Purposeful Philanthropy

Long and his sister, who was also adopted, had great childhoods, and adoption wasn’t something they talked or thought about very often. “The only time I thought about it was once a year, when we would get a solicitation from the children’s home for something they called ‘The Little Red Stocking Fund,’” he says. His parents always sent a donation.

Decades later, when a family friend invited him to some fundraising events for Children’s Home Society, Long was happy to offer support. His wife, Mary, got involved too.

Today, their commitment to helping vulnerable children find “loving, permanent, safe homes” is a philanthropic passion, but they still pursue it strategically.

That means they have zeroed in on a specific goal: eliminating the financial burden on families in North Carolina who want to adopt but can’t afford the full cost.

It also means planning for what he calls “a very meaningful gift,” well beyond the money the couple has already donated to Children’s Home Society and a second charity, Gift of Adoption, to date.

It means working closely with these charities and inspiring others to give. “Being a strategic giver means more than just writing a check,” he says.

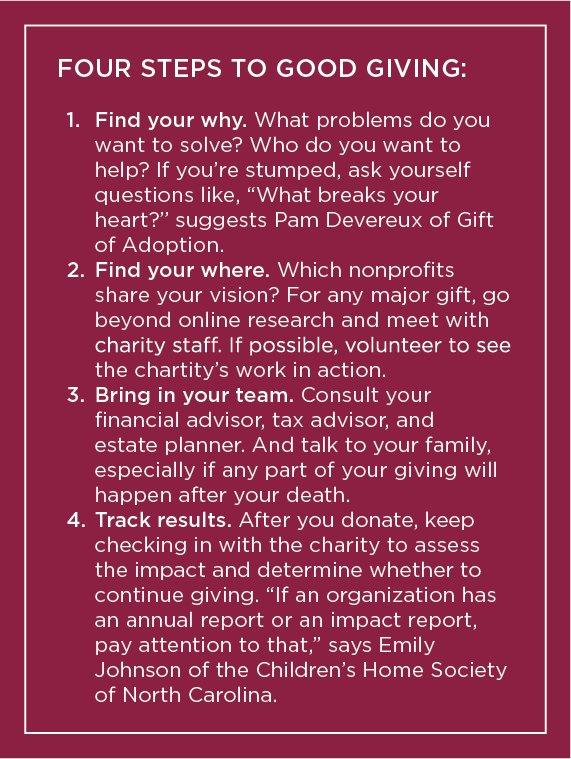

If you want to be a strategic giver too, here are a few ways to get started.

Pick Not Just a Charity but a Purpose

Donors gave nearly $600 billion to U.S. charities in 2024, according to Giving USA. They choose from among 1.8 million nonprofit organizations.

Major strategic giving starts by really thinking about those choices.

With a little prompting, most people can identify causes they’ve always cared about, says Sara Piner, a senior vice president at the Foundation for the Carolinas. The foundation has a guidebook that suggests potential donors think about their beliefs and interests but also about the populations they want to serve (such as children, animals, immigrants, or veterans), the reach (local or beyond), and the impact they want to have (what to change, solve, build, or sustain). This kind of exercise can help individuals and families compose a purpose statement to guide their personal philanthropy.

Long and his wife are clear about why they are giving and the impact they want to have: “We are focusing our family on adoption, not only because it affected me personally, but because it attacks a root cause of many societal problems that can be linked to children lacking stable, loving homes,” he says. “We prefer to think of these expenditures as investments, not gifts. Creating a family has a forever impact.”

Get to Know Nonprofits and Stay Involved

Choosing a specific charity or charities for major strategic giving can take legwork, says Heather Shanahan, senior director of endowments and foundations at CAPTRUST. While it’s a good start to review a charity’s financial reports to the IRS (990 forms) and to review online ratings and profiles at sites such as Charity Navigator and GuideStar, that’s often not enough.

“Ideally, you’ll sit down with a charity’s leadership to discuss your giving plans and their needs,” says Shanahan.

Her advice: Be sure to ask for the group’s donation policy. You might learn that it can’t accept the piece of property you hoped to donate or that it doesn’t have the infrastructure to support the new program you hoped to fund. “You don’t want to give a gift that creates a new burden for an organization,” she says.

Such meetings also give charity leaders a chance to hear what matters to you as a donor and to start what should be an ongoing relationship, says Pam Devereux, CEO of Gift of Adoption, a nonprofit based in Illinois with 30 chapters nationwide providing adoption assistance grants.

An enduring relationship allows donors and staff to work “together toward a goal that’s bigger than both the organization and the donor,” she says. And that means donors like Long can increase their impact.

Long’s ongoing relationship with Gift of Adoption includes sitting on its strategic advisory council and on an investor board that covers overhead costs. He also previously served on the board of directors at Children’s Home Society, which focuses on family preservation, foster care, and adoption. Today, Long remains involved, including as a formal and informal fundraiser.

“I know that he talks about Children’s Home Society with his personal and professional acquaintances,” says Emily Johnson, the organization’s chief philanthropy officer. “He’s talking about it in his Bible study. He’s talking about it in meetings with other investors.”

Long also talks about Gift of Adoption every chance he gets, Devereux says, often inspiring others to give “without even asking.”

When Children’s Home Society was working to build a leadership group of donors, “Bob committed a major gift early,” says Johnson. “We were able to share his generosity with others to inspire increased giving.”

Think Through Your Giving Plan

You may know why and where you want to give but still need to work on the how. This includes deciding whether to donate a few large gifts or many smaller ones, whether to give mostly during your life or after death, and which financial and legal vehicles to use.

“There is no one-size-fits-all solution to charitable gift planning,” says Piner. For example, you might decide to give to charities directly, to set up a family foundation (if you have the resources), or to use the increasingly popular donor-advised funds (DAFs). A DAF allows you to contribute to—and make grants from—a fund administered by a charitable organization.

You may also decide to earmark your donations for specific purposes or let a charity decide how to best use the money. These are called unrestricted gifts, and they’re a hallmark of “trust-based philanthropy,” says Johnson, made possible by close relationships between donors and charitable groups.

“To figure it all out, you’ll likely need a team that includes a financial advisor, a tax professional, and an estate planning attorney,” says Shanahan. “And you’ll want to keep them in the loop as your giving plan evolves.”

Long didn’t set out to become a philanthropist. But by anchoring his giving in personal experience and purpose, he’s become an advocate, investor, and changemaker in the lives of children across North Carolina.

His message to others? You don’t have to have a high net worth to be a strategic giver—you just have to be intentional. “A well-placed gift can change a life,” Long says. “Or in our case, thousands of them.”

If you’re ready to give more than a check—to give with purpose, with passion, and with a plan—you might find, like Long has, that strategic philanthropy is one of the most powerful legacies you can build.

Written by Kim Painter