You may cash out the balance of your vested assets, roll them over, or leave them in the plan. While these options are generally available for all qualified retirement accounts, this article focuses on 401(k) plans.

Understanding Vesting: A Key to Your Benefits

Vesting refers to the process of earning ownership of assets over time. Vesting is an important concept because any contributions that are not vested are forfeited. Depending on your plan’s vesting schedule, it may be optimal to wait until you are fully or nearly vested before making a change.

The vested balance of your 401(k) plan is the portion of your account that always belongs to you. Regardless of how or why you leave your job, your vested balance is yours to take. It includes your pre-tax, after-tax, and Roth contributions, as well as any investment earnings on those contributions. For employer contributions, the amount you can roll over depends on your plan’s vesting schedule.

There are several types of vesting schedules.

- Under cliff vesting, an employee becomes fully vested after a specified period—for example, three years.

- Graded vesting allows employees to gain ownership gradually according to a schedule, such as 20 percent per year until fully vested.

- Some plans offer immediate vesting, meaning employees gain ownership of all contributions as soon as they are deposited.

- When an employee reaches the plan’s full retirement age, they are considered fully vested.

Cashing Out After Leaving Your Job

Some people consider cashing out their 401(k) when leaving a job to cover immediate cash-flow needs. However, it is usually best to avoid dipping into retirement funds unless absolutely necessary. Withdrawals from these accounts are typically subject to ordinary income tax, except for amounts contributed after tax or to a Roth 401(k). If you separate from service before age 55, and you’re younger than 59 ½, withdrawals are also subject to a 10 percent early-withdrawal penalty in addition to income tax.

Stay Invested

If your account balance in your company’s retirement plan exceeds $5,000, you generally have the option to leave the money in the plan. Otherwise, your employer may require you to cash out the balance. Under the SECURE 2.0 Act, the maximum legal limit for mandatory distribution is $7,000. Leaving money in your former employer’s plan is often the most convenient option, especially if you are not ready to move the funds or are unsure how to allocate them.

Investments left in an employer’s plan will continue to grow tax-deferred until you begin taking withdrawals. Even if you do nothing, you retain the right to roll over the funds at any point in the future.

One of the main reasons to leave your 401(k) in place is the cost. Larger employers often negotiate lower fees, which may be less than those charged by other investment vehicles. In addition, leaving money in the employer’s plan provides many of the same benefits you had as an active employee, such as greater protection from creditors.

Roll it Over

There are two main rollover options. You can roll your money into your new employer’s plan and to an individual retirement account (IRA). The preferred method is a direct rollover, in which funds are transferred directly to the new custodian. Direct rollovers have specific advantages, including avoiding the mandatory 20 percent withholding on the taxable portion of the account. Employers are required to allow direct rollovers to IRAs or another employer’s 401(k) plan.

The other option is a 60-day rollover, also known as an indirect rollover. In this case, you receive the funds and have 60 days to deposit them into a new retirement account. With an indirect rollover, the employer must withhold 20 percent of the taxable amount, which you can reclaim when you file your tax return—if you deposit the full amount within the 60-day window.

Which one makes sense largely depends on your goals. Consider these questions:

- How do you plan to manage your investments?

- How would loan and withdrawal provisions impact or benefit you?

- Is minimizing costs a priority for you?

- What investment options does your new plan offer?

Why Roll to an IRA

If you want to maximize your investment options, an IRA is often the best choice. IRAs are not limited by the number of investment options, and funds can be moved between different custodians. This flexibility allows for a variety of active management styles and greater diversification. You can also directly manage the account and select investments that suit your preferences.

IRAs offer more flexibility regarding distributions because they are not governed by employer plan rules; instead, withdrawals are at the individual’s discretion. Generally, pre-tax dollars are rolled into a traditional or rollover IRA, which remains tax deferred. After-tax dollars are rolled into a Roth IRA, where qualified withdrawals are tax free.

Why Roll to Your New Employer’s 401(k) Plan

A 401(k) generally offers greater protection than an IRA. Under the Employee Retirement Income Security Act (ERISA), funds in an employer-sponsored retirement account typically cannot be seized by creditors.

If you need to borrow money, a new employer’s 401(k) may allow for this through a loan provision. IRAs, on the other hand, do not permit loans; funds can only be accessed through a distribution. To determine whether your plan offers loan provisions, consult 401(k) plan documents.

If you are still working past the required minimum distribution (RMD) age and own no more than 5 percent of the company, you may be able to postpone your first distribution until the year after you retire.

Another reason to consider switching to a new employer’s plan is cost. The new plan may offer lower investment fees than your current plan, which can make a significant difference over time.

Address Your Outstanding Loans

Be sure to repay any outstanding loans from your plan. Otherwise, they will be treated as taxable distributions. If you leave your job, you generally have 60 days to repay the loan to avoid taxes and penalties.

Aligning with Your Long-Term Financial Goals

When deciding how to manage a 401(k) from a previous employer, your choice should align with your long-term financial goals.

Key considerations include surrender charges imposed by plans, comparing investment fees and expenses, and understanding the rights you give up when transferring funds in or out of employer-sponsored plans.

Source: IRS

Resource by the CAPTRUST wealth planning team

Important Disclosure

This content is provided for informational purposes only, and does not constitute an offer, solicitation, or recommendation to sell or an offer to buy securities, investment products, or investment advisory services. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness, or reliability cannot be guaranteed. Nothing contained herein constitutes financial, legal, tax, or other advice. Consult your tax and legal professional for details on your situation. Investment advisory services offered by CapFinancial Partners, LLC (“CAPTRUST” or “CAPTRUST Financial Advisors”), an investment advisor registered under The Investment Advisers Act of 1940.

General Questions

When does the mandatory Roth catch-up provision under SECURE 2.0 take effect?

- Effective January 1, 2026, the mandatory Roth catch-up contributions will be required for employees with over $150,000 of 2025 Federal Insurance Contributions Act (FICA) wages.

Can employers require all catch-up contributions to be Roth?

- No, IRS guidance prohibits requiring all employees to make Roth catch-up contributions.

If a plan does not offer Roth deferrals, must catch-up contribution be eliminated for all participants?

- No, under SECURE 2.0, employees with prior-year wages over $150,000 must make Roth catch-up contributions. If the plan does not permit Roth deferrals, these employees cannot make catch-up contributions. However, employees below the $150,000 threshold may continue making pre-tax catch-up contributions.

What is the impact of the employer match on Roth catch-up contributions?

- The impact depends on the employer’s matching formula and whether catch-up contributions are eligible for a match. Even if the employee’s catch-up contribution is Roth, the employer match is still contributed on a pre-tax basis.

FICA Wage Limit

If an employee works for two legal entities within our organization, is the $150,000 threshold based on combined wages?

- FICA wages are reported separately by each legal entity, even if they are within one organization. Typically, the threshold is based on wages from the employer sponsoring the plan. If the plan aggregates compensation across related employers, combined wages may apply.

Can commission-based employees be eligible one year but not another?

- Yes, commission-based earnings can fluctuate, affecting eligibility year to year.

Catch-Up Election Methods

Does a spillover election automatically switch participants to Roth catch-up contributions once the standard limit is reached?

- Yes, a spillover election directs deferrals above the $24,500 402(g) limit into catch-up contributions. Under SECURE 2.0, plans may implement a deemed Roth election for employees older than 50 with prior-year FICA wages over $150,000.

What if a high earner continues making pre-tax contributions?

- Employers must correct errors, typically by reclassifying contributions as Roth and adjusting payroll records. This process may require issuing corrected tax forms and amended tax returns.

What are the key difference(s) between a spillover and deemed Roth?

- Spillover means excess contributions automatically become catch-up.

- Deemed Roth means catch-up contributions automatically designated as Roth for high earners.

Contributions

Can Roth contributions count as catch-up?

- Yes, Roth contributions can count as catch-up, but only if the plan document specifies that catch-up applies after combined pre-tax and Roth deferrals reach the limit ($24,500 in 2026). Therefore, if the plan states that the deemed Roth election applies only after the participant’s combined pre-tax and Roth deferrals reach the limit, the Roth deferrals would already be accounted for and would not be counted as Roth catch-up contributions.

Testing Implications/Correction Methods

Which funds are returned first during annual non-discrimination testing, pre-tax elective deferrals or Roth elective deferrals?

- Fund return timing varies in plan documents. Please refer to your plan document for the order of sources used for excess contribution refunds.

Payroll Provider

What issues arise if payroll does not separate pre-tax and Roth elections?

- If payroll systems do not maintain separate elections for pre-tax and Roth contributions, it can lead to significant compliance and reporting problems. Misclassification may result in incorrect tax withholding and inaccurate Form W-2 reporting. This is especially critical for high earners subject to the Roth catch-up requirement under SECURE 2.0. Failure to separate these elections can also make corrections more complex, often requiring amended payroll records and tax forms. To avoid these issues, employers should ensure that payroll systems clearly distinguish between pre-tax and Roth contribution sources and coordinate with their recordkeeper for proper setup.

