A Roth conversion involves transferring funds from a traditional retirement account—such as a 401(k), 403(b), or individual retirement account (IRA) funded with pre-tax dollars—into a Roth IRA.

Why would someone consider a Roth conversion? The biggest benefit lies in the tax treatment of the converted funds. Once the funds are in the Roth IRA, future growth of those assets is tax-free. Withdrawals in retirement are also tax-free, assuming they meet certain criteria. As with any strategy, there are important considerations to keep in mind.

When you convert funds to a Roth IRA, the amount converted is taxable income in that tax year. For example, if you convert $100,000 from a traditional IRA to a Roth IRA, that $100,000 will be added to your taxable income in the conversion year.

Converting large amounts can result in a significant tax bill and may push you into a higher tax bracket. Even so, using retirement funds to pay taxes may make sense for those looking to convert large IRAs to reduce their future required minimum distributions (RMDs).

The timing of your Roth conversion matters too. Generally, it’s a good idea to convert when your income is lower—for example, after you’ve retired and before you begin drawing Social Security. You may also choose to convert over the course of several years to spread out the tax impacts. But if you can get comfortable with these considerations, a Roth conversion can provide you with benefits beyond tax-free growth and withdrawals. Some of these benefits are:

- Tax diversification. Having both traditional and Roth accounts allows you to manage your tax liability in retirement. For example, if your income in a given year is higher than expected, you can withdraw from the Roth IRA without increasing your taxable income.

- No RMDs. Traditional IRAs and 401(k)s require you to begin taking RMDs at age 73. Roth IRAs have no RMD requirement during your lifetime. With a Roth account, you have more control over your retirement withdrawals and can leave the funds to grow for your heirs.

- Benefits for heirs. Roth IRAs can be passed on to beneficiaries, who can inherit the account income tax-free. This means your heirs can enjoy the tax-free growth and withdrawals if the Roth IRA has been held for five years or more—a significant advantage, especially if your beneficiaries are in a higher tax bracket.

As always, you should consult your tax and financial advisors and consider your unique situation and goals.

Life is uncertain, and it’s often these unknowns that cause the most worry—for instance, the future of Social Security benefits.

Financial planning can help alleviate some of these worries by providing clarity and by making sure your Social Security benefits are appropriately accounted for in your long-term financial strategy.

How Social Security Began

Congress established the Social Security program to provide a reliable fixed income for retirees. In the beginning, there were more workers paying their share of the payroll tax—now known as Federal Insurance Contributions Act (FICA) tax—into the plan than there were retirees receiving benefits, so excess funds were used to create a trust to house the growing surplus.

From 1984 to 2009, the total amount of money gathered from FICA taxes exceeded the amount of money that the Social Security program was paying in benefits, and funds accumulated in the trust.

However, by 2010, things changed. The number of retirees receiving benefits was higher than originally expected, likely due to high unemployment rates and an aging population that collectively retired after the 2008–2009 financial crisis. The fund began paying out more than it was receiving. To meet its financial obligations, the Social Security program needed to use a portion of its trust to cover the deficit.

Social Security Changes, Past and Future

Multiple adjustments have already been made to the program, like increasing the Social Security wage base limit, which is the amount of income subject to Social Security taxes. Another change redefined full retirement age, which is the age when a person can begin collecting their full Social Security benefits. Changes such as these began in 1983, and small adjustments continue to be made.

Some likely future adjustments could include another change to full retirement age or further adjustments to the amount of income that is subject to Social Security taxes. Both major political parties have proposed these changes, and other strategies, as solutions to shore up any gap in benefits. Although privatization of the Social Security trust has been proposed a few times over the years, recently, it has not been a major topic of discussion. We believe privatization is an unlikely change.

2025 Social Security Changes

The Social Security Fairness Act, signed into law on January 5, 2025, effectively repeals the Windfall Elimination Provision (WEP) and Government Pension Offset (GPO) rules. This means that individuals who were previously subject to WEP and GPO may benefit from an increase in their Social Security benefits. However, the timeline of when these changes will take effect has not yet been determined by the Social Security Administration.

What impact will this change have on the viability of Social Security? Likely, it will speed up the timeline for when Congress must make Social Security decisions, but it won’t change how likely or unlikely those changes are.

The Viability of Benefits

When people talk about potential Social Security changes, they often express concern that the program will be eliminated, and they won’t receive the benefits they’re counting on.

Even in the unlikely event that Congress doesn’t make further adjustments, and the trust fund portion becomes depleted, Social Security benefits won’t vanish overnight. Benefits would be reduced but not eliminated entirely.

According to a recent study by the Social Security Trustees, by 2035, even if the fund were depleted, Social Security would still be able to pay 83 percent of scheduled benefits from the incoming payroll tax portion of the fund. In 2098, it would still be able to cover 73 percent of scheduled benefits.

In other words, even if Congress chose to do nothing at the time to correct the depletion (a highly unlikely strategy for any Congressional delegation), the program would still be able to pay a sizeable portion of benefits for multiple generations.

Regardless of what happens in future legislation, planning for Social Security benefits is an important part of building your retirement income plan. To prepare for a range of potential futures, talk with your financial advisor. They can help you model different scenarios and stress-test your plan against outcomes like a reduction in benefits. Knowing you’re prepared for whatever may happen can help provide perspective.

When she was in her early 40s, Schooley, now 63, launched a career in the maritime industry after more than two decades working in hospitality. She’s now the senior captain of a ship for a daytime tour company in Seattle, Washington.

“It was a huge leap to go from providing the waitstaff for events to being responsible for the safety and well-being of a ship, the crew, and hundreds of passengers,” says Schooley.

She found the perfect fit for her second act, but the journey to a new career was turbulent at times.

Learning to Serve

Schooley, the youngest of six children, was introduced to hospitality at a young age.

