new legislation, nicknamed SECURE Act 2.0, would increase the required minimum distribution (RMD) age to 73 starting in 2022, then to 74 in 2029 and 75 in 2032.

This change is expected to become law either by the end of this year or sometime in 2022. However, the potential impact of a higher age requirement on your RMD timing is mixed and depends on how quickly you need the money.

The majority of retirees will not be impacted. According to the Internal Revenue Service (IRS), 79 percent of retirees take more than their RMD annually because they need the money.

However, for the 20.5 percent who take only the minimum amount required, the extra years could provide more time to strategize.

If you have income sources in addition to your IRA and company plan, waiting another one to three years can be a big plus because it allows your savings to grow on a tax-deferred basis for longer.

Another big planning opportunity related to RMDs at 73 is that the SECURE Act leaves the eligible age for qualified charitable distributions, or QCDs, intact at 70 1/2. The QCD gives charitably inclined retirees the opportunity to make tax-free gifts using assets from their tax-deferred accounts.

The mismatch between the QCD-eligible age (70 1/2) and the new RMD age of 73 provides an opportunity to use QCDs aggressively when first eligible with an eye toward reducing RMDs when they commence. However, it is a short window, and QCDs are limited to $100,000 per year.

A delay in the RMD age is also an opportunity to convert more of a traditional 401(k) or IRA over time to a Roth IRA.

While taxes are paid on the converted money, withdrawals down the road would be tax-free, unlike distributions from a traditional IRA or 401(k), which are taxed as ordinary income.

Similarly, those post-retirement, pre-RMD years allow for tax-lowering maneuvers not directly related to the IRA. For example, tax-gain harvesting in taxable accounts can help reduce or eliminate capital gains taxes eventually due on those assets.

While the first SECURE Act eliminated the stretch IRA for the majority of beneficiaries who inherited IRA assets in 2020 or later, it does provide a big opportunity for Roth IRA beneficiaries.

Distributions from inherited Roth IRAs are almost always tax-free. A beneficiary could take no distribution until the tenth year after inheriting the account, leaving all the earnings in the inherited Roth IRA to grow tax-free. The account could then be emptied in the tenth year after years of tax-free growth with no tax bill for the beneficiary.

If you are considering your estate plan and are thinking about how your beneficiaries will fare under the new rules, now may be a good time to consult with a knowledgeable tax or financial advisor.

Competitive wages and benefits are key to attracting and retaining talent. That’s become increasingly clear to employers as record-low unemployment and a shortage of skilled workers make it difficult to fill openings. Along with health benefits, retirement savings vehicles have long been the most valued employer-sponsored perks. Administering such plans requires strict governance and oversight, however, and organizations face significant financial risk if they run afoul of their fiduciary responsibilities.

A fiduciary is anyone with decision-making power over the creation, management, or administration of an employee benefit plan. This could be the company itself, its directors and officers, plan administrators, and trustees. The Employee Retiree Income Security Act of 1974 (ERISA) created fiduciary liability for employers that offer employee benefits plans, leading to widespread availability of fiduciary liability insurance coverage in the mid-1970s. Such coverage protects the company and individuals against fiduciary-related claims of negligence, mismanagement, or other actions deemed not in the best interest of plan participants.

ERISA Litigation

The number of ERISA lawsuits doubled from 2018 to 2020, according to Forbes. Such litigation began around 2005 and has been running rampant ever since, says Phyllis Klein, a senior director of retirement services for CAPTRUST. Fiduciary liability insurance is crucial not only because of the sheer number of lawsuits, but also because of the cost of litigation, which has been growing astronomically, Klein says.

According to Bloomberg Law, lawsuits alleging fiduciary breaches have garnered more than $430 million in settlements in recent years. Most of the suits have targeted plans in excess of $1 billion in assets and are related to excessive fees. And the settlements are meaningful:

- In July, Koch Industries agreed to pay $4 million to settle a lawsuit alleging the company allowed excessive recordkeeping fees to be charged to participants in its defined contribution plans.