Sources:

www.congress.gov/bill/117th-congress/house-bill/2617

www.irs.gov/pub/irs-drop/n-23-62.pdf

Important Disclosure: This material is not individual investment advice. If you have questions or concerns regarding your own individual retirement or investment needs, please contact a CAPTRUST representative for further assistance. Nothing contained herein constitutes financial, legal, tax, or other advice. Consult your tax and legal professional for details on your situation. This content was developed with the support of artificial intelligence (AI) tools to assist in ideation, content creation, and grammatical refinement. All final materials have been reviewed and approved by CAPTRUST personnel to ensure accuracy, clarity, and compliance with our fiduciary standards. Data contained herein from third-party providers is obtained from what are considered reliable sources, however, its accuracy, completeness, or reliability cannot be guaranteed.

Investment advisory services offered by CapFinancial Partners, LLC (“CAPTRUST” or “CAPTRUST Financial Advisors”), an investment advisor registered under The Investment Advisors Act of 1940.

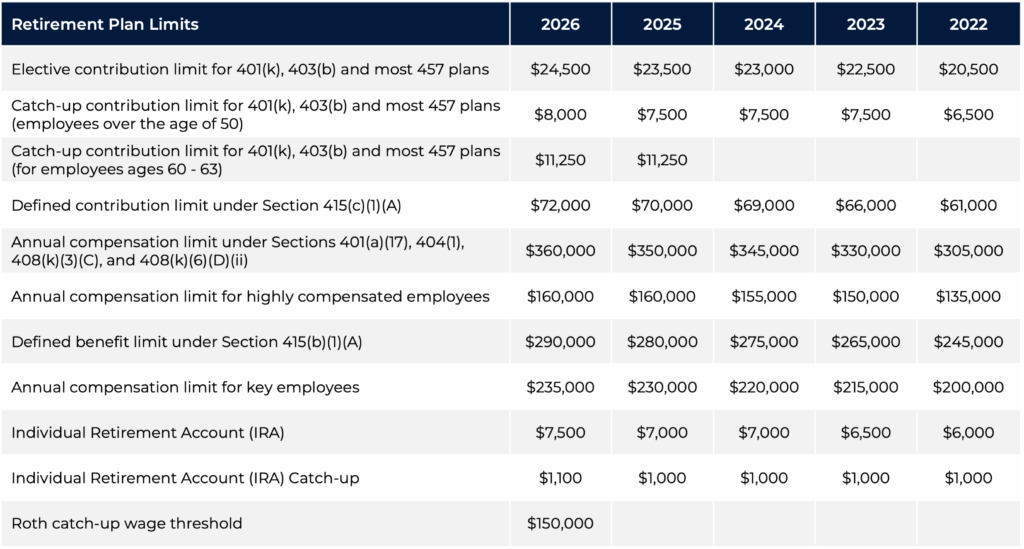

The IRS today announced the updated retirement plan contribution limits for the 2026 tax year. These adjustments reflect cost-of-living changes and help individuals and employers plan more effectively for retirement savings and benefits strategy.

If you contribute to a 401(k), 403(b), 457(b), traditional individual retirement account (IRA), Roth IRA, or manage a workplace retirement plan, now is a great time to review the thresholds and adjust your contributions accordingly.

The new limits may present opportunities to increase tax-deferred savings or fine-tune retirement strategies in alignment with your long-term goals.

Below is a snapshot of the 2026 contribution limits.

Source: “2026 Amounts Relating to Retirement Plans and IRAs, as Adjusted for Changes in Cost-of-Living,” IRS

Whether you’re optimizing your personal retirement contributions or reviewing employer-sponsored plan limits, our advisors are here to guide you through what these changes could mean for your financial future.

Align Your Strategy with the New 2026 IRS Contribution Limits

To learn more about how these changes may impact your plan or portfolio, contact your CAPTRUST financial advisor at 800.216.0645, or visit our locations page to connect with an advisor near you.

This content is provided for educational purposes only, and does not constitute an offer, solicitation, or recommendation to sell or an offer to buy securities, investment products, or investment advisory services. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness, or reliability cannot be guaranteed. Nothing contained herein constitutes financial, legal, tax, or other advice. Consult your tax and legal professional for details on your situation.

She enrolled at the University of Miami to study marine biology. After a bout of seasickness on an early field trip, she changed course to microbiology.

It was a tremendous time to enter the field. Microbiology was evolving from simply observing organisms through a microscope to decoding the mechanisms of life itself. Baskin committed herself fully to the discipline.

“I got a PhD, and then I wound up getting a postdoctoral fellowship,” says Baskin. “Then I was in Bethesda at the National Institutes of Health for a couple of years.” By the early 1980s, she was working in a virology research lab in Minneapolis at the University of Minnesota.

The work was rigorous and rewarding, but still, something was missing.

Wanting More

In 1982, Baskin sensed an opportunity when the Food and Drug Administration approved the first antiviral drug against herpes simplex.

She did what due diligence she could on her own as the new field of antiviral drug development flourished. Unlike antibiotics, which kill bacteria, antiviral drugs treat viral infections by interfering with a virus’s ability to reproduce or function within the body.

Baskin canvassed Minneapolis-area pathologists to assess the market need and create awareness for a clinical virology testing service. Their feedback gave her the confidence to proceed.

“I wanted to do something,” says Baskin. “I didn’t know the word entrepreneurial at the time, but I guess that fits? I hired two wonderful virologists—way better than me—and decided to open a private diagnostic virology lab.”

The first home of ViroMed Laboratories was an 800-square-foot lab in the basement of an office park near her home. Later, she bought a van and turned it into a mobile lab to handle time-sensitive tests quickly. She recalls possibly being the first to recognize and act on this opportunity.

Baskin’s instincts proved correct. As the fields of antiviral drugs and testing technology grew, so did ViroMed. The company won major contracts and a reputation for quality and quick turnaround thanks to her focus on rigorous process and operational excellence.

Baskin is humble about her achievements: “Much of what I do is intuitive. I mean, I never took a business course or anything like that,” she says. “I just assume everybody else can do what I do.”

One milestone came when the company secured a global contract to perform AIDS testing for the U.S. Navy, a development that tested her resilience and persistence.

Baskin’s long hours and determination paid off in 2001 when the company caught the eye of Laboratory Corporation of America (LabCorp), one of the world’s largest clinical laboratory networks. She sold ViroMed’s clinical testing business to LabCorp to add to its infectious disease business and spun off the rest of the company to form AppTec Laboratory Services (AppTec).

Building on Success

Unlike ViroMed, AppTec was not a from-scratch start-up. Baskin had been nurturing the contract research and testing organization within ViroMed that served medical device makers and biologics developers.

“I had made some acquisitions at ViroMed,” says Baskin. “I looked at what our portfolio of expertise was, and I said, ‘You know, there must be other industries that could use our strong expertise.’” Once again, her intuition was right.

The medical device industry was evolving rapidly, driven by an aging population, chronic diseases, and advances in minimally invasive procedures. Increasingly, companies outsourced device testing to specialized contract labs, like AppTec, rather than building in-house capacity.

She also expanded into biologics, which proved to be another big opportunity for AppTec. Biologics are medicines derived from living sources—such as cells, proteins, genes, or tissues—and are used to treat diseases like cancer, autoimmune disorders, and diabetes.

With the support of venture capital partners, Baskin grew AppTec into a testing powerhouse with nearly 500 employees and facilities in St. Paul, Philadelphia, and Atlanta. In 2008, WuXi PharmaTech acquired the company, expanding its U.S. presence and biologics expertise.

Success to Significance

“I’m not recommending this for everybody, but for me, there was never any great long-term plan,” says Baskin. “If you’re going down the path and you don’t open your eyes to other things that may be available because you made your choice, you’re going to miss a lot.”

During her time in Minneapolis, the CEO of the Minneapolis YMCA approached Baskin about a board position. She was interested but cautious. “I said, well, the only way I’m going to be on the board is if I can have a project,” she says. “I don’t want to work on somebody else’s project.”

She developed a pilot program to help a cohort of first-generation college students at the University of Minnesota succeed. The program involved mentoring 35 students, not so much in academics but on what it’s like to be in college.

“Because they had nobody in their family or friend group that had ever gone to higher education, and they didn’t know what to do,” says Baskin. “They were thrown into a big university without the support that they needed.”

It was a success. Ninety-five percent of the students in the pilot program graduated in five years, confirming her belief that smart, talented students can excel with the right resources.

The amazing triumph of this project gave her the confidence that you can make a difference in the lives of students through high- impact programs.