Her father was a long-haul truck driver. Her mother worked as a waitress at the revolving restaurant in Seattle’s famous Space Needle, the iconic landmark with panoramic views of the city and beyond.

Schooley and her siblings occasionally accompanied their mother to work. “We’d do our homework in the break room from the 600-foot level,” she says.

Schooley followed in her mother’s footsteps, working as a server at several restaurants, including one her parents owned for a few years.

Eventually, her mom started her own business, Always at Your Service, which provided trained service staff for parties and other occasions. It was a family affair. Schooley and her siblings helped with every aspect.

“We took care of staff and staging for everything from intimate dinners for two to events with 800 people at large venues,” she says. “We worked at weddings, holiday parties, corporate parties, and team-building events, as well as on private yachts and daytime cruise boats.”

Their customers included corporate executives, bureaucrats, and wealthy entrepreneurs. The business took off during the late 1980s and early 1990s. “People who worked for Microsoft in Redmond, Washington, created a ton of business,” she says.

Keeping Her Head Above Water

Throughout her 20s and 30s, Schooley worked nights, weekends, and holidays while also raising two daughters on her own. “My hours were all over the place,” she says. “There were no set workdays or benefits to the job. I was running from one event to another, making sure staff showed up.”

Working at the company and being a mom was exhausting, but her siblings would help with babysitting when they weren’t pitching in at the family business.

To escape the pressures of work, Schooley went out on the water. “I had a little motorboat that I could tool around in with my daughters.”

Schooley developed a love for boating when she was a child, during a trip to a lake with family and friends. “I remember the first time someone held me while skiing,” she says. “I have a vivid memory of the joy of the water.”

In 1998, Schooley took over running the business when her mother retired. That same year, she got married and moved with her husband, Pete Sandall, to an area of Seattle where it was difficult to keep her boat—so she sold it.

But she missed being on the water and, after a few years, she started thinking about ways to subsidize her hobby.

Charting Unfamiliar Territory

There was a Seattle Maritime Academy near her home. “One day I was driving by, and I pulled in,” she says. “I asked them what it would entail to get a license to run a little boat.”

The staff explained the cost and time involved. “I enrolled that same day,” she says. “I just wanted to dip my toe in to see what it would take.”

Her goal was to get a license to run a small commercial boat offering charters for up to six passengers, but academy personnel recommended she get a master’s license instead—one that would allow her to operate a vessel of up to 100 gross tons.

The test was similar, but there were key differences involving the size of the boat and the sea time she would need before she could apply for a license. Sea time is the number of hours a person has spent working on a vessel.

Training included an 80-hour course that would prepare her to take the licensing test. This training was broken into three parts: learning the rules of the water, charting courses, and studying federal regulation codes that pertain to maritime law.

Schooley was in a class with crab fishermen from Alaska, yacht delivery people, a water taxi service operator, and an employee of Argosy Cruises, which offers sightseeing tours on Elliott Bay, Lake Washington, and areas of Puget Sound.

After she passed the course, she worked for Argosy Cruises to earn her required sea time, which was the equivalent of 365 eight-hour days. “I already had some sea time from catering events on private yachts, but I still needed a lot of additional work,” she says.

Steering Her Career in a New Direction

In 2004, Schooley started work as a deckhand for Argosy Cruises, where she learned the mechanics of maritime diesel engines, radio communication, how to raise and lower fenders, basic knots, and line-handling skills for securing the ship.

“I had to learn to safely tie up a vessel, securing it to the dock with primary lines,” she says. “I had to draw a schematic of the vessel, with the details of everything from the hatches and holes to electrical equipment and the lifesaving equipment onboard.”

There were times she doubted her new direction. “When I started as a deckhand, there was a horrible storm that came through with 40-mile-an-hour winds. It got rougher and rougher, to the extent that a refrigerator fell off the wall. I really did stop and wonder if this was the career for me.”

She couldn’t afford to quit her hospitality job while she was taking the class and doing various jobs on the ship, so she continued to run the family business. “I worked 60 to 80 hours a week,” she says. “It was rough.”

Also, there was a lot to learn about driving on water. “To become a captain, you have to know how to safely navigate a ship while managing a crew,” she says. “You have to pilot the vessel in all kinds of weather conditions, including winds, fog, and rain. I learned to drive by instrument with no visibility. The training was much harder than I expected.”

In 2005, Schooley got her 100-ton master’s license and began working full time for Argosy Cruises.

She decided to close the family business. “It was difficult to end that chapter,” she says. “But I felt like I was on two treadmills at the same time, and I had to jump off one.”

Landing in an Important Role

As a senior captain, Schooley can pilot all the ships in the company’s fleet. She is currently in charge of the 125-foot Salish Explorer, Argosy Cruises’ largest ship. “This just became my baby,” she says. “Every year, we switch to a different boat.”

“The vessel can carry more than 500 passengers, but we usually only take about 200 to 300 passengers per trip in peak season,” she says. During the summer, she’s in charge of six one-hour cruises a day on Elliott Bay.

“When I’m driving the ship, I’m focused on navigation, communication, and visibility,” she says. “I’m monitoring three radios. I’m constantly watching everything, including ferry traffic, recreational vessel traffic, and fishing boats.”

The ship has five crew members, one of whom is a senior deckhand. The deckhands must check in with her regularly. She also watches the cameras around the ship to check passengers’ safety.

“Every single person must carry their weight,” she says. “It’s a well-oiled machine. As a ship’s captain, you have to trust yourself, trust your crew, and trust your instruments. It’s a massive amount of responsibility, but I have crew members who help manage the vessel.”

Running a Tight Ship

Schooley still uses her well-honed hospitality skills. “If we have a private chartered cruise with caterers,” she says, “I make sure all the elements come together at the right time, including the catering service, music, and decorations.” She even officiates weddings occasionally.