- In 2020, Oracle Corp. settled a 401(k) lawsuit for $12 million. The suit alleged that Oracle breached its fiduciary duty to plan participants by including three investment options in the 401(k) plan that underperformed their benchmarks and charged excessive fees.

- In 2021 Cerner Corp. agreed to pay $4.1 million to settle allegations that the plan fiduciaries violated their ERISA duties by retaining poor-performing investments and charging excessive fees.

Rising Premiums

As litigation costs and settlements continue to rise, fiduciary insurance premiums are also increasing significantly. Double-digit increases are common, with some insurers charging double or triple their previous premiums. According to Pension & Investments, employers can expect even higher premium increases in 2022. And as Klein explains, costlier premiums may not be the only challenge companies face going forward.

“Because the insurers have paid out so much money to settle these cases, they are becoming selective in, not only the cost of the insurance, but how much they are willing to insure,” Klein says. “An employer may have been insured for $25 million, but now, they can’t find a single insurer willing to insure them for $25 million, so they have to look to multiple companies to build up to the level they are comfortable with.”

Regardless of the cost or the challenge of securing adequate coverage, Klein says fiduciary liability insurance is a must-have. Unfortunately, it may soon become difficult to obtain coverage at all, as some insurers may decide they don’t want to be in the fiduciary liability insurance business anymore because the risk of large settlements is just too great.

“We may start to see insurers just not want to insure anymore because it’s a constant payout,” says Klein. “Some of the settlements have been in the tens of millions of dollars, and insurers are asking whether the premiums are worth the risk.”

Managing Risk

In determining whether to offer coverage, insurers are increasingly asking probing questions to determine whether a company’s fiduciaries are practicing good governance. Do you meet regularly? Do you keep meeting minutes? Are you benchmarking your plan on a regular basis? Do you review your fees regularly? Do you have an investment advisor? Do you have company stock in the plan? Such questions are becoming commonplace, as insurers seek to determine the likelihood of a client being targeted for a class action suit.

Herein may lie the silver lining, as fiduciaries become more judicious about practicing good governance to satisfy insurance carriers and reduce the risk of facing a class action ERISA suit.

“Anyone can sue you, but if you have good governance and good processes in place, that will go a long way in helping to manage the risk,” says Klein. “You’re never going to get rid of the risk, but if you embrace your role as fiduciary, ask the right questions, and stay engaged, it will become more manageable.”

Studies show that employees are far more likely to save for retirement when they can participate in a retirement plan at work. But for small companies, the cost and resources required to start and maintain a retirement plan can be prohibitive.

In fact, only 53 percent of small business employees have access to workplace retirement plans. And with nearly half of all private sector workers employed by small companies, that means almost 30 million Americans are without retirement plan access.1

Fortunately, Congress has taken notice. Recent legislation expanded tax incentives designed to make it more affordable for small businesses to establish retirement plans—and easier for Americans to save.

Startup Costs Tax Credit

Establishing a retirement plan can be costly, especially for small employers. The small-employer retirement plan startup credit helps reimburse some of the expenses required to create a new plan.

The Setting Every Community Up for Retirement Enhancement (SECURE) Act of 2019 increased these tax incentives. Now, small businesses can take advantage of a $250 credit per non-highly compensated (NHCE) employee. This includes a minimum credit of $500 and a maximum credit of $5,000 per year.

Small businesses can apply this credit to 50 percent of the costs related to plan administration and participant education. Businesses can claim this tax deduction for up to three years.

Automatic Enrollment Credit

Automatic enrollment is a plan feature that allows employers to enroll eligible employees in a retirement plan at a set contribution amount without direct permission. Participants can change the deferral amount or opt out at any time but do not need to take action to start saving.

Employee inertia is one of the major roadblocks to retirement savings. Thus, automatic enrollment has proven to enhance retirement plan participation—and retirement outcomes.