Eureka Moment

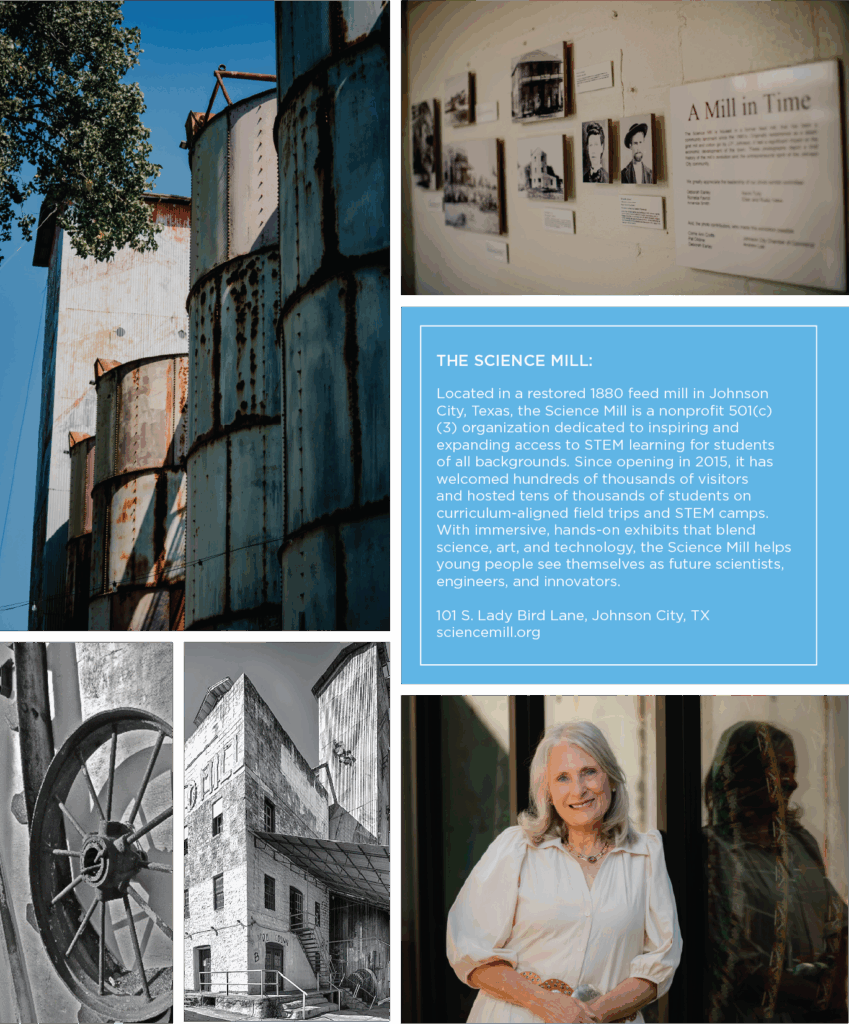

In 2010, Baskin and her husband, Robert P. Elde, PhD, a science educator and former dean of the University of Minnesota’s College of Biological Sciences, retired and relocated to Johnson City, Texas—about midway between Austin and San Antonio.

“We got tired of the snow and the cold,” says Baskin. “It was going to be our winter place, and then we’d go back to Minnesota for the rest of the year.”

One day, as she was about to step into the shower, her phone rang. A friend called to tell her the old feed mill in the middle of town was for sale. The friend suggested that perhaps she could turn it into a bar or an art gallery.

The mill was built in the 1880s by President Lyndon Johnson’s great uncle, James Polk Johnson. It started as a steam grist mill but was later converted to electricity and became a feed mill. It ceased operations in the 1980s and turned into a restaurant and entertainment complex for several years before lying largely dormant.

Throughout its life, the mill significantly impacted the town’s economic life and served as a community landmark. “It was so cool and had great bones and these big silos,” says Baskin.

“At that point in my life, I was not going to open a bar,” she says. “That was just not in the cards. I went to the shower and started thinking about it. Then I said, ‘Wouldn’t it be a cool thing to be able to create a science museum for kids of this area who really don’t have a lot of access?’”

Baskin’s Vision

As usual, Baskin did her due diligence. Because of Johnson City’s strategic location between Austin and San Antonio, her proposed museum could attract school field trips from both cities as well as nearby rural communities without anything like her vision.

She knew funding would likely be hard to source because of her focus on middle school kids—but she believed they could make it work.

In fall 2012, Baskin and Elde bought the historic mill and began renovation to create the Science Mill. The restoration preserved much of the building’s original structure. They repurposed the grain storage silos as exhibit spaces that offer unique, immersive experiences. Walkways now connect the property’s original structures, allowing smooth visitor flow while retaining their original character.

According to the Science Mill’s website, “The design was conceived not as a contrast between new and old, but as the dynamic evolution of the mill from a place of industrial production to a place that can produce science leaders for the new generation.”

“When we grew up, there was no greater aspiration than to be a scientist,” says Baskin. “So much was happening at that time. It was exciting. But now it isn’t the same.”

Baskin and Elde worked together to shape the museum’s exhibit mix, from interactive technology and robotics to immersive biology. Elde personally designed the on-site biology lab where students can explore living systems firsthand.

Hands-On Experience

The Science Mill opened to the public in early 2015. Its mission is clear: to inspire and engage students in science, technology, engineering, and math (STEM), especially those from rural and underserved communities who might not otherwise have access to hands-on learning.

“You can’t fall in love with science by reading about it,” says Baskin. “You have to do it.”

Baskin describes the museum’s purpose as helping kids see themselves in science. Rather than presenting abstract concepts in books, the Science Mill invites students to do science—tinkering, experimenting, and problem—solving in ways that connect to real-world careers.

Inside the Mill, students encounter exhibits that blend science, technology, and art through play and discovery. A few current exhibits include the following:

In one silo, the Light Loom transforms hand motions into shifting waves of color and light.

Another silo houses the Cell Phone Disco, where invisible electromagnetic waves from cell phones trigger dazzling bursts of light.

In the main gallery, students can use the Virtual Body Table to explore three-dimensional scans of human and animal anatomy.

Each installation is designed to spark curiosity by inviting exploration without step-by-step instructions.

Making a Mark

Over the past 10 years, the Science Mill in Johnson City has welcomed more than 400,000 visitors, including more than 91,000 students on school field trips. For many students, especially those from underserved areas, the Mill isn’t just a destination; it’s a bridge. It subsidizes admission and transportation, delivers hands-on STEM programs into classrooms, and offers field trips aligned with Texas curriculum standards.

The Science Mill has also grown beyond the walls of the historic mill itself. For example, its STEM Career Immersion Camps have served more than 17,000 students from more than 50 school districts, with 55 percent of those camps held in rural communities and 100 percent of attendees participating at no cost.

Students who visit report greater confidence in STEM, heightened interest in STEM careers, and a stronger sense of belonging in science learning environments.

“I always tell people that I worked all my life and did a lot of stuff, but this was the hardest job I ever had,” says Baskin. “And it took everything I had learned through all those years of for-profit business. I used every single one of those skills that I had learned before on this little museum.”

For Baskin, the Science Mill is more than a project; it’s a calling.

“It’s not cool to be a scientist when you’re in middle school,” she says. “That’s when we lose our kids. That’s especially when we lose our girls.”

Her second act ensures that in Johnson City—and far beyond—science stays within reach, right when it matters most.

Written by John Curry

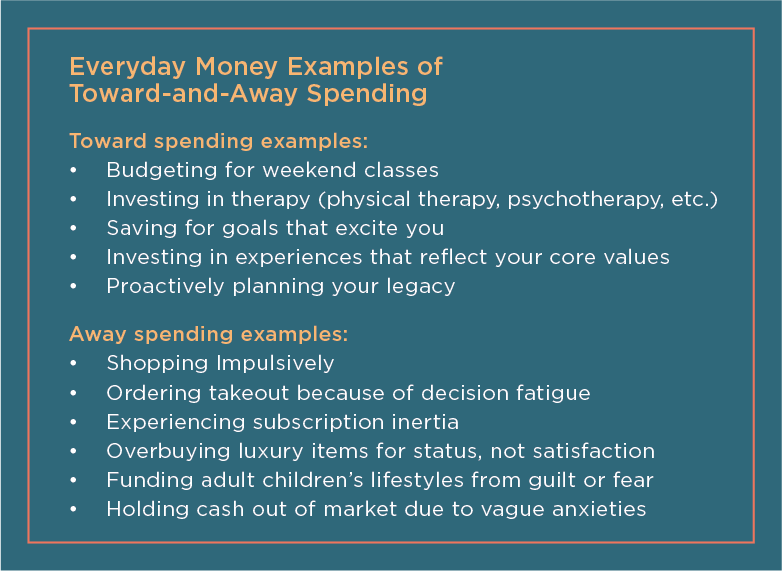

This sort of impulsive purchase can be described as an away move, something done to avoid discomfort. It distracts you from your stress, but it likely won’t help you meet your long-term goals.

We face a dozen similar decisions every day; moments when we can either act in a way that aligns with our goals and values or that simply helps us not feel worse. These aren’t always high-stakes decisions, but over time, the pattern matters.