Schooley’s husband says the maritime career combines his wife’s hospitality skills with her love for being on the water.

“When she’s in the wheelhouse, she’s clearly the captain,” Sandall says. “There’s no messing around. She’s got radios, and she’s on the ball, looking around.

“She’s in charge,” he says. “It’s impressive—all the hats she has to wear.”

Tricia Nielsen, a friend, former colleague at Argosy Cruises, and classmate at the maritime academy, says Schooley runs a tight ship in a supportive way that makes crew members feel appreciated, so they strive to do their best. One key to her success is that she takes the time to build relationships, Nielsen says.

At this stage of her life, Schooley says she’s exactly where she wants to be. “I’m happy being on the water, and I’m happy being around other people who love working on boats.

“Every day I go to work is a gift,” she says. “I have the best office in the world. The only regret I have is that I didn’t do it sooner.”

By Nanci Hellmich

Nanci Hellmich, an award-winning multimedia reporter, covered myriad topics for USA TODAY for more than 30 years. Now she writers for AARP, encore.org, and other organizations. She’s been named a top online influencer on weight loss and nutrition and has appeared on numerous television shows including NBC’s TODAY.

A fiduciary is a person or organization who prudently takes care of money or assets for another person or organization. Under the Employee Retirement Income Security Act of 1974, also known as ERISA, retirement plan sponsors are fiduciaries of their retirement plans. This means they are legally bound to act solely in the best interest of their plan participants. Fiduciaries who fail to fulfill that duty can face penalties and personal liability for plan losses.

Topics covered include:

- How you can identify plan fiduciaries;

- Four critical fiduciary responsibilities;

- The potential consequences of a fiduciary failure;

- Fiduciary liability reduction strategies and tactics; and

- How to differentiate between the two Department of Labor (DOL) fiduciary correction programs.

Additional CAPTRUST Resources:

Fiduciary Best Practices for Plan Sponsors Slide Deck

The Importance of Fiduciary Training

For a copy of the transcript, click here.

Our 2024 series:

- 2024 Fiduciary Training Series, Part 1: Roles and Responsibilities

- 2024 Fiduciary Training Series, Part 2: Plan Governance

- 2024 Fiduciary Training Series, Part 3: Fiduciary Risk Management

- 2024 Fiduciary Training, Part 4: Avoiding Scams

It’s a childhood memory many Americans share: that feeling of walking into class to discover there’s a substitute teacher. There’s a little shock, followed by a lift of reprieve. Maybe the quiz is canceled. Maybe you’ll get away with not having finished your homework. Or maybe you’ll get to watch a movie. But, as an adult, have you ever considered becoming a substitute teacher?

Substitute teachers are the unsung heroes of their schools and communities, and they’re in desperately short supply. Every day, nearly 50 million students in the U.S. go to school in a badly stressed education system with an ongoing teacher shortage. According to the Learning Policy Institute, there are almost 42,000 unfilled teacher positions across the country, and that number is likely underestimated.

Teachers are valiant, overworked, and underpaid. Also, they’re human beings who, at times, will need a day of leave to recover from the flu, nurse a sick child, or tend to an emergency. But sometimes, there just aren’t subs to replace them.

If you’re someone who enjoys being around children, has extra time, and wants to continue giving back to your community, substitute teaching could be a great fit for you. Here are some reasons professionals and retirees from many fields might consider joining a local substitute teacher pool.

A Crisis of Unfilled Teacher Absences

Sadly, the noble instructors of our nation’s youth often have difficulty taking the sick days or personal leave they’re entitled to because of the shortage of subs. While this has been a longstanding problem, the pandemic worsened shortages to the point that 20 percent of requests for teacher coverage went unfilled, according to the Bureau of Labor Statistics (BLS).

The problem is even more severe in economically disadvantaged districts and neighborhoods. In the Chicago Public Schools system, for example, the fill rate for absences in bottom-quintile schools averaged only 50 percent, compared to more than 95 percent at top schools, according to a 2023 BLS report.

“There are not enough subs, period,” says Elaine Thesus, a retired teacher in Greenville, North Carolina, who frequently substitutes. “Last Friday, I got a notice that there were 47 unfilled teacher absences in my school district.”

In some districts, teachers who require a day of leave must request it at least one month in advance due to the lack of available substitutes. Realistically, teachers can’t always know in advance when they need to miss work.

This means schools resort to drastic measures. They move students to a gym, cafeteria, or library, sometimes with little or no supervision. Classrooms may double up, leaving another teacher overwhelmed. “A resource teacher, librarian, or paraprofessional might get pulled in, just so there’s an adult in the room,” which means important student services won’t be delivered, says Minnie Ford, a retired educator and current substitute.

Or students get absorbed, meaning they’re distributed between several other classrooms and given independent work. “It’s a day of instruction lost, and it’s overloading the other classrooms,” says Thesus.

To make up for the shortfalls, school districts have tried raising pay, providing free training, and relaxing the requirements for joining the substitute pool. Most school districts have pathways for nonteachers to become substitutes, though the specifics vary.

Many former teachers, like Ford and Thesus, return to the classroom as substitutes after retirement, because they understand the dire need—and because it’s a pretty good gig. Trained, experienced educators are ideal substitutes, but anyone can be great at the job.

But I’ve Never Taught Before

If you’re an older adult or retiree from a nonteaching background, you can step up to help fill the gap. It doesn’t matter whether you’re familiar with the material. You can give a lot to students simply by drawing on your life experiences as a parent, coach, or professional.

“That’s what we need: more people who will take a day of leave from their job and sub once every month or two,” says James Monroe. “Then the school system could have a bigger bank of substitute teachers.” Monroe retired from a 15-year Air Force career before he moved into education. He worked as a substitute teacher in the 1990s before becoming a full-time high school teacher.