The SECURE Act incentivizes employers to add automatic enrollment to their plans by offering a tax credit of $500 per year, for up to three years. The credit is available to all new and existing small-employer plans that add an automatic enrollment feature. For new plans, it is in addition to the startup credit.

It is also important to note that the automatic enrollment tax credit is not limited to individual plans. Small employers that participate in a multiple employer plan (MEP) can also take advantage of the credit by adding automatic enrollment.

Who Is Eligible?

The small-employer credits are available to businesses with 100 or fewer employees. These employees need to have earned at least $5,000 in compensation in the prior year. Among them, there must also be at least one plan participant who is an NHCE. An NHCE must own less than 5 percent of the business or earn less than $125,000 annually.

Additionally, the employees cannot have received contributions or accrued benefits in another retirement plan sponsored by the same employer, a member of a controlled group that includes the employer, or a predecessor of either for the three tax years before the first year of eligibility.

On the Horizon

Concerns about Americans’ ability to successfully retire are widespread. But retirement plan access may help mitigate a potential crisis. Thus, expanding retirement plan coverage continues to be a legislative priority.

Some states have taken matters into their own hands. State-sponsored automatic individual retirement accounts (auto-IRAs) provide a retirement savings vehicle for workers without an employer-sponsored plan.

Proposed legislation like the Build Back Better Act—approved by the House Ways and Means Committee in September—seeks to mimic this on a national level. It would require employers that do not sponsor a retirement plan to automatically enroll their employees in an IRA or a 401(k)-like plan, starting in January 2023. Should this become law, it may motivate private employers to establish plans to avoid a government-run option.

Another piece of legislation, the Securing a Strong Retirement Act of 2021—known as the SECURE Act 2.0, seeks to further encourage small businesses to establish retirement plans. The SECURE Act 2.0 proposes an additional increase to the small-employer startup plan credit. It would also allow small employers that join an established MEP to take the startup credit for the first three years in the plan.

With retirement plan access center stage, employers are likely to face continued pressure to provide employees with an option to save. Small businesses are wise to be proactive.

Along with the current tax incentives—which combined can total up to $5,500 per year, or $16,500 for three years—employer-sponsored plans have business advantages. Retirement plans support employee wellness and retirement readiness. They also serve as a recruitment and retention tool. These benefits may be the competitive edge a small business needs to thrive.

1 “2020 Small Business Profile,” U.S. Small Business Administration Office of Advocacy

Elevating diversity and closing inclusivity gaps are an absolute must for any successful organization, says Lanaya Irvin, president of Coqual, a nonprofit research organization that helps leaders create more diverse and inclusive workplaces.

“Diversity, equity, and inclusion is more than just the right thing to do, it’s actually better for business,” says Irvin. And she is not alone in her thinking.

Deloitte shows that when employees think their organization is committed to and supportive of diversity and inclusion, the companies report better outcomes. Specifically, Deloitte reports increases in the ability to innovate (83 percent), responsiveness to changing customer needs (31 percent), and team collaboration (42 percent).

And Cloverpop, a cloud-based platform to communicate, measure, and manage decision making across enterprises, has long associated diversity with better decision making and higher business performance. Cloverpop’s research bolsters the case that employers that build diverse and inclusive teams more often attain the desired outcome—whether that be increased revenue, bolstered employee wellness, or changes in infrastructure, to name just a few.

According to Cloverpop, gender diverse teams make decisions that give the best outcome for themselves and others 73 percent of the time. And as for teams that include an even wider range of ages and different geographic locations? They make better decisions 87 percent of the time! 1

Moreover, according to Boston Consulting Group, companies that reported above-average diversity on their management teams also reported revenue from products and services launched in the past three years that was 19 percentage points higher than that of companies with below-average leadership diversity. 2

But does being inclusive matter for retirement plan committees? Yes, says Tim Irvin, a CAPTRUST institutional advisor based in New York City, New York. “When an employer cultivates diversity and inclusion among its retirement committee, it is far more likely to meet plan participant needs.”