When Good Intentions Meet Reality

A few years ago, my partner and I met with our CAPTRUST financial advisor, Veronica Karas, for a quarterly check-in. Karas gently pointed out that, despite having a healthy income and modest savings goals, we were consistently coming up short at the end of the month.

When we reviewed our spending, we noticed a theme: a steady stream of high-priced dinners. Some were celebrations, some were tied to business, and some were just fun nights out with family and friends.

At first, it felt like we had only a binary choice. We could give up entertaining, or we could give up saving. Eventually, we recognized there was a third path, one that didn’t require sacrifice, just more clarity. With a little self-reflection and a mindset shift, we would be able to recalibrate how we spent our money without giving up the things that brought us joy.

The Bigger Picture

Our spending patterns were no surprise to our advisor, who sees clients’ saving behaviors ebb and flow all the time. Karas suggests couples commit to regular financial wellness dates. “Review what made you feel fulfilled and what drained you,” she says. Ask yourself prompts like, “Which of my expenses felt aligned with my goals this month?” She also recommends regular advisor check-ins. “I always remind clients: Insight without rhythm will fade. Reflection is a practice, not a project.”

Karas says she sees common patterns in spending motivation among her clients, typically based on their phases of life. In their 30s, she says, clients tend to chase external validation and status items, like expensive cars or big homes. By their 60s, there’s a shift toward internal satisfaction—curating legacy, deepening relationships, or protecting time.

Rather than viewing financial planning as a trade-off between present happiness and future security, Karas encourages clients to seek a middle ground. “Form good habits that feel like wins right now and for the future, like simplifying, gifting, and planning meaningful experiences,” she says. “The key is recognizing that trade-ups beat trade-offs.”

Applying a New Framework

Melissa Kirsch, a writer for The New York Times, recommends a similar framework for moving toward a life you love. This means taking a broad look at your life—not just your spending. Her number one recommendation? Make two lists.

The first is a list of things you want to move away from, like a draining friendship or overpriced daily lattes. The second is a list of things to move toward, like reading more or spending time outdoors. It’s the kind of list we often make in January and forget by February. Kirsch suggests a more frequent habit. “What if these new-year traditions became new-month traditions?” she says.

Each month, make your toward and away lists. Name what you want more of and what you want less of. At the end of the month, take 10 minutes to review.

There is support for this practice in the work of many behavior-change experts, like Tony Robbins. Robbins says we’re usually driven by one of two things: what we want to experience or what we want to avoid. When we don’t pause to notice which desire is at the wheel, we end up feeling reactive instead of intentional. This applies to our daily behavior and relationships but also to our spending and saving habits.

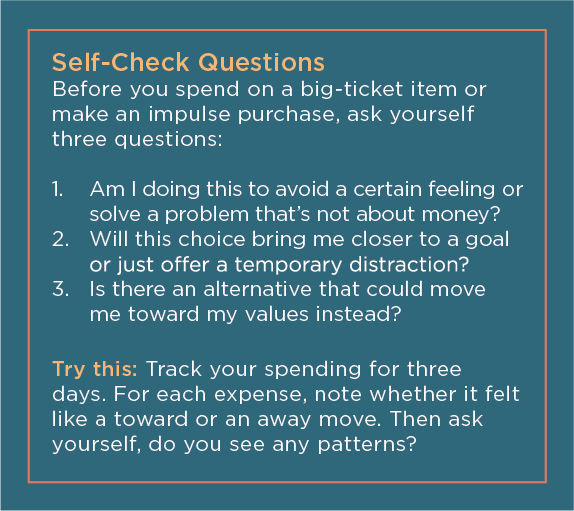

Soon after learning about this list-making method, I decided that, each month, I’d look through every purchase I’d made and ask myself a simple question: was this individual purchase moving my partner and I toward our values and goals, or was it an away move—reactive, impulsive, or driven by stress?

Some expenses were necessary and neutral, like gas and groceries. Others clearly supported our long-term financial goals, like buying in bulk or enrolling in a cooking class to reduce how often we eat out.

And then there were the ones that were clearly reactive: purchases made to soothe, compensate, or avoid. Takeout after a long day because we were too drained to cook. Expensive gifts for our grown-and-flown kids because we missed them and wanted them to feel loved. And those restaurant dinners we had sworn off but still craved when emotions ran high. These kinds of choices aren’t a problem now and then, but we know we need to keep them in check, and we want to be fully aware of what is driving them.

What that list revealed was powerful. It wasn’t about cutting back or blaming ourselves. It was about starting to understand the reasons behind our spending. Were we acting proactively or reactively? Were we leaning into our values or trying to escape discomfort?

Repeated monthly, this practice became a valuable compass. It helped us prioritize saving and align our spending with what we really value, like time with friends and family, time spent outside, and good food.

The next time we met with our advisor, our balance sheet spoke for itself. We weren’t all the way back to where we wanted to be, but we were on track for smarter spending and saving.

A Gentle, Objective Approach

B.J. Fogg, in his book Tiny Habits: The Small Changes That Change Everything, cautions that this type of self-evaluation should be made gently, with positivity. He urges readers not to judge themselves harshly for their own reactive behaviors.

“We change best by feeling good, not by feeling bad,” says Fogg. “Make sure your attempts at demotivating behavior don’t morph into guilt trips.”

Karas agrees. She says most budgeting tools focus on the bottom line rather than the emotional component of spending behaviors and trends. “I’d love to see budgeting prompts like, which purchase this week energized you? or which made you sigh with regret?” Tagging your expenses with the emotions that surround them can turn raw data into reflective insight. Imagine seeing a pie chart not just of dollars spent but of energy gained. That’s the future of fintech with heart.”

If you start to view spending through this lens, you can build more than savings. You can build confidence, alignment, and a greater sense of agency in your life.

By combining intuitive self-assessment with actionable insights, you may also find it easier to make financial decisions and proactive adjustments that align your everyday choices with your long-term retirement and savings goals.

The Takeaway

No one gets this right 100 percent of the time. But noticing the reasons behind your spending is a step toward more empowered choices. It’s not about guilt. It’s about direction.

By taking stock of what’s working and what’s not, you gain clarity on the forces shaping your financial well-being. This framework isn’t a replacement for comprehensive financial planning, but it can offer valuable insights alongside it. While detailed budgets and investment strategies address the mechanics of money management, the toward-and-away lens addresses something deeper: the emotional and psychological patterns that drive your choices.

The beauty of these lists is in their accessibility. While tools like spreadsheets and apps can help, toward-and-away lists start with honest reflection. Over time, self-awareness becomes a quiet but powerful form of self-knowledge, one that can help you make choices that feel both financially sound and personally authentic.

Written by Cara J. Stevens

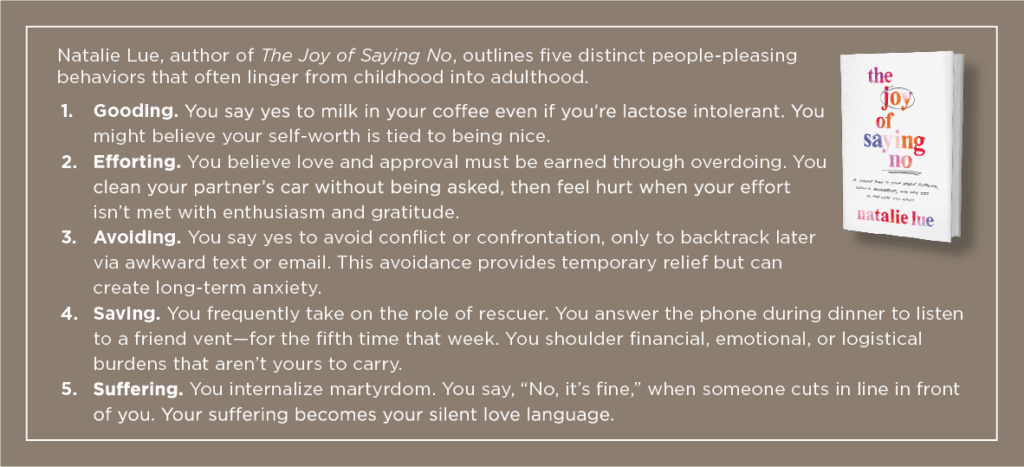

At first, it feels flattering—your time is in demand. But if you don’t learn to say no with intention, your well-earned freedom can quickly vanish under a pile of coffee dates, volunteer commitments, and favors that weren’t part of your retirement dream. Without meaning to, you may find yourself working just as hard as before, only this time without a paycheck.

That’s the paradox of retirement. An open calendar that promises peace can become a trap if you don’t guard it with boundaries. Saying no becomes a critical skill, not because you’re selfish but because you’re protecting the life you’ve spent decades working toward.

Still, for many of us, saying no doesn’t come easy. It feels uncomfortable. Unnatural. Even risky. Why is that?