“You’ve got a wealth of knowledge you might not even realize,” he says. “You’d be surprised at the number of kids you might influence. Students really like having new people in their classrooms.” Male substitute teachers are especially needed, as kids tend to see fewer men working in schools.

Sometimes, the most valuable thing is a listening ear. If a student is struggling with an assignment, offer to help them read the directions. Ask them what they think they should do next. “A lot of kids don’t get that kind of attention from adults,” says Monroe.

Students benefit from exposure to diverse role models and hearing about different kinds of jobs. “If you’re subbing in high school, you can share how you got into your field,” says Ford. “You can help students fill out applications or make resumes.”

Grandparent Mentality

Thesus says being a substitute is easier and more fun than being a teacher, much like the trope that being a grandparent is better than being a parent. After retirement, she changed her attitude from “I’m their teacher” to “I’m their sub.”

“I get to enjoy all the positive things about teaching without the headaches,” she says. “I don’t have to deal with parents, discipline, grading, paperwork, lesson planning, or meetings. At 3:30, I’m going to leave this class behind.”

This mentality makes her more relaxed about things like how students act in the classroom. While she doesn’t allow fighting or extreme unruliness, “if they’re talking quietly in class, I don’t care,” says Thesus. “Behavior you can’t get away with at home, grandma doesn’t care!”

Working in a room full of kids from Gen Z or Generation Alpha can be an opportunity for older adults to keep current. People who haven’t spent much time around youth culture may find it invigorating, because many students today have a unique vibe. “A lot of kids today are treated almost like their parents are their friends,” says Monroe. “There are pluses and minuses to that, but they are then more comfortable and more open to speaking to adults, which is a good thing.”

Thesus has encouraged retired friends who have time on their hands to investigate substitute teaching. She touts the extremely flexible schedule, lack of late hours, and, in most cases, summers off. “You can choose when you want to work or not to work,” she says.

Becoming a substitute teacher can be a truly adventurous—but also simple—way to give back. Substitutes make a positive impact on the students in their classes, the schools where they work, and the broader community. After all, you never know whether something you bring to the classroom might become an important memory for one of the world’s future leaders.

By Jeanne Lee

Jeanne Lee is a freelance writer living in a lovely college town in Ohio. She has written about consumer and business topics for 20 years, including stints at Fortune and Money. her works has appeared in publications like USA TODAY, Fortune Small Business, and Health. She loves thinking about ways for people to hack their finances, and she daydreams about paying off her mortgage before she has to pay for college for her two boys.

Kirkland was skeptical and pressed him on his role, but Davis responded credibly and knew a lot about her relationship with the bank. He told her the fastest way to stop the unauthorized transaction was to give him access to her computer, which she reluctantly allowed.

Davis then wired $15,000 from Kirkland’s bank account to an individual in the United Arab Emirates via a wire transfer set up in her name. By the time Kirkland’s nagging doubts got the better of her, it was too late. The money was gone.

Fraud on the Rise

Cybercrime is how most money is stolen these days. “It’s a $10.5 trillion global industry that’s larger than the sale of all illegal drugs worldwide, combined,” says Mark Hurley, founder and chief executive officer of Digital Privacy and Protection (DPP). “It’s far easier to steal money with a computer than with a gun, and it’s far harder to catch the bad guys.”

Hurley, a serial entrepreneur in the financial services industry, saw a business opportunity in helping the clients of wealth managers guard their assets. He founded DPP in 2020.

According to a 2023 Gallup poll, 15 percent of U.S. adults said at least one member of their household had been the victim of a scam in the last year.

Karen Denise, head of wealth client service at CAPTRUST, says the Gallup data matches what she sees among clients. “Unfortunately, we’re hearing from more and more people that they have responded to a fraudster who appeared to be contacting them from a legitimate financial institution,” she says. “We work with them to try to recover their funds, but that can take time, and it’s very stressful.”

These sophisticated cybercriminals constantly innovate new tactics, making it difficult to stay ahead of them. To make matters worse, many such criminals work from outside the U.S., often placing them out of the reach of law enforcement. In the event they’re identified, they’re rarely prosecuted.

You’ve Been Hacked

According to Hurley, one of the most common tricks in recent months has been the “your account has been hacked” call.

Cybercriminals have become much more aggressive lately. In the past, they relied on text messages or emails to bait victims. Increasingly, they pose as company representatives and cold call their potential victims, ostensibly to help them address a hacked account.

“They’ll tell victims that their account has been breached and that they need to take certain steps to protect themselves,” says Hurley. “Typically, they’ll ask for specific personal information and direct the victim to open one of their apps and insert a code.”

Once the code is entered, the criminals can access the victim’s device and online accounts. They can move money or send a wire to themselves, as in Kirkland’s case. In one variation on this scam, the criminal convinces the victim to move the money themselves to protect the funds.

Losing money is bad, but that’s not always the extent of the issue. “When an investment or retirement account is involved, the damage can be compounded with taxes and tax penalties,” says Denise.

Someone’s Been Kidnapped

Another common fraud is the fake kidnapping scam, which seems even more frightening.

Criminals download videos from unprotected social media accounts and use artificial intelligence software to clone voices and images of people. They then call a victim and say they’ve kidnapped their loved one—often a child or grandchild—threatening to hurt them unless money is immediately sent to them either via wire transfer or cryptocurrency.

In the background, the relative will be screaming for help, and the call will appear to be from that person’s phone. To avoid detection, criminals may intercept the person’s calls. “As farfetched as this might sound, these criminals are very convincing and have a high success rate,” says Hurley.

These are only two of today’s dozens of scams. Enterprising cybercriminals are busy evolving their strategies and inventing new forms of stealing.

