Planning a Business Exit That Leaves a Legacy

It’s no surprise that many family business owners postpone planning their exit. Selling a business involves legal and financial complexity, and owners are often consumed with daily operations and growth strategies. Many also struggle to even imagine stepping away, having dedicated much of their lives to their work. “People who have their own business, oftentimes it is their personal identity,” says Denise Rothermel, a financial planner and business valuation specialist at CAPTRUST.

Among business owners aged 55 and older, only 17 percent report having plans in place for selling or transferring ownership of their business within five years, according to a Gallup poll. Yet without a plan, a family business is at great risk of losing value or even closing if the owner becomes incapacitated, the market changes, or emergency circumstances force a quick sale.

But “selling a family business isn’t just a financial transaction,” says Rothermel. “It can be a deeply emotional one.”

In one case, Rothermel advised a married couple who built a successful yacht restoration company. Over the years, it grew to a premium provider in the market. As they approached retirement age, they hadn’t done much to prepare for what came next.

Then, an unexpected offer from a potential buyer caught them off guard. The offer was sizable—but could the business fetch more? Should they shop it around to maximize value? How much labor and preparation would that involve? More importantly, were they ready for the next stage of life? And what would happen to their employees?

The couple turned to Rothermel for guidance. She told them that before pursuing a sale, it’s often necessary to do some soul searching to clarify financial priorities and legacy goals. “My job is to quarterback them through all of that,” says Rothermel.

What Comes First: It’s Values, Not Valuation

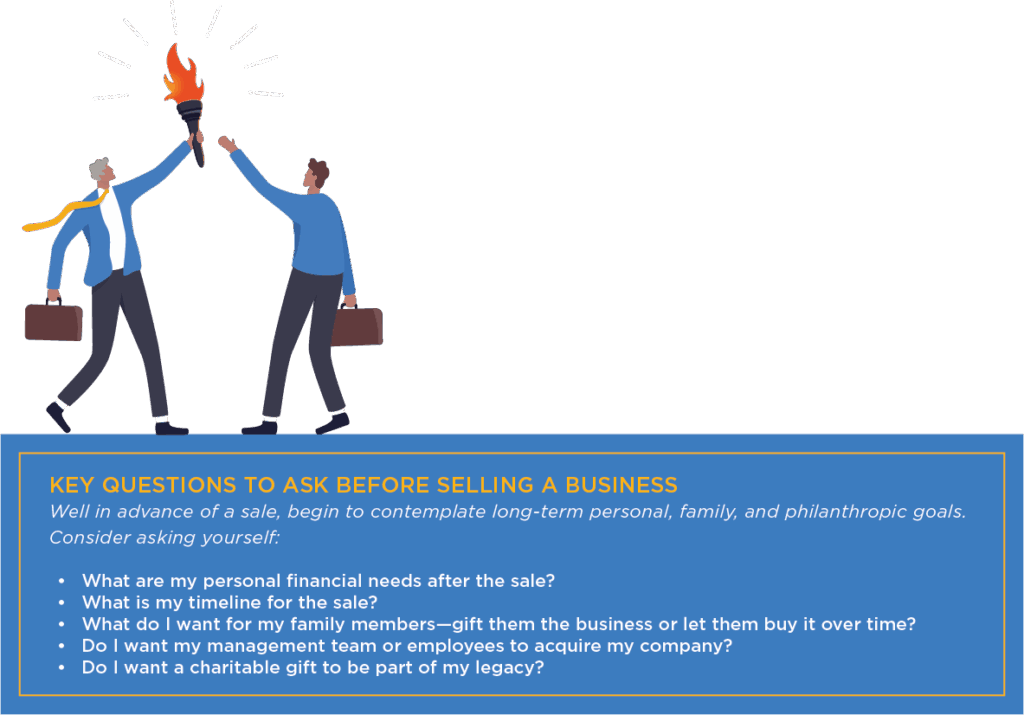

Business owners often focus on tangible aspects of a sale, such as cash and stock. “Most people just think about the market valuation of their business, but it’s not that simple,” says Rothermel. Sellers need to weigh their values carefully, as these can inform the timing and structure of the transaction.

“It’s a balance of tangibles and intangibles,” says Rothermel. Thinking through the intangibles that matter the most will provide a foundation for decisions about the timing, price, deal structure, and tax planning of a sale.

For example, it’s nearly impossible to assign a dollar value to the satisfaction of seeing a son or daughter step into a leadership role, having the means to support a philanthropic cause, or the joy and freedom that often come with departing a stressful business.

After the offer on the yacht restoration business, Rothermel had a frank talk with the owners. “Yes, your company is likely worth more than that,” she said. “But [the offer] gives you more money than you will need to live off of in retirement.”

The couple also considered the ramifications of trying to optimize the company for market in hopes of a higher sale price. “It could take years,” Rothermel told them, and there would be no guarantee. “Meanwhile, what if the economy changes?”

The Right Deal at the Right Time

A successful business exit isn’t always about the highest price. It’s about making a deal that satisfies as many priorities as possible—and proper planning can take time. One to three years before a potential sale, owners can begin holistic discussions with their financial advisors about their goals. Professionals with experience in business valuation, tax planning, and exit planning can assist with examining priorities, maximizing business value, and matching the structure of a sale with the desired tangible and intangible goals. Ultimately, “tax considerations will drive a lot of how you structure the sale,” says Rothermel.

For example, if a primary goal is keeping a business in the family, a seller might accept payment in installments, allowing a son or daughter to use earnings from future operations to purchase company shares. Or if the goal is for family members to inherit, special planning techniques can minimize the tax burden for heirs. “A lot of families sell a business, or a piece of a business, through an intentionally defective grantor trust,” says Rothermel. This trust lets an owner legally remove the entity from the estate while still receiving payments from the business and paying income tax on those earnings.

An owner may also choose to transfer ownership of the business to loyal employees or a management team that contributed to the company’s success. “You might do a stock redemption and let your management team acquire it,” says Rothermel, “or, have your employees buy you out through an employee stock ownership plan (ESOP).” ESOPs are a tax-favored way to transfer ownership to employees while providing a fair price to the business owner.

“ESOPs are most commonly used to provide a market for the shares of departing owners of successful closely held companies, to motivate and reward employees, or to take advantage of incentives to borrow money for acquiring new assets in pretax dollars,” according to the National Center for Employee Ownership.

When seeking an outside buyer, a business broker or financial consultant may unlock potential value that’s not obvious to the owner—particularly by understanding the business’s differentiators and marketing them to various buyers.

“People know what they want to be paid, but they’re not always objective. That’s why you should consider having a valuation professional on your team, such as a business broker or a financial planner who works on strategy and tax planning,” says Rothermel. Sellers can sometimes be misled by rules of thumb or industry comparables, but they maximize value by understanding what matters most to them and what makes their business special.

Sailing into the Sunset

Ultimately, the couple accepted the offer. A bird in the hand is worth two in the bush. They concluded that accepting the buyout offer would reduce their risk, increase their freedom, and let them start enjoying retirement immediately. “It gave them two to five more years of doing what they want,” says Rothermel.

Written by Jeanne Lee