Why Saying No Gives You the Ick

Long before emails, deadlines, and family group chats, we were kids trying to stay safe in a grown-up world. For many of us, the earliest lesson was simple: Acceptance equals survival.

“Saying no in childhood often triggered disappointment, anger, or withdrawal,” says Natalie Lue in her book, The Joy of Saying No. It’s a cautionary tale about why constant people-pleasing not only is a detriment to joy but can also harm your health. “We learned to equate no with rejection. This early wiring makes it hard to distinguish a simple boundary from an emotional risk.”

As we grow up, what we say no to is often either family or work. A parent may feel like a failure when they miss a child’s basketball game to prioritize a work project. Someone may feel like they’re disappointing their partner when they need to visit an aging parent on a regular date night.

In both examples, the person saying no feels guilt and regret. Coupled with the subconscious childhood fear of rejection, these adult experiences can make saying no feel like an insurmountable challenge to be avoided at all costs.

The result is that we say yes too often and overcommit ourselves to what other people want from us. It’s a lose-lose situation. Both paths lead to stress.

The Cost of Cortisol

When our cave-dwelling ancestors faced life-threatening danger—an unknown sound or sight nearby—their brains sent a distress signal to their adrenal glands, which released cortisol, the stress hormone. Cortisol, in turn, signaled their body to release glucose, a fuel that could power either fight or flight. This mechanism evolved to help humans succeed in a dangerous world.

While most of us are no longer on high alert to threats in the brush, our bodies, brains, and nervous systems have not evolved at the same pace.

The human body today reacts the same way to an overly full calendar as our ancestors’ bodies reacted to a lion. Cortisol erupts, but rather than pushing a person to fight or flee, it triggers inflammation, weight gain, insomnia, depression, memory loss, and an increased risk of heart disease.

Lourdes Aldanondo, a therapist, naturopath, and co-author of the best-selling Ignite Your Life for Women, says many people think people-pleasing is just a personality quirk. But it’s also a cultural phenomenon and a chronic stressor with real effects on physical and mental health.

Persistently elevated cortisol levels wreak havoc on the body. “If you never say no, your body lives in a state of subtle stress,” says Aldanondo. “Depending on your individual body’s vulnerabilities, you may develop irritable bowel syndrome, or if you’re a regular athlete, your muscles may tighten, leading to spasm and injury. If you’ve always been prone to headaches, stress can turn into a three-day migraine.”

“Each person’s body reacts to stress differently, but the common cause is the same,” says Aldanondo. “If you do not get a handle on the stress in your life, it’s a matter of when—not if—you will become ill.”

And the impact extends beyond stress. It also affects how we shape our daily lives, especially in retirement.

Retirement Brings Expectations

Life in retirement is fundamentally different from life with a career. The shift from structured workdays to an open calendar creates a false impression you are constantly available. You have the chance to control your days and weeks—in theory at least. It’s important to recognize this opportunity and seize it.

“Perhaps the most important thing to learn is that free time doesn’t equal availability,” says Lue. Without clear boundaries, your well-earned freedom can quickly morph into everyone else’s convenience.

“Boundaries are the walls that protect your freedom,” says Aldanondo. “They’re not rigid; they’re flexible, but firm. When you listen to your body, especially your gut, your life becomes much easier.”

In retirement, saying no is essential. Imagine your boundaries not as a fence to keep others out, but as a frame that can help hold your life in place.

Calendar with Intention

One person taking charge of retirement is former CAPTRUST Chief Marketing Officer John Curry, who stepped back from a busy career last year and moved to Barcelona.

“As a working person, your day starts out full,” says Curry. “Within that fullness, you create capacity to do the things you love, like innovation or spending time with your team. You’re starting at the top and working down.” But that changes when you retire.

“In retirement, you’re building from the ground up,” he says. “You don’t have to do anything. So the question becomes, what do you want to do? How do you build the day or the week that you want?”

For Curry, that means scheduling daily Spanish-language study time, date nights with his wife, Marcela, regular time with friends, gym sessions, and rehearsals with his band. He jokes that this approach to scheduling feels a lot like playing Tetris.

“Each day begins as an empty board,” says Curry. “I stack time blocks—morning Spanish, evening rehearsals—so the pieces fit without pressure. When it works, I get to do things I enjoy without feeling overburdened or stressed.”

Curry says he has created a weekly structure that honors his passions, while also saying no to things that don’t align with his values or goals.

King of Your Castle

As in all things, balance is key. People will take as much as you give them.

Maybe you have a friend who always wants to meet up for dinner. Or you volunteer for an organization that is always asking for more. Thinking strategically about your calendar helps you avoid the pitfalls of saying yes when you want to say no.

You can’t build a fulfilling day or week—one that includes the joys of a well-lived life—without strong boundaries.

“If I know I’m going to be writing this week, how do I make sure I have the focus time I need?” says Curry. “I know I have music rehearsals on Wednesdays and Saturdays, so how do I defend my free time those days?”

Another good metaphor is to think of your boundaries as a moat around a castle. You hold the rope that raises or lowers the drawbridge. As the monarch, you’re responsible for protecting everyone inside.

“I know when I get overburdened,” says Curry. “I may commit to a music project or I know someone’s coming to visit me, and so I won’t be able to do some of my regular things. When that happens, I have to call a timeout and figure out what I can do to pare it back.”

Lower the drawbridge for the things you want in your life, but remember, saying no can protect your freedom.

Making It a Habit

If you struggle to say no and often find yourself overcommitted, don’t worry—you are not alone. Establishing boundaries isn’t easy, especially if you’ve never done it—or have done it poorly. But like any new habit, it gets easier with practice.

Here’s how to get started.

- Press pause. It’s easy to fall back into old patterns. A friend or relative asks you to do something you’ve done dozens of times already. Instead of saying yes automatically, call a mental timeout to really consider the request and remind yourself you hold the rope to the drawbridge.

- Don’t say sorry. If you decide to say no, you do not need to apologize. A simple “I appreciate the offer, but I have to pass” is enough. No further explanation required.

- Expect pushback. Be prepared for resistance. You might hear, “What do you mean? You’re retired. You’ve got all the time in the world!” Maybe that’s true, but it’s your time, and only you get to decide how you will spend it.

- Hold steady. If you give in, you teach others that you’re open to negotiating. But if you hold steady, you teach them to respect your boundaries. The more often you do this, the less likely it is that you will get pushback.

The key to success is knowing when to lower the drawbridge and when to keep it raised. Finding that balance is essential, especially during retirement, which should be your chance to control your calendar.

“There’s a common myth that boundaries are burdensome, but a well-placed no creates space for a truly joyful yes,” says Aldanondo. “Yes should be a buoy, not a boulder. It should lift you up, not sink you. When you choose the yes that lights you up, you show up better for your family, your work, and yourself.”

Written by Catherine Stuckey

Long and his sister, who was also adopted, had great childhoods, and adoption wasn’t something they talked or thought about very often. “The only time I thought about it was once a year, when we would get a solicitation from the children’s home for something they called ‘The Little Red Stocking Fund,’” he says. His parents always sent a donation.

Decades later, when a family friend invited him to some fundraising events for Children’s Home Society, Long was happy to offer support. His wife, Mary, got involved too.

Today, their commitment to helping vulnerable children find “loving, permanent, safe homes” is a philanthropic passion, but they still pursue it strategically.

That means they have zeroed in on a specific goal: eliminating the financial burden on families in North Carolina who want to adopt but can’t afford the full cost.

It also means planning for what he calls “a very meaningful gift,” well beyond the money the couple has already donated to Children’s Home Society and a second charity, Gift of Adoption, to date.

It means working closely with these charities and inspiring others to give. “Being a strategic giver means more than just writing a check,” he says.

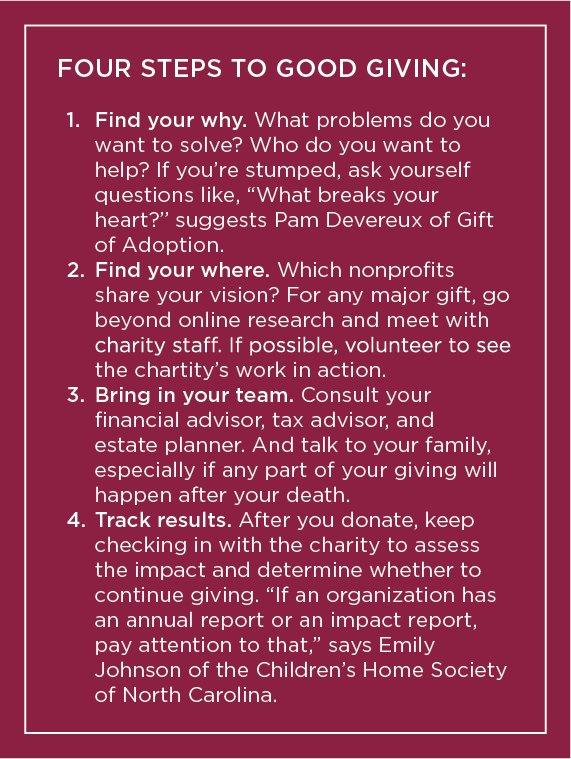

If you want to be a strategic giver too, here are a few ways to get started.