Danger Ahead

It’s important to be on alert for potential frauds. “Successful ones tend to include two common aspects,” says Hurley. “They’re trying to get you to act urgently, and the parties involved will sound genuine, maybe even like authority figures.”

These scams work because the criminals do their homework by collecting unprotected personal information on the internet. They know a lot about each victim before contacting them, so they sound especially convincing.

“A surprising amount of personal data is available online via public records and social media,” says Denise. This can include a person’s address, property value, phone number, email address, voter registration information, employer, job title, age, gender, race, and more.

Even worse, the information in unprotected social media accounts is effectively in the public domain, and anyone who wants to can access it.

Cybercriminals also regularly hack into people’s personal email accounts, so they know what’s going on in a potential victim’s life. “For all these reasons, the criminals will sound like they’re the real thing and can be very persuasive, even to sophisticated individuals,” says Hurley.

Small But Important

“While scammers today can be very sophisticated and convincing, there are some simple things you can do to protect yourself from them,” says Denise.

Here are a few tips you can start using immediately.

- Don’t talk to strangers. Don’t answer calls from people who aren’t on your contacts list. A legitimate person will leave a voicemail and callback number.

- Approach with caution. Most successful scams attempt to get you to act quickly and will sound like an authority figure. Be skeptical, and don’t get swept up in their urgency.

- Assume the worst. Neither your bank nor government agencies like the Internal Revenue Service (IRS) will call you about a problem. The bank will freeze your account; the IRS will send you a letter.

- Don’t share PII. Do not provide personally identifiable information (PII)—like passwords, and account, credit card, or Social Security numbers—to anyone who calls you on the phone. Legitimate service providers don’t typically ask for this kind of information over the phone.

- Call back. If you suspect you’re getting lured into a scam, hang up and call your bank, broker, or other service provider at a verified number.

- Protect your social media accounts. Criminals can use photos, videos, and check-ins shared on social media to target you unless you engage privacy settings on these accounts.

Key Defenses

There are a few important defensive actions that can also help immunize you against would-be scammers.

Privacy Settings

Managing the privacy settings in the apps, search engines, and browsers you use is critical. “Otherwise, you’re making it very easy for very bad guys to find you and steal your passwords and personal information,” says Hurley.

Each application has its own security settings, so you’ll need to dig in. Facebook, for example, has 80+ specific security and privacy settings to control who can see your profile, friends, posts, comments, and shares, and which apps and websites have access to your Facebook data. Beneath these categories lie many subcategories—and this is only one application.

Doing this yourself requires research and takes time, but it’s OK to lean on trusted experts. “For most people, it would take about 100 hours of work to figure out the settings and engage them,” says Hurley. “And companies regularly change them, so it’s not a one-time process.”

“We track privacy settings on the most popular applications and can implement

the right settings and set up password managers for our clients in a single three-hour appointment,” says Hurley.

Password Hygiene

Another key practice: Use long and complicated passwords. “AI systems can now correctly guess any eight-digit alphanumeric password in less than a second,” says Hurley.

To make your passwords effective and secure, use a minimum of 20 randomly generated characters—including uppercase and lowercase letters, numbers, and symbols.

Don’t use names, birthdays, or pet names, and never use the same password for more than one account.

Yes, this means you will have to juggle dozens of impossible-to-remember passwords. Thankfully, using a password manager, like LastPass, Keeper, or NordPass, can help you create, save, and manage passwords for your online accounts.

Device Security

The default settings on your personal computers and smartphones automatically record the passwords for every account that you access with them. That means if you haven’t turned on the appropriate security settings on your devices and a cybercriminal breaches your device, they’ll be able to access every one of your accounts.

It’s no more difficult than a thief looking over your shoulder as you enter your smartphone passcode at a restaurant and then stealing your device.

To help reduce this risk, use a complex passcode, a fingerprint, or facial recognition to unlock your device; set your phone to automatically lock itself after a short period of inactivity; and enable functionality to erase all information on your phone if it’s lost or stolen. Also, use multi-factor authentication (MFA) when it’s available.

MFA is a security process that requires you to provide two or more verification factors to access a resource. This is what is happening when your online account wants to send a text to your phone, then asks you to enter a code from that text before letting you log in.

Yes, MFA can be frustrating and slow you down when you’re trying to log into your accounts, but it is one of the very best defenses against scams and cyber threats.

“If you’ve been scammed, the quicker you take action, the less damage will occur,” says Hurley. “Once cybercriminals breach you, they quickly use the information they get to target every financial and social media account you have. This is how a single breach often leads to losing millions of dollars.”

After You’ve Been Scammed

What to do depends on how and what was breached. The first step is to figure out what happened and why and then take steps to minimize the damage.

This could be as simple as changing a password or as complicated as freezing your bank, custodial, and credit accounts, and making filings with the Federal Trade Commission, Federal Bureau of Investigation, and local law enforcement.

“Assume that, if you have been breached, the bad guys will soon return,” says Hurley. “Just as sharks regularly return to where they’ve been able to find animals to devour, cybercriminals return to target clients they’ve breached before.”

The Emotional Toll

Falling victim to a cybercriminal isn’t just a financial issue. Being scammed can erode the victims’ trust in others, and they may feel ashamed or embarrassed, especially if they lost a significant amount of money.

Also, scams can lead to feelings of anxiety and fear, as victims may worry about their financial security and the potential consequences of the scam.

These feelings can cause a victim to stay quiet or delay alerting the authorities about their situation. But it’s important to remember that acting quickly is the key to recovering lost funds and protecting oneself from future scams.

“Financial scams targeting older people can have a severe and long-lasting emotional impact,” says Denise. “It’s important to us to do everything we can to protect our clients and help them when they need us.”

By John Curry

CAPTRUST’s former Chief Marketing Officer, John Curry is now constructing his own second act and adjusting to unretirement in Spain. In the finance industry since 1986, Curry was instrumental in the launch of VESTED magazine, serving as its original editor in chief.