According to Irvin, there are a few things employers may want to consider to ensure they have a diverse group of decisions makers leading their retirement plan committees.

Look around. Get started by simply looking around the room, says CAPTRUST’s Irvin. “Once you have a retirement plan committee made up of qualified experts who can effectively make decisions on behalf of participants and beneficiaries, the obvious—and often uncomfortable—starting point is to take stock of how visibly diverse the retirement plan committee is.”

Represent the whole. Make sure your committee’s demographics match your employee base, says CAPTRUST’s Irvin. “To build a highly effective retirement plan committee, the committee members need to be qualified and reflect the same characteristics as the plan participants,” he says. “What matters is that they are knowledgeable about the plan and representative of the institution.”

And once the right group of fiduciary-minded people are together, it’s time to set the tone, Irvin says.

Put it on the agenda. “Showing that diversity is important by keeping it on the retirement plan committee agenda is a good idea,” says Irvin. Committees can even go a step further, he says, by embedding diversity and inclusion into the organization’s overall strategy. This allows the retirement plan committee to prioritize the topic alongside other business key performance indicators (KPIs) and objectives.

To get started, define which diversity measurements will be monitored, says Irvin. For example, committees can look at who is using what benefits, and how often. Are more women participating in the plan versus men? How many participants identify with a race other than White? Which groups have lower contribution levels or higher loan usage?

Another important piece? Make the numbers visible to the retirement plan committee so that all are collectively held accountable, says Irvin.

The result: Retirement plan committees absolutely benefit from engaging people from different races, religions, genders, ages, and socioeconomic conditions, says CAPTRUST’s Irvin. “A homogenous group simply will not ask the same questions as a diverse group.”

Adopting an inclusive and diverse approach can bring a wide range of viewpoints on age, race, culture, and inclusivity, allowing the committee to better serve participants from all demographics.

CAPTRUST’s Irvin says he is very lucky to have a lot of clients where the retirement plan committee is a mix of different characteristics, races, and ages. “I work closely with institutional retirement plan committees that have really made a strong effort to have broad representation across gender, age, job classification, race, sexual orientation, and ethnicity.” As a result, he says, “the conversation is changing—more people have a voice.”

1 “Hacking Diversity with Inclusive Decision Making,” Cloverpop, 2017

2 Lorenzo, Voigt, Tsusaka, Krentz, Abouzahr, “How Diverse Leadership Teams Boost Innovation,” Boston Consulting Group, 2018

Missing participants are former employees who leave funds in an employer’s retirement plan but fail to keep their contact information current. These participants are no longer actively engaged in the management of their accounts—and the problems they cause for plan administrators are only increasing.

Missing participants do not receive important communications about their accounts. For example, they miss out on fee disclosures, fund changes, or communications about recordkeeper transitions. They may even forget about their accounts. Worse, with limited or no engagement, participants’ retirement readiness suffers.

For plan sponsors, missing participants can increase plan costs due to their negative impact on average account balances. They may also pose a significant administrative burden and increase fiduciary risk, including the potential for Department of Labor (DOL) audits.

While most organizations struggle with missing participants, there plan sponsors can take steps to address the issue. In January, the DOL released guidance on locating missing participants. This new guidance expands on past bulletins that focused primarily on enforcement. Here are a few takeaways.

Finding Missing Participants

A plan’s recordkeeper or third-party administrator (TPA) can serve as a partner in locating missing participants. Plan sponsors can ask their TPAs which methods they utilize and consider implementing additional ones.

Plan sponsors should keep in mind that incorrect addresses often result in missing participants. For example, typos such as zip code errors, misspelled street names, or the omission of an apartment number can be enough to lose track of someone.

Plan sponsors looking for missing participants can search historical plan records and any related plan date and documents on file. Check benefit and employment records and alternative contact information. Public records for licenses, mortgages, and real estate taxes—or even the phone book—are other sources for contact information.