Pick Not Just a Charity but a Purpose

Donors gave nearly $600 billion to U.S. charities in 2024, according to Giving USA. They choose from among 1.8 million nonprofit organizations.

Major strategic giving starts by really thinking about those choices.

With a little prompting, most people can identify causes they’ve always cared about, says Sara Piner, a senior vice president at the Foundation for the Carolinas. The foundation has a guidebook that suggests potential donors think about their beliefs and interests but also about the populations they want to serve (such as children, animals, immigrants, or veterans), the reach (local or beyond), and the impact they want to have (what to change, solve, build, or sustain). This kind of exercise can help individuals and families compose a purpose statement to guide their personal philanthropy.

Long and his wife are clear about why they are giving and the impact they want to have: “We are focusing our family on adoption, not only because it affected me personally, but because it attacks a root cause of many societal problems that can be linked to children lacking stable, loving homes,” he says. “We prefer to think of these expenditures as investments, not gifts. Creating a family has a forever impact.”

Get to Know Nonprofits and Stay Involved

Choosing a specific charity or charities for major strategic giving can take legwork, says Heather Shanahan, senior director of endowments and foundations at CAPTRUST. While it’s a good start to review a charity’s financial reports to the IRS (990 forms) and to review online ratings and profiles at sites such as Charity Navigator and GuideStar, that’s often not enough.

“Ideally, you’ll sit down with a charity’s leadership to discuss your giving plans and their needs,” says Shanahan.

Her advice: Be sure to ask for the group’s donation policy. You might learn that it can’t accept the piece of property you hoped to donate or that it doesn’t have the infrastructure to support the new program you hoped to fund. “You don’t want to give a gift that creates a new burden for an organization,” she says.

Such meetings also give charity leaders a chance to hear what matters to you as a donor and to start what should be an ongoing relationship, says Pam Devereux, CEO of Gift of Adoption, a nonprofit based in Illinois with 30 chapters nationwide providing adoption assistance grants.

An enduring relationship allows donors and staff to work “together toward a goal that’s bigger than both the organization and the donor,” she says. And that means donors like Long can increase their impact.

Long’s ongoing relationship with Gift of Adoption includes sitting on its strategic advisory council and on an investor board that covers overhead costs. He also previously served on the board of directors at Children’s Home Society, which focuses on family preservation, foster care, and adoption. Today, Long remains involved, including as a formal and informal fundraiser.

“I know that he talks about Children’s Home Society with his personal and professional acquaintances,” says Emily Johnson, the organization’s chief philanthropy officer. “He’s talking about it in his Bible study. He’s talking about it in meetings with other investors.”

Long also talks about Gift of Adoption every chance he gets, Devereux says, often inspiring others to give “without even asking.”

When Children’s Home Society was working to build a leadership group of donors, “Bob committed a major gift early,” says Johnson. “We were able to share his generosity with others to inspire increased giving.”

Think Through Your Giving Plan

You may know why and where you want to give but still need to work on the how. This includes deciding whether to donate a few large gifts or many smaller ones, whether to give mostly during your life or after death, and which financial and legal vehicles to use.

“There is no one-size-fits-all solution to charitable gift planning,” says Piner. For example, you might decide to give to charities directly, to set up a family foundation (if you have the resources), or to use the increasingly popular donor-advised funds (DAFs). A DAF allows you to contribute to—and make grants from—a fund administered by a charitable organization.

You may also decide to earmark your donations for specific purposes or let a charity decide how to best use the money. These are called unrestricted gifts, and they’re a hallmark of “trust-based philanthropy,” says Johnson, made possible by close relationships between donors and charitable groups.

“To figure it all out, you’ll likely need a team that includes a financial advisor, a tax professional, and an estate planning attorney,” says Shanahan. “And you’ll want to keep them in the loop as your giving plan evolves.”

Long didn’t set out to become a philanthropist. But by anchoring his giving in personal experience and purpose, he’s become an advocate, investor, and changemaker in the lives of children across North Carolina.

His message to others? You don’t have to have a high net worth to be a strategic giver—you just have to be intentional. “A well-placed gift can change a life,” Long says. “Or in our case, thousands of them.”

If you’re ready to give more than a check—to give with purpose, with passion, and with a plan—you might find, like Long has, that strategic philanthropy is one of the most powerful legacies you can build.

Written by Kim Painter

“Glory Days” is a deceptively upbeat anthem about people lingering in the glow of their past. The characters in the song—an aging athlete, a single mom, and Springsteen himself—are caught in the gravitational pull of their former triumphs. They get together, have a few beers, and talk about the way things used to be. While there’s warmth in their memories, there is also a creeping sense of stagnation.

It’s a story that resonates because it’s deeply human. We all have chapters that shine: a career peak, an athletic high, a creative breakthrough, or a time when our house was full of family. These moments matter, but when they become the standard by which we measure everything else, they can also be obstacles to a happy future.

When the Past Defines the Future

Hanging on to former success is rarely about arrogance. It’s about identity. Something worked. Something clicked. It made you feel like the best version of yourself. And so it’s tempting to chase that same magic again. But as the world shifts, what once seemed just right may no longer be.

Marlon Brando, for example, struggled for years after early acclaim with films like The Wild One and A Streetcar Named Desire. He reemerged many years later in The Godfather by embracing his age and evolving his craft.

Organizations face similar traps. Kodak, once the king of film photography, also invented one of the first digital cameras (in 1975) and earned patents for numerous imaging technologies in the 1980s and 1990s. Yet faced with the choice between digital and analog, it clung to its film legacy. The result? Lost leadership and missed opportunities.

The same pattern shows up in our everyday decisions. A former executive in search of a part-time retirement job might hold out for a title, salary, or perks that no longer fit. An investor might chase yesterday’s returns. An amateur athlete might stop playing the sport they love just because they can’t achieve their former personal best.

The risk is directional. Looking backward too long makes it harder to move forward. It keeps us thinking about our former selves, without a full view of who we are, here and now.

The Psychology of Staying Stuck

Nostalgia can be powerful and productive. It buffers us against anxiety and reminds us of our potential. But when it becomes the lens through which we make decisions, it can also distort our judgment.

“When you’ve made it once, you know exactly what it takes to do it again,” says Wilson Hoyle, a CAPTRUST senior executive and inspirational speaker to organizations across the country. “That knowledge can motivate or paralyze you.”

In his long career, Hoyle has led thousands of employees and watched many more clients and colleagues retire, redefining who they want to be and moving into new phases of life. He also speaks frequently to professional sports teams and to players who are often in the middle of their glory days.

When people hang on too tightly to the past, he says, they’re falling prey to three key cognitive behaviors:

- Status quo bias. We naturally prefer what’s familiar, even if the environment has changed. But avoiding change for the sake of comfort can limit growth.

- Loss aversion. We feel the sting of loss more intensely than the pleasure of gain, making us overly cautious or protective against perceived risks that may no longer apply.

- Anchoring. We latch on to old benchmarks and can’t let them go. Opportunities that don’t match that standard may get dismissed, even if they align more closely with our current needs, goals, or values.

These are natural biases that our brains have developed to try to keep us safe. They help us avoid making bad decisions. They can also keep us stuck in the past. Two empty nesters might find themselves unable to enjoy their years of independence and freedom. Or a person might hold on to weight goals and beauty standards that are now unreasonable and downright damaging.

Letting Go, Not Losing Ground

Letting go of past success doesn’t mean rebuffing it. It means recognizing that success today might require a new definition.

“The people who transition well after early success are the ones who can do two things: turn the page and start from the bottom, with no sense of entitlement,” says Hoyle. “It’s not about rejecting your past. It’s about not being beholden to it.”

Americans are living longer than ever now, spending an average of 25 to 30 years in retirement. This reality forces a reevaluation of what it means to be productive, fulfilled, and financially secure later in life. Holding on to outdated assumptions can create a mismatch between goals and resources.

“Sometimes, you need to be willing to go backward to go forward,” says Hoyle. “And that takes humility.” His advice: Reexamine what you need to feel satisfied today, not what made you feel fulfilled in the past, so you can set new goals that match your current goals and needs.

The Cost of Clinging

What once felt like stability can quietly become resistance. In a world that demands adaptability, a refusal to evolve can quietly erode career prospects, financial resilience, and personal well-being. Being anchored to the past can show up in subtle but consequential ways:

- Turning down opportunities. Waiting for a role that matches a past salary or job title can lead to long employment gaps or diminished offers. Time passes, gaps widen, and financial strain sets in.

- Fighting a pivot. Clinging to old friends or a now-dysfunctional marriage, refusing to downsize when you know you need to, and continuing old hobbies that no longer bring you joy are three examples of how we reject adaptation. In doing so, we fight our own evolution.