Though balance generally declines with age, many people don’t realize it’s happening until they take a tumble, says Debra Rose, professor and chair emerita of the Department of Kinesiology at California State University, Fullerton.

That’s what happened to Shana O’Brien, 58, the owner of a real estate brokerage in Vancouver, Washington, and Portland, Oregon. She was dancing with her husband in their home when one of her dogs ran between her legs, catching her off balance, and she fell. O’Brien says she landed on her bottom and one hand, crushing her wrist. To fix it, she needed surgery to implant a permanent titanium plate.

“It made me feel like a really old lady,” she says, but it was also a wake-up call. She had to do something to improve her balance.

For O’Brien, that something has been yoga. But experts say there are many activities—including other balance-focused workouts and tweaks to existing workouts and routines—that can help us stay firmly on our feet as we age.

The Facts About Falling

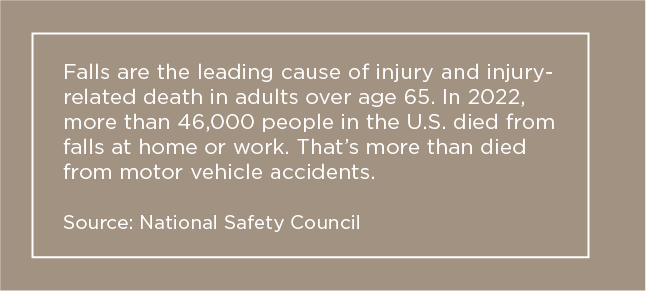

Falls are the leading cause of injury in adults over age 65, happening to one in four people every year, according to the Centers for Disease Control and Prevention. One large study found that, in women, injuries from falls start arising even earlier, between ages 45 and 55. Bad balance isn’t the only reason people fall. Everything from loose rugs to poor lighting to the wrong footwear can contribute, says Rose.

But the loss of balance that comes along with age is a bigger problem than many people realize. It not only increases the risk of falling but can also threaten your independence and keep you from doing things you love. “People stop going places and doing things because they don’t feel quite balanced enough,” she says.

Rose says this happens for several reasons, including age-related changes in proprioception: your body’s ability to sense its own position and movements. Proprioception relies not only on your brain but also on receptors in your skin, muscles, and joints, and on structures in your inner ear. Changes in vision, including poor depth perception, play a role, as do chronic medical conditions and medications.

As your balance declines, you might not immediatly notice as you walk more slowly, grab more handrails, and show other signs of unsteadiness. But you’ll be at risk every time you walk on an uneven sidewalk, encounter a wet floor, or reach down to pull a weed from your garden.

You might think it’s safest to just sit all day, but inactivity only makes things worse, says Carol Clements, a New York City dance therapist and personal trainer who is the author of Better Balance for Life. “Balance is a skill,” says Clements. “It gets better with practice and deteriorates without it.”

As people get wobblier, fear of falling can set in, leading to even more inactivity and worse balance, she says. “So, if you want to feel confident and be agile and not fall, balance training is important.”

What Counts as Balance Training?

If you like the idea of a class, you have choices. Many senior living communities, gyms, and fitness centers offer balance and fall-prevention classes. Rose developed a program, outlined in her book, Fallproof, that is taught at many places around the country. Other options include disciplines such as yoga, tai chi, and mat Pilates.

If you’ve been injured in a fall or are frail, your doctor should refer you to a physical therapist to decide the best balance-training program for you, Rose says. However, if you’re in reasonable health, there are lots of balance-boosting activities you can safely try as part of your regular workouts or daily routine. For example, you might consider the following.

- Lift free weights from a standing position instead of using a weight machine or bench. This combines balance and strength training.

- Do front and side-to-side lunges. These strengthen your legs, which is important for preventing falls, and might help you stay on your feet when you lunge in your next pickleball or tennis match.

- Work out on an unstable surface like a Bosu ball or a foam pad.

- Walk on uneven trails.

- Practice walking backward and shuffling side to side.

- Practice doing some activities with your eyes closed, after making sure you’re in a safe spot.

Clements suggests adding balance challenges to everyday activities. Here are a few ideas to try:

- Train yourself to brush your teeth while standing on one leg, starting with a finger on the bathroom counter and your toe just above the floor.

- Squat upward, and then down, from a sturdy chair using your buttocks, not your back muscles.

- Do heel lifts while working at the kitchen sink.

- Walk an imaginary tightrope while you talk on the phone.

Beverly Connell, 56, a legal assistant in Atlanta, Georgia, has come up with her own methods to overcome a fear of falling that started in her 40s, after three bad stair falls. For years, she says, she avoided stairs entirely. But the former gymnast recently decided she needed to regain her courage and her balance. She started climbing stairs again and got herself a rebounder, a mini trampoline that comes with a safety bar.

The first time she used it, says Connell, “I literally almost fell off.” These days, she says, she’s jumping without “hanging on for dear life” and taking the stairs at the train station without gripping a rail.

As for O’Brien, she’s studying to be a yoga instructor. She no longer feels like an old lady, she says, and thanks to her renewed balance and strength, “I don’t need to be afraid of falling every minute.”

By Kim Painter

Kim Painter is a freelance writer specializing in health, wellness, and retirement. She was a USA TODAY staffer and contributor for many years and now writers for AARP and other outlets. She lives in McLean, Virginia, where she practices what she preaches: wearing sunscreen, eating kale, and getting at least 10,000 steps a day.

Kids have dreaded and enjoyed the playground spinner in equal parts since the early 1900s. These brightly colored, circular contraptions, usually six to nine feet in diameter with metal bars for handholds, use angular momentum to turn, picking up speed to a sometimes-terrifying pace. If you were born between 1920 and 1990, you’ve probably ridden on one, or run around one, spinning your friends into a playground frenzy.