While sometimes viewed as an outdated approach, mail to the last known mailing address can work. The DOL recommends using certified mail through the U.S. Postal Service (USPS). Beyond that, plan sponsors should try email, telephone, text message, and social media. Engaging former colleagues or publishing a list of missing participants on the company intranet can also be successful. Another resource is the Social Security Death Index, a database of names and dates of birth and death for over 77 million Americans.

How to Prevent Missing Participants

To limit the number of future missing participants, plan sponsors have a few options. Consider rolling over terminated employees’ account balances of $5,000 or less to an individual retirement account (IRA). Also, talk to the plan’s recordkeeper or TPA and ensure undeliverable mail and uncashed checks get flagged for follow-up.

Engaging participants before they go missing helps, too. Plan sponsors should encourage employees to keep their retirement plan contact information current. Communicating this, along with cybersecurity best practices, such as regularly updating passwords, is good procedure for plan sponsors. Another proactive option is to conduct preventive searches on an annual or semi-annual basis for all terminated participants.

By making a good-faith effort to locate participants—and taking steps to prevent them from going missing in the first place—plan sponsors can help protect themselves and ensure all plan participants receive the retirement plan assets that they are entitled.

Q: Bitcoin has received a lot of attention lately from the financial media and investors. What is it, and what are some of the risks?

Many of our readers have noticed the fierce debate over Bitcoin recently. Is it an investment, digital gold, a scam, a network of computers, or even the future of currency? If you’re wondering what all the fuss is about, here is a brief introduction explaining what Bitcoin is and what it isn’t and detailing some of this emerging asset’s unique characteristics.

Bitcoin is a digital asset (sometimes called a cryptocurrency) supported by a peer-to-peer Internet-based ledger system. It was launched in 2009 by an individual or group known by the pseudonym Satoshi Nakamoto. Unlike printed currency or minted coins, Bitcoin is not created or maintained by a government. Whereas Bitcoin has been talked about as a currency—to be used for buying and selling goods and services—today, it is thought of increasingly as an investment.

It is not a security. Bitcoin is an asset—like a direct investment in real estate, such as a home, or an investment in physical gold bars. Bitcoin is not an investment like a mutual fund or exchange-traded fund (ETF), both of which are regulated securities.

It is volatile. Over bitcoin’s history, its value has fluctuated wildly, with peak-to-trough drawdowns of greater than 50 percent in a single day. As speculation and confidence in bitcoin has ebbed and surged, this volatility has led to problems for people trying to make payments in bitcoins. At the beginning of 2017, one bitcoin was worth about $1,000. In March 2021, the price topped $60,000 for the first time. In between, bitcoin investors have been tested, over and over, by gut-wrenching price declines.

It is difficult to manage. The decentralized nature of the Bitcoin system makes it more challenging to follow the flow of money and for governmental regulators to get a handle on it. Major bitcoin exchanges located around the world have been subject to trade disruptions and the potential for increased regulatory scrutiny. Also, unlike credit card charges, transactions are irreversible.

It is not insured. While securities accounts at U.S. brokerage firms are insured by the Securities Investor Protection Corporation (SIPC), and bank accounts at U.S. banks are insured by the Federal Deposit Insurance Corporation (FDIC), bitcoins held in a digital wallet or exchange do not have similar protections.

It is vulnerable to security threats. Fraud, technical glitches, hackers, cyberattacks, or malware could cause bitcoin exchanges to stop operating or permanently shut down. Login information needed to access exchanges can be forgotten, lost, or stolen by hackers or phishers. Once access is denied, it cannot be restored, resulting in the loss of one’s bitcoin account.

It may limit your recovery in the event of fraud or theft. If fraud or theft results in you losing bitcoins, you may have limited recovery options. Third-party wallet services, payment processors, and bitcoin exchanges that play important roles in the use of bitcoins may be unregulated or using developing technologies vulnerable to hacking.