- Straining relationships. Holding on to an old identity can create tension at home. For example, one spouse might continue spending to maintain a lifestyle no longer supported by current earnings. Over time, this friction creates stress and chips away at emotional well-being.

- Avoiding necessary adjustments. Whether it’s downshifting your career, retooling your fitness regimen, reskilling, or revisiting your financial plan, delay compounds risk. The longer someone tries to sustain a former version of success, the harder it becomes to adjust with intention.

In each case, the issue isn’t nostalgia. It’s inertia.

Four Ways to Move Forward

Letting go is easier with a plan. “There’s no shortcut to building something meaningful,” says Hoyle. “The ones who remember that are the ones who succeed a second time.”

Here are four strategies to help you move from looking back to moving ahead:

- Name what you’re holding on to. Ask yourself: What part of the past am I trying to re-create? Is it influence, recognition, empowerment, security? Naming it helps shift the narrative.

- Reframe risk. Growth lives just outside of your comfort zone. A pay cut for purpose or a bold lifestyle pivot might feel like a step down but could be your best investment in the long run.

- Update your success metrics. What mattered then may not matter now. Redefine success around who you are today. Flexibility, autonomy, fulfillment, and impact are all valid metrics.

- Craft a new narrative. Replace “I peaked back then” and “That was the best time of my life” with “That season prepared me for what’s next.” Your past isn’t the ceiling. It’s the foundation of your next level.

Hoyle also mentions the importance of friends and family: “The ones who move forward the most consistently tend to be surrounded by support—not voices telling them they’re above starting over. That kind of environment makes it easier to embrace humility and begin again.”

Building on the Glory, Not Living in It

If you’re looking for positive role models, consider LeBron James and Joni Mitchell. James achieved early success on the basketball court but continues to evolve in business and through activism. Mitchell didn’t stay in folk music forever, although it was the genre that made her famous. In the late 1970s, she pushed into jazz and experimental sounds, willing to risk commercial success to keep growing.

Whether you’re navigating a career shift, a relationship change, a financial transition, or personal reinvention, it’s worth asking: Am I looking backward to feel safe, or forward to make progress? Clinging to the past can limit your ability to build something new. The most resilient people are those who honor their history without being bound to it.

Celebrate your wins, but don’t stop there. Your next success might not look like your last one. And that’s not just OK. It’s essential.

“You don’t need to peak again to move forward,” says Hoyle. “You just need to get started.”

Written by John Curry

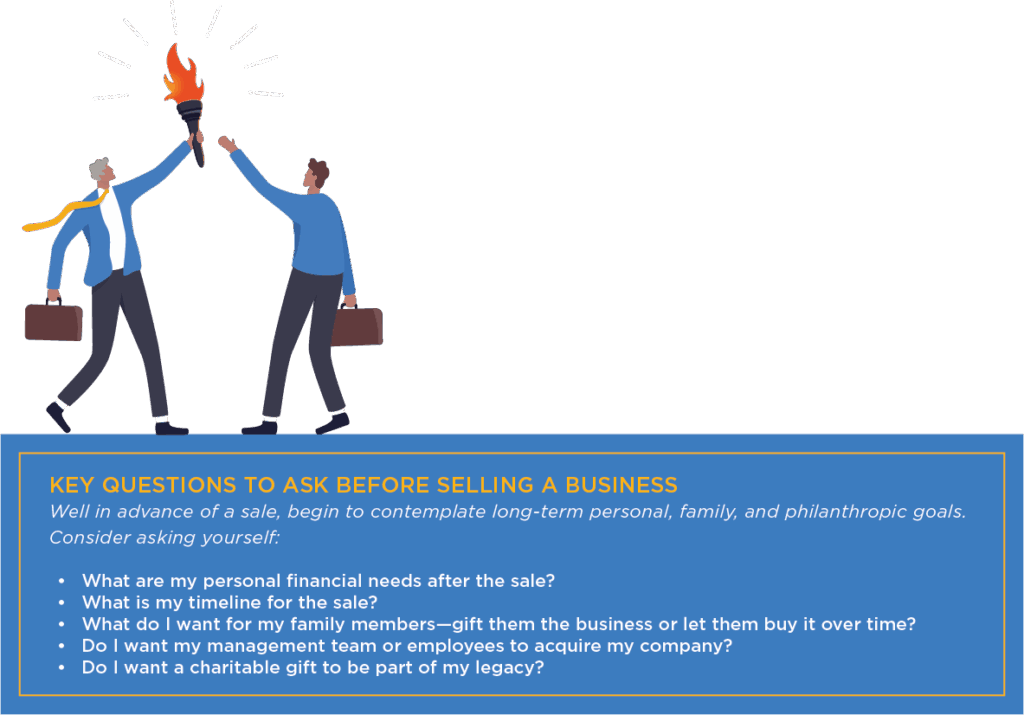

It’s no surprise that many family business owners postpone planning their exit. Selling a business involves legal and financial complexity, and owners are often consumed with daily operations and growth strategies. Many also struggle to even imagine stepping away, having dedicated much of their lives to their work. “People who have their own business, oftentimes it is their personal identity,” says Denise Rothermel, a financial planner and business valuation specialist at CAPTRUST.

Among business owners aged 55 and older, only 17 percent report having plans in place for selling or transferring ownership of their business within five years, according to a Gallup poll. Yet without a plan, a family business is at great risk of losing value or even closing if the owner becomes incapacitated, the market changes, or emergency circumstances force a quick sale.

But “selling a family business isn’t just a financial transaction,” says Rothermel. “It can be a deeply emotional one.”

In one case, Rothermel advised a married couple who built a successful yacht restoration company. Over the years, it grew to a premium provider in the market. As they approached retirement age, they hadn’t done much to prepare for what came next.

Then, an unexpected offer from a potential buyer caught them off guard. The offer was sizable—but could the business fetch more? Should they shop it around to maximize value? How much labor and preparation would that involve? More importantly, were they ready for the next stage of life? And what would happen to their employees?

The couple turned to Rothermel for guidance. She told them that before pursuing a sale, it’s often necessary to do some soul searching to clarify financial priorities and legacy goals. “My job is to quarterback them through all of that,” says Rothermel.

What Comes First: It’s Values, Not Valuation

Business owners often focus on tangible aspects of a sale, such as cash and stock. “Most people just think about the market valuation of their business, but it’s not that simple,” says Rothermel. Sellers need to weigh their values carefully, as these can inform the timing and structure of the transaction.

“It’s a balance of tangibles and intangibles,” says Rothermel. Thinking through the intangibles that matter the most will provide a foundation for decisions about the timing, price, deal structure, and tax planning of a sale.

For example, it’s nearly impossible to assign a dollar value to the satisfaction of seeing a son or daughter step into a leadership role, having the means to support a philanthropic cause, or the joy and freedom that often come with departing a stressful business.

After the offer on the yacht restoration business, Rothermel had a frank talk with the owners. “Yes, your company is likely worth more than that,” she said. “But [the offer] gives you more money than you will need to live off of in retirement.”

The couple also considered the ramifications of trying to optimize the company for market in hopes of a higher sale price. “It could take years,” Rothermel told them, and there would be no guarantee. “Meanwhile, what if the economy changes?”

The Right Deal at the Right Time

A successful business exit isn’t always about the highest price. It’s about making a deal that satisfies as many priorities as possible—and proper planning can take time. One to three years before a potential sale, owners can begin holistic discussions with their financial advisors about their goals. Professionals with experience in business valuation, tax planning, and exit planning can assist with examining priorities, maximizing business value, and matching the structure of a sale with the desired tangible and intangible goals. Ultimately, “tax considerations will drive a lot of how you structure the sale,” says Rothermel.

For example, if a primary goal is keeping a business in the family, a seller might accept payment in installments, allowing a son or daughter to use earnings from future operations to purchase company shares. Or if the goal is for family members to inherit, special planning techniques can minimize the tax burden for heirs. “A lot of families sell a business, or a piece of a business, through an intentionally defective grantor trust,” says Rothermel. This trust lets an owner legally remove the entity from the estate while still receiving payments from the business and paying income tax on those earnings.

An owner may also choose to transfer ownership of the business to loyal employees or a management team that contributed to the company’s success. “You might do a stock redemption and let your management team acquire it,” says Rothermel, “or, have your employees buy you out through an employee stock ownership plan (ESOP).” ESOPs are a tax-favored way to transfer ownership to employees while providing a fair price to the business owner.

“ESOPs are most commonly used to provide a market for the shares of departing owners of successful closely held companies, to motivate and reward employees, or to take advantage of incentives to borrow money for acquiring new assets in pretax dollars,” according to the National Center for Employee Ownership.

When seeking an outside buyer, a business broker or financial consultant may unlock potential value that’s not obvious to the owner—particularly by understanding the business’s differentiators and marketing them to various buyers.