In recent years, the spinner has become a subject of debate, no doubt because it is connected with countless physical injuries, episodes of dizziness, and well-intentioned psychological trauma. Nonetheless, some experts contend that the spinner’s movements can be therapeutic to growing children, helping them develop strength, coordination, and balance. It also provides a helpful metaphor for work and retirement.

If you’ve ever ridden a playground spinner, you know it is always a struggle to stay on board, and sometimes, you can spend more than half of the ride trying to decide if you should just let go and jump off. Trying to find the right time to stop working is similar.

Finding the Right Time

High achievers tend to have a hard time making the jump to retirement. This may be true for a number of reasons. Some identify strongly with their work and feel concerned about their ability to move on. Societal messages that reinforce the value of work, stigmatize early retirement, or create fears of falling behind may create additional pressure.

“Others simply like what they’re doing and feel like they have more to contribute to the organization,” says Michelle Scarver, a CAPTRUST financial advisor in San Antonio, Texas. “Or, frankly, they may just be having fun.”

Others may have golden handcuffs—unvested benefits of some kind—that create uncertainty about timing or even financial disincentives to retire.

Golden handcuffs can come in the form of a compensation package, stock incentive plan, deferred compensation, bonuses, or other perks. “Golden handcuffs tend to amplify the decision about when to retire, and they can complicate the analysis of a retirement plan,” says Nick DeCenso, head of wealth management solutions at CAPTRUST’s headquarters in Raleigh, North Carolina.

For others, money is a scorecard, and they fear losing relevance or social standing.

“Moving into retirement is a big decision, both financially and emotionally,” says Scarver. “As financial advisors, we can help address the financial side with a thorough plan so people can give themselves permission to retire, but 90 percent of the decision is emotional.”.

How Brains Resist Retirement

There are several cognitive biases at work here. The sunk cost fallacy may make it difficult for high earners to walk away from the investments they’ve made in their own knowledge and experience. And loss aversion—the tendency to weigh potential losses more heavily than potential gains—may cause them to focus on what they think they might lose (e.g., status, income, and purpose), rather than what they stand to gain (e.g., more free time, deeper relationships, and experiences).

These high earners could also be in their peak earning years, so fear of missing out (FOMO) may make them think the best is yet to come financially. This manifests in thoughts and comments like “Next year is going to be big, so I don’t want to lose out,” or “If I can just do this for another year or two, we won’t have to worry about money.”

One important question that also arises when considering the right time to retire: How long can I expect to be healthy?

“Financial planning plays a big role in confirming to people that they will be OK, even despite the rising cost of health care, but health is always a concern,” says Scarver. “Clients tell me all the time that they don’t want to miss out on good years of retirement due to failing health, and they want to be able to enjoy the retirement they saved and planned for.”

Flipping FOMO on its head is one strategy that may help create clarity around this key decision.

Talking to family and friends about—and, ideally, even documenting—the interesting and exciting things you plan to do after you stop working may help tip the scales in favor of retirement over more work and more money. Tangible plans can trump vague fears.

Put another way: It’s important to name the risks of staying on the spinner and the rewards of stepping off.

Three Transition Tactics

Here are a few other tips that may help you feel more comfortable with the transition from work to retirement:

Investigate your handcuffs. If you have unvested benefits with your employer, you may find that you’ll lose less than you fear. For example, tiered vesting on retirement plans, stock programs, and deferred compensation plans could mean that you keep the lion’s share of those benefits when you retire. “The best way to gain confidence in your decision is to have a well-developed retirement plan—one that factors in the golden-handcuffs dynamic and focuses on meeting your personal goals in retirement,” says DeCenso.

Determine how much is enough. “One common transition hurdle is that it’s hard to get comfortable with not having a paycheck,” says Scarver. “For a while at least, it can make people feel uneasy to start drawing money from their savings to pay for everyday living expenses.” After watching your savings account balance grow for so long, it can feel stressful to watch that money slowly decrease, even if you know this is what you saved it for.

One way to manage these feelings? Rather than focusing on the total value of your accumulated retirement savings, visualize this money as regular income using the four percent rule. Multiply the value of your portfolio by 0.04. The resulting number is the level of cash flow your portfolio should be able to support. You may find you already have more than enough to breathe easy.

Practice mindfulness. Biases are sneaky because they operate outside of our conscious minds. Managing them means staying alert to the moments when you feel you may be falling prey. Then, you can interrupt your brain’s natural tendency to be more thoughtful and intentional instead.

Did you just feel a pang of FOMO looking at the calendar for the upcoming work year—or wonder what you’d do this year without work? Once you realize what you’re feeling, you can contemplate that feeling more logically and rationally so you aren’t just reacting to passing emotions. The more you practice, the better you’ll get at it.

Once you have tried these tactics, it might also be a good idea to identify your personal goal line. And, of course, you’ll want to validate your assumptions.

Working with your financial advisor to document this plan and check your progress along the way will help make sure those couple more years don’t keep slipping into the future. It’s easy to keep moving your own finish line.

“There will always be more work than can be finished, and there will always be money left on the table,” says Scarver. “But for most of us, work is not the point of living.”

By John Curry

CAPTRUST’s former Chief Marketing Officer, John Curry is now constructing his own second act and adjusting to unretirement in Spain. In the finance industry since 1986, Curry was instrumental in the launch of VESTED magazine, serving as its original editor in chief.

David Sedaris, who has authored more than a dozen books and hundreds of essays, has a generous following. According to his website, there are more than 10 million copies of his books in print, and they’ve been translated into 25 languages. He frequently fills large auditoriums across America with audiences eager to hear him read.

Yet Sedaris says he typically spends more time picking up trash than writing—nearly eight hours a day on average, often covering 20–25 miles on foot.