U.S. Treasury Secretary Janet Yellen has called Bitcoin “an extremely inefficient way of conducting transactions.” But she also said it makes sense for central banks to consider a digital dollar, which could lead to faster, safer, and cheaper payments—a statement that could open the door to regulations from the Federal Reserve, Treasury, or the U.S. Securities and Exchange Commission (SEC) in the coming years.

The question of whether Bitcoin has a place in your portfolio is not an easy one to answer. At this time, Bitcoin is speculative, but it may become more desirable in the future and may provide a means of portfolio diversification. Overall, the universe of Bitcoin as an investment vehicle is small but could expand as consumers, Wall Street, and technology firms build momentum toward mainstream acceptance.

If you’re considering investing in Bitcoin, be prepared to potentially lose much—if not all—of your investment. Proceed with caution, educate yourself, know the risks involved, and work with your financial and tax advisors to determine whether Bitcoin makes sense for your portfolio. Depending on how comfortable you are with volatility, it may be wiser to stay on the sidelines than to be on the field.

Q: My husband and I want to start transferring ownership of our family business to our children. We’ve heard about family limited partnerships. What are they, and how do they work?

A family limited partnership (FLP) is an agreement between family members involved in a trade or business. It divides rights to income, appreciation, and control and can hold investments, real estate, cash, or other business assets. An FLP can be a good solution to help transfer ownership of the family business to the next generation during your lifetime—all while allowing you to retain control of the business.

FLPs have two types of partners. General partners usually own the largest share of the business and oversee operations. They can gift as much as 99 percent of the limited partnership interests to the younger generation. Limited partners have no management responsibilities, and they are not liable for the debts of the FLP beyond their contributed capital. Limited partners, instead, buy shares of the business in exchange for dividends, interest, and profits the FLP generates. A powerful advantage of an FLP is that it can help cut federal gift and estate taxes.

Leverage the annual gift tax exclusion and gift and estate tax applicable exclusion amount. Gifts of interests in an FLP are subject to federal (and state) gift tax. However, you can minimize your federal gift tax liability by taking advantage of the annual gift tax exclusion. Through 2021, gifts of limited partnership interest up to $15,000, per recipient, are free from gift tax. Further, every taxpayer has a federal gift and estate tax applicable exclusion amount equal to the basic exclusion amount of $11,700,000 in 2021. However, it is important to note that this amount could be reduced to a much lower level under the Biden administration. Transfers that do not fall under the annual gift tax exclusion will be free from gift tax to the extent of your available applicable exclusion amount.

Take valuation discounts. By discounting the value of limited partnership interests, more FLP interests can be gifted tax free to the next generation, which results in more assets passing out of an individual’s taxable estate.

Limited partners have very restricted rights, such as the inability to transfer an interest, withdraw from the FLP, and take part in management. These restrictions can result in a business value significantly less than the value of the underlying assets, and the valuation discounts can be considerable, totaling as much as 35 percent. Discounts applied may include the minority interest discount and the lack of marketability discount.

Remove future appreciation from your estate. Business assets generally increase in value over time. Distributing your assets among family members through the FLP freezes the current value of your estate and keeps any future growth in value out of it later. You may have to pay gift tax now, but it will be less than the tax calculated on a higher future value.

An FLP is a passthrough entity for income tax purposes. The Internal Revenue Service (IRS) does not recognize an FLP as a taxpayer, and income of the FLP passes through to the partners. So, you can shift business income and future appreciation of the business assets to other members of your family in a lower tax bracket. Through 2025, subject to various limits, an individual taxpayer can deduct 20 percent of domestic qualified business income (not counting compensation) from the FLP.

Keep in mind, FLPs are subject to more restrictive rules than other forms of business entity to be valid in the eyes of states and the IRS. To determine whether an FLP is the right vehicle for your estate planning needs, consult with a qualified lawyer and tax accountant with experience in structuring FLPs.