“People know what they want to be paid, but they’re not always objective. That’s why you should consider having a valuation professional on your team, such as a business broker or a financial planner who works on strategy and tax planning,” says Rothermel. Sellers can sometimes be misled by rules of thumb or industry comparables, but they maximize value by understanding what matters most to them and what makes their business special.

Sailing into the Sunset

Ultimately, the couple accepted the offer. A bird in the hand is worth two in the bush. They concluded that accepting the buyout offer would reduce their risk, increase their freedom, and let them start enjoying retirement immediately. “It gave them two to five more years of doing what they want,” says Rothermel.

Written by Jeanne Lee

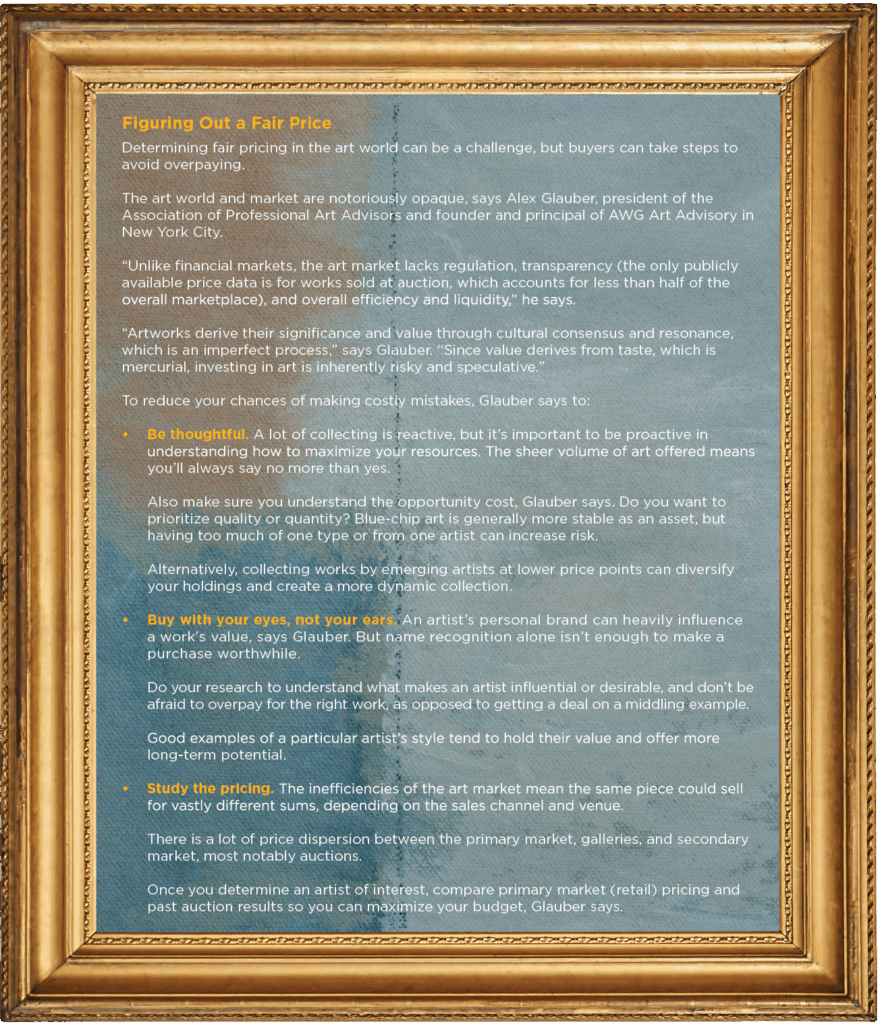

Beyond its aesthetic appeal, art can offer a meaningful—and at times lucrative—way to diversify a portfolio. Yet investing in art isn’t as simple as buying what you love. It requires expertise, strategy, and, perhaps most importantly, passion.

Mike Molewski, a CAPTRUST financial advisor in Allentown, Pennsylvania, has learned this firsthand—along with several of his clients. One enjoys acquiring modestly priced oil paintings from Cuba. Another prefers high-end works from a New York City gallery.

Molewski himself owns about 40 early American Western-themed pieces, including oil-on-canvas paintings that capture the lives of Native Americans.

“Artwork can be an important and enjoyable part of a diversified investment portfolio,” Molewski says. “It’s nice to feel interested in and passionate about a piece when you first see it, but ultimately, it has to be a sound investment.”

Art advisor Laura Smith Sweeney, founder and principal of LSS Art Advisory in New York and San Francisco, echoes the sentiment. She says most buyers want purchases to increase in worth, or at least retain their value.

Art is a passion asset like other collectibles such as cars and wine. “These assets fall into the alternative portion of a portfolio,” says Smith Sweeney, who has a dual background in art history and wealth management.

Recently, Smith Sweeney says, a client told her how much she treasured a new piece—a portrait of a woman—that they found together. It captivated the buyer’s interest when she saw it at an art fair, and she loves it even more now that it’s installed in her home. “It reminds her of the Mona Lisa because the eyes seem to follow you.”

That emotional connection is part of the magic—and the challenge—of collecting art. But behind every compelling piece lies a set of practical considerations. For investors, understanding the financial mechanics of the art market is just as important as following one’s heart.

Exploring Options

“There are several financial advantages to owning quality artwork,” Molewski says. For instance, art is a traditionally stable asset class, comparable to gold. It’s illiquid but often a good investment in the long run.

“We suggest collectibles such as art be no more than 10 percent of a person’s portfolio because of it’s illiquidity,” he says. “To sell them, you have to find the right resources, pay commissions, and pay transfer costs, plus any taxes due.”

“Some people invest in shares of blue-chip artwork through firms such as Masterworks or Public,” says Molewski. Masterworks is devoted completely to art and collectibles. Public offers a wider range of investable assets that includes art.

While fractional investing offers a lower barrier to entry, some collectors prefer a more hands-on approach. For example, one of Molewski’s New York clients bought an $800,000 painting for his family’s home. This level of investment requires additional due diligence, and Molewski says the client was careful about seeking an art dealer’s expert advice to make sure his purchase was an investment-grade piece.

Molewski says his personal collection is paying off for him and his wife, Diane. “We love the art we own,” he says. “It fits the style of our home and makes it more enjoyable. It has also been a great investment. We’ve been asked to sell certain pieces, and the amount offered was much more than we paid.”

“The key to buying a collection is working with a professional such as an art advisor, art dealer, or gallery owner,” Molewski says. “There needs to be a lot of trust. If you don’t trust your advisor, it’s so much harder to make good decisions.”

Avoiding Pitfalls

Smith Sweeney works on the other side of that relationship, often serving as the trusted advisor. She says one big piece of her job is helping clients avoid costly mistakes, such as overpaying or buying a forgery. “Clients sometimes come to us with artwork they purchased before working with us. They may have paid $25,000 to $100,000 for it, and there is a limited resale market for the work.”

The resale price, just like the buying price of a piece, is based on many factors, including the artist’s reputation and the medium, from oil paintings and sculptures to photographs and prints. As you’d expect, emerging artists’ work is typically priced lower than work from artists who already have global recognition. “It’s like start-up companies versus established, multinational corporations,” says Smith Sweeney.

“Limited-edition prints often appeal to new buyers,” says Meghan O’Callaghan, a San Francisco art advisor who works with Smith Sweeney. “These prints are not posters. The artist often collaborates with a master printmaker to create an original piece. It’s a booming segment of the market with strong resale value.”

And it’s a great way to get started when investing in art. Acquiring a few treasures can create a ripple effect. “Some people catch the bug and want to dive deeper,” says Smith Sweeney. “They move beyond buying for the wall above the couch. They want to become collectors. They want to get involved in the artists’ careers.”

Leaving a Legacy

Another benefit: Art can play a meaningful role in a family’s long-term financial and philanthropic plans. Financial advisors can help clients think strategically about their collections by connecting them with reputable art professionals and helping them incorporate artwork into a broader estate plan. That includes evaluating the potential tax implications, ensuring proper documentation and valuation, and aligning the art with a client’s legacy goals.

“Art is a unique asset, and planning for its future is just as important as planning for other investments,” says Molewski. “We help clients think about where their pieces should go and how to handle the transfer thoughtfully and efficiently.”

Some clients choose to pass down art to their children. Others donate pieces to museums or establish private foundations. Each option involves distinct benefits and challenges. For instance, gifts to family may trigger capital gains taxes if the art is later sold, while donations to charitable institutions can offer significant tax deductions but may require coordination with museum acquisition committees and donation guidelines.

In any case, the emotional value of art can complicate decisions.

“The art that my wife and I feel passionate about may not be the same as what our children care about,” Molewski says. “If that’s the case, we would want them to sell the art, then invest in what they like.”

Ultimately, as a financial advisor, Molewski says the goal is to ensure the collection serves both the client’s values and their financial goals—during their lifetime and beyond.

Written by Nanci Hellmich