Over time, Sedaris has turned this hobby into a personal mission. In fact, he’s become so well known for his efforts that his local council named a garbage truck after him. It’s called Pig Pen Sedaris and has a cartoon pig painted on its side.

“I do it because I want to live in a nicer environment,” Sedaris told the West Sussex County Times. “I’m angry at the people who throw these things out their car windows, but I’m just as angry at the people who walk by it every day. I say pick it up yourself. Do it enough and you might one day get a garbage truck named after you. It’s an amazing feeling.”

Sedaris’s obsession with garbage might seem bizarre to some, but his commitment to cleaning up his community also demonstrates how seemingly insignificant actions can become a legacy.

The Litter Problem

Littering is a global issue, with millions of tons of trash accumulating in urban, suburban, and natural areas every year. According to the nonprofit Keep America Beautiful, the U.S. alone spends almost $11.5 billion annually on litter cleanup, and there are currently more than 50 billion pieces of litter on the ground. That’s 152 pieces for every American.

Cigarette butts, bottles, food wrappers, and other debris harm wildlife, pollute waterways, and reduce the aesthetic appeal of communities. Plastic waste, in particular, breaks down into microplastics, which can find their way into the food chain, posing health risks to plants, animals, and humans.

However, studies show that individual actions, like Sedaris’s, can have a compounding effect. For example, the presence of litter in an area can encourage further littering, a phenomenon known as the broken windows theory. Conversely, a clean, litter-free environment promotes a sense of communal pride and discourages further trash from accumulating. It’s proof that when even one person decides to act, they can inspire a ripple effect.

Tips for Picking Up Litter on Your Own

The benefits aren’t just communal; they’re personal, too. Many people find that picking up litter provides a simple form of exercise and a sense of accomplishment. There’s something deeply satisfying about seeing a messy area transformed through your efforts.

Moreover, taking action—no matter how small—can provide a mental health boost, giving you a sense of agency and control in the face of overwhelming environmental issues.

Picking up litter doesn’t require a lot of equipment or planning, but there are a few tips to make it easier, safer, and more enjoyable. Start by taking a small bag or bucket and gloves on your daily walk. You might also consider buying a litter grabber: a long, pole-shaped tool with a claw on the end that helps you reach things without bending over as often.

Remember, you don’t need to clear an entire beach or forest to make an impact. Simply cleaning up your street or a nearby park can be rewarding. If you make it a habit, you might find that you look forward to the process. As Sedaris says, “You do it because it needs doing, and you like the feeling of making a small difference.”

Finding Like-Minded People

While picking up litter alone is impactful, joining a community effort can amplify the results. These not only cover more ground but also inspire others to participate. Group cleanups can also be a great way to meet people who share your commitment to keeping public spaces litter-free.

Nonprofit environmental organizations like Surfrider Foundation and Keep America Beautiful often host local events, which can range from beach sweeps to greenway cleanups. Many cities and states also organize community days, where residents gather to remove litter from streets, waterways, and public spaces. Adopt-a-Street and Adopt-a-Highway programs are another way to help and are available in most cities and suburbs.

Every Little Bit Counts

At a time when environmental challenges can feel daunting, picking up litter is a simple, tangible way to make a difference. Every piece of trash removed is one less item polluting the environment, harming wildlife, or degrading the beauty of natural spaces.

If you want to give it a try, start small. Collect litter on your daily walk or join a community event. “You don’t need to be a hero,” says Sedaris. “Just someone who wants to live in a better world.” By taking action, you’re not just picking up trash. You’re also inspiring others to do the same and proving that small efforts can indeed lead to big change.

By Roxanne Bellamy

Roxanne Bellamy is editor in chief of VESTED magazine. She has a Bachelor of Arts and Master of Philosophy in English and has written for many industries, including beer, textiles, and finance. Her work has appeared in Fast Company, Inc., Forbes, and more. Her retirement dream is to be a National Geographic Explorer.

Getting a new car is a big decision. Even accounting for inflation, cars today are significantly more expensive than they were 25 years ago. So before you start test-driving your dream ride, you have a choice to make—buy or lease? A handful of issues will drive the decision for you.

Leasing usually means a smaller down payment and smaller monthly payments. The downside: When the lease ends, you won’t own the car. If you purchase a car and use credit or financing, you’ll typically need a larger down payment, and your monthly payments will be higher. But once you’ve paid off the loan, the car is all yours—with no more payments. You can sell it later and recoup some of your outlay.

If you’ve got the cash, you can buy the car outright and drive it until the wheels fall off, with no monthly payments. You’ll forfeit the earnings power of that cash, but you’ll save by not financing either by loan or lease.

Now think about how much you drive. Are you constantly on the road, or is your car mainly for quick trips around town? If you’re a road warrior, buying might be a better idea. Leases come with mileage restrictions—usually between 10,000 and 15,000 miles per year. Drive more than the limit, and you could be looking at some hefty fees at the end of your lease term.

If you’re always itching to drive the latest models, leasing might be right for you. You can get a new car every few years when your lease ends. Plus, the car is usually under warranty for the entire lease period. But if you know you’re likely to get attached to the car and don’t mind driving the same vehicle for years, buying could be the way to go.

One more thing to consider: If you’re the type of person who likes to customize their vehicle, buying is probably your best option. When you own the car, you can modify it however you want. With a lease, you can’t make permanent changes. And leasing companies can be picky about wear and tear, which might mean extra fees when you turn it in.

So what’s the bottom line? If lower monthly costs and driving a new car every few years sound good to you, leasing might be right. But if you’re a high-mileage driver, want to customize your ride, or prefer to own an asset long term, buying could be better.

Remember, there’s no right or wrong answer. It all comes down to your personal situation. Think about your budget, your driving habits, and your plans. The best choice is the one that fits your lifestyle and